After reading our column the week before last – Fiscal baselines, take your pick – some legislators and others asked for something we didn’t do in that column – estimate, on Alaska’s current fiscal trajectory, how long it is before the Permanent Fund Dividend (PFD) is gone.

As we explained in response, the answer depends on what projections are used for several factors. From the revenue side, for example, the crucial variables are forward oil prices and production levels, Permanent Fund return levels, proceeds from existing taxes and fees, and the presence or absence of new revenue sources.

From the spending side, the essential variables are the inflation rate, the level of revenues required to fund the state’s obligations for employee retirement, the amounts set aside for the state capital budget, and the extent of the adoption of new programs or the expansion of existing ones.

But we can use the projections contained in the various fiscal baselines we examined in that column to make an estimate.

In doing so we are using the revenue baseline from our – Alaskans for Sustainable Budgets – most recent Friday “Goldilocks” charts. We explain the weekly “Goldilocks” charts here.

We are using that baseline because, of the various alternatives, it reflects the most recent projections for all of the various factors, particularly oil prices. The oil prices used in the two other baselines we examined – that from the administration’s Office of Management & Budget (OMB), and that from the Legislature’s Legislative Finance Division (LegFin) – are based on the Department of Revenue’s Fall 2022 Revenue Sources Book (DOR’s Fall Forecast).

The outlook for oil prices reflected in the futures market has shifted somewhat since the time DOR’s Fall Forecast was prepared. The “Goldilocks” charts capture that shift.

Like OMB’s, the “Goldilocks” charts also use the Permanent Fund Corporation’s (PFC) most recent, long-term outlook for Permanent Fund earnings. We believe that reflects a more standard approach than LegFin’s.

And like LegFin’s, the “Goldilocks” charts do not incorporate additional revenues from Governor Mike Dunleavy’s (R – Alaska) proposed “carbon management” fee approach. Not only has the approach not yet been enacted, but the administration also has not provided any support for Dunleavy’s claimed revenues even if it ultimately is. As we said in our earlier analysis of the proposal as part of our look at the governor’s proposed FY24 budget and 10-year plan, at least so far “there’s not much there, there,” in terms of revenues.

On the spending side, we are using the baseline from LegFin’s “current policy” approach. We are using that projection because, of the various alternatives, we believe it reflects the most likely outcome of future appropriations bills. As we explained in a previous column, we believe OMB’s spending baseline woefully understates the impact of currently projected future inflation levels.

And while our – again, Alaskans for Sustainable Budgets – spending baseline does take into account currently projected future inflation levels, it starts from a base we calculated last summer, after the governor had made his final adjustments and signed off on the FY23 appropriations bill. While we have some issues with LegFin’s baseline, given the spending pressures for new and expanded programs in the current Legislature, we believe it better captures at this point the likely future spending trajectory than ours.

In considering the future of the PFD we assume, as the Legislature has done for the past six years, that the resulting deficits between revenues and spending are largely filled by continuing reductions (cuts) in the current law PFD. Having effectively drained one of the state’s “rainy day” savings accounts (the Statutory Budget Reserve) and mostly drained the other (the Constitutional Budget Reserve), successive legislatures and administrations have left future ones with no other realistic alternatives in the absence of adopting the substitute, broad-based revenues we believe they should, but they seem unwilling to enact.

