In early May, with less than a month remaining in the session, Representative Zack Fields (D – Anchorage) introduced HB 185, “An Act establishing an income tax equal to the amount of the annual permanent fund dividend.”

In the Sponsor Statement, Fields claims that “[t]he effect of HB 185 would be to increase PFD income to lower income Alaskans while ensuring Alaska remains a low-tax jurisdiction for higher earning individuals.” To accomplish that, the bill establishes an annual income tax equivalent to each year’s Permanent Fund Dividend (PFD) for “individuals earning $75,000 and families earning $150,000.” A tax in the same amount also would apply to non-residents receiving income in Alaska.

For Alaskans, the bill does not propose a general income tax. Like PFD cuts, the tax is limited to income received from the PFD. Rather than being referred to as another PFD “cut,” it simply is called a “tax.”

Under the bill, “lower income earners” – individuals with less than $75,000 in income and families with less than $150,000 – and all children would continue to receive PFDs without the offsetting tax.

Surprisingly given its purpose, a distributional analysis of its impact on Alaska families was neither included with the Sponsor Statement nor as part of the bill’s presentation package. The purpose of this week’s column is to flesh that out.

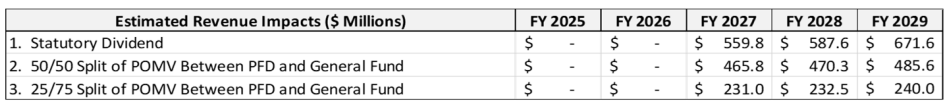

As filed, the bill would take effect on January 1, 2026, with the first revenues received during FY27. The fiscal note accompanying the bill estimates the revenue to be raised by the bill for the three-year period, FY27 – FY29, under three scenarios, with the PFD set at current law (statutory), POMV (percent of market value) 50/50 and POMV 25/75.

The average annual revenue projected to be raised over the three years under the current law (statutory) PFD is $606 million, under POMV 50/50, $474 million, and under POMV 25/75, $235 million.

None of the projected tax revenues are sufficient to offset the projected deficits – in other words, balance the budget – over the same period. Based on recent oil futures prices, the most recent Permanent Fund Corporation projections of future POMV and current law PFD levels, and using the Legislative Finance Division’s projection of future, “current law” spending levels, the projected deficits for the same three-year period as covered by the HB 185 fiscal note are $1.78 billion (FY27), $1.94 billion (FY28) and $2.38 billion (FY29).

The average deficit over the period is $2.03 billion. At most (maintaining the current law PFD), HB 185 only raises $606 million, or less than 30% of the deficit. None of the bill, the Sponsor’s Statement, or the presentation package submitted in support of the bill provide any guidance on how the remainder of the deficit should be addressed.

But looking also at how the remaining gap would be balanced is necessary to provide a complete picture of the full impact of the proposed approach on Alaska families. An approach may appear to be reasonable when limited to its own terms, but if it does not fully balance the budget, any reasonableness it may reflect may be overwhelmed by the additional steps taken to close the remaining fiscal gap.

To complete the picture of the full impact of HB 185 on Alaska families, we use two alternatives to close the remaining deficit. The first is to make additional PFD cuts, the approach that the legislature has used consistently since 2017. As we have done in previous columns, the second is to use a distributionally neutral, supplemental flat tax to close the remaining deficit.

