Over the past several years some legislators and legislative candidates have repeatedly resorted to the phrase “no taxes” when asked to summarize their fiscal philosophy. For many, we anticipate that will continue well into the coming election cycle, if not beyond.

Prior to the 2019 legislative session we responded favorably to those who used that shorthand, because we understood it to mean they supported limiting Unrestricted General Fund (UGF) spending to the level supported by traditional revenues, plus the portion of the Permanent Fund earnings draw remaining after distribution of the current law (statutory) Permanent Fund Dividend (PFD) – the approach that Governor Mike Dunleavy (R – Alaska) effectively campaigned on during the 2018 election cycle.

Since the 2019 legislative session, however, the phrase effectively has come to mean something else entirely.

What changed during the course of the 2019 legislative session was the reality that there isn’t sufficient statewide political will to reduce state spending to the level outlined in Governor Dunleavy’s 2018 campaign.

Reducing spending to that level was the driving force behind Dunleavy’s proposed FY20 budget introduced during the 2019 legislative session. But after the pushback received by legislators during that session, by the end Dunleavy couldn’t even muster 16 out of 60 legislators – the amount necessary to uphold line item vetoes – for the approach.

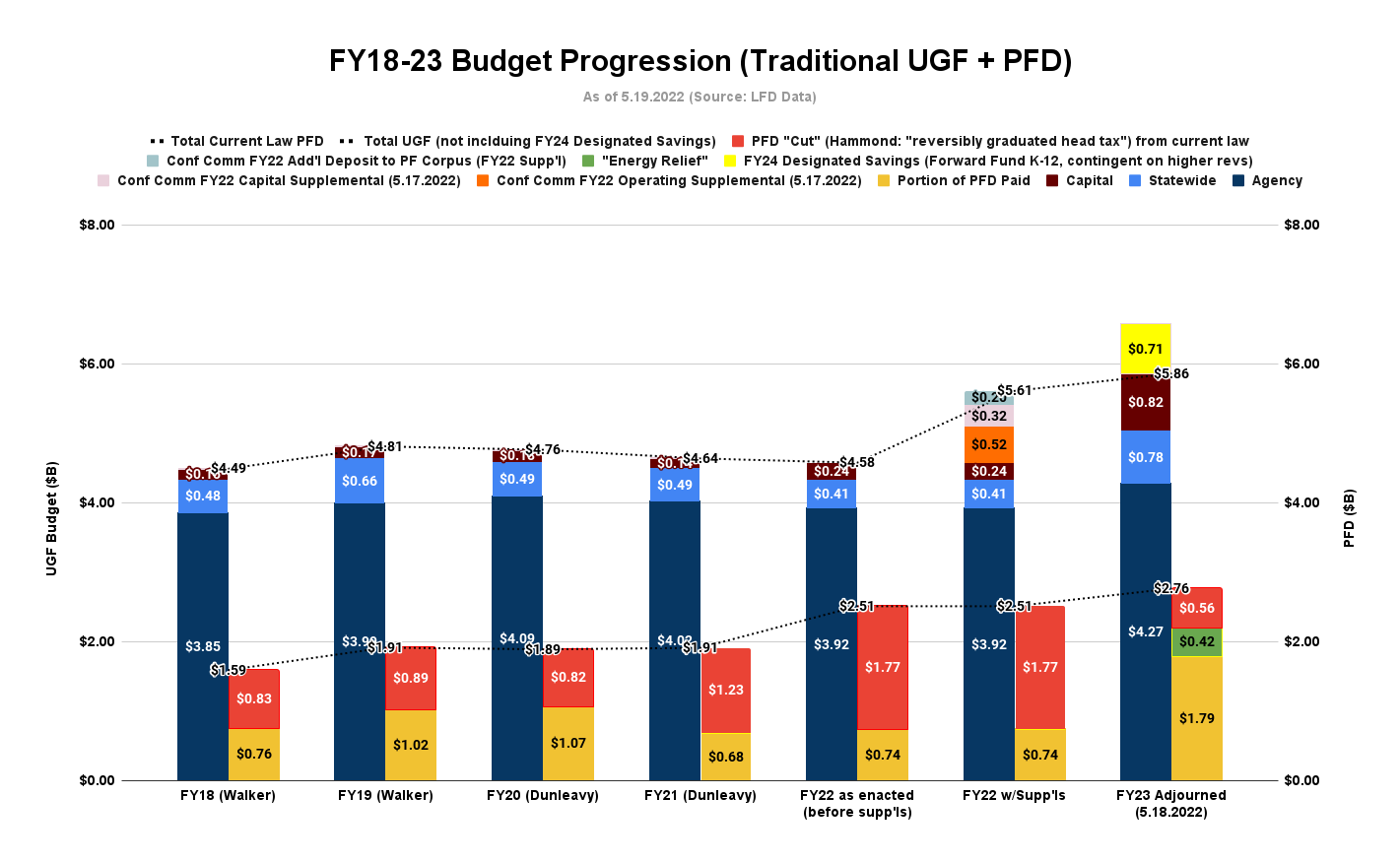

