One of the things that has intrigued us most over the years is the extent to which the economic interests of most of Alaska’s legislators diverge from middle and lower-income Alaska families, which combined comprise 80% of Alaska households, when it comes to the revenue (tax) approach the legislators take when in Juneau.

We have previously written about the issue a couple of times. The first was in late 2021, toward the beginning of our time writing these columns, when we broke down the then-legislators by income bracket. As we said at that time:

So, if PFD cuts have the largest adverse impact of all the options on 80% of Alaska families and the overall Alaska economy, why, over the past 6 years, has the Alaska Legislature used them not only first, but exclusively to raise the additional funds necessary to balance the budget?

To us, one answer — and perhaps the most important — is to look at the breakdown of the Alaska Legislature by income bracket. …

Forty legislators — fully two-thirds of the Legislature — fall in the Top 20%, from whom PFD [Permanent Fund Dividend] cuts take the least of the three options. And of those, twenty-two — itself more than a third of the Legislature — are in the Top 5%, from whom PFD cuts and sales taxes are the two lowest cost options.

Our second column on the issue was in early 2024, near the beginning of that year’s legislative session, when we specifically looked at the then-members of the House Finance Committee as they began considering various revenue bills. As the title reflected, in that piece we asked, “Is the fact that legislators live in a much different economic world than 80% of Alaska families leading to deep PFD cuts?”

We concluded that it was. Recalling that was the session that began with many legislators expressing concern about the outmigration of working-age, working-class Alaska families, we wrote this:

If legislators are as truly concerned as they claim about the overall Alaska economy and Alaska families, all of those factors should lead the Legislature to reject, or at least moderate, the continued use of deep PFD cuts as a funding source and focus instead on one or more of the alternatives.

But they haven’t. So, why is that?

We’ve come to believe that part of the reason is as simple as the fact that the legislators deciding to use PFD cuts don’t feel personally what the 80% of Alaska families living in the middle- and lower-income brackets face.

Building on the House district-by-district database we developed for our column two weeks ago, we are taking another look at the issue in this week’s column, this time by comparing each legislator’s own economic interests to those of the average household in the legislator’s district. We have also expanded our database to include Alaska’s Senate Districts.

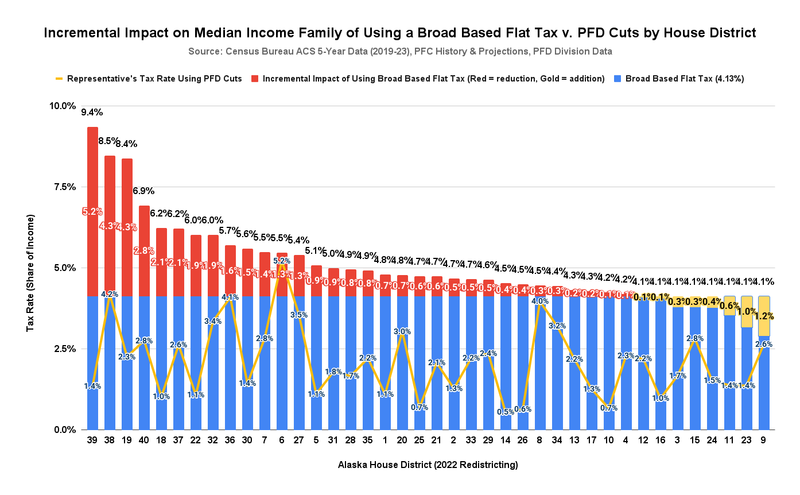

The analysis is eye-opening. In the column two weeks ago, we compared the impact on the average household in each House district of using a broad-based flat tax to raise the same amount of revenue as is currently raised through PFD cuts, with the impact of using PFD cuts alone. This was our conclusion:

In short, the median income household in 80% of Alaska House districts – and from the perspective of the Governor, the statewide median income household overall – would be better off economically using a flat rate tax of some sort than PFD cuts to pay for the costs of state government. While the median income household in the remaining 20% of Alaska House districts – the state’s wealthiest – might contribute a bit more, the percentage increase would be far less than the improvement realized by the vast majority of the state’s households; most importantly, those in the remaining 20% would be required to contribute no more as a share of income than anyone else.