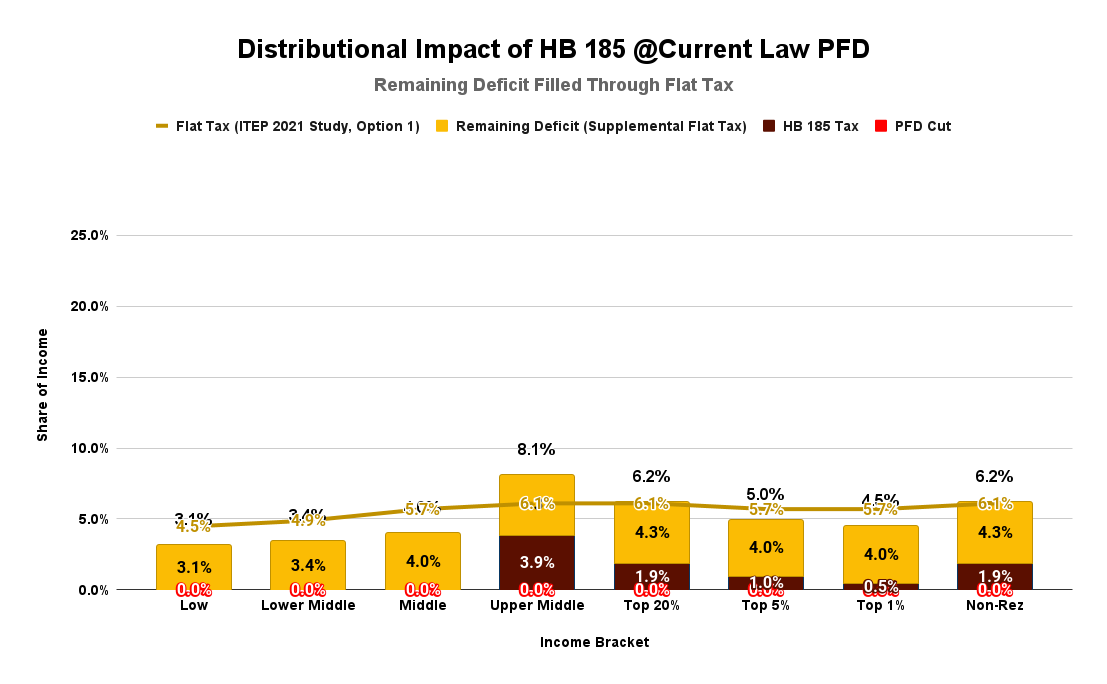

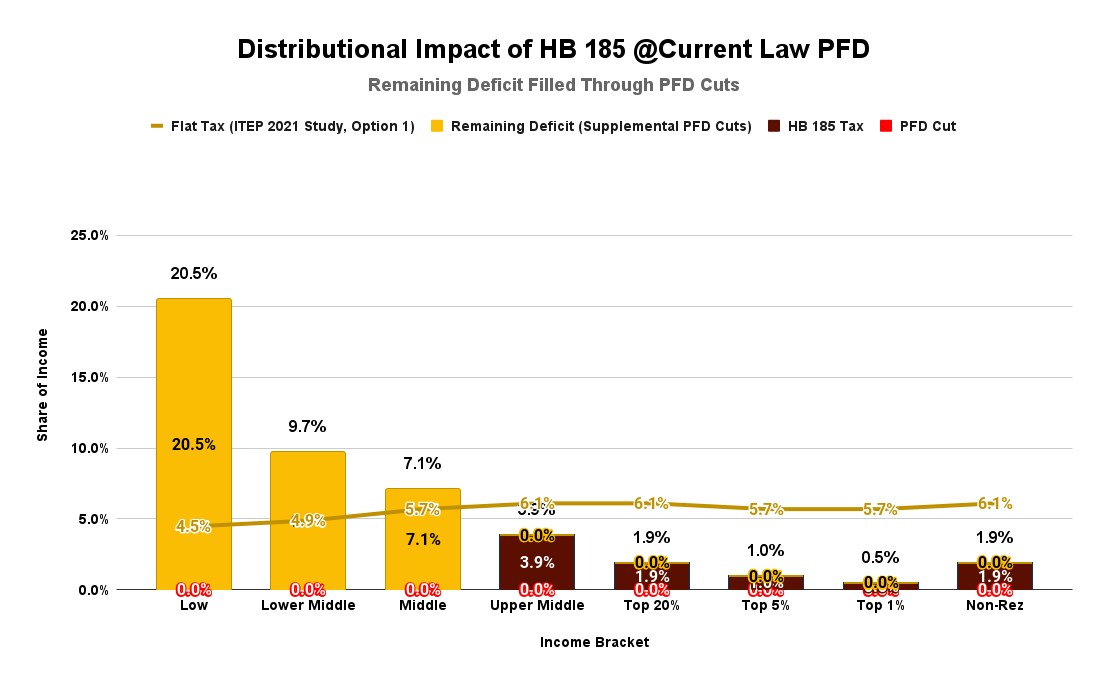

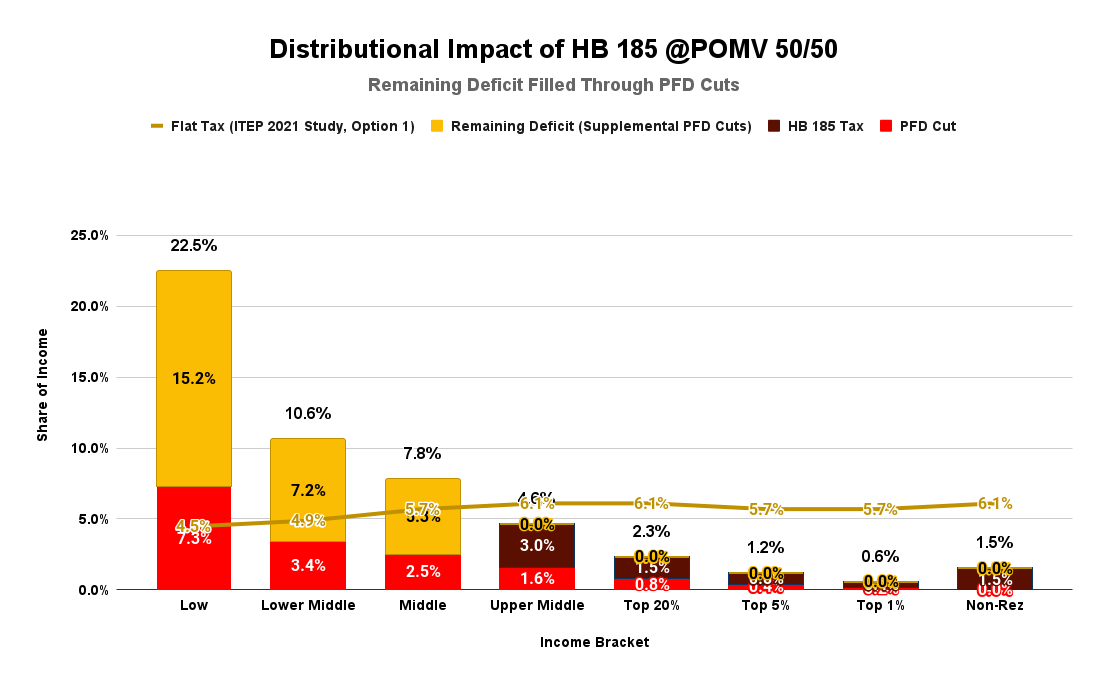

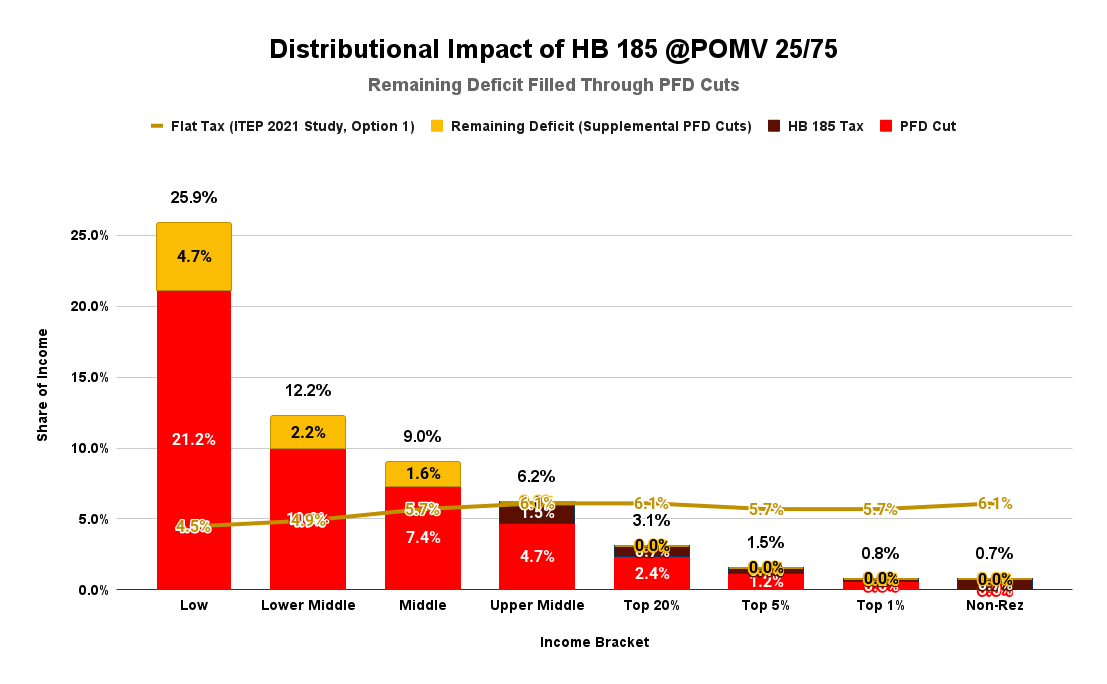

Here are the results. To provide perspective, we have included a line to reflect a distributionally neutral flat tax to close the full $2.03 billion deficit as part of each chart. As we explained in a previous column, doing so enables readers quickly to identify whether – and to the degree – the proposed approach is regressive, neutral, or progressive.

Reflecting the $75,000 threshold for the tax on individuals, we apply the tax to those falling in the upper middle-income bracket and above for purposes of this analysis. Households of two adults or more subject to the $150,000 threshold would fall in the top 20% and above bracket.

Using a supplemental flat tax to close the remaining deficit

We start by looking at the impact of combining the tax with the current law PFD and filling the remainder of the deficit through a supplemental flat tax. Because it maintains the largest PFD, this approach both raises the most revenue from the tax and initially has the lowest impact on those not subject to the tax.

While uneven, the result generally has a progressive tilt, with those at lower income levels paying a lower overall rate than those subject to the HB 185 tax (upper middle-income families and above). We assume non-residents receiving Alaska income (“Non-Rez” in the chart) have the same average income as those in the top 20% and, thus, bear the same overall tax levels as those in that income bracket.

Because the statutory PFD represents a material amount of income for those in the upper middle-income bracket, the HB 185 tax (which eliminates the PFD for those in that bracket and above) significantly impacts them. Because the statutory PFD represents an increasingly trivial amount of income for those in the top 20%, even with the additional supplemental flat tax required to close the remaining deficit, they still pay less than the average alternative flat tax rate.

Essentially under this alternative, upper middle-income families – and to a very slight degree, those at the lower end of the top 20% – subsidize everyone else.