Instead, by the time the smoke cleared, FY20 spending ended down only $50 million (1%) from prior year levels, and PFDs, while up slightly from the prior year, still were 43% below the statutory level.

Since then not only has Governor Dunleavy not renewed his efforts to reduce spending to the levels outlined in his 2018 campaign, neither the minority House nor majority Senate caucuses, nor even individual legislators within those caucuses – many of whom also were elected based on the same campaign rhetoric – have proposed budgets consistent with that approach.

Instead, they have continued to rely by default on the approach initiated by former Governor Bill Walker in 2016, primarily using PFD cuts to help fill the funding shortfalls necessary to balance the budgets.

Some claim that’s also a “no taxes” approach. But as former Governor Jay Hammond – widely considered the creator of the PFD – made clear in his seminal book focused on Alaska fiscal policy, Diapering the Devil, PFD cuts are nothing more than taxes in another form: “reversibly graduated head taxes on all and only Alaskans.”

In short, what “no taxes” has come to mean as a result of the 2019 experience is not “no taxes,” but rather “use instead the tax approach of PFD cuts” to continue to fund government.

We anticipate some candidates – potentially including some sitting legislators – will continue to claim during this coming election cycle that the 2018 definition of “no taxes” is still realistically achievable.

But just as it proved to be following the 2018 election, achieving that in the future is an absolute fiction.

