In a recent article carried by Alaska Public Media, reporter Robert Woolsey references Senator Bert Stedman (R – Sitka) in concluding that overdraws from the Permanent Fund earnings reserve would be for the purpose of paying a Permanent Fund Dividend (PFD). At other times, Senator Stedman has claimed that taxes proposed by Governor Mike Dunleavy (R – Alaska) and others would be for the purpose of paying a PFD.

Both are highly misleading narratives.

Under current law, PFDs are fully funded by draws from the Permanent Fund earnings reserve. AS 37.13.145(b) provides that: “At the end of each fiscal year, the corporation shall transfer from the earnings reserve account to the dividend fund established under AS 43.23.045, 50 percent of the income available for distribution under AS 37.13.140.”

As we’ve explained in a previous column, while AS 37.13.145(e) also provides that a portion of the earnings reserve may be appropriated to the general fund and AS 37.13.145(f) puts a cap on the combined amount that may be transferred as dividends and appropriated to the general fund, those provisions do not impact the PFD.

Read together, the statutes instead limit the amount that may be appropriated to the general fund to the portion remaining within the overall cap after the transfer of the amount statutorily designated for the PFD.

That means that, under current law, PFDs are fully funded; doing so does not require any additional revenues. Instead, any overdraws of Permanent Fund earnings or taxes are to cover any shortfalls in the revenue stream supporting the general fund.

That is not only our reading.

During a Senate floor debate two years ago on an amendment related to the PFD to the then-operating budget, Senator Lyman Hoffman (D – Bethel), by far the longest-serving member of the Legislature whose service dates back to the 1980s, said this in response to previous arguments by Senator Stedman and then-Senator Natasha von Imhof:

Going back to people’s reference to … I don’t want to tax somebody to turn around and give it out as a dividend, I don’t believe that to be the case. As was stated by several people before me, the letter of intent that Senator Adams put into that bill setting up the Permanent Fund Dividend … [said the Permanent Fund Dividend] is the first call.

So if the dividend, whatever that amount is, is placed into an operating budget, and what is spent on government is placed into that budget, the first call is for the dividend. The ad hoc draw is for government, to fund government. And if we are going to have to tax people, it’s not taxing people to give them a bigger dividend check because they receive the first call. It’s taxing people to the level of government we are voting on in this budget.

We appreciate that in its 2017 decision in Wielechowski v. Alaska, the Alaska Supreme Court held that in the course of the appropriations process in any given year, the legislature can ignore the statutes and set a different amount to be transferred to the dividend fund or, indeed, for any other statutorily designated program.

But that decision did not void that or any other statutory designation; it merely said that the legislature (or governor) could ignore them in any given year in the course of the appropriations process.

And the Supreme Court’s decision certainly did not say that the PFD comes after other spending (is the “last call”), such that any additional revenues from overdraws or taxes necessarily are to fund it.

It also is misleading for Senator Stedman and others to imply that the Legislature (and governor) aren’t already, to use Senator Hoffman’s words, “taxing people” to pay for the “level of government” passed by the Legislature and approved by the governor.

As long-time (also dating back to the 1980s) University of Alaska – Anchorage Institute of Social and Economic Research (ISER) Professor Matthew Berman wrote earlier this year: “Let’s be honest. A cut in the PFD is a tax — the most regressive tax ever proposed.”

The fact is that the Legislature is already using targeted taxes on a specific source of income – PFDs – to pay for “the level of government” it is voting on in its budgets.

Why target that particular source of passive income rather than, as do some other states, corporate dividends, other investment or inheritance income, or just use adjusted gross income in general?

As we’ve explained in previous columns, the answer is because, as befits Senator Stedman, using PFD cuts is a diabolically clever way to directly target middle and lower-income Alaska families to pay for the state’s additional revenue requirements, effectively shielding those in the top 20% income bracket, as well as oil companies and non-residents.

The rationalization that overdraws or taxes would be necessary to avoid the cuts is just political window dressing to cover that deeper objective.

There are serious consequences of the press and others buying into such misleading narratives: hook, line, and sinker.

To us, the primary one is that now that Alaska has reached the point of “taxing people to the level of government [the legislature is] voting on” in its budgets, the narrative has been used effectively to avoid a transparent evaluation of which alternatives are the best for the state to adopt in response.

If you automatically assume that PFDs come last, such that “government” doesn’t need more revenue, and also that PFD cuts aren’t taxes, there isn’t anything more to think about.

But neither of those is true. Government does need more revenue, and while PFD cuts – “the most regressive tax ever proposed,” and which, according to a 2016 ISER study, also has the “largest adverse impact” on the economy – are one option, there are many others.