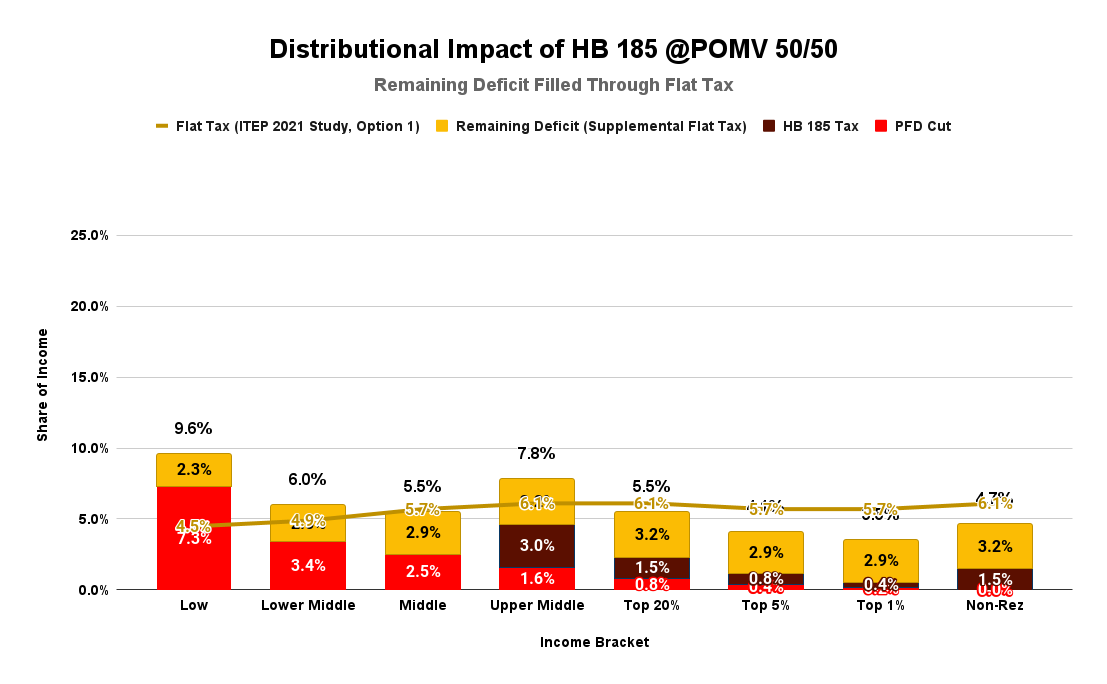

Next, we look at the impact of combining the tax with a POMV 50/50 PFD and filling the remainder of the deficit through a supplemental flat tax. Because of the lower PFD, the amount of the HB 185 tax – and thus, the impact of the tax on those subject to it – is lower also. On the other hand, those not subject to the tax – the 60% of Alaska families in the middle, lower middle, and low-income brackets – are impacted heavily by the reduction in the PFD from current law levels to POMV 50/50.

Because of the impact of the reduction in the PFD from current law levels to POMV 50/50, even with the tax and using a distributionally neutral supplemental flat tax to fill the remainder of the deficit, the approach turns regressive, with those at lower income levels largely paying a higher overall rate than those in the top 20%.

Again, the impact on upper-middle income families stands out. As in the previous approach, because the statutory PFD represents a material amount of income for those in the upper middle-income bracket, the HB 185 tax (which eliminates the PFD for those in that bracket and above) significantly impacts them. Because the PFD represents an increasingly trivial amount of income for those in the top 20%, even with the additional supplemental flat tax required to close the remaining deficit, they pay increasingly less than the average alternative flat tax rate.

As is the case under any approach relying on significant PFD cuts to balance the budget, the lower 80% of Alaska families subsidize the top 20%.

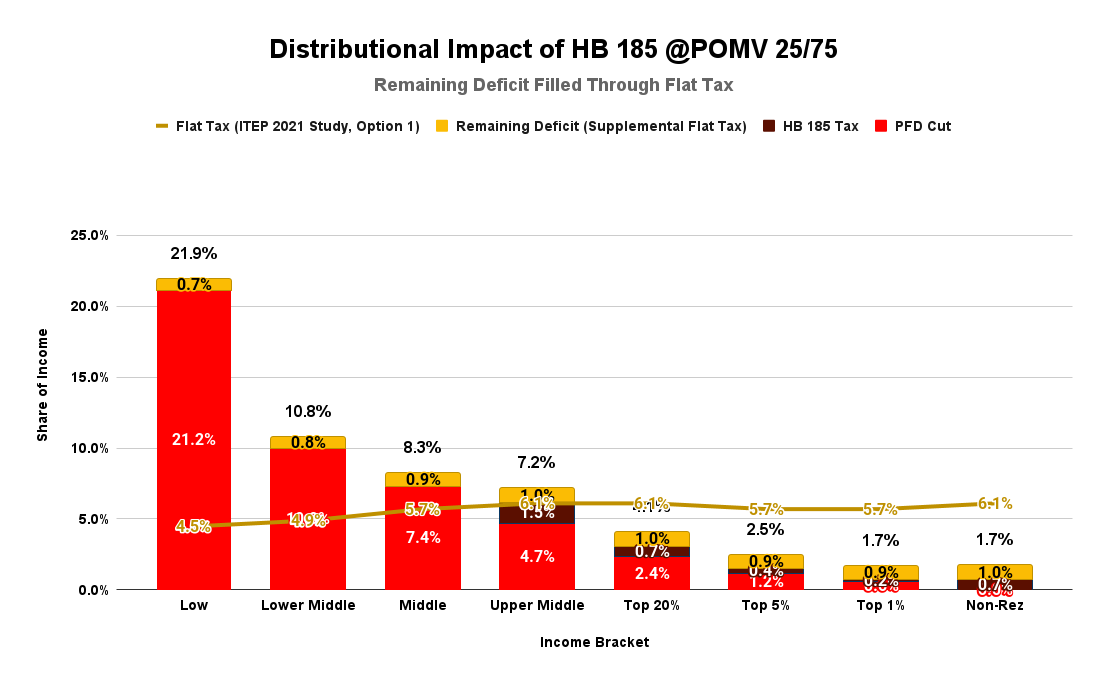

Next, we look at the impact of combining the tax with POMV 25/75 PFD and filling the remainder of the deficit through a supplemental flat tax. Because of the lower PFD, the amount of the HB 185 tax – and thus, the impact of the tax on those subject to it – is lower also. On the other hand, those not subject to the tax – the 60% of Alaska families in the middle, lower middle, and low-income brackets – are even more heavily impacted by the reduction in the PFD from current law levels to POMV 25/75.

