Those who follow our Facebook, Twitter or LinkedIn pages know that we publish various charts daily that over the course of a week and month cover a fairly wide variety of topics related to oil, gas and Alaska fiscal policy.

On Friday afternoon we publish what have become known among some as the “Goldilocks” charts, a series of three charts – updated each week for the latest developments in oil futures and periodically for material changes in inflation – that look at the Dunleavy administration’s 10-year fiscal outlook under three PFD scenarios: current law, POMV 50/50 (the administration’s proposal) and POMV 25/75 (the approach being pushed by at least the leadership of the House majority coalition).

The reason they are called the “Goldilocks” charts is because, looked at from the perspective of how they impact Alaska fiscal policy, the three results are viewed by some as “too hot,” “too cold” and “just right,” although there is disagreement which adjective goes with which chart.

As we write this week’s column, the most recently published “Goldilocks” charts are those published last Friday (March 25).

We focus on them in this week’s Alaska Landmine column as the Legislature continues to move further into this year’s budget process and as some press forward on permanent changes to the PFD statute.

As we’ve made clear in previous columns – and will discuss again later in this column – we don’t believe any changes to the PFD statute are appropriate. Instead, we believe the revenue shortfalls the Legislature is facing in paying for current and projected government spending levels can and should be addressed through other, more equitable and lower impact means.

But even setting that aside, in all events we don’t believe the POMV 25/75 approach is appropriate. As the “Goldilocks” charts demonstrate, POMV 25/75 goes much further – depending on your perspective, is either much “too cold” or “too hot” – than necessary in dealing with Alaska’s current fiscal situation. Even adjusting the 10-year outlook for current, elevated inflation expectations, POMV 25/75 still takes far more money out of Alaska’s private sector than is necessary to balance the projected budgets.

In addressing the state’s current fiscal challenges, we shouldn’t be creating new, private sector ones.

