One of the criticisms we hear most often about this column is that we focus too much on the Permanent Fund Dividend (PFD).

The reason that we write so much on the issue is because we consider preserving it the linchpin to equitably, sustainably and, from an economic perspective, robustly resolving Alaska’s fiscal future, which after all, is the central focus of Alaskans for Sustainable Budgets.

But we do analyze other things, write about them often and would be happy to write about them even more. Indeed, we’ve developed a list of non-PFD topics that we have planned on working through over the coming weeks. Last week’s – “How much would ‘government take’ from oil need to increase to balance the budget” – was one.

But like Michael Corleone (Al Pacino) said in The Godfather: Part III, “Just when I thought I was out, they pull me back in!”

Those who regularly read the column will realize that, over the past several months, most of our time on the PFD has been spent responding to various myths used by some to justify cutting it. One is that “Alaska doesn’t have a sufficient tax base” to pay for government any other way than through PFD cuts. A second is that advocating for substituting more equitable taxes for PFD cuts to pay for government is “class warfare” or as others put it, “wealth envy.” A third is that the federal income tax impact is a decisive reason to support PFD cuts over other options.

All of those are myths. Alaska clearly has a sufficient tax base, the class warfare actually flows in the opposite direction and the federal income tax impact is only one factor to be considered – and a minor one which is outweighed by other factors.

But the myths are so persistent they need to be clearly rebutted in order to avoid them unfairly tainting the discussion.

We recently encountered yet another. In response to a post we had made, a commentator said: “I currently oppose an income tax in Alaska because of the snow birds who contribute heavily to our economy and would leave our state for another state residence if we imposed an income tax. … My gut tells me the top 5% in Alaska own multiple homes in multiple places and it would be easy for them to change their residency to a new location and not come back.”

That echoes a similar claim made by retiring Senator Natasha von Imhof (R – Anchorage) in a 2018 interview rationalizing her support for PFD cuts.

“While Alaska’s tax burden is the country’s lowest, according to the Tax Foundation, von Imhof argued that taxes would still push high earners and business owners out of the state. ‘People who have money, they will leave,’ von Imhof said. ‘They will go to states where they can actually do their business and not have the high cost of health care.’”

Yes, you read that right. She blamed the potential move of “people who have money” on the “high cost of health care,” not taxes, but nevertheless argued that it would be taxes that somehow push those “people” over the edge.

In essence, her argument is that middle and lower income Alaska families – those most affected by PFD cuts – should effectively offset the “high” healthcare costs of “people who have money” by using PFD cuts to substitute for the taxes that those “people” otherwise would pay as their share of the costs of government.

While neither comment indicated the level of “income tax,” in the case of the first commentator, nor the type of “tax,” in the case of von Imhof, that would trigger the alleged exodus of “people who have money,” the approach we hear most often from those who repeat this myth is a progressive income tax that would take more from higher income Alaska families than others.

We can understand that, at a certain level, a progressive income tax could act as an incentive for relocation. That has been used as a rationale, for example, by some relocating from New York to Florida, or from California to Texas.

But, according to the Tax Foundation, in New York residents “with money” are dealing with a top marginal state income tax rate of 10.9%, in addition to a state sales tax rate of 4%, with substantial additional income and sales taxes assessed at the local level as well. And in California, residents “with money” are dealing with a top marginal state income tax rate of 13.3%, in addition to a state sales tax rate of 7.25%, with substantial additional income and sales taxes assessed at the local level as well.

(And even then, according to IRS statistics, in the five years between 2014 and 2019, the latest year for which data are available, the number of returns in the top 5% actually grew by 7% in California and 3% in New York, hardly consistent with the theory that high tax rates are pushing people out of those states.)

On the other hand, as we have explained in previous columns, in Alaska a broad based flat tax of roughly 3.1% would be sufficient to cover projected deficits through the remainder of this decade.

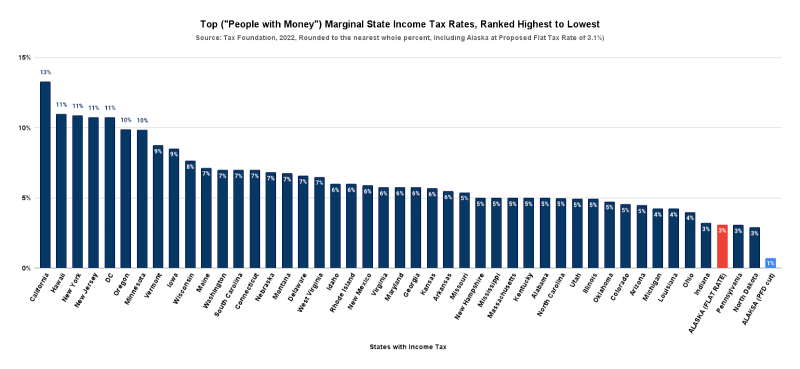

As we show in the chart below, while that rate (in red) is higher than the marginal (and trivial) tax rate now paid by Alaska’s top 5% through PFD cuts (light blue, far right), it is less than the top marginal income tax rate in every other of the forty-three states having one with the exception of Pennsylvania (with a top marginal rate of 3.07%) and North Dakota (2.9%).

