One of the things we have observed about politics over the past few decades is that if you don’t have an agreed plan that takes into account both the right and left on any issue, results are apt to swing wildly from one ditch to the other depending on who is in control at any given moment.

Alaska is filled with examples of that. At the federal level the area available for oil and gas leasing in NPRA (National Petroleum Reserve – Alaska) has been contracted, then expanded, then contracted again depending on which political party controls the White House. The 1002 area of ANWR (Arctic National Wildlife Refuge) has been closed to leasing, then made available, then effectively closed again.

The Senate’s action this week on the Permanent Fund Dividend (PFD) is the latest example. (As of the time this week’s column is being written the House hasn’t yet voted on whether to concur with the Senate’s changes. For the status of that process, see this update from and continue to follow the Alaska Landmine’s front page and Twitter feed.)

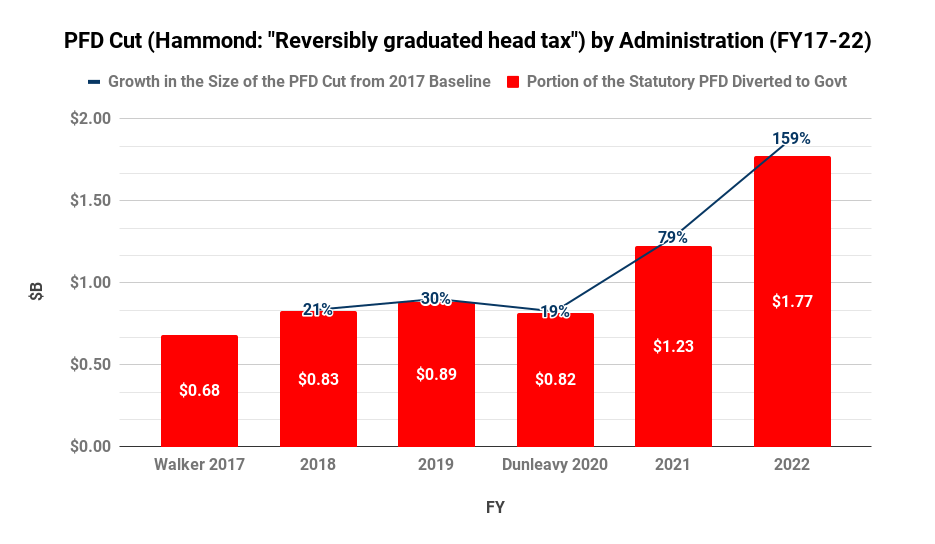

Since former Governor Bill Walker initiated PFD cuts in the middle of the last decade – and despite an explicit state statute providing for another disposition – diversions of revenue from the PFD to the general fund have been used as the main tool for closing ongoing state deficits. As we discussed in a previous column, with one exception – Governor Mike Dunleavy’s (R – Alaska) first year in office when they slightly declined – PFD cuts have risen every year through FY22.

