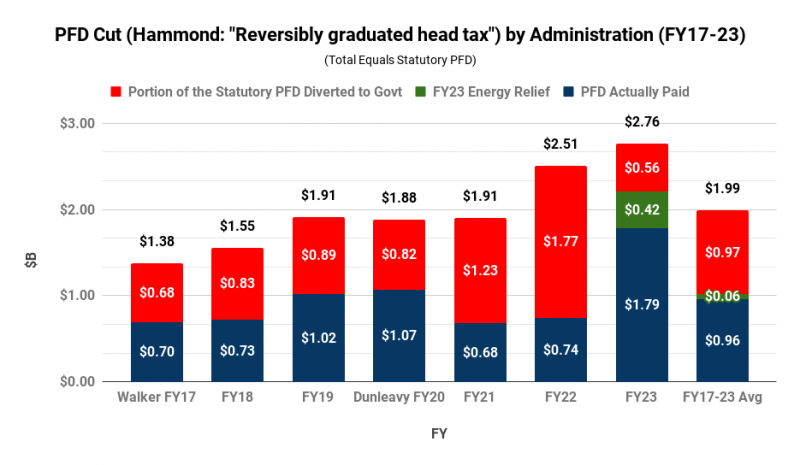

While some talk about a fiscal “surplus,” even in the current fiscal year (FY23) the Legislature has continued to divert a portion of the current law (statutory) Permanent Fund dividend (PFD) to government to help cover the costs of spending.

As regular readers of these columns will know, our view is that, when needed, we should raise any additional revenues required to fund government – the portion over and above the “other half” of the Permanent Fund earning stream designated for government – through more equitable and lower impact (economically) approaches (some form of taxes), rather than through the continued diversion of PFDs.

Sometimes when discussing the issue, some will challenge our preference for more equitable and lower impact approaches by asserting that Alaska doesn’t have the “individual revenue or tax base” sufficient to cover the deficits through alternative methods. A recent comment put it this way: “Correct me if I’m wrong but we don’t have the revenue base to support the required revenues outside of oil and natural resource development.”

That claim is, indeed, hugely wrong. It is the Alaska version of an urban myth.

PFDs go into the private sector – the “tax base.” Diverting a portion to government takes the portion being diverted out of the private sector. While there are impacts, no one of which we are aware has claimed that the private sector can’t handle the amount being diverted.

Any more equitable approach would only be to substitute for the portion of the PFDs currently being diverted to government. If the private sector has enough capacity to handle the amount being taken out through PFD cuts, it has enough to handle taking the same amount out instead through a replacement approach.

In short, if the private sector has survived the diversion of private sector revenue to government through PFD cuts, it can survive the diversion of the same amount instead through taxes.

Indeed, substituting taxes for PFD cuts would actually reduce the burden on Alaska’s “tax base.”

Because only Alaskans receive PFDs, using diverted PFDs to fund the additional requirements of government takes money only from Alaskans. Non-residents contribute nothing, or as former Governor Jay Hammond put it in Diapering the Devil, “transient pipeline workers, commercial fishermen and construction workers get off scott–free.”

In a 2016 study for the state, economists at the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) estimated that by using taxes instead, non-residents would contribute between 6.5% – 11% of any needed additional revenues, leaving Alaskan families with responsibility only for the remainder.

Put another way, by substituting taxes, Alaskans would only need to contribute between 89% – 93.5% as much toward the cost of government as they do using PFD cuts; the remainder would be supplied by non-residents.

Indeed, we believe the savings to Alaskans realized from using taxes instead of PFD cuts to raise government revenue could be even greater. As we explained in a previous column, by using PFD cuts, government regularly is taking more from the state’s “tax base” than we believe it would be able to sustain using taxes. By requiring government to be transparent about what it is taking from the private sector – rather than using the “stealth tax” of PFD cuts – we believe the Legislature would be forced to restrain its appetite.

Again, as former Governor Hammond put it in Diapering the Devil, “after all, the best therapy for containing malignant government growth is a diet forcing politicians to spend no more than that for which they are willing to tax.”

So, if using taxes to raise revenues would take less from the Alaska “tax base” than is currently being taken through PFD cuts, why do some nevertheless continue to push the “tax base” argument.