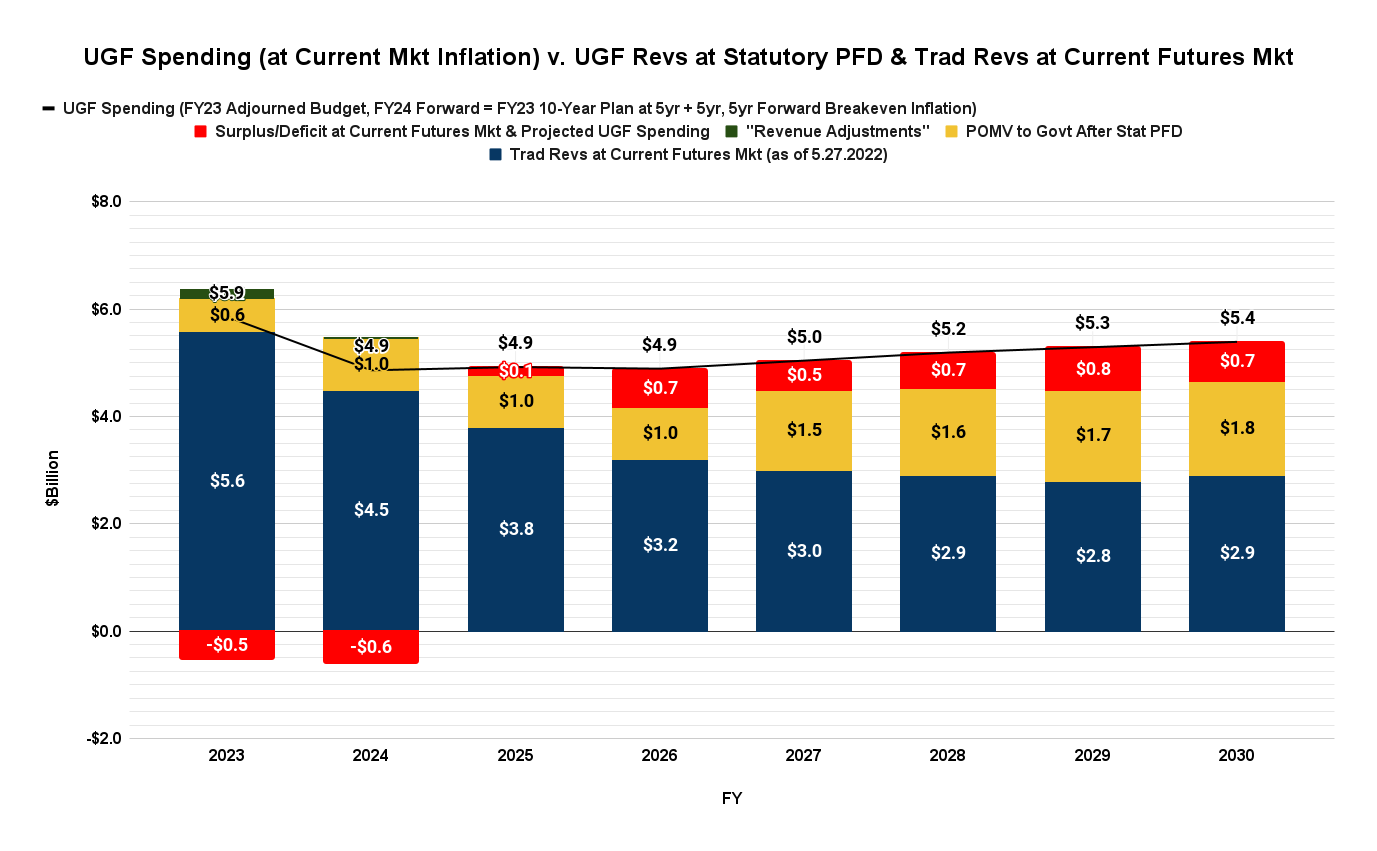

Even at the high oil prices currently prevailing in the market and across the futures strip, and assuming a return (after the huge splurge of this year’s session) to the constrained spending levels outlined in the Governor’s FY23 “10-year” plan (adjusted for current inflation expectations) – a fairly heroic assumption in itself – the outlook still is for significant current law budget deficits (red above the line) in the years ahead.

Those budget deficits will need to be closed by some legislative action. As we’ve experienced since 2019, in the absence of alternative, broad based revenues, “no taxes” will simply continue to mean “use taxes in the form of PFD cuts instead.”