As we demonstrate in the following charts, the impact on individual legislators in most districts of using PFD cuts, however, is starkly different from the impact on the average household in those districts.

While the average household in 80% of Alaska House districts would be better off economically under a flat-rate tax of some sort than under PFD cuts, the same is true for only 2 of 40 members of the House. Put differently, while 80% of Alaska families would be better off with the state using a flat tax to raise revenue, only 5% of House legislators are. Conversely, while only 20% of Alaska families are better off using PFD cuts, 95% of House legislators are.

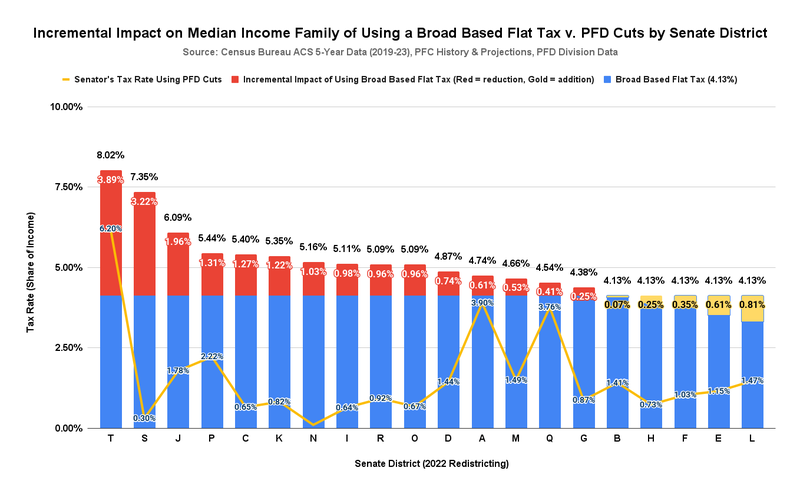

The Senate numbers are largely the same. Similar to the House, the average household in 15 of the 20 Alaska Senate districts (75%) would be better off economically if the state used a flat-rate tax to raise revenue instead of PFD cuts. The same is true for only 1 of the 20 Senators themselves. In short, while looking at the data by Senate district, 75% of Alaska families would be better off using a flat tax, only 5% of Senate legislators are. Conversely, again looking at the data by Senate district, only 25% of Alaska families are better off with PFD cuts; 95% of Senators are.

Here is the breakdown by House district (as before, for those who want a quick way to match district numbers to the names of the representatives, can use this link to the Legislature’s website):

We explained the red and blue bars in our earlier column. In brief, the blue bars show the impact, as a share of income, on all Alaska households from raising the same amount of revenue as this year’s PFD cuts by replacing them with a broad-based flat tax. The effective tax rate (impact as a share of income) would be 4.13%.

In the districts with red and blue bars, the number at the top of each bar —the total of the red and blue —represents the impact on the average (median) household in each Alaska House district from using PFD cuts. So, for example, the impact, as a share of income, of using PFD cuts on the average household in House District 39—the farthest to the left—is 9.4%.

The red bar shows the reduction, as a share of income, in the level of “government take” from the average household in each district that would result from changing the way the Legislature raises revenue, from PFD cuts to a broad-based flat tax. The average household in 32 of the 40 House districts would see a reduction. Again, using House 39 as the example, government take, as a share of income, on the average household in the district, would fall from 9.4% with PFD cuts to 4.13% with a broad-based flat tax. In short, the level of government take, as a share of income, would fall by 5.2% for the average household in that district by replacing PFD cuts with a broad-based flat tax.

