Regularly when responding to our discussion about issues related to the Permanent Fund Dividend (PFD), some will accuse us of engaging in “class warfare.” They mean the term in a derogatory sense, objecting to our focus on the hugely regressive impact of using PFD cuts to fund government on middle and working class – 80% – of Alaska families, and the conversely trivial impact on the top 20%.

Every time we read such comments it reminds us of this by Pulitzer Prize winning editorial cartoonist Ben Sargent for the Austin American Statesman:

Yes, we agree that someone is engaging in “class warfare” around the PFD issue. But it’s not us. It’s those in the top 20% who continue to push using PFD cuts to pay for the costs of government in order to dodge contributing in more than a trivial way themselves.

Over time, the top 20% “defenders” have used different rationalizations.

Some focus on the argument that using PFD cuts to fund government “treats everyone the same. No matter your age or your income level, you contribute the same.”

Others argue that we shouldn’t refer to the approach the Legislature is taking as PFD “cuts.” Instead, in their view, regardless of what the PFD amount is, “it is always a windfall to each person who receives one.” (Put differently, middle and lower income Alaska families should just be damned happy they receive anything.)

Others argue that PFDs are “welfare,” and that some Alaskans shouldn’t be taxed to pay them to others.

Still others claim that Alaska families aren’t deserving of any portion of the Permanent Fund earnings because they have made no personal investment in exchange for the “handout.”

And the list of rationalizations goes on and on.

But the one common thread throughout is that they all miss the point.

Those that argue that using PFD cuts to fund government “treats everyone the same” intentionally ignore the impact of cuts on income levels. What’s ultimately important to each family when they sit down at the kitchen table to go over their finances isn’t how much an expense is, it’s what percent of income (or remaining savings) it takes.

And PFD cuts clearly hit middle and lower income Alaska families much harder in that respect than those in the top 20%. As the Institute on Taxation and Economic Policy (ITEP) put it in their 2017 report for the Legislature:

… while every individual in Alaska receives the same size PFD, this payout is a much more significant source of income for families of modest means. While a $2,000 annual payment amounts to 2 percent, or less, of the income of an Alaskan earning a six-figure salary, its value is closer to 10 percent of income for a minimum wage worker bringing home roughly $20,000 in earnings per year.

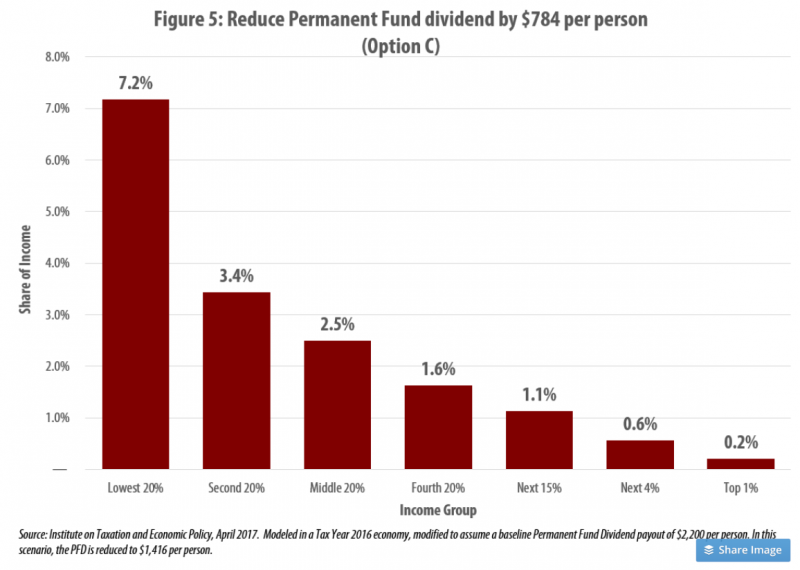

As a result, reductions in the PFD are steeply regressive, having a far larger impact on families with lower incomes. Figure 5 demonstrates that while a $784 cut to the PFD payout could free up approximately $500 million for Alaska’s budget, that gain would come at a high cost for Alaska’s most vulnerable residents. Low-income families could expect to see their incomes cut by 7.2 percent under this change while the impact on middle-income families would amount to 2.5 percent and high-income Alaskans would see impacts well below 1 percent of their incomes.

We understand that losing 0.8% of their income may not mean much for those in the top 20% – households which, on average, have incomes of $250,000 – but losing the same amount has double the impact on upper middle, triple the impact on middle, four times the impact on lower middle and nine times the impact on low income Alaska families.

It’s easy to say something is not that big a deal when it has little impact on you, but there’s a significant air of former French Queen Marie Antoinette’s “let them eat cake” about it when the same conclusion is applied to those for whom it has a much larger impact.

The same applies to those who argue that PFD cuts aren’t really “cuts,” just a smaller “windfall.”

As we’ve explained in previous columns, the Permanent Fund earnings stream is a windfall to all Alaskans. No Alaskan has invested in its development. It’s a windfall to everyone.