But even in those two states, as well as the other seven that don’t have an income tax, that’s only part of the story. Those states also have substantial state sales taxes (Pennsylvania 6%, North Dakota 5%), as also do Washington (6.5%), Texas (6.25%) and Florida (6%), which are other states to which some suggest Alaskans would flee for tax reasons. Those need to be factored in as part of any state tax comparison.

Alaska, on the other hand, has no statewide sales tax.

Given such substantial differences in overall tax rates, it’s hard to see many Alaskans – much less the droves projected by the commentators – fleeing for tax reasons even if Alaska were to implement a moderate flat tax.

But even if some did, the state revenue impact likely would be more than offset by the new revenue received at the same time from non-residents.

According to the Institute on Taxation and Economic Policy’s (ITEP) 2021 study for the Legislature of various flat tax alternatives, 7.3% of the total revenue raised by a flat income tax would come from nonresidents.

At a flat tax rate of 3%, that’s about $60 million in non-resident revenue.

According to IRS statistics, the top 5% in Alaska have an adjusted gross income of a little under $7 billion. At a flat tax rate of 3%, that’s about $210 million in revenue.

That means that more than 28%, or roughly 1-in-3.5, of households in the top 5% would need to flee as a result of the adoption of a 3% flat tax rate in order to make it a bad deal for the state.

Even if 20% of households in the top 5% left, Alaska would still come out significantly ahead, and, regardless of how you look at the data, not even California or New York have remotely suffered that level of out-migration. We see no data which supports a conclusion that Alaska would even approach those states, much less be worse.

The commentator mentioned at the top of this column argued that the impact of any departures could be felt also in the private and philanthropy sectors: “If you could tally the donations to nonprofit organizations and in GDP to Alaska [from the top 5%], I believe it is substantial.”

Just because some might change their tax residence does not mean they would flee the state entirely. As multiple home owners, “snow birds” in particular might continue to live in Alaska the same, or nearly the same amount of time and stay engaged in the same, or nearly the same, amount of economic and philanthropic activity as before, but just change their tax residence to another state.

But even if some completely departed in order to dodge paying even a moderate level of taxes, that doesn’t justify continuing to use PFD cuts instead of taxes.

As with Senator von Imhof’s claim about healthcare costs, all that argument suggests is that middle and lower income Alaska families – those most affected by PFD cuts – should subsidize the economic and philanthropic activities of those “people who have money” by using PFD cuts to cover for the taxes those “people” otherwise would pay.

In short, it suggests that middle and lower income Alaska families should continue to be worse off so that a few snow birds “with money” can continue to enjoy a “part time, tax free” Alaska lifestyle without contributing anything more than a trivial amount toward its costs.

Seriously, give us a break. Alaska isn’t competing for a Top 10 listing in “Lifestyles of The Rich and Famous;” this is real life. If some don’t want to live or give here anymore because they have to contribute a moderate amount toward the cost of state government, so be it. As Sarah Palin famously once said about Exxon when it was being recalcitrant about participating in some endeavor, “don’t let the door hit you in the stearn on the way out.”

Notably, Exxon’s still here. And the data strongly suggests, even with a moderate flat tax, most, if not all, of Alaska’s “people with money” will continue to stay as well. And even if some don’t, new revenue from non-residents will more than make up any shortfall.

The argument is just another myth.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Thanks for writing this, Brad, and stating what should be obvious . . .

Huge problems with this analysis. California and New York have a lot more draws in lifestyle for top earners. People largely stay despite taxes. Look what happened in a less desirable state like Maryland. One of the first questions I get when recruiting is taxes. And high earners are often here to get big bucks in their field without taxes and they take frequent trips away. You take away a puece of that income advantage with a tax along with greater expenses and it will push them away. We have a much more transient populatio than other states and people… Read more »

After all these years, at least spell the name right, Brian. It’s Keithley, with an e. As for the remainder, we get that you want others to pay for government (through PFD cuts) so that you, Natasha and others can escape with contributing a trivial amount. But as we said, even if some leave (which we doubt, they will still make money here even with a moderate tax), the new revenue from non-residents will more than make up for the leakage. If some are, it’s time that all Alaskans pay equitably for at least part of the costs of their… Read more »

Now I feel bad about misspelling your name:(

Brad, you spelled “Alaska” wrong in the last bar/column of your own graph. Come on, how long have you been spelling your state wrong. Get it together man.