Instead of red, 8 of the 40 House districts have yellow bars. The average family in those districts, 20% of the total, would see an increase in government take under a broad-based flat tax rather than PFD cuts. The bar shows the level of the increase as a share of income. Using a broad-based flat tax, however, none of the households in those districts would experience a higher government take than any other household in any other district.

The points within each district along the dark yellow line reflect the impact on that district’s House member of using PFD cuts. In calculating the impact, we have started with the member’s income as reported by them in the most recent Public Official Financial Disclosure (POFD) filed by the legislator with the Alaska Public Offices Commission. The income reported by members on the POFD forms is a range. We have used the midpoint of each member’s range.

To that, we have added the amount the member’s household would have received if the full statutory PFD had been paid, then divided the PFD cut by that sum to determine the impact as a share of the legislator’s overall household income. For example, again looking at House District 39—the farthest to the left—the impact of using PFD cuts on the representative from that district is a mere 1.4% of income, much, much, much less than the impact on the average household in that district of 9.4%.

Strikingly, looking across the entire chart, the impact on the legislator in every district in the state from using PFD cuts is less than the impact on the average household in that district. The closest the impact on the member comes to the average household in that district is in House District 6, where the impact, as a share of income, of using PFD cuts on the member is 5.2%, compared to 5.4% on the average household in that district. House District 8 is also relatively close. The impact, as a share of income, of using PFD cuts on the legislator from that district is 4.0%, compared to 4.4% on the average household in that district.

More are like House District 37, however, where the impact, as a share of income, of using PFD cuts on the member is less than half the impact on the average household in the district.

As we noted previously, the other striking takeaway from the analysis is that while the average household in 32 of the 40 House districts (80%) would see a reduction in the level of government take from using a broad-based flat tax instead of PFD cuts, only two of the legislators (House Districts 6 and 38) would see a similar reduction. Two more (House Districts 8 and 36) would be close, but the remaining 36 House members (90%) would see an increase from replacing PFD cuts with a broad-based flat tax.

In other words, while replacing PFD cuts with a broad-based flat tax would be economically beneficial to the average family in 80% of the state’s House districts, it would have a financially adverse impact on 90% of the House members. That’s a huge, conflicting disparity.

Here is the same breakdown by Senate district (here is the link to match Senators’ names to the districts):

The total number at the top of each bar, the blue, red, and yellow bars, and the points on the dark yellow line, represent the same as on the previous chart of the House districts. The impact of using PFD cuts on the senator from District N is so small — less than 0.1% — that it doesn’t show up on the chart at the scale we are using.

As with the House, the impact on the Senator in every district in the state from using PFD cuts is less than the impact on the average household in that district. The closest the impact on the member comes to the average household in that district is in Senate Districts A and Q, where the impact, as a share of income, of using PFD cuts on the member is within one percentage point of the average household in those districts. Compared to the House, they aren’t very close, though. The members of both House Districts 6 and 8 are each within 0.5 percentage points of the average household income in their respective districts.

Other than for Senate Districts A, Q, and T, the impact, as a share of income, of using PFD cuts on the Senators from the remaining 17 districts (85%) is less than half that on the average household in their district.

As with the House, the other striking takeaway is that while the average household in 15 of the 20 Senate districts (75%) would see a reduction in the level of government take from using a broad-based flat tax instead of PFD cuts, only one Senator (Senate District T) would see a similar reduction. Every one of the remaining 19 Senators (95%) would see an increase.

Some argue from this data that many members of the Legislature are intentionally elevating their own and their Top 20% donors’ self-interest above that of their constituents by continuing to vote to use PFD cuts, rather than other, much broader-based approaches, which would have a significantly lower impact on the 80% of Alaska households falling in the middle and lower-income brackets but a higher impact on the members.

We don’t go that far. But, indeed, those continuing to vote to use PFD cuts to fill the state’s deficits rather than other, much broader-based approaches are largely voting for an approach that favors their own and their Top 20% donors’ economics over those of the vast majority of Alaska families. And over time, we have become convinced that they continue to vote for PFD cuts, knowing that is the impact.

