Governor Mike Dunleavy (R – Alaska) released his proposed FY2025 budget and 10-year plan as we completed this week’s column yesterday. We are digging into them and will have our initial comments in next week’s column.

In the meantime, a question we received in response to last week’s column made us realize that it would be useful to explain how we approach establishing the baseline for our looks at Alaska’s fiscal issues, including that which we will use in assessing Dunleavy’s proposed FY2025 budget and 10-year plan.

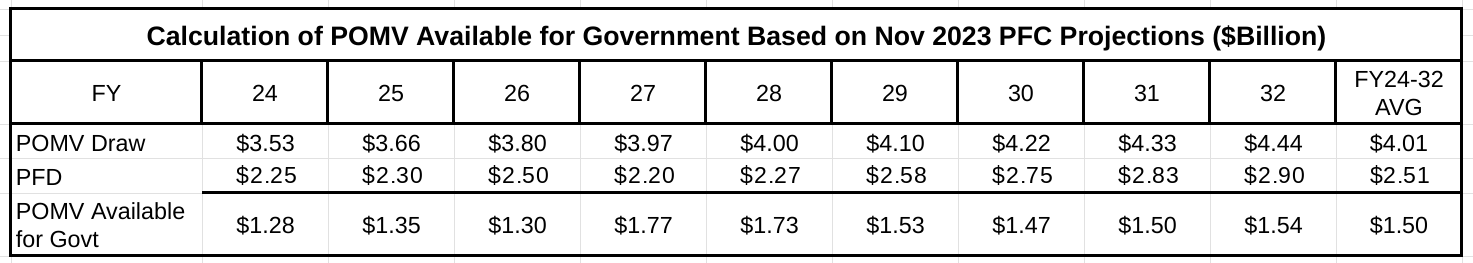

As some readers may recall, last week’s column focused on our current view of the state’s fiscal baseline. The question we received relates to how we calculate the amount included in the baseline for the percent of market value (POMV) draw available for government. The answer involves the relationship between the POMV draw and the Permanent Fund Dividend (PFD).

Because of its size, any fiscal outlook is necessarily affected by the approach used to calculate the PFD. If it’s ignored or diminished, as some try to do, the state’s financial outlook appears much different than if accounted for at statutory levels, as we do.

We account for it at statutory levels in developing our baseline outlook because that’s what the law currently provides. We appreciate that, under the Alaska Supreme Court’s 2017 decision in Wielechowski v. State, the law also allows the Legislature to set the PFD – or, for that matter, any other statutory formula – at other than statutory levels in any given year as part of the appropriation process.

But that’s only on a yearly basis, in the course of the annual appropriation process. Just as with the K-12, Medicaid, or any other statutory funding formula, looking forward to any given year or number of years before the appropriations process is completed for them, the starting point should be what the current statutes provide.

Doing that provides a complete picture of the overall fiscal situation the state is facing under the statutes as currently in effect. Presuming cuts to the PFD in advance, just like presuming cuts to the K-12, Medicaid, or any other statutory funding formula, provides a distorted outlook of the baseline situation under current law, biased in one direction or another.

Even the Alaska Senate recently admitted the continued relevance of the current PFD statute. Rather than ignore the current statute, through Senate Bill 107 the majority seeks to amend it to reduce the level of the amount provided under current law to, as passed by the Senate, “25 percent of the income available for appropriation under AS 37.13.140(b),” or, as passed by the House Ways & Means Committee, “50 percent of the income available for distribution under AS 37.13.140(b).”

Neither alternative has been enacted, however, so the current statute remains in effect.

Some show the state’s current fiscal outlook by starting with the full percent of market value (POMV) draw as revenue and then including the PFD at various levels as part of projected spending.

But that’s not what the current statute provides. Instead, as we explained in an earlier column, the current statute provides that the PFD is first to be deducted from the overall POMV draw before determining the amount of the draw available for use to help cover government spending.

That view is reinforced by the reading given to the statute by Senator Lyman Hoffman (D – Bethel), by far the longest-serving member of the Legislature whose service dates back to the 1980s, during a Senate floor debate two years ago on an amendment related to the PFD amount included in the then-proposed appropriations bill. In response to previous arguments by Senator Bert Stedman (R – Sitka) and then-Senator Natasha von Imhof, Senator Hoffman said this:

Going back to people’s reference to … ‘I don’t want to tax somebody to turn around and give it out as a dividend,’ I don’t believe that to be the case. As was stated by several people before me, the letter of intent that Senator Adams put into that bill setting up the Permanent Fund Dividend … [said the Permanent Fund Dividend] is the first call.