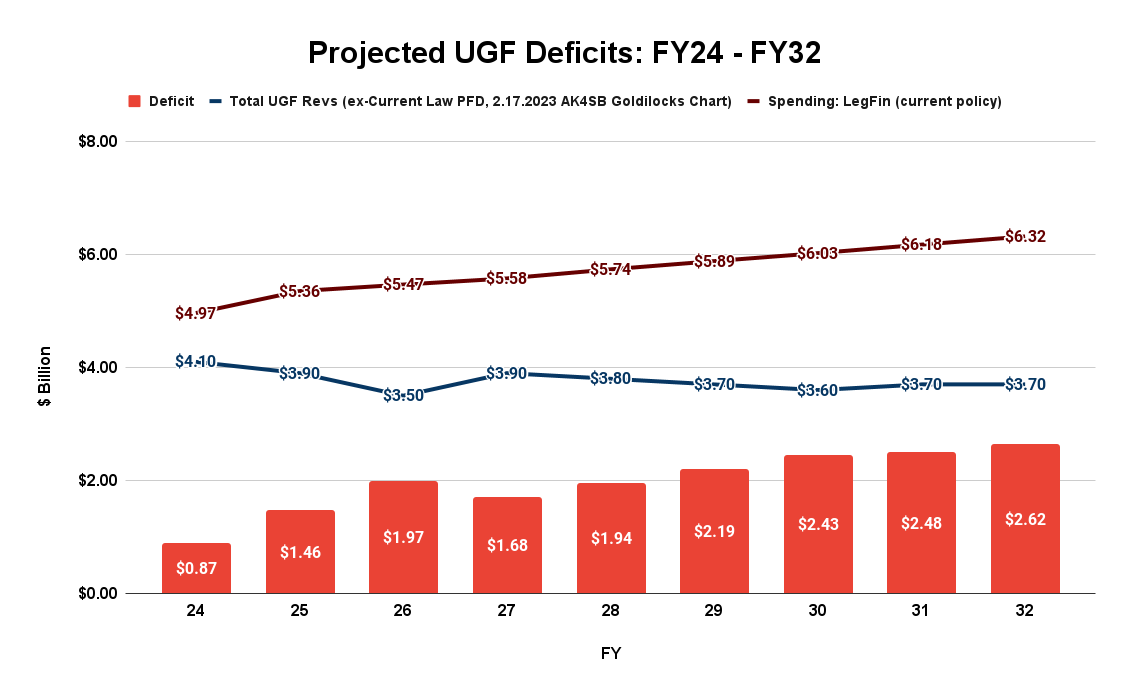

Here’s the result of applying those two baselines – deep and rising deficits (the red bars) throughout the entire period:

Because we assume, for purposes of this analysis, that the deficits are resolved primarily through continued PFD cuts, the amount of the cuts we include in our current analysis equals the amount of the deficits in the chart above.

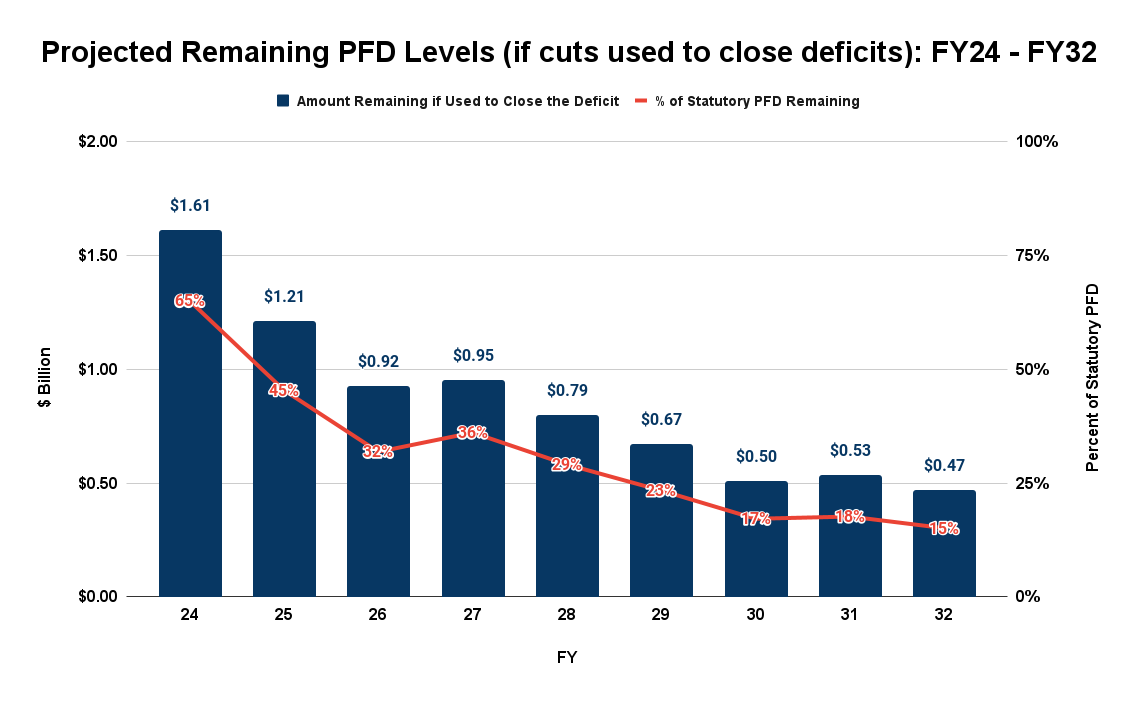

Using that, the following chart calculates the amount remaining for the PFD after resolving the projected deficits, both as an absolute amount (bars) and as a percent of what the statutory PFD otherwise would be for the period covered by the baselines (line).

Over the period the PFD declines from $1.61 billion in FY24 (65% of the amount provided under current law, or roughly $2,400/PFD, calculated at 650,000 recipients) to $470 million by FY32 (15% of the amount provided under current law, or roughly $675/PFD, again calculated at 650,000 recipients).

While the PFD does not entirely disappear during the period, by FY32 – ironically the 50th anniversary of the enactment of the PFD program – the writing is clearly on the wall. Like the Statutory Budget Reserve and Constitutional Budget Reserve before it, on its current trajectory, the PFD will likely be a mere token, if not entirely gone, by the mid-to late-2030’s.