For the present, we continue to believe, as we expressed in our prior columns, that such voting patterns are the consequence of the legislators living at income levels and in donor (and lobbyist) circles that significantly distance them from the economic situation facing the 80% of Alaska families in the middle and lower-income brackets.

But while we are not yet prepared to say that they are doing so for the explicit purpose of favoring their own and their Top 20% donors’ interests over those of the vast majority of Alaska families, the result is the same.

By using PFD cuts, middle- and lower-income Alaska families are contributing more—and, in many cases, much more—as a share of income to cover government costs than they would under a broad-based flat tax. At the same time, their legislators, their legislators’ donors, and others in the Top 20% —along with non-residents and oil companies —continue to contribute significantly less.

At the very least, the voting patterns suggest the appearance of self-dealing.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“……….One of the things that has intrigued us most over the years is the extent to which the economic interests of most of Alaska’s legislators diverge from middle and lower-income Alaska families………”

Funny you mention that. I was thinking about the difference between the legislators of today compared to those of the pre-oil years just the other day. Before oil, the legislature was dominated by commercial fishermen and hunting guides, which were the primary private sector industries. Today? The legislature is dominated by…………..lawyers.

Like you…………….

Money can attract people just like carrion attracts scavengers…………….

“The legislature is dominated by…………..lawyers.”

-Reggie Taylor

No it isn’t.

Lie.

Senate President Gary Stevens is not a lawyer.

House Speaker Bryce Edgmon is not a lawyer.

House Majority Leader Chuck Kopp is not a lawyer.

Senate Majority Leader Cathy Giessel is not a lawyer.

House Minority leader Mia Costello is not a lawyer.

Reggie Taylor never, ever knows what he’s talking about.

“………No it isn’t. Lie……….” Not a lie. I was incorrect. You made me look, and look in great depth. Things have changed since the 1980’s-1990’s. In the Senate, 3 of 20 senators are lawyers (Claman, Dunbar, & Wielechowski), or just 15%. In the House, there is a single lawyer out of 40 members (Josephson), or just 3%. Now, it isn’t the lawyers who dominate the legislature. It’s the educators. Of the Senate, 4 of 20 are/were educators (Stevens, Bjorkman, Cronk, Hughes), or 20%. In the House, 8 of 40 members are/were educators (Carrick, Costello, Dibert, Eischeiud, Niayuq Frier, Hannan, Himschoot,… Read more »

Reggie Retardo hovers over another Landmine article which he eagerly digests like a fly – vomiting onto it and slurping it up. Regurgitating MAGAtized word salad and absorbing only that which fuels the malignant cancer of hatred and despair inside him.

See my correction, based upon review of facts (not anything Dan

contributed), and twist it to your best effort. I await your contribution…………

“……..Regurgitating MAGAtized word salad………..”

Oh, and BTW, I’m as opposed to Trump and his stupid $2000 “dividend” acquired with his insane tariff wars as I am Mr. Keithley’s welfare dividend scheme, so your “MAGA” bullshit is just the same “hatred” you accuse me of. Any vote buying is corruption, whether it’s Alaskan or Trumpist.

So, based upon socialist “dividend” advocacy, it’s looking like Mr. Keithley is in the same little dinghy as your favorite POTUS, Tiger, not me.

Go roar in your mirror……………..

It’s early and maybe I need more coffee, but can I ask what Brad means by “flat tax?” Nepo baby Steve Forbes used to push for a flat federal tax, which amounts to eliminating the progressive income brackets. Obviously, this would be a great deal for a rich guy like Forbes. Is Brad talking about a fixed percentage of your taxable income as calculated for the IRS, or a fixed percentage of your federal tax which is calculated using progressive income brackets?