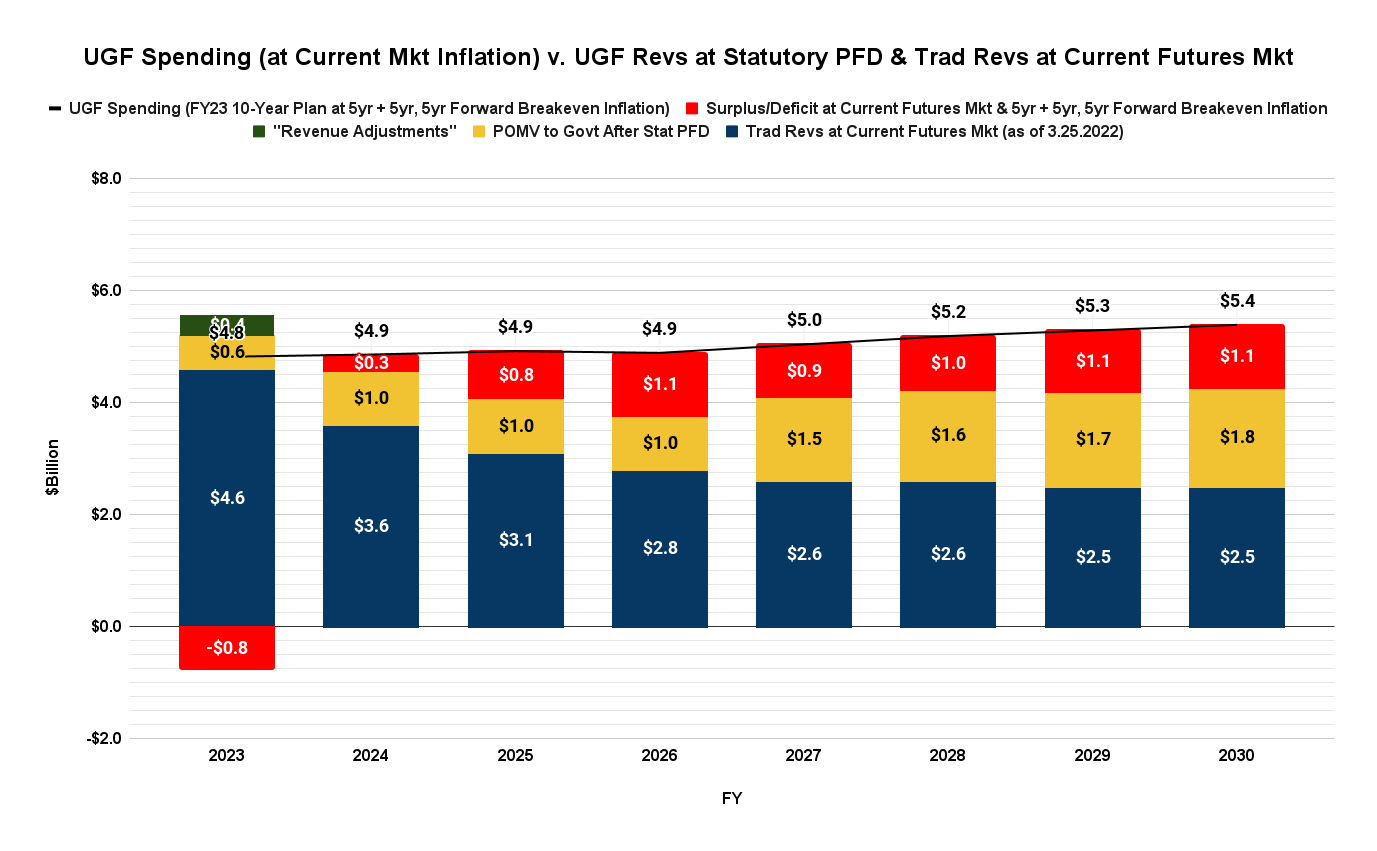

As we describe in the legend, the red portion of the bar on each of the “Goldilocks” charts represents the amount of surplus or deficit for each year at the spending levels projected in the Dunleavy administration’s 10-year plan, adjusted for current inflation expectations in the manner we explained in a previous column. Red at the bottom of the bar indicates a surplus, red at the top a deficit.

The first chart – which incorporates the current law (i.e., statutory) PFD – currently balances for FY23 at spending levels up to $5.6 billion (UGF, not counting the PFD), but absent substitute revenues or other steps falls quickly into significant deficits after that.

Over the period covered by the administration’s “10-year outlook,” the approach currently is projected to run an average annual deficit of $700 million and a total deficit of $5.6 billion.

The reason some call the approach reflected by this chart “too hot” is because, after FY23, it shows significant and increasing deficits (“hot”) throughout the remainder of the period even at currently projected oil prices.

Others use “too cold” because preserving the statutory PFD by closing those deficits would require other actions – spending cuts, alternative revenues or a combination of both – the achievement of which those applying the term consider too remote (“cold”) in the current political environment.

Either way, it serves as one boundary.