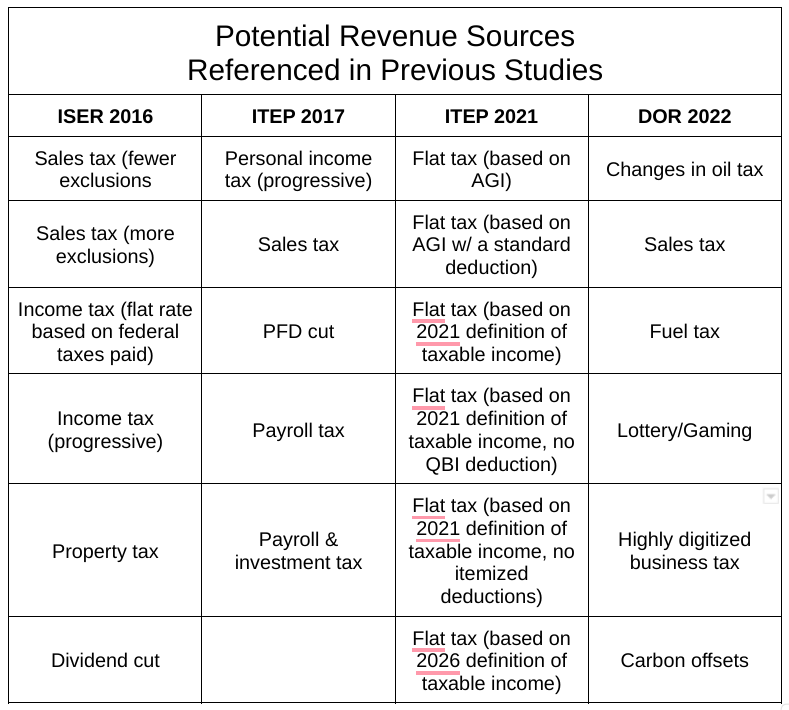

Combined, the 2016 ISER study and a 2017 study by the Institution on Taxation and Economic Policy (ITEP) identified six more – sales tax, progressive income tax, a “flat tax” based on federal taxes paid, a statewide property tax, a payroll tax, and a combined payroll and investment tax.

A 2021 ITEP study added six more to that – flat taxes calculated on various bases.

And the Department of Revenue’s 2022 “Fiscal Plan Model” added yet another five more to those: increased oil taxes, a fuel tax, state lottery/gaming, a highly digitized business tax, and carbon offsets.

Even eliminating duplicates, these total to 19 different proposals:

Viewed from a distributional perspective, any of the other eighteen alternatives would be more equitable and have a lower adverse impact on the economy than PFD cuts. Even if some were not complete alternatives – would not raise sufficient revenues to close the entire fiscal gap – at least they would reduce the need for other options.

Yet, by buying into the misleading narrative, none have received a full, transparent airing either in the Legislature or the press, comparing their impact on Alaska families and the Alaska economy to PFD cuts.

Because of the failure to consider and enact at least some of the alternatives, the second consequence of the misleading narratives is that middle and lower-income (80% of) Alaska families are bearing the full brunt of the state’s fiscal situation.

The alternative that is “the most regressive tax ever proposed,” is also, according to a 2017 ISER study, “by far the costliest measure for Alaska families,” and which also has “the largest adverse impact” of all the alternatives on the Alaska economy, is not only the primary but effectively the only option the state is using.

All of the impact falls hardest on middle and lower-income Alaska families. As we’ve explained previously, those in the top 20% income bracket, non-residents, and the oil companies essentially are escaping, as former Governor Jay Hammond once put it, scot-free.

The third consequence of the misleading narratives is that those in the top 20%, non-residents, and oil companies are receiving an ever-increasing share of the “free money” created by the Permanent Fund earnings.

As we’ve explained in previous columns, the “free money” doesn’t disappear once the PFD is cut. Instead, it is used to shield the top 20%, non-residents, and oil companies from bearing any share of the additional costs of government, allowing them to keep the same amount of money in their bank accounts instead.

The free money redirected from the PFD remains a “dividend,” but instead of being one that benefits all Alaskans, it becomes a “tax avoidance dividend” (or TAD) that increasingly benefits only certain groups. As we’ve explained elsewhere,

The TAD is the flip side of the Permanent Fund Dividend (PFD). The PFD is the portion of Permanent Fund earnings paid out each year to Alaska residents. The TAD is the portion of Permanent Fund earnings used instead to pay for government.

The effect of the TAD is to shield Alaskans (and non-residents) from paying for the portion of government spending covered instead by Permanent Fund earnings. It is as much of a “free ride” to Alaska residents [and non-residents] as the PFD. By shielding them from taxes, it allows Alaskans [and non-residents] to keep the dollars they otherwise would be required to pay for that portion of government spending in their pockets.

In starting the PFD program, the founders envisioned it as one that would benefit all Alaskans. As preeminent Alaska historian, University of Alaska – Anchorage Professor Stephen Haycox once put it in an op-ed:

… the dividend program … is how all Alaskans receive some personal benefit from development of their natural resources. Would it please the designers that the state Legislature has now diverted into state coffers … a large portion of what used to be the people’s direct benefit. No! … Hammond said clearly that the fund’s earnings should go into the people’s hands, not the Legislature’s.

Through PFD cuts, that vision is being corrupted into one in which only certain groups – which includes non-residents – benefit.

Those in the Legislature, as well as in the Alaska press, should stop falling for misleading characterizations of the PFD and solutions to Alaska’s fiscal situation. There are a number – at least 19 – ways to address the situation. The Legislature – and press – should start transparently comparing them to each other to find the one that is the most equitable to Alaska families and has the lowest overall impact on the Alaska economy.

Through a fully informed and transparent process, hopefully, more – including the Legislature – will come to realize that PFD cuts are the worst of all of the options both for the vast bulk of Alaska families as well as the overall Alaska economy.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.