A fixed rate tax based on federal adjusted gross income. It wouldn’t “eliminate” progressive income brackets in Alaska because we have none. Instead, it would replace, as ISER Professor Matt Berman calls current PFD cuts, the “most regressive tax ever proposed,” taking much less from middle- and lower-income Alaska families than the current, PFD-cut-based approach does.

We have discussed the approach in detail in previous columns. A recent one is here:https://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-alaska-has-a-revenue-design-problem/

“……..A fixed rate tax based on federal adjusted gross income……….”

This is what we paid before 1975, when it was changed to a “progressive” rate based upon the federal adjusted gross income. The rate grew from 10% to 16% by 1965, and repealed in 1980.

None of that addresses the concerns of transforming a poorly considered social dividend based upon a bonanza into a new welfare scheme used to justify it’s continuance while the working class has to pay a reinstitute income tax. Everything Bill Richards warned has come true. Every bit.

Well, sure, PFD confiscation is the worst because it is a head tax, which means a 5-year-old kid contributes exactly the same as the president of ConocoPhilips Alaska. I see that Brad means a fixed percentage of your Federal tax, which is calculated using the Federal progressive brackets.

“……… PFD confiscation is the worst because it is a head tax………..”

It is, by definition, a flat negative tax. What Mr. Keithley is repeatedly proposing, in order to be fair to the poor, is to treat it as a Universal Basic Income scheme instead of a “dividend” from a now dead bonanza. In short, it will now be a new welfare program, still dependent on the Legislature to fund (or alter) as they see fit per the constitution.

No, that is not what the above analysis uses. It uses a flat rate based on adjusted gross income (as Dan points out, “Reggie” rarely gets anything right).

Using a flat rate of federal taxes paid would result in MUCH higher rates. Based on the most recent IRS data, Alaska federal tax liability is a little over $4 billion. Recovering a $1.77 billion deficit on that base would result in a surtax rate of somewhere between 40 and 45%. That is not at all what we are suggesting.

“……..as Dan points out, “Reggie” rarely gets anything right………”

Do you deny that the Alaska income taxes I paid before 1975 were a 16% flat tax calculated on my federal adjusted gross income?

Jezus, you really don’t know what you’re talking about, do you Reggie? Prior to 1975 the SoA levied a flat percentage of federal income tax liability, not gross income as you claim. In 1975 the SoA switched to a graduated tax rate structure independent of federal tax rates. State income tax was repealed in 1980. At no time did the SoA ever implement a flat tax calculated on anyone’s federal adjusted gross income.

https://taxsim.nber.org/historical_state_tax_forms/AK/HB%20115%20-%20Background%20-%20History%20of%20Alaska%20Income%20Tax.pdf

“……..Jezus, you really don’t know what you’re talking about, do you Reggie? Prior to 1975 the SoA levied a flat percentage of federal income tax liability, not gross income as you claim……..” Typo. I meant adjusted gross income, but it might have been on the tax liability, which was based upon the adjusted gross income. I’m an old man, I’ll admit, t and my debate skills with lawyers suck, but I’m not going to sit quietly while you socialists tax and redistribute. Sorry, but not sorry. The tax was a FLAT TAX (percentage based upon the federal taxes). After 1975 (the year the… Read more »

“……..Using a flat rate of federal taxes paid would result in MUCH higher rates………”

Do you deny that this “MUCH higher rate” as a flat tax on federal adjusted gross incomes would hit the middle class at the exactly same “rate” as it would your fabled 1% and 20%, and actually more, since your imagined 1% and 20% have the advantage of sheltering more of their incomes?

Brad,

A tax scheme, no matter how well intentioned, will inevitably result in self dealing far beyond what may be happening with the PFD.

Federally, the IRS code is 6800 pages. Should be about 20. The other pages 6780 are the tweaks (exemptions) inserted by politicians over the years.

It is insane to believe our legislators would resist the temptation to trade an exemption here and there for campaign cash.