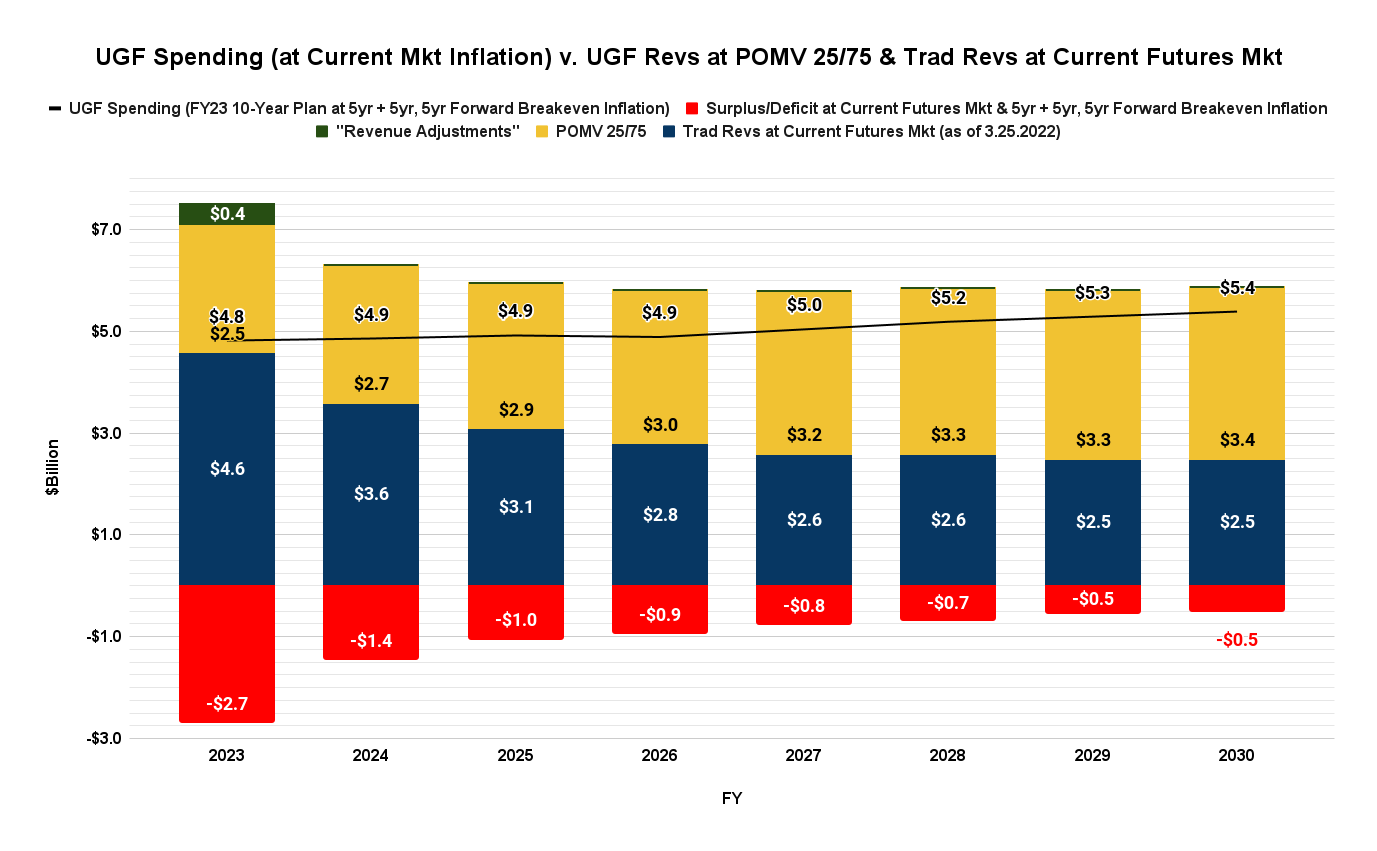

Setting the other boundary is the third of the weekly “Goldilocks” charts – which incorporates POMV 25/75. That produces a surplus not only for FY23, but in every other year throughout the remainder of the period, even after adjusting projected spending levels for current inflation expectations.

Over the period covered by the administration’s 10-year outlook, the approach currently is projected to run an average annual surplus of $1.1 billion and a total surplus of $8.5 billion – for perspective, more in surplus than the statutory approach runs in deficit.

The reason some call the approach reflected in this chart “too hot” is because it produces surplus after surplus (runs government “hot”), either building savings or, some hope and others fear, creating significant additional fiscal space for increased government spending over the period.

Others – including us – use the phrase “too cold” because they look at the approach from the perspective of its impact on private sector income. By reducing the PFD below the levels required simply to balance the budget, the policy takes too much out of Alaska’s private sector, causing Alaska’s private sector economy to run much “colder” than needed (i.e., too “cold”).

But, either way, it serves as the other boundary.

The third chart – which reflects the Governor Mike Dunleavy’s (R – Alaska) proposed POMV 50/50 approach – some call “just right,” but others “wimpy.”

Those that call it “just right” focus on the fact that, over the period covered by the forecast – FY23 to FY30 – the approach largely balances without the need for additional revenues. The $2.4 billion in projected FY23 – 25 surpluses slightly more than offset the $2 billion in post FY25 deficits.

Those that call it “wimpy,” on the other hand, focus on the fact that it relies on fairly deep PFD cuts to achieve that balance – an approach that former Governor Jay Hammond called in his book, Diapering the Devil, “reversibly graduated head taxes” and that, according to studies by researchers at the University of Alaska – Anchorage’s Institute of Social and Economic Research (ISER) which we have discussed in previous columns, has the “largest adverse impact” of all the various revenue option on both the Alaska economy and 80% of Alaska families.

Those that call it wimpy – including us – argue that the better, “just right” approach instead is to maintain current law PFD levels and close the resulting deficit with a combination of spending reductions and substitute revenues that have a lower – more moderate – impact on both the bulk of Alaska families and the Alaska economy.

From that perspective, by failing to take those additional steps the approach “wimps out,” leaving Alaskan families and the economy worse off than they should be.