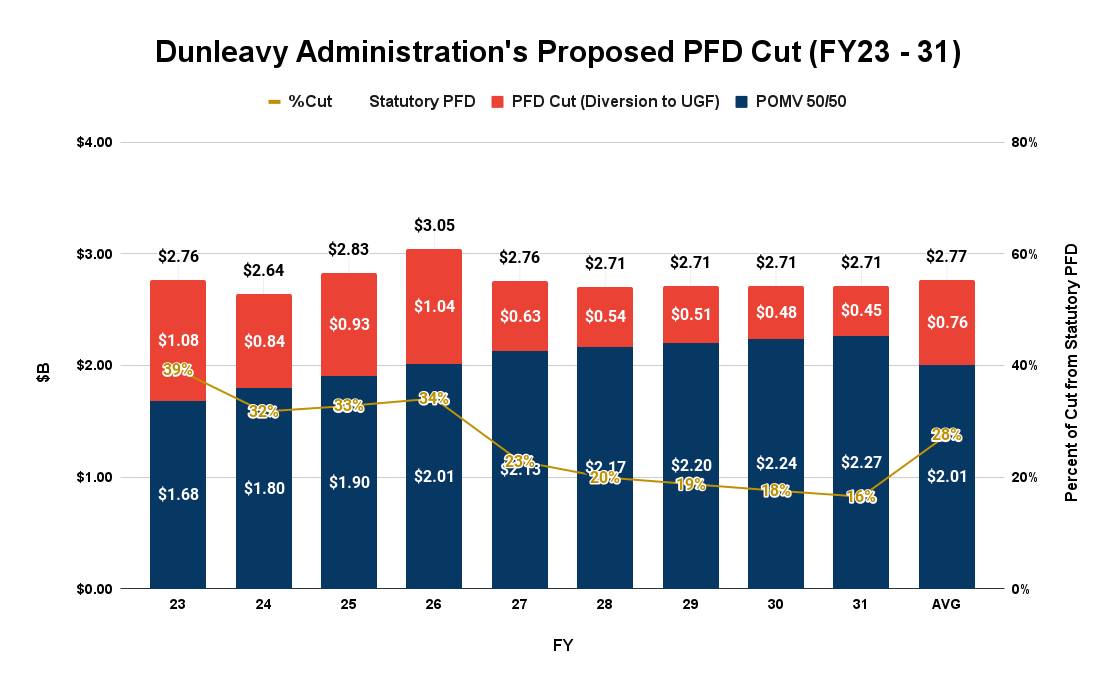

For his part, Governor Dunleavy already has admitted as much. As graphed out here, his proposed “POMV 50/50” approach – which splits the statutory percent of market value (POMV) draw equally (“50/50”) between government and PFDs – is nothing more than a thinly veiled long term cut in current law PFD levels.

Looking at his most recent 10-year plan, those cuts in turn are used to offset the deficits otherwise resulting from the current law PFD. Dunleavy’s “no taxes” line is drawn after that – after an average annual (over the FY23-31 period) 28% PFD cut is already put in place.