The elitism of your response is laughable. It’s the Dwyane Wade way of thinking. “If the lower classes would cut down on their water consumption, my obscene waste wouldn’t be a big deal.” https://www.google.com/amp/s/www.insider.com/dwyane-wade-hidden-hills-home-exceeded-water-budget-2022-8%3famp

Your argument is that the rich come to Alaska because they can take advantage of all the benefits and services of other States without having to pay for them, subsidized by the working class. Way to miss the point of Kiethly’s post.

Gotta agree with Sarah on this one: Don’t let the door hit you on the way out.

As von Imhof hops around in her Gulfstream, private lodges,etc….reality check please!

What about non-petroleum minerals, primarily gold? The State of Alaska gets the ’50s-based 3% royalty, a far cry even from the puny 12.5%-minus-tax-credits we receive from oil. What effect might that have if mining paid even that?

Sorry to pound the point again, but you say: “According to IRS statistics, the top 5% in Alaska have an adjusted gross income of a little under $7 billion. At a flat tax rate of 3%, that’s about $210 million in revenue.” That top 5% probably has another $2-3 billion in real income, which equates to another $100 million in revenue. Using AGI is a sham. It ignores all the “free money” that the top 20% take, while railing against anything that might help the middle class. The $53 billion in cash handouts that Lisa Murkowski voted for in the… Read more »

So what do you call the annual PFD?

To me, it depends on who is receiving it and how they “use” it.

I would call it part of the way that Alaska decided, decades ago, to spread among its residents the benefit of the wealth of the land, which should not just go to oil companies. Taking part of that and using it to meet State needs is another way of using that wealth. But it breaks the original promise. And it takes away from those who are most in need of the benefit. Whereas a minimal tax, whether level or progressive (and the latter is the most just in a conscientious society), spreads the burden of maintaining state services among everyone,… Read more »

The PFD is exactly what it says in the name. It’s a dividend from a fund, just like a mutual fund dividend.

The Permanent Fund is the investment, the Dividend is the distribution of the proceeds, and the State taking a portion of the dividend is a tax, and should always be labeled as such.

Brad, here is another supportive perspective. Economists also factor in so-called “hedonic values” in analyzing consequences of, say, a liability in a tort claim. In a word, Rich people don’t mind paying taxes if there is a value derived from the payment. When John McMillion—CEO of NW Alaska Gas Line, a near-miss Gasline project in the late 70s— appeared in a Fairbanks Forum just as it appeared that FERC approval would green-light the project. The Mayor and Fairbanks City Council had offered McMillian a huge tax-break in exchange for relocating his HQ in Fairbanks. McMillion politely declined in favor of… Read more »

What is entirely missing from this conversation, Brad, is the need for Alaskans to garner the maximum benefit from the sale of our finite resources as the FIRST step in our policy discussions- as they pertain to revenue. That is what the Alaska Constitution requires- stated explicitly in Article VIII. SB-21 has fleeced Alaskans, unconstitutionally. A typical family of four has lost about $20,000.00 to reduced dividends while Exxon, et al, have been taking our oil, along with the corporate welfare subsidies included in SB-21. Some communities, like the Fairbanks North Star Borough, have seen their population drop- with no… Read more »

Last week’s column was focused entirely on government take from oil. As we explained there, 2020’s Ballot Measure 1 – a measure to increase oil taxes – was defeated overwhelmingly, 58% – 42%. https://bit.ly/3SX4PKh

We don’t believe a flat income tax, as a substitute to PFD cuts, would cause Alaskans to “flee.” Middle & lower income (80%) of Alaska families would be better off with an income tax, https://bit.ly/3zoomJt, and, as we explain in this week’s column, we don’t believe “people who have money” (the remaining top 20%) would flee either.

Brad, a few points. First, the oil industry spent 25 million on a propaganda campaign to sway voters. The pro people spent a little over 1 million. A 25 to 1 funding imbalance. What would voters have done if they knew the truth? None of this changes the fact that Alaska is required to obtain maximum benefit for our oil. Now, under SB-21, we get nowhere close to what other jurisdictions get. Second, I offered a specific example of what is going on in the Fairbanks North Star Borough, where there are high property taxes, and very dirty air. That… Read more »

If you collect a pfd you shouldn’t own a home in another state period.. so many people leave alaska for three months to be back just in time to keep their state benefits and pfd. Fuck em.. they are a burden to those of us that live here