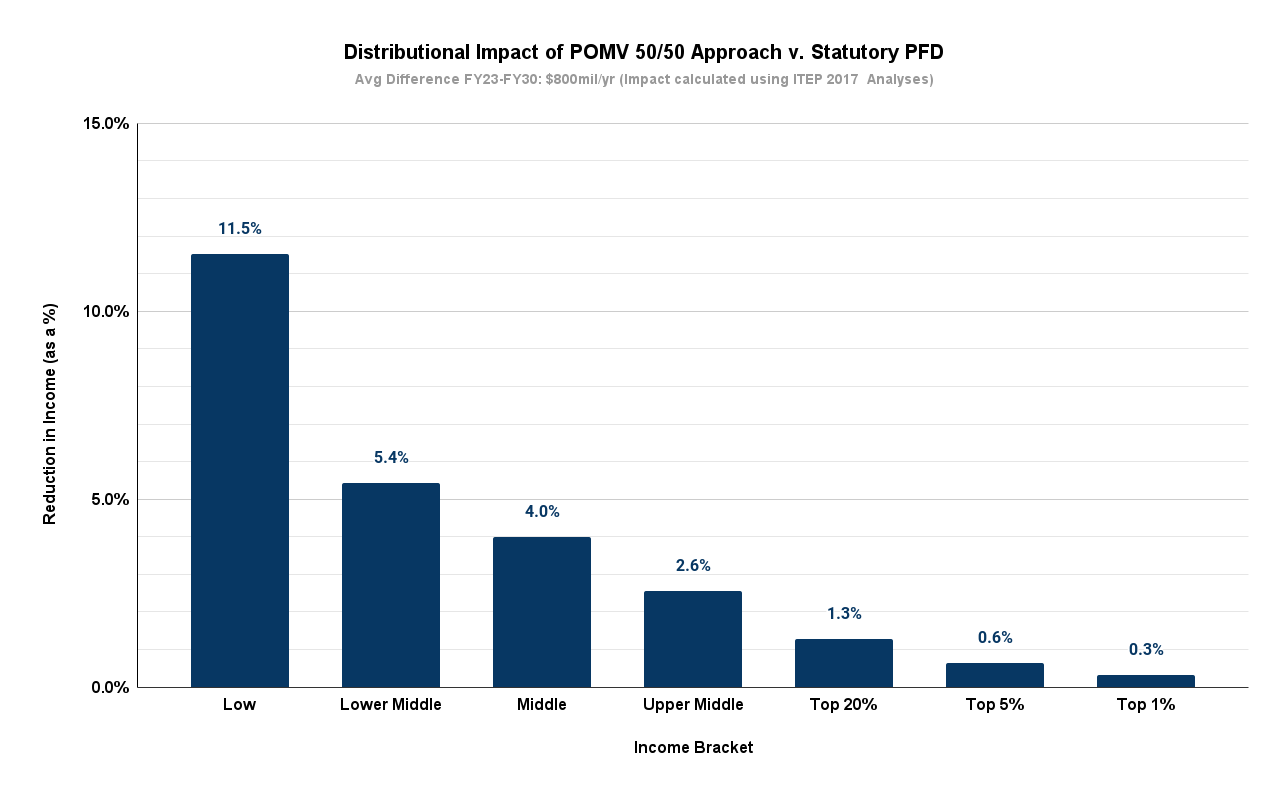

Looking at the distributional analysis of this approach, as we’ve done in previous columns, supports the argument.

Focusing on the difference between the projected average statutory PFD and the projected PFD under POMV 50/50 over the forecast period (roughly, $800 million per year), here’s who bears the burden of closing the deficit through the POMV 50/50 approach.

The result is clearly regressive, with the lowest 20% contributing 38 times, and the middle 20% 13 times more than the top 1% to close the deficit. As we’ve explained in previous columns, because it is more regressive, the approach also has a larger adverse impact on the Alaska economy than any other approach.