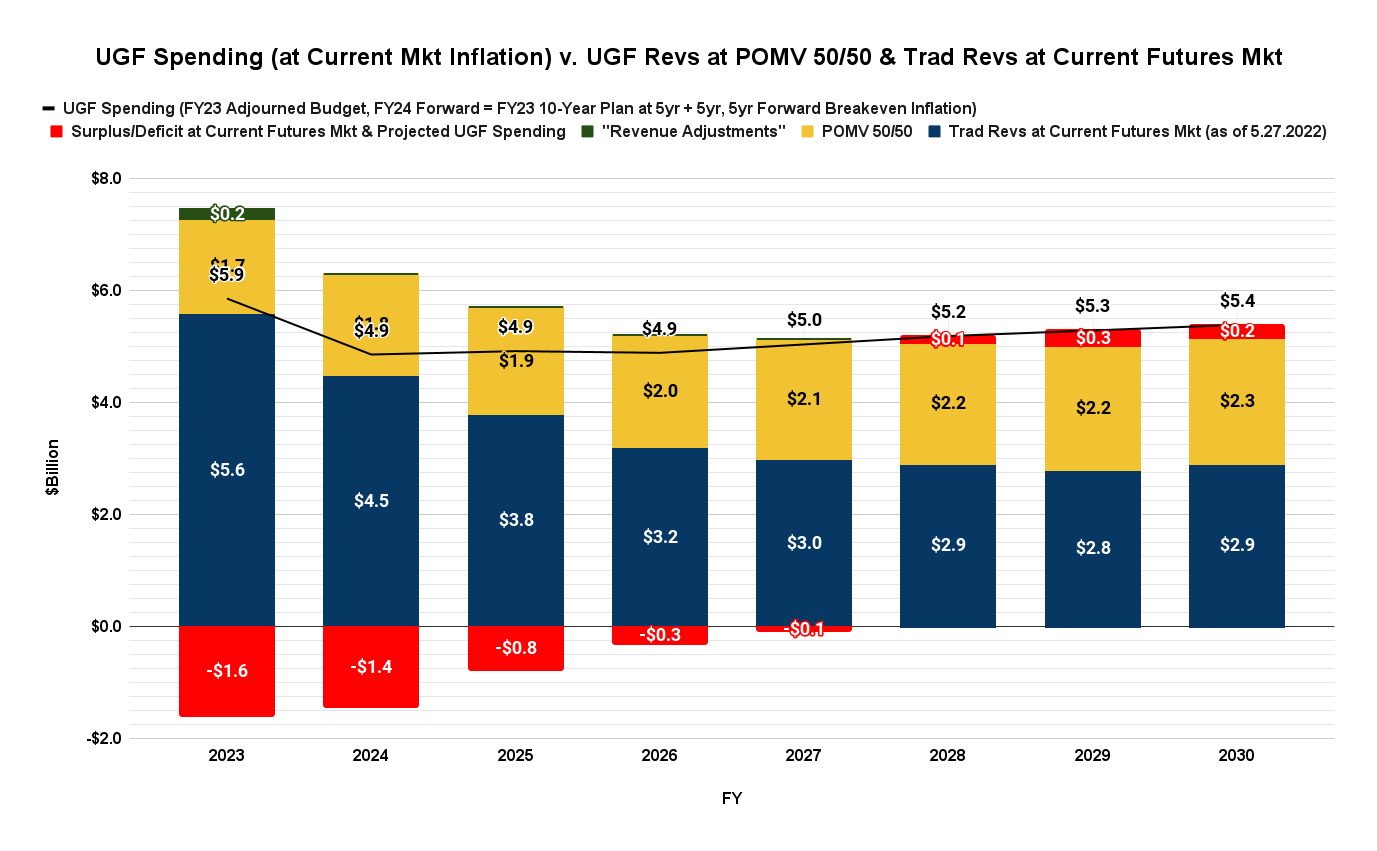

But even that line is optimistic. Again using the high oil prices currently prevailing in the market and across the futures strip, and the “heroic assumption” of a return to the constrained spending levels outlined by Dunleavy’s his most recent “10-year” plan (adjusted for current inflation expectations), the outlook even under a POMV 50/50 PFD approach still is for a return to budget deficits (red above the line) later this decade.

If post-FY23 spending levels reset at higher rates as a result of the FY23 splurge – or oil prices stabilize at lower levels – “no taxes” may quickly become a return to the pre-FY23 “use an average 44% PFD cut instead.”

Of course, as we explain above, “no taxes,” but “use PFD cuts instead” isn’t really a “no taxes” position. Instead, it’s a tax approach that minimizes taxes only to those in the top 20% income bracket, by shifting the bulk of the tax burden instead to middle and lower income Alaska families. The only difference between PFD cuts and other tax approaches is which Alaskan families incur the burden.