So if the dividend, whatever that amount is, is placed into an operating budget, and what is spent on government is placed into that budget, the first call is for the dividend. The ad hoc draw is for government, to fund government. And if we are going to have to tax people, it’s not taxing people to give them a bigger dividend check because they receive the first call. It’s taxing people to the level of government we are voting on in this budget.

As a consequence, when we prepare any analysis of the state’s fiscal situation – as we included in last week’s column and as we will include in our upcoming assessment of Governor Dunleavy’s proposed FY2025 budget and fiscal plan – we begin by deducting the PFD from the overall POMV draw before showing the amount of the POMV available for government.

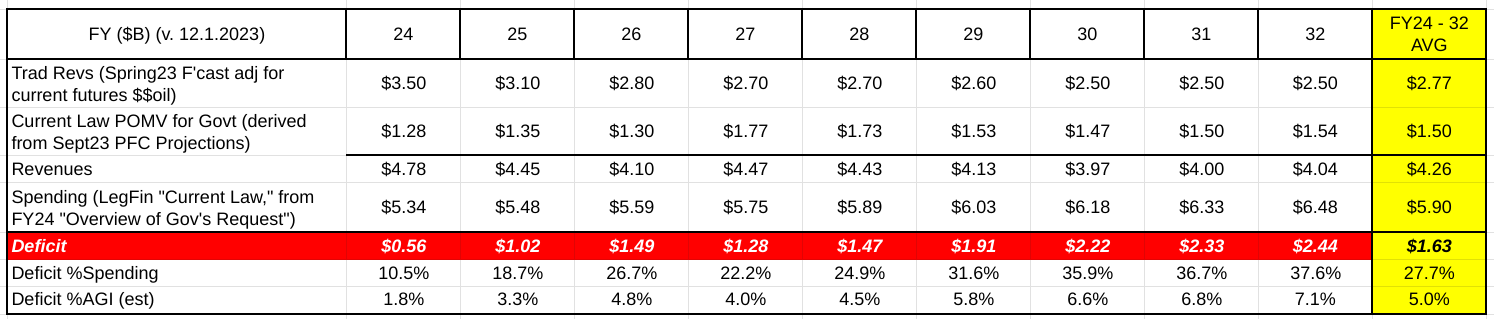

Here is the chart we included in last week’s column:

We included the portion of the POMV available for government in the second line, below those available from traditional revenues. Consistent with current law, here is how we calculated the numbers:

In addition to providing what we believe is a more accurate baseline of Alaska’s fiscal situation, we believe this approach also helps highlight the choices that Governor Dunleavy and the Legislature should consider in determining Alaska’s fiscal future.

Including the full POMV as revenue available for government and showing the PFD as a diminished amount after other spending assumes, a priori, that the appropriate approach to closing any deficits is to use PFD cuts.

On the other hand, as we did in last week’s column, including only the portion of the POMV available for government calculated under current law in the baseline shows the full size of the deficits the state faces on its current course under current law. That approach leaves the question of the best approach for closing the deficits open for separate, further analysis and discussion.

While PFD cuts are among the options, they are far from the only ones. As explained in a previous column, previous studies considering the issue have identified at least 18 others.

Moreover, as we’ve also explained in previous columns, using PFD cuts is the worst of the options from the standpoint of Alaska families and the overall Alaska economy. Any of the other 18 options are better for both.

The approach to presenting the state’s fiscal baseline greatly affects readers’ understanding of the need for that additional analysis. The need to undertake a separate analysis of the best alternative is obscured to the point of being obliterated when the full POMV draw is included in revenues, and the PFD is shown later as a remainder after the deduction of proposed government spending.

On the other hand, both the need and the magnitude of the fiscal challenge facing the state are obvious when, as provided under current law, only the portion of the POMV available after the deduction of the statutory PFD is included in revenues. Using such an approach, the size of the actual deficits the state faces stands out in stark relief, as in the chart we included in last week’s column.

Before finalizing this week’s column, we took a quick glance at Governor Dunleavy’s proposed FY25 budget and 10-year plan to determine what approach the administration is taking concerning this issue. The bottom line is consistent with the approach we outline above. While his budget and 10-year plan include the full POMV in revenues, they deduct the full amount of the projected statutory PFD as a “use of funds” before determining the level of deficit or surplus.

However, by initially including the full POMV in revenues, that approach still distorts how readers look at the fiscal challenges the state faces ahead. We will explain why further in next week’s analysis.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

The 10 year from OMB breaks down the PFD draw per capita. If you break that out to see what population assumptions they used – it was 671,900 for ten years straight. What a sad state we’d be if the population did not grow for a decade.