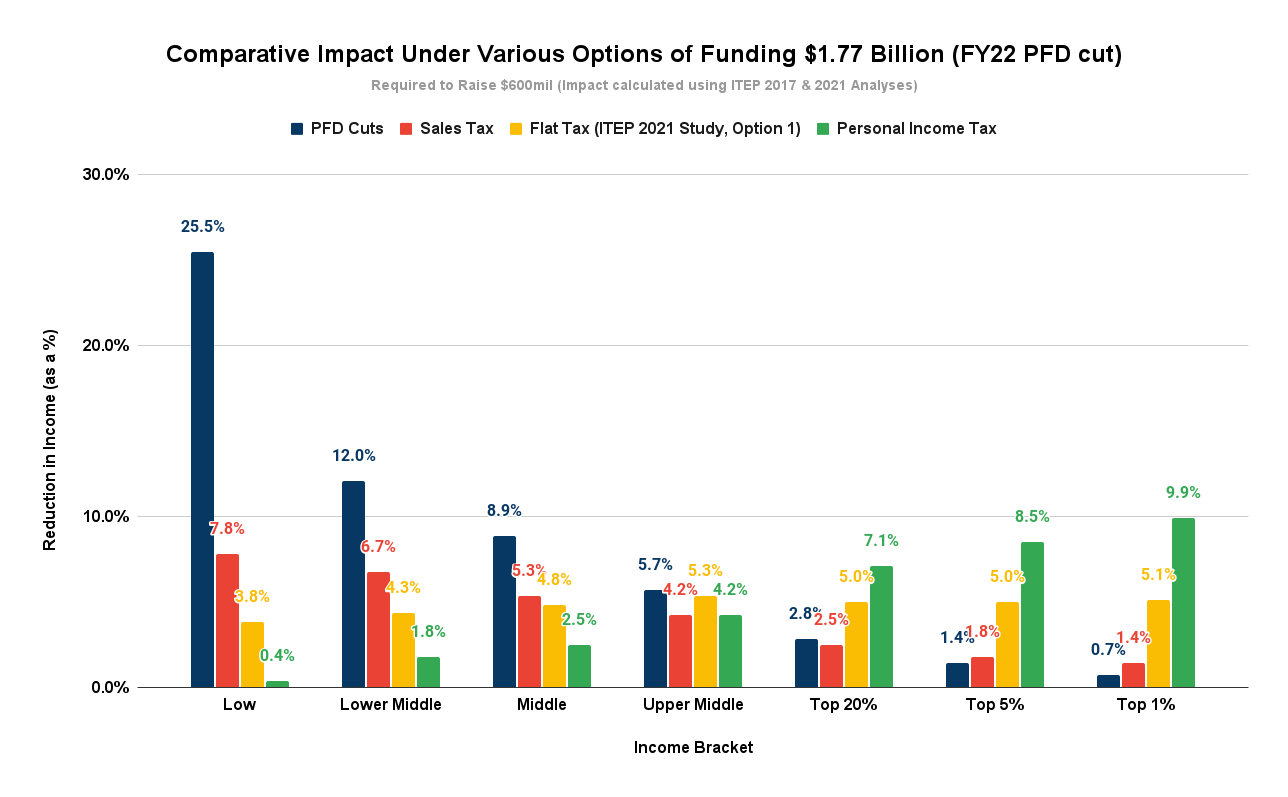

As we have explained repeatedly in previous columns, the outsized losers of that approach have been middle and lower income Alaska families, who have been involuntarily compelled to contribute more, in most cases much more, toward the cost of government than they would under other, more balanced revenue approaches.

The clear winners have been the top 20% – and within that the top 5% and top 1% – who have been able to avoid contributing more than a trivial share of their income toward those costs.

In an effort last year to resolve the ongoing debate about the PFD’s role in an overall fiscal plan and find some balanced approach, the Legislature established a bi-cameral, bi-partisan “Fiscal Policy Working Group” composed of both some of the most progressive and some of the most conservative members of the Legislature. As we discussed in a previous column, somewhat surprisingly given the wide ranging views of its membership, the group developed a plan that, if implemented, would settle the issue somewhere in the middle, at a reasonable cost both to middle and lower income Alaska families and those in the top 20%.

But that plan largely has been ignored since its publication. Instead, both House leadership, through its HB 259, the successor to HB 4003 which we discussed at length in a previous column last December, and Senate leadership, through its SB 199 which we analyzed in our column the week before last, have continued to pursue alternatives which would make deep (and fiscally inequitable) PFD cuts permanent.

In short, despite the middle ground approach outlined by the Fiscal Policy Working Group, leadership in both bodies have continued to push one-sided plans which almost completely protect the top 20% from contributing to the costs of government by shifting the burden instead largely onto the backs of middle and lower income – 80% of – Alaska families.

As a result it should not be surprising that when presented with the opportunity earlier this week due to the absence from key votes of a leading opponent, Senate supporters of a larger PFD – one which reverses the disproportionate distribution of costs to middle and lower income Alaska families – pushed through an amendment to the proposed budget incorporating for the first time since Governor Walker’s 2016 partial veto, a full, statutory PFD.

Like NPRA and ANWR, in the absence of an agreed plan that adopts a middle ground, once the numbers favored their side, those who lost previous rounds took advantage and pushed for their own complete, one-sided victory.

Of course, just like the supporters of PFD cuts have gone too far over the past few years in pursuing their agenda, the supporters of the full, statutory PFD are now pushing too far in pursuing theirs.