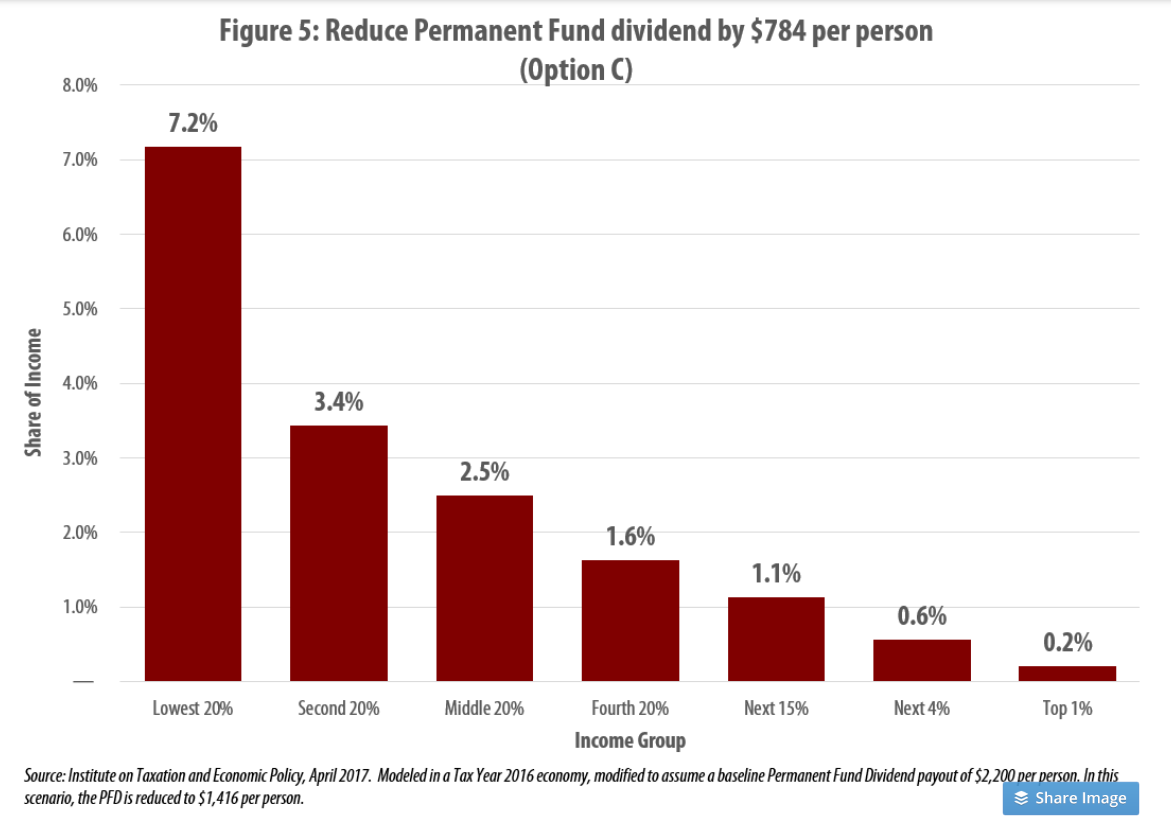

As this chart from the 2017 study for the Legislature by the Institute on Taxation and Economic Policy (ITEP) demonstrates, while using PFD cuts to fund government takes a trivial amount as a share of income from those in the top 20% income bracket, they take (tax) an increasingly larger share from the remaining 80% of Alaska families.

As former Governor Hammond put it, by using PFD cuts to pay for government “the poor [and, indeed, middle income Alaska families] … pay a larger percentage of their ‘income’ in taxes than … the rich, [while] transient pipeline workers, commercial fishermen and construction workers … get off scott–free.”

And the adverse impact on Alaska of using PFD cuts/taxes to fund government is not limited just to middle & lower income Alaska families. As the University of Alaska – Anchorage’s Institute of Social and Economic Research (ISER) concluded in its 2016 analysis of the Short-Run Economic Impacts of Alaska Fiscal Options, because “[t]he impact of the PFD cut falls almost exclusively on residents, and it is highly regressive, … it has the largest adverse impact on the economy per dollar of revenues raised.”