I don’t like using the PFD for State services but giving Juneau the power to select tax winners and losers is not the solution.

Even with all the exemptions and exclusions, the federal income tax remains progressive (taking more from those in higher income brackets). The self-dealing in terms of regressivity (pushing the burden off on middle- and lower-income families) is minot, certainly compared to using PFD cuts.

Let jus review the current field of welfare programs funded in full or part by the Legislature: Food and nutrition SNAP (Supplemental Nutrition Assistance Program): Provides food benefits on the Alaska Quest card for eligible low-income households. WIC (Women, Infants and Children): Supports nutritional needs for women, infants, and children. Senior Farmers’ Market Nutrition Program: Offers checks for seniors to buy fresh produce at farmers’ markets. Commodity Supplemental Food Program (CSFP): Provides food to low-income seniors. Financial and cash assistance ATAP (Alaska Temporary Assistance Program): Offers cash assistance and work services to low-income families with children. Adult Public Assistance (APA): Provides cash assistance for eligible aged,… Read more »

I disagree with the idea that cutting the PF dividend is exactly the same thing as a tax. No one has to do anything to get a dividend check – it is just money that falls out of the sky. An income tax taxes people’s income which mostly results from hard work. Money that people get through hard work is superior to the money that falls out the sky and should be taxed only after the sky money is no longer sufficient to pay for government.

The “money that falls out of the sky” doesn’t go away with PFD cuts. The benefit just transfers over to shield those in the Top20%, non-residents, and the oil companies from taxes to pay for their proportionate share of the costs of government. In doing so, it turns into a $100,000 dividend for some. https://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-the-100000-dividend/

The PFD is every Alaskan’s share of the state’s commonly owned wealth. It shouldn’t be gerrymandered through PFD cuts so that some get much more of the benefit than others.

“………The “money that falls out of the sky” doesn’t go away with PFD cuts. The benefit just transfers over to shield those in the Top20%, non-residents, and the oil companies from taxes to pay for their proportionate share of the costs of government……..” The money pays for state government, much of which is already socialist welfare spending. Your straw man to tax the fabled “top 20%”, non-residents, oil companies, and itinerant yetis is just a red, lawyeresque cape waved about to get the bull riled up and get it to focus on your antics. You very much intend to include… Read more »

You don’t seem to want to address the point i made, which is that sky money and money earned through work are different. Please do that before you write another article equating the two. Also, i do believe that oil companies are undertaxed in Alaska vs other jurisdictions – but coporate taxes and personal taxes are separate issues – why confound your proposal for personal taxes with a discussion of corporate taxes?

We do address it, often. Even if you assume that inheritance income (which is essentially what PFDs are) is somehow inferior, the fact is that the benefit of it doesn’t go away as you suggest happens through PFD cuts. It simply shifts over to shield the Top 20%, non-residents, and oil companies from paying their share of government costs. The statute divides the benefit of the “sky” money 50/50 between a use that primarily benefits middle- and lower-income Alaska families and a use that benefits the Top 20%, non-residents, and oil companies. Those who advocate for PFD cuts don’t really… Read more »

Nothing in my comment implies that some benefit goes away. You keep avoiding my argument. Why should we tax income people earned through hard work so we can pay sky money to people? You keep equating earned and sky money. They are not the same. One is earned through work, the other just comes to people as if it just falls out the sky. If you want to respond to my comment you must explain why they are the same.

“………Those who advocate for PFD cuts don’t really want the “sky money” to go away; they just want it redirected to their benefit so they can continue to avoid contributing toward the costs of government, even as those costs grow and grow………” As a middle class retired senior, that is exactly true for me: I don’t want to pay more for the increase in government spending to people who are not working, because that is the majority of the budget, especially when you include PFD appropriations. A $1351 PFD is a $1 billion appropriation, and I’m unwilling to pay an… Read more »

Also, i don’t agree that if the dividend is cut, some get more than others. Everyone gets the same cut.