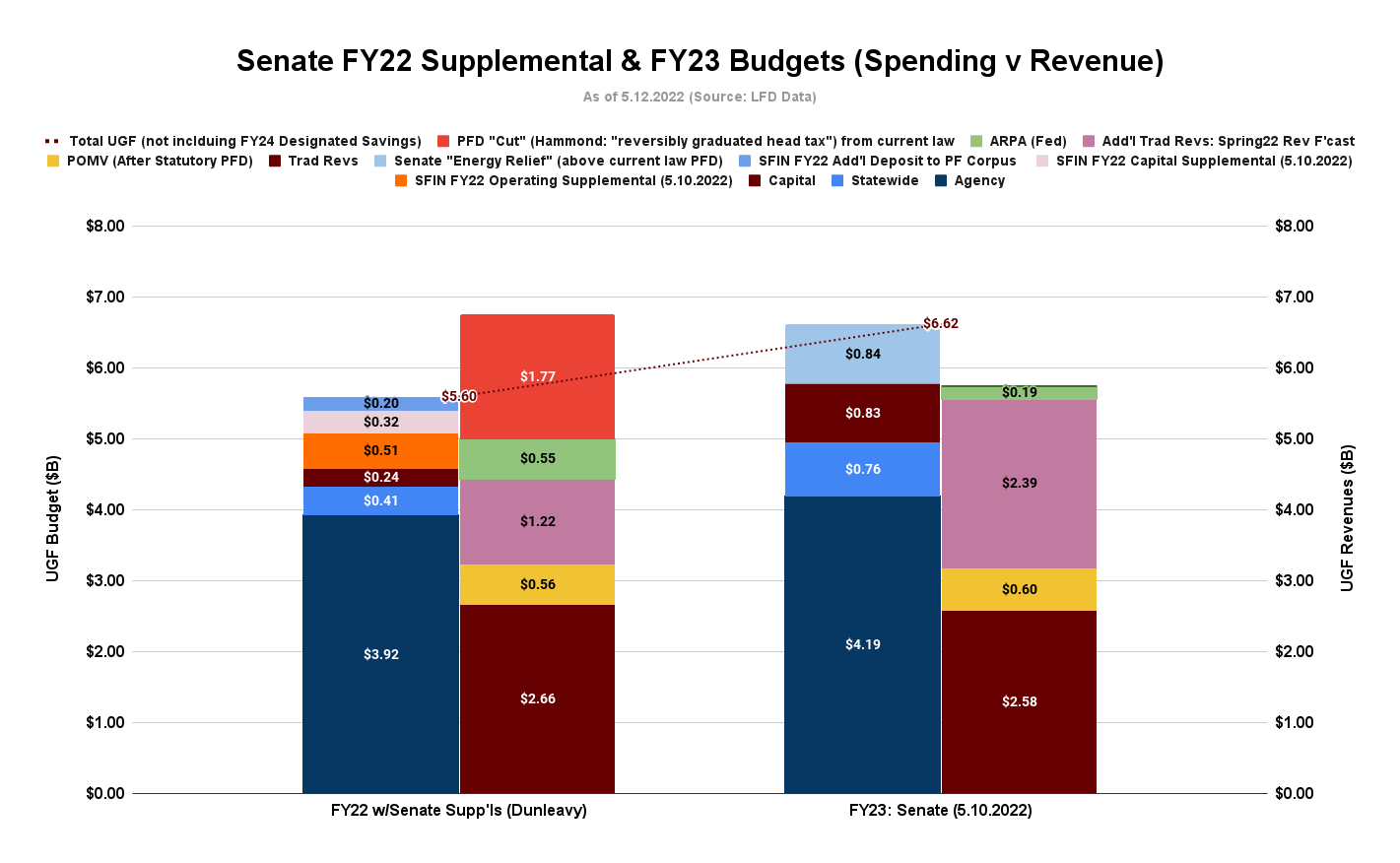

Supporters of the Senate action note that when viewed over the two year cycle, the FY22 and FY23 budgets largely balance.

Including the deep PFD cuts still included in the FY22 budget, over the two year period total UGF revenues ($12.52 billion) almost precisely match traditional UGF spending ($12.22 billion).