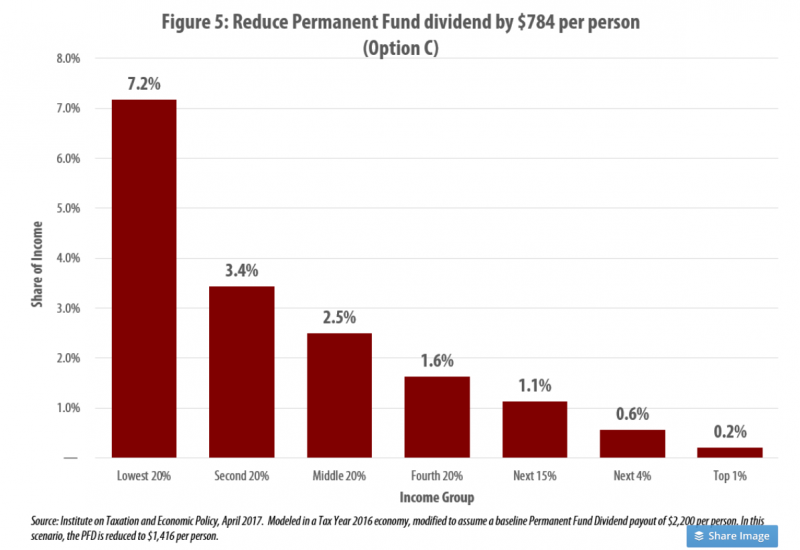

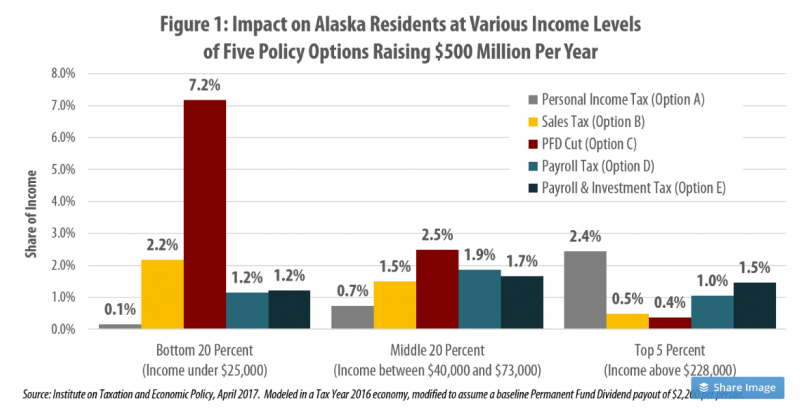

Largely, because the top 20% perceive the urban myth as a useful (if false) scare tactic. As a 2017 report prepared for the Legislature by the Institute on Taxation and Economic Policy (ITEP) summarizes, because they are extremely regressive, using PFD cuts to fund government pushes the burden mostly onto middle and lower income Alaskan families.

Using PFD cuts, upper middle income Alaska families end up contributing two times more toward the cost of government than the top 20%, middle income Alaska families contribute three times more, lower middle income Alaska families four times more and lower income Alaska families nine times more.

According to the 2016 ISER study, because “the impact of the PFD cut falls almost exclusively on residents, and it is highly regressive,” PFD cuts also have “the largest adverse impact on the economy” of all of the various revenue options.

As ITEP’s 2017 report demonstrated, any other revenue option is far more equitable, with the amount taken from middle and lower income Alaska families far less disproportionate than using PFD cuts.

But that’s not how the top 20% view the issue. To them, using PFD cuts minimizes, indeed trivializes, the share of income they are required to contribute toward the costs of government. Regardless of whether any of the alternatives are more equitable or have a lower impact on the economy overall, any other approach requires them to contribute more than using PFD cuts.

As a result, it is in their interest to raise any argument – true or not – that they think will motivate others to oppose prioritizing taxes over PFD cuts as a means of paying for government, even if doing so is worse for the remaining 80% of Alaska families and the overall economy.

It’s a variation on a theme attributed to a former president of General Motors that “what’s good for GM is good for America.” Here, the top 20% take the same, narcissistic view that “what’s good for Alaska’s top 20% is good for Alaska.”

The “tax base” argument is just another in a long line of urban myths they push to support that desired outcome.

So, what is the Alaska “tax base”? Based on the most recent data available from the Internal Revenue Service (2019), Alaska has about $26 billion in resident Adjusted Gross Income. Adding to that the portion of the PFD diverted to government in that year ($810 million), and non-resident Alaska income estimated using the ISER numbers (~ $2.25 billion), the overall tax base is about $29 billion.

At that size, raising $500 million – the baseline amount used in ITEP’s 2017 report – would require an overall tax rate of less than 2%, significantly less as a share of income than the impact on 80% of Alaska families resulting from using PFD cuts instead.

Covering the $970 million in annual PFD cuts averaged over the seven-year period from FY17 through FY23 would require an overall tax rate of slightly more than 3%, again significantly less than the impact on 80% of Alaska families resulting from using PFD cuts instead.

The only ones that would contribute more as a share of income than they would using PFD cuts are the top 20%, and they wouldn’t contribute any more than most Alaskans have been required to contribute using PFD cuts.

The top 20% want Alaskans to think that Alaska doesn’t have “enough tax base” to absorb the difference, but Alaska already has through PFD cuts. The only question is who bears the costs. The top 20% are pushing urban myths in a determined effort to ensure it’s not them.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

No thanks for taxing some Alaskan’s a tax on the money they EARN to raise their families just to give a big dividend. The out of staters are minimal compared to full time Alaskans.

Another Alaska urban myth. The dividend is paid for from Permanent Fund earnings, not taxes.

As former Governor Hammond made clear, taxes would be to pay for the additional costs of government over and above the other half of the PFD. http://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-class-warfare/

I know it’s not paid by taxes NOW. Talking about taxing some of us so some of us pay for government in order to pay out big dividends is bunk.

The PFD is never paid from taxes. By statute it is paid from PF earnings.

What’s “bunk” is some trying to dodge taxes for the additional costs of government (above the 50% of PF earnings already set aside for that) by selfishly attempting to divert for their benefit the share that is meant for ALL Alaska families. http://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-why-paying-a-tax-while-continuing-to-distribute-a-pfd-makes-the-most-sense/