Even with the tax and using a distributionally neutral supplemental flat tax to fill the remainder of the deficit, the approach turns heavily regressive, with those at lower income levels consistently paying a significantly higher overall rate than those in the top 20%.

Unlike under the previous approaches, the impact on upper-middle income families no longer stands out. That is because, under POMV 25/75, the PFD is already heavily reduced. The incremental impact of taxing away the relatively small remaining PFD from upper-middle income families no longer dominates.

Because the PFD represents an increasingly trivial amount of income for those in the top 20%, even with the additional supplemental flat tax required to close the remaining deficit, they still pay increasingly less than the average alternative flat tax rate.

As is the case under any approach relying on a significant PFD cut, the lower 80% of Alaska families subsidize the top 20%. The extent of the subsidy rises with the amount of the PFD cut, as demonstrated by comparing the impact of the POMV 50/50 approach on the lower 80% of Alaska families with the significantly greater impact using POMV 25/75.

Using additional PFD cuts to close the remaining deficit

As an alternative, we have looked also at the impact of combining the HB 185 tax with various PFD levels and filling the remainder of the deficit through PFD cuts on those not subject to the tax.

We start by combining the HB 185 tax with the current law PFD. Because the current law PFD remains in place, initially, there is no impact on middle, lower-middle, and low-income Alaska families.

But that benefit is quickly overwhelmed by using PFD cuts to close the remaining deficit. While those in the middle, lower middle, and low-income brackets pay no tax, they nonetheless end up paying more than those in the upper-income brackets that do pay the HB 185 tax as a result of using PFD cuts to close the remaining deficit.

Even with the tax, the approach turns heavily regressive, with those at lower income levels being required to contribute a significantly higher overall share of income than those in the top 20%. As is the case under any approach relying on a significant PFD cut to balance the budget, the lower 80% of Alaska families subsidize the top 20%.

Next, we look at the impact of combining the tax with a POMV 50/50 PFD and filling the remainder of the deficit through additional PFD cuts. From the standpoint of achieving a reasonable balance among all Alaska families, the impact goes from bad to worse.

The combination of PFD cuts resulting from reducing the current law PFD to POMV 50/50, plus the regressive impact of using additional PFD cuts to balance the remaining budget gap, make the approach hugely regressive. Even with the tax, middle-income Alaska families still are required to contribute 13 times more, lower-middle income Alaska families nearly 18 times more, and low-income Alaska families more than 37 times more than the top 1%. The lower 80% of Alaska families continue to heavily subsidize the top 20%.

Finally, we look at the impact of combining the HB 185 tax with a POMV 25/75 PFD and filling the remainder of the deficit through additional PFD cuts. The result has the largest adverse impact on middle and lower-income Alaska families of any of the alternatives.

Overall, the tax requires a trivial contribution from those in the upper-income brackets, while the PFD cut from current law to POMV 25/75 has an increasingly regressive impact. Even though exempted from the HB 185 tax, middle-income Alaska families still are required to contribute 12 times more, lower-middle income Alaska families more than 15 times more, and low-income Alaska families more than 32 times more than the top 1%. The lower 80% of Alaska families continue to heavily subsidize the top 20%.

The takeaway is simple. While HB 185 may appear on its face to produce a more equitable result, its failure to raise enough revenue to close the overall deficit – and the resulting need to use supplemental revenue measures to finish closing the fiscal gap – continues to result in hugely regressive results.

As we have explained before, a much more equitable result is achieved by using a flat tax to satisfy the overall revenue requirement. As the alternative line on the above charts demonstrates, under that approach, all Alaska families – both well-off and working families alike – share roughly the same level of responsibility for paying for the costs of government.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

HB 185 applies the tax at income levels of $75K & above (for individuals) and $150K and above (where there are two or more adults in the family). Even then, additional revenues are required to balance the budget at all projected PFD levels. After this column was published, we were asked what the income level cutoff would need to be at each projected PFD level to preserve the “full PFD” for the remainder. We did some calculations based on the numbers we used in the column. Very roughly: The cutoff would need to be around $28K (& $56K) to preserve… Read more »