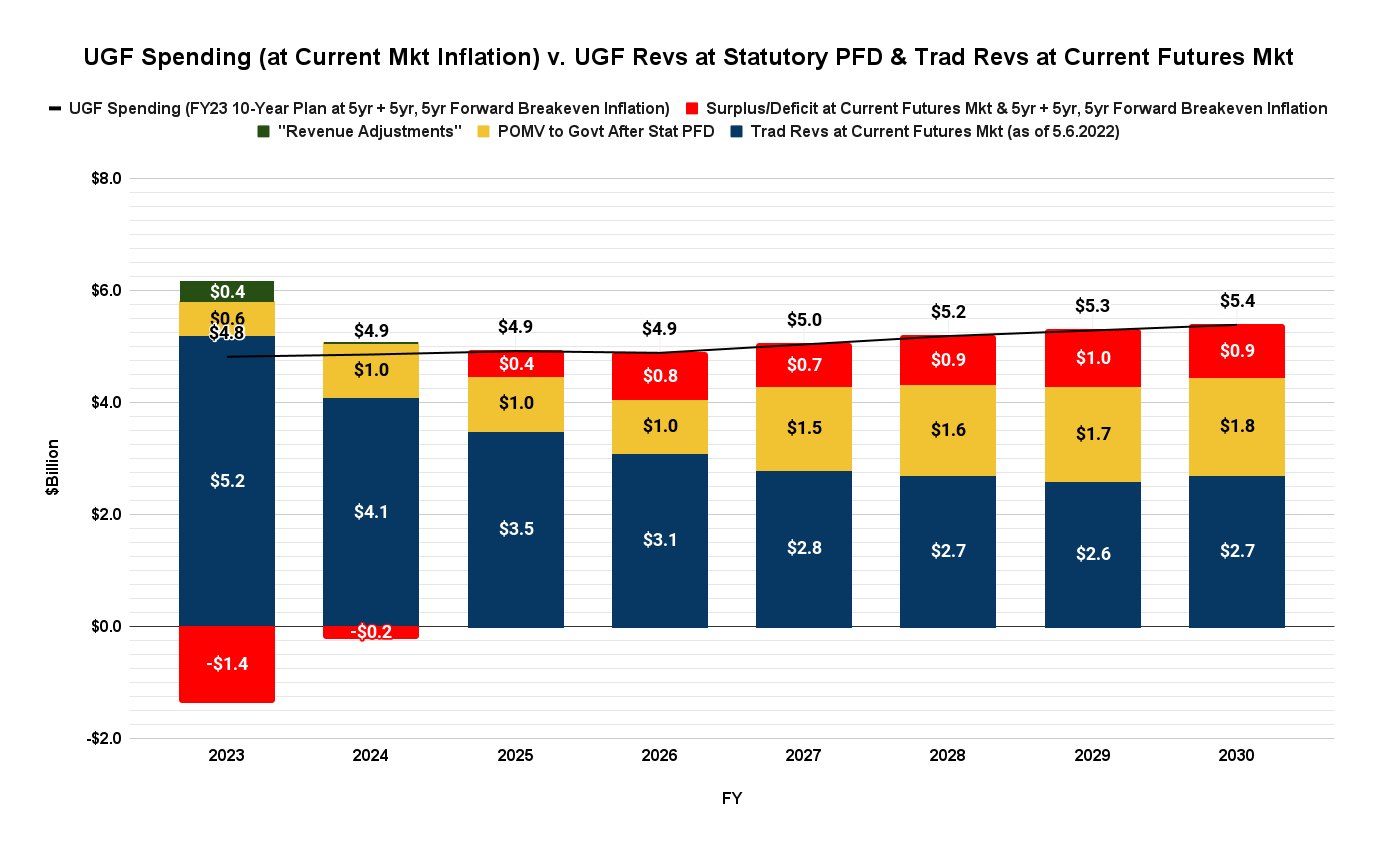

But the problem, of course, is that just like a plan built only on deep PFD cuts overreaches, so does a plan built on paying a full, statutory PFD without any source of other revenue. As our regular Friday “Goldilocks” charts repeatedly show, while a budget built on a full, statutory PFD (without other sources of revenue) balances in the first year and, with spending restraint, maybe for one year beyond that, based on current oil futures by the third and subsequent years the budget will be sliding deeper and deeper into deficit (red above the line).