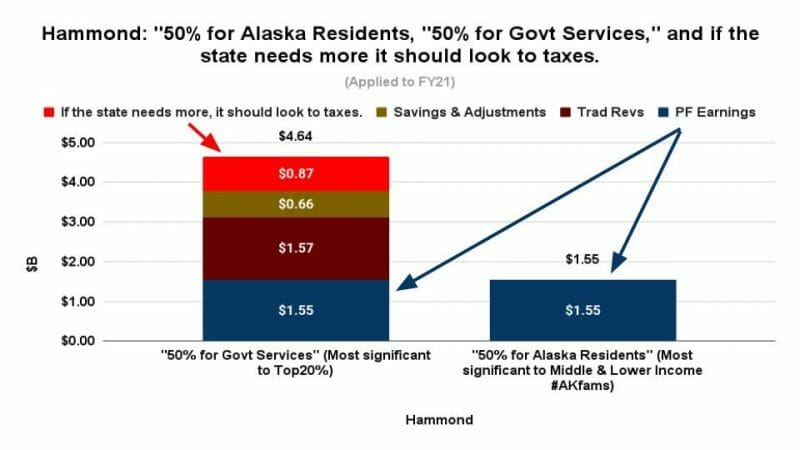

As former Governor Jay Hammond envisioned, the PFD statute shares that windfall half directly to Alaska residents and half to government services. While the half distributed as PFDs benefits all Alaska families, the “other half” of the “windfall” directly benefits a subset, those who otherwise would pay taxes to fund government services.

It is, in effect, a subsidy of those would be taxpayers – a material portion of whom are in the top 20%.

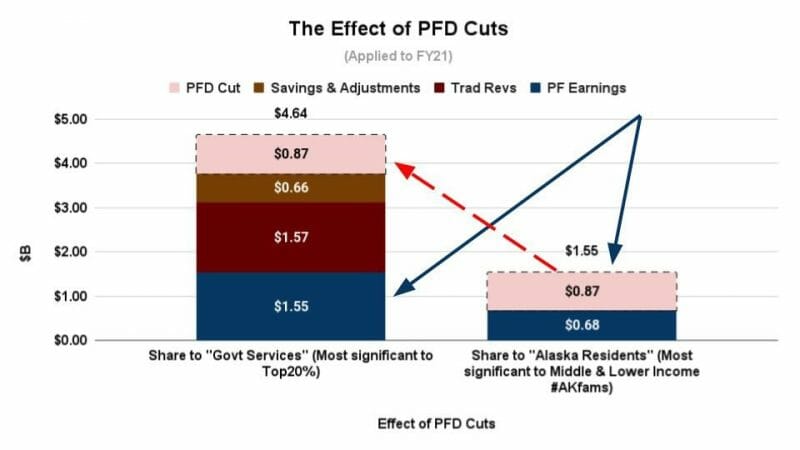

Reducing the PFD below the baseline set in the statute doesn’t reduce the overall windfall, it just transfers more of it to paying for government, effectively increasing the subsidy to the subset who would otherwise pay the amount in taxes.

Those in the top 20% who talk about PFDs as a “windfall” and lower PFDs as just a lower “windfall” are in fact simply attempting to mask a thinly veiled, self-serving effort to divert a higher share of that “windfall” to their own pocket by keeping the money they otherwise would pay in taxes in their bank account instead.

The same thing is true for those that describe the PFD as “welfare” which would be paid for from taxes.

Arguing that PFDs would be paid from taxes is a fiction. Alaska’s statutes specifically tie the PFD to “the income available for distribution” from Permanent Fund earnings. They aren’t paid from oil taxes, nor would they be paid from individual taxes. And they aren’t “welfare.”

Instead, they are the share specified by statute to be distributed to Alaska families from the commonly owned wealth created by oil royalties. That’s not “welfare;” like any oil royalty trust in the Lower 48, that’s simply a mechanism for distributing the proceeds from a commonly owned resource to its owners.

As former Governor Hammond envisioned, taxes are simply a charge to cover the costs of government that exceed the “other half” of Permanent Fund earnings. Using PFD cuts (or if you prefer, lower PFDs) to cover those costs instead only serves to increase the subsidy enjoyed by those who would otherwise pay taxes to cover them.

If there’s any “welfare” involved, it’s embedded in the additional subsidy that the top 20% want to capture for themselves by using diverted PFDs to cover the additional costs of government rather than covering them through taxes. It’s “corporate welfare” to those in the upper income brackets, funded from reduced distributions important to middle and lower income Alaska families.

Finally, as we’ve explained previously, no Alaska family has made any “investment” in generating the Permanent Fund earnings. How they are used is a “handout” to all Alaska families.

Governor Hammond’s vision was to divide the “handout” 50/50 between all Alaska families and that subset who would otherwise pay taxes to support Alaska government, a significant portion of which are in the top 20%. Reducing the “handout” to one group simply increases the “handout” to the other.

We get that, now that they have run through the “other half” intended to be used for government and the time has come to pay taxes, the top 20% – who haven’t “invested” any more in creating the Permanent Fund earnings than anyone else – nevertheless want an increased share of the “handout” used for their benefit to put off that day even further.

But let’s recognize where that increased share comes from – out of the pockets largely of middle and lower income Alaska families.

Yes, the PFD issue does involve “class warfare,” but it’s not middle and lower income Alaska families that are the instigators. They seem – as are we – perfectly satisfied with the historic, 50/50 split of Permanent Fund earnings.

Instead, like the Ben Sargent cartoon above, it’s being initiated by those largely in the top 20% who, now that it has come time to contribute themselves toward the additional costs of government, want to continue to put that day off by redividing the Permanent Fund earnings “pie,” diverting more and more of it to their benefit.

Their claim of “class warfare” is simply a form of the old Karl Rove tactic of projection – attempting to divert blame by accusing someone of doing what you are doing yourself – or more colloquially, the pot calling the kettle black.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

So your argument here is that the wealthy should be forced to pay more taxes because they have more money? Gee, never heard that one before. How stereotypically Marxist of you.