One of the things that has struck us most during the years we have followed Alaska’s fiscal debates – including this week’s debate over the Fiscal Year 2025 budget before the House Finance Committee – has been legislators’ consistent willingness to throw others under the fiscal bus in order to save themselves and others in the top 20% from personally contributing more than a trivial amount toward the spending they are approving.

As we’ve discussed in previous columns, Alaska has been running current budget deficits for over a decade. For the first several years, the deficits were balanced largely with borrowings from previously accumulated savings. As we explained last week, to the extent those borrowings are not repaid, they essentially shift the burden of that spending to future generations. To use a phrase from former Governor Jay Hammond, the current generation – including the legislators that approved them – escape “scot-free”.

Once savings were substantially depleted, the Legislature next started using cuts in the Permanent Fund Dividend (PFD). But that was just another way of shifting the burden to “anybody but us.”

As we’ve explained in previous columns, PFD cuts largely shift the burden of the spending to middle and lower-income Alaska families. Those in the top 20% – which historically have included most, but with the recent pay increase, now everyone in the Legislature – contribute only a trivial share toward the costs.

And whenever it appears that some in the Legislature might balk at continuing to use PFD cuts to cover the growing deficits, the next fallback leaders in the Legislature have offered is not to offer finally to help contribute to the remainder themselves but to threaten to shift a portion of the burden to the oil companies through reduced oil tax credits. Indeed, House Finance Co-Chair Representative Neal Foster (D -Nome) did exactly that just this week during the House Finance Committee’s markup of the FY 2025 Operating Budget.

But that’s not a serious effort to spread the burden. Even on the surface, it’s just another way for legislators to redirect the burden to “anybody but us.”

At its core, however, the approach essentially is no more than a cynical political dog whistle intended to activate the broader oil and gas industry to push back on those proposing to balk at the deeper PFD cuts. Since the industry is the source of substantial campaign funding and support, as happened this week, that approach quickly has the effect of redirecting those pushing back against PFD cuts elsewhere into intentionally dead-end proposals, such as funding the PFD out of overdraws from the Permanent Fund earnings reserve account or the remaining portion of the Constitutional Budget Reserve (CBR). It’s all carefully staged kabuki theater to give the appearance of effort but not the reality.

Even when some propose a broader approach, it’s not really a serious effort to include themselves among the contributors. For example, as we’ve explained in previous columns, Representative Alyse Galvin’s (I – Anchorage) proposed “income tax” (HB 156) is nothing more than a different way largely of getting to the same end result as the 25/75 POMV (percent of market value) approach. Yes, the top 20% contribute a little more, but not nearly enough to make a material dent in the deficit. Balancing the budget still requires very deep PFD cuts. Legislators – even those with high incomes like Galvin – still would pay significantly less than middle and lower-income Alaska families. Rather than seriously addressing the issue, the proposals are just another political charade to create faux-cover for claims that they are willing to make contributions, but without actually proposing a mechanism that would require them to do so.

The only serious effort anyone has proposed in this Legislature that actually would spread the burden more broadly, at least in part to include legislators and others in the top 20%, is Representative Ben Carpenter’s (R – Nikiski) proposed sales tax, HB 142. While sales taxes are still regressive – take more from middle and lower-income families – than other approaches, they are significantly less so than PFD cuts. Ironically, Carpenter’s bill would do far more to spread the burden more equitably from the perspective of middle and lower-income Alaska families than either Galvin’s HB 156 or Representative Zack Field’s (D – Anchorage) similar HB 185. But, faced with the prospect of actually spreading the burden, Carpenter’s fellow Republicans on the House Ways & Means Committee have tanked the effort by refusing to vote for it.

To us, if we were going to vote to maintain current spending levels or increase them further, we would recognize that we have, to borrow a term from Article 1, Section 1 of the Alaska Constitution, a “corresponding obligation” to step up and pay an equitable share of the costs. It seems the height of hypocrisy to advocate maintaining or increasing current spending levels but when the bill comes due, push it off largely on those in lower income brackets. It’s the political equivalent of ordering the best steak at the finest 5-star restaurant in New York City, but when the check comes, pushing it off on someone walking down the street who can’t afford even to walk in the door.