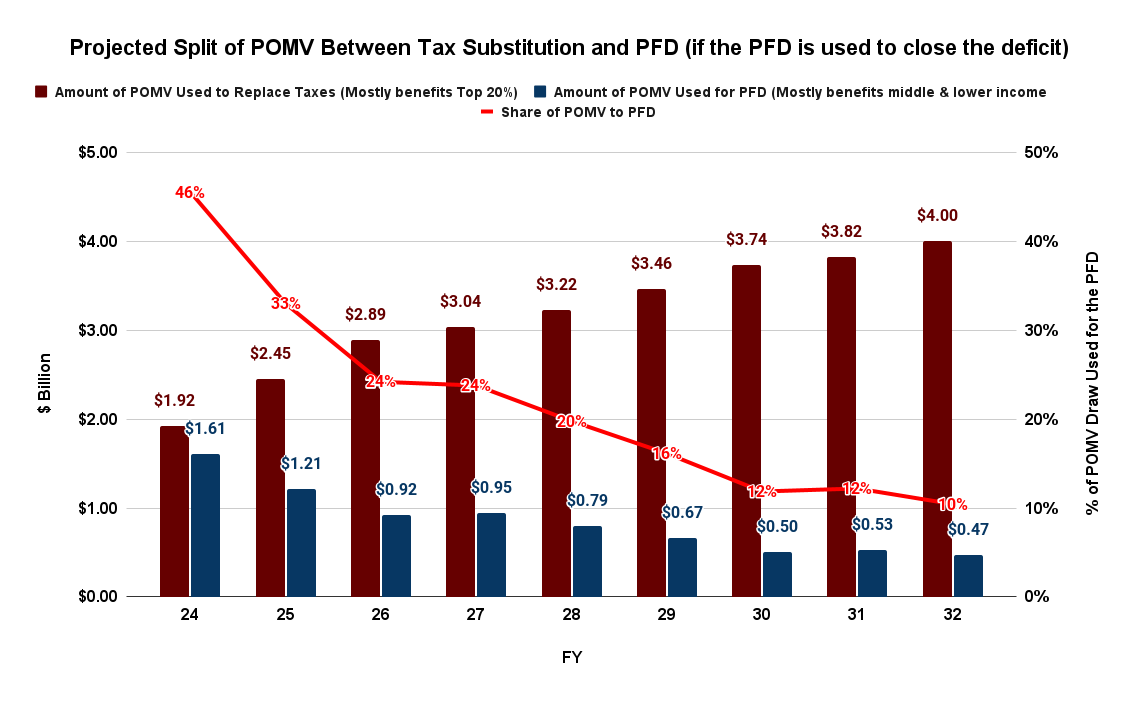

But the Permanent Fund earnings stream, from which the PFD is to be paid, won’t be gone – indeed, it will be bigger than ever, growing, as measured by the amount of the statutory percent of market value (POMV) draw, from $3.53 billion in FY24 to $4.47 billion by FY32. What will have become of it?

Currently, the earnings stream is split roughly equally between being used to substitute for taxes, mainly benefitting the top 20%, and distributing a portion of Alaska’s resource wealth directly to Alaska families through the PFD, largely benefitting middle and lower-income Alaska families.

By FY32, however, it largely will have evolved into a revenue stream that is almost entirely used to benefit the top 20%, with 90% of the POMV draw going to substitute for taxes and only 10% remaining for the PFD. We have previously explained how the segments benefit the various income classes here.

Here’s the change over time. The (growing) amount of the POMV draw going to substitute for taxes is the red bar; the (declining) amount going to the PFD is the blue bar. The line is the percent of the POMV draw going to the PFD.

As the chart demonstrates, the “free money” some complain about won’t disappear, it will just be converted from a stream that, currently, is largely evenly split between the top 20% and the remaining 80%, to one that, by the end of the period, mostly benefits the top 20%.

Some argue the state will finally stop spending beyond its revenue base once the PFD is gone – i.e., once the Permanent Fund earnings stream has been entirely converted to substitute for taxes.

That may or may not happen. Given recent history, we believe it is as likely that the state simply will move on to the next most regressive revenue approach – sales taxes – to continue to support increased spending in a way that avoids the top 20% bearing much of the costs.

But even if the state does (finally) balance spending and revenues at that point, substantial damage will already have been done. Former Governor Jay Hammond’s vision of splitting the “free money” flowing from the state’s Permanent Fund roughly equally between those in the upper and remaining income brackets will be dead.

Middle & lower-income Alaska families will not only have increasingly borne most of the burden of closing the state’s fiscal gap throughout the late 2010s, 2020s, and deep into the 2030s, they will continue to do so in perpetuity.

Once the top 20% have successfully redirected all (or all but a token amount) of the Permanent Fund’s “free money” to their benefit, they won’t give any of it back. They will want to continue maintaining Alaska as their own personal, “big government services but no (or at most, low) taxes for them” haven.

To quote Buzz Lightyear, middle & lower-income Alaska families will continue to bear the bulk of the burden “to infinity and beyond.”

It’s no coincidence that’s the future vision for Alaska some in the Legislature and their well-funded and placed donors and supporters hold anyway, as their replacement for Hammond’s.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

It is a mystery that no one seems to outraged by this situation.As a state were are not even talking about this situation. I read Brad’s columns and the information he is trying to get across is that the people who have the most, the top 20 will continue to take the most and the lower and middle income earners will continue to to pay, unfairly. What is it that is unclear about this and why aren’t our legislature fighting mad. Is if because many of them are in the top 20%. A few maybe but not all. This is… Read more »

Personally I think we should give all earnings from the pfd back to the federal government to somewhat soften the guilt we obviously have for letting the taxpayers in the lower 48 support us for all these years.