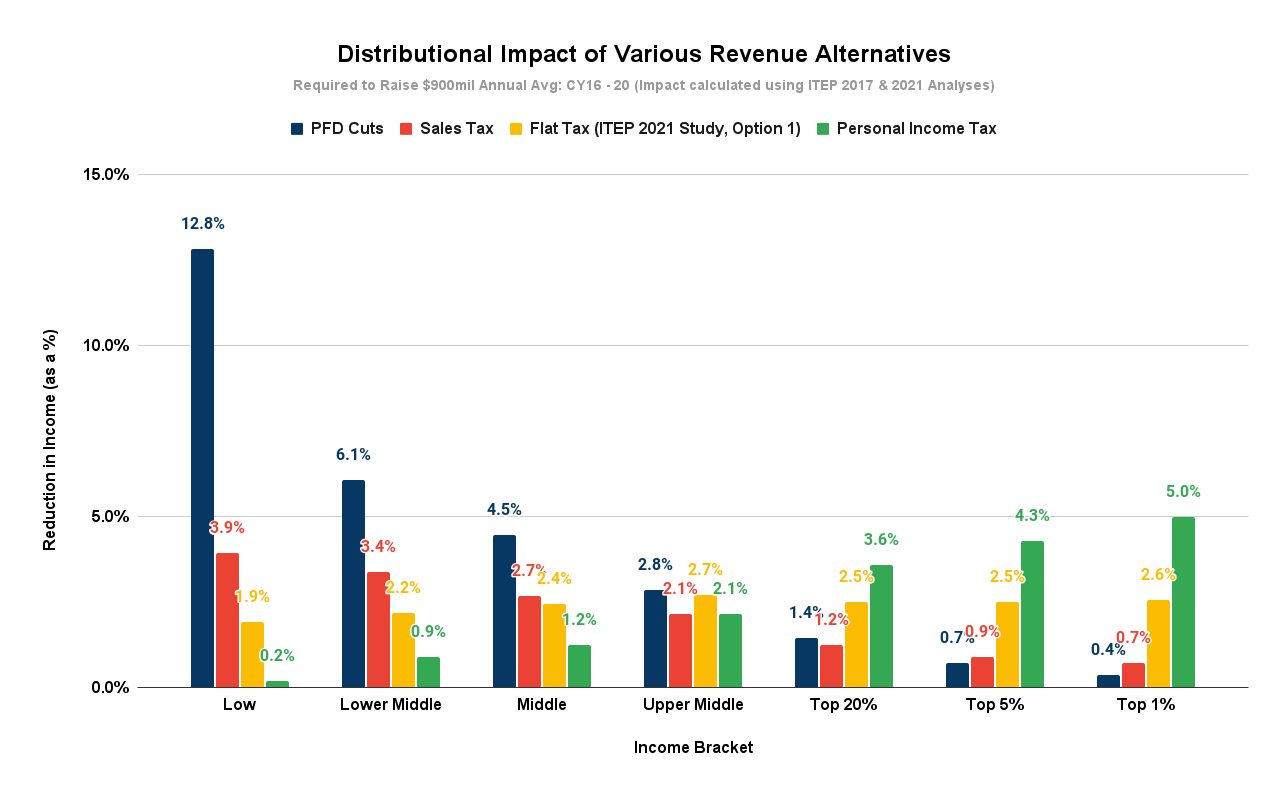

As the ITEP and ISER analyses demonstrate, any other tax approach, including even a progressive income tax, not only takes less from 80% of Alaska families (see the following chart derived from the 2017 ITEP study), it also has a lower adverse impact on the overall Alaska economy.

So, what does “no taxes” really mean in the post-2019 era? Since 2019 it has meant one thing – use a form of taxes (PFD cuts) instead that takes more from middle and lower income Alaska families, and has a larger adverse impact on the overall Alaska economy, than any other option.

In short, at least in Alaska the phrase has become a 21st Century addition to George Orwell’s 1984 “newspeak:” “propagandistic language that is characterized by .. the inversion of customary meanings.” Put another way, a phrase that means the exact opposite of what it sounds like.

In Alaska fiscal policy, “no taxes” now means “large taxes, but only on middle and lower income Alaska families,” and through them, the overall Alaska economy.

Put in that context, anyone using the phrase this coming election cycle is either looking out entirely for the top 20% – focusing only on “no taxes” for them – or completely clueless about the reality of Alaska’s current and long-term fiscal situation.

Alaskans have been and will continue to incur taxes to pay for government. The only open questions are which tax approach is used, and who pays the tax burden.

“No taxes” is code for middle and lower income Alaskan families paying the burden through continued PFD cuts/taxes.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.