In short, the approach is not sustainable.

Regardless of the final outcome of the Senate’s budget – whether the full PFD survives or not – our hope is that this experience is sobering to both sides of the issue. We hope that those pushing deep PFD cuts realize that support for that approach is razor thin and that when presented with the opportunity – as occurred earlier this week in the Senate and may occur as a result of any future election cycle – those supporting larger PFDs are fully prepared to push the result to the other extreme.

Similarly, we hope that those pushing for a full, statutory PFD without other sources of revenue realize that, while achievable in a year with extraordinarily high oil prices and still large volumes, their approach is unsustainable even over the near term.

As we explained during the second segment of our “Weekly Top 3” podcast this week, we are not especially sanguine about realizing those hopes.

We are concerned that, flush from their recent success, those pushing for a full, statutory PFD without other sources of revenue will continue to do so, believing that, just as is happening this year, something serendipitous – continued high oil prices, the ability finally to realize long talked about but never achieved spending cuts – will arrive to support their efforts.

Similarly, we are concerned that those pushing for deep PFD cuts will continue to do so, telling themselves that the Senate vote this week was a fluke and that, if only they continue to push hard enough, their goal of protecting the top 20% from contributing any material amount toward the growing costs of government can finally be permanently ensconced in statutes.

But as we’ve discussed before, neither extreme is in the best interests of ALL Alaska families, nor the overall Alaska economy.

What’s needed instead – as is incorporated in the recommendations of the Fiscal Policy Working Group – is a middle ground approach that deals fairly with both middle and lower income Alaska families and those in the top 20%.

If incumbent legislators won’t, we will be looking for challengers in the coming election cycle who are prepared explicitly to sign on to that plan. If there are enough, perhaps then we will be able to stop veering from the ditch on one side of the road to the other.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Yes. Sadly, yes. “…perhaps then we will be able to stop veering from the ditch on one side of the road to the other.”

Brad,

So now that your populist friends in the legislature have allowed you to “peer into the abyss” with that $5,500 PFD and understanding the havoc it will raise as our revenues are drained while most of that money leaves the state after a very short-term retail sales boom or is saved and not spent by consumers now you promote spending cuts? Give me a break!

Your comments on these articles are head-scratchers, Lynn. Are they satire, perhaps, or is he maybe a close friend that you’re ribbing? It appears that you’re either commenting without reading or intentionally misrepresenting what he’s saying.

He’s been promoting a balanced, equitable approach to state budgeting throughout this series, and this particular article isn’t about spending cuts. It’s about equity & balance.

The caveat always being that we pay a “statutory” PFD come hell or high water. What he and so many others conveniently ignore is that the very dollars that paid that now unaffordable PFD amount are now directly required to fund state government. That wasn’t the case when we had sufficient revenue from oil. His call for a “balanced budget” rings hollow with me as long as he ignores fiscal reality. The “paradigm” has changed and that is the fiscal reality as we return to a “post oil” Alaska. And now we are facing a national recession so every dime… Read more »

There is no “statutory PFD” caveat in these articles. It’s true that many Alaskans are insisting on statutory PFDs, just as many are insisting that tax-free services are mandatory even if it means effectively handing Permanent Fund earnings over to Outside & foreign billionaires. Where we fall individually on this spectrum tends to be tied to our personal circumstances, but those of means & influence who believe that a tax-free ride is the only responsible approach to state budgeting are no less grasping than those who rely on the PFD. Alaskans in the upper tiers politically & economically are using… Read more »

He’s also been promoting taxes and refuses to supplant oil taxes for revenue.

Can you guess why? Maybe Big Oil Brad can tell us.

Specifically, he’s promoting a 2% flat tax. That’s not your preferred approach (revisiting oil taxes) or mine (ensuring that we’re harvesting the maximum benefit from *all* of our resources, including oil, and instituting a progressive income tax so that we’re not giving PF-funded services away to nonresidents). However, the fact that he isn’t addressing what you or I want isn’t “refusal”. Those things just aren’t part of his own preferred solution. Perhaps you’re right. Maybe Big Oil sees the writing on the wall and has hired him to pitch a 2% flat tax to head off more ambitious revenue-raising schemes.… Read more »