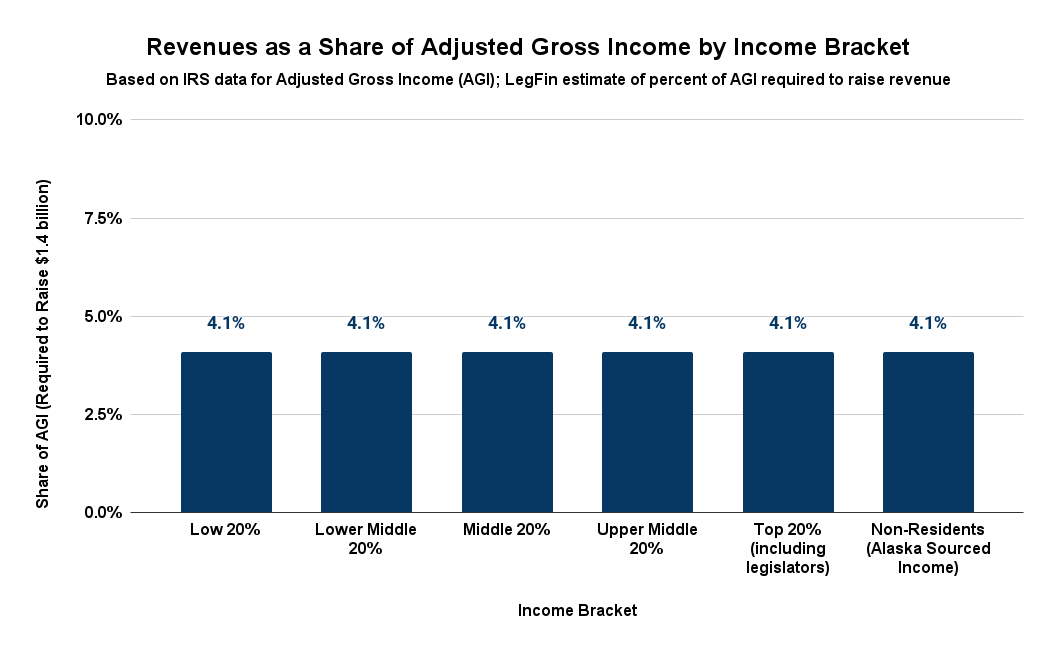

The flat tax we have previously discussed would do exactly that. It would distribute the costs of government spending evenly across all income brackets. Legislators, others in the top 20%, and non-residents would contribute the same share of their income toward the costs of government as those in the middle and lowest-income brackets.

As importantly, it would reach non-residents receiving a portion of their income – and thus, the benefits – from Alaska sources, materially reducing the burden on Alaska families and the overall Alaska economy. If adopted, Alaska families overall would pay somewhere in the neighborhood of 10% less for the costs of government than they do now.

At anticipated FY25 deficit levels, the costs of government would be spread like this:

But that’s not what any of the legislators have proposed. Instead, they are simply working through a series of mechanisms designed to push the costs off on anybody but them. Even when some claim to break the mold by proposing a new approach, as with Galvin’s proposed HB 156, once you look under the hood, it’s still an approach that pushes the costs off on somebody else. They want the glory and adulation that comes with doling out state money to favored groups, but they don’t want to have any part of the “corresponding obligation” to contribute themselves or have their top 20% donors contribute to the costs.

It’s a twisted, perverse approach that exists only in Alaska. In every other state, legislators, along with others in the top 20%, contribute materially to government costs through sales, income, or some other tax mechanism. When they look at proposed spending, legislators have to take a moment to reflect on whether it is something they consider worthy of their own—and their donors’—money.

But not in Alaska. Here, by using PFD cuts – or what long-time University of Alaska—Anchorage Institute of Social and Economic Studies Professor Matthew Berman has correctly labeled “the most regressive tax ever proposed” – legislators are able to spend freely, knowing in the end the bill will be sent to “anybody but us.”

Some occasionally ask how Alaska got into its current fiscal condition. The answer is by giving legislators the ability to spend freely without personal consequences—or “corresponding obligations”—to them or their top 20% donors. The economic and political incentives are all on the spending side; there is no balance. It’s a recipe for exactly the type of fiscal nightmare into which Alaska has walked itself.

And from the sound of things while following this week’s House Finance Committee hearings, current legislators – including even those in the House minority – aren’t about to fix it. They are just fine having “anybody but us” continue to pay the tab they are running up.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“The flat tax we have previously discussed would do exactly that. It would distribute the costs of government spending evenly across all income brackets” Not entirely true. Your flat tax proposal is based on the myth of the AGI, an accounting trick that makes the top 20% look like they pay a higher percentage of their income than they actually do. In 2019, the IRS reported taxpayers filed 148.3 million tax returns, reported earning nearly $11.9 trillion in adjusted gross income. Statistia.com reports personal income in 2019 was $18.402 trillion. That’s a $6.5 trillion difference. Handouts and subsidies to the… Read more »

How about a sales tax that:

1) Excludes food and baby items.

2) Includes a luxury tax for everything from new cars to new homes and big boy toys.

3) Is in place for the summer (tourist) months only with the exception of the luxury tax which is in place all year.

It wouldn’t raise much compared to the size of the deficit; it’s sort of the regressive equivalent of Rep. Galvin’s HB 156. Showy, but without much substance.

The point is Alaska has built up huge deficits. Little bites here and there don’t begin to fill the hole and, in fact, are a distraction because they give the impression something has been done to address the issue when, in fact, it hasn’t.

How much would that raise?

ITEP’s 2017 study estimated that a 3% sales tax with usual carveouts would raise $500 million. An additional seasonal carveout would likely reduce that number by, conservatively, an additional ~40%, and another significant adjustment would come in reconciling a state sales tax with those communities that have local sales taxes (many have suggested putting a cap on the combined rate with the local sales tax coming first). In the end, we would be surprised if such a carve-out heavy approach raised much beyond $250 million, and even less if Anchorage adopted a local sales tax that had to be reconciled.… Read more »

According to these people

“ If Alaska were, however, to match the national average, collecting state sales taxes equivalent to 2.4 percent of state personal consumption, it would raise about $962 million a year. Generating $500 million a year would require collections equal to 1.25 percent of personal consumption, and $1 billion a year would require about 2.5 percent.”

This is of course a straight sales tax with no carve outs for things like food.

https://alaskapolicyforum.org/2023/11/alaska-fiscal-crisis-sales-tax/

What would a sales tax do to allow Outside and foreign enterprises to pay for the government services they require to turn a profit here? We are currently using revenues from our natural resources and Permanent Fund to underwrite their operations, while we look down our noses at Alaskans who rely on the PFD and accuse them of being the source of our fiscal woes.

Eliminating the PFD is not a tax. Period.

Getting rid of tax credits for oil is not a tax either.

Do both of those and the state would be in a much better financial situation.

Call it what you like. We have a family trust consisting of natural resources and the Permanent Fund that was established specifically for the welfare of Alaskans. The intent is clearly memorialized in the trust documents.Yet the family patriarchy has been bestowing trust assets on their cronies (and themselves) while tight-wadding the intended beneficiaries. Perhaps “theft” is a better word than “tax”.