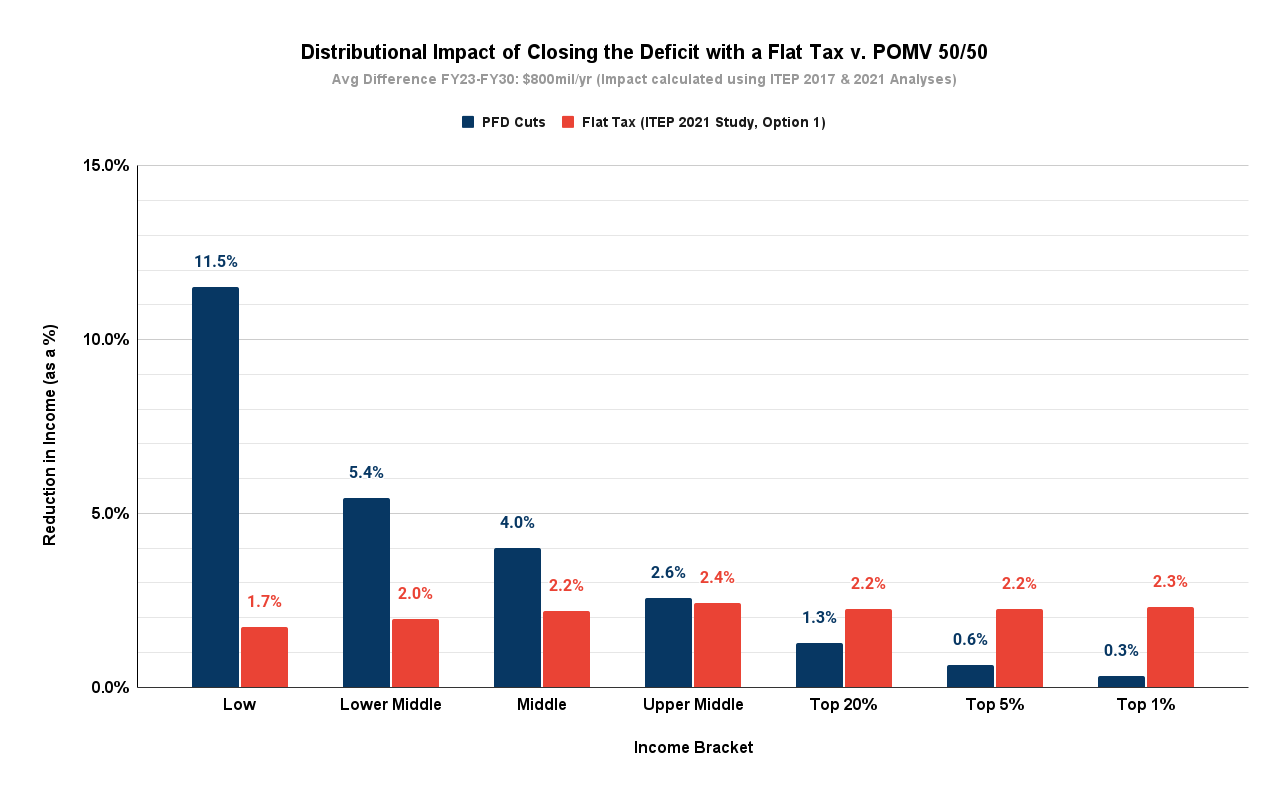

A far more equitable, lower impact – i.e., less “wimpy” – approach is distributing the full PFD and closing the resulting deficit, instead, through a combination of spending cuts and flatter revenues. To compare apples to apples, here’s what the distributional impact would look like if the deficit was closed with a flat tax (in red) instead of PFD cuts.

But, as large as the inequity and regressivity of the POMV 50/50 approach is, it pales in comparison to POMV 25/75.

Focusing again on the difference between the projected average statutory PFD and the projected PFD under POMV 25/75 over the forecast period (roughly, $1.8 billion per year), here’s who bears the burden of closing the deficit through the POMV 25/75 approach.

Understandably, the impacts are significantly more than with POMV 50/50, with POMV 25/75 diverting from Alaska families more than double as a share of income to government.

In short, not only is POMV 25/75 taking more out of the PFD than necessary to balance the budget, it is building that surplus mostly on the backs of middle and lower income families. While some try to sell the approach as “helping” working Alaska families, in fact it is the reverse; it is making their economic situation much more difficult.

If the Legislature decides that the surplus envisioned by the POMV 25/75 approach somehow is needed, it should build it through far more equitable, lower impact means. Here’s what the distributional impact would look like if the difference between the two approaches was closed instead with a flat tax (in red) rather than PFD cuts.

At least all Alaska families would contribute to building the resulting surplus equitably, rather than pushing the economic burden mostly to middle and lower income Alaska families.

Of course, the numbers in these charts will continue to evolve over time as oil prices, inflation rates and other factors change. We will continue to cover the results every Friday afternoon through the “Goldilocks” charts. Those interested should follow along.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Just “cut to the chase” and publish the same charts every week to support the exact same message every week: “Spend every available dime and remember that the PFD is good while saving for future generations is bad”.

That’s not the message, and it’s hard to believe that you of all people have not picked up on that.

Those who believe that PFDs for mainstream Alaskans are theft from future generations also seem to believe that dedicating Permanent Fund earnings to building the profits of Outside & foreign enterprises is the epitome of responsible fiscal stewardship.

And they are never willing to explain why.