At the risk of returning to a subject some think we have already overdone, this week we focus again on the argument some (largely on the right) make that using taxes to raise revenue would only serve to increase government spending levels.

As we’ve explained in previous columns, we believe that is wrong, that taxes would substitute instead for cuts in the Permanent Fund Dividend (PFD), and as we put it in the last column we wrote on this subject, replacing PFD cuts with taxes would result in fairer revenues, not more spending.

The reason we return to it this week is because we are heading toward a real world example this coming legislative session that demonstrates our reasoning.

As it’s shaping up, one of the central issues this coming session is the level going forward of education, mostly K-12, funding. While that issue has been building over the past few sessions, the reason it will be a central issue this coming year is because of the announcement during this year’s election cycle of the potential closure of various K-12 schools in Anchorage, and the triggering effect that has had on the perception it’s a statewide issue.

While many will push back on the need, looking at the results of this election cycle the reality is that there will be significant legislative support for an increase, not only in next year’s budget but through structural changes to the Base Student Allocation (BSA) and elsewhere, future funding levels as well.

The question is where the funds will come from to cover the cost.

Unlike last session when a combination of unrestricted, COVID-related federal funding and high oil prices provided a substantial cushion for increased spending, this coming year – Fiscal Year 2024 (FY24) – is shaping up to be much more challenging. Current inflation rates will create a push for higher spending levels just to maintain the status quo. At the same time, the current oil futures market suggests FY24 oil prices – and thus, traditional revenues – will be down not only from current levels, but also from those included in the Department of Revenue’s Spring 2022 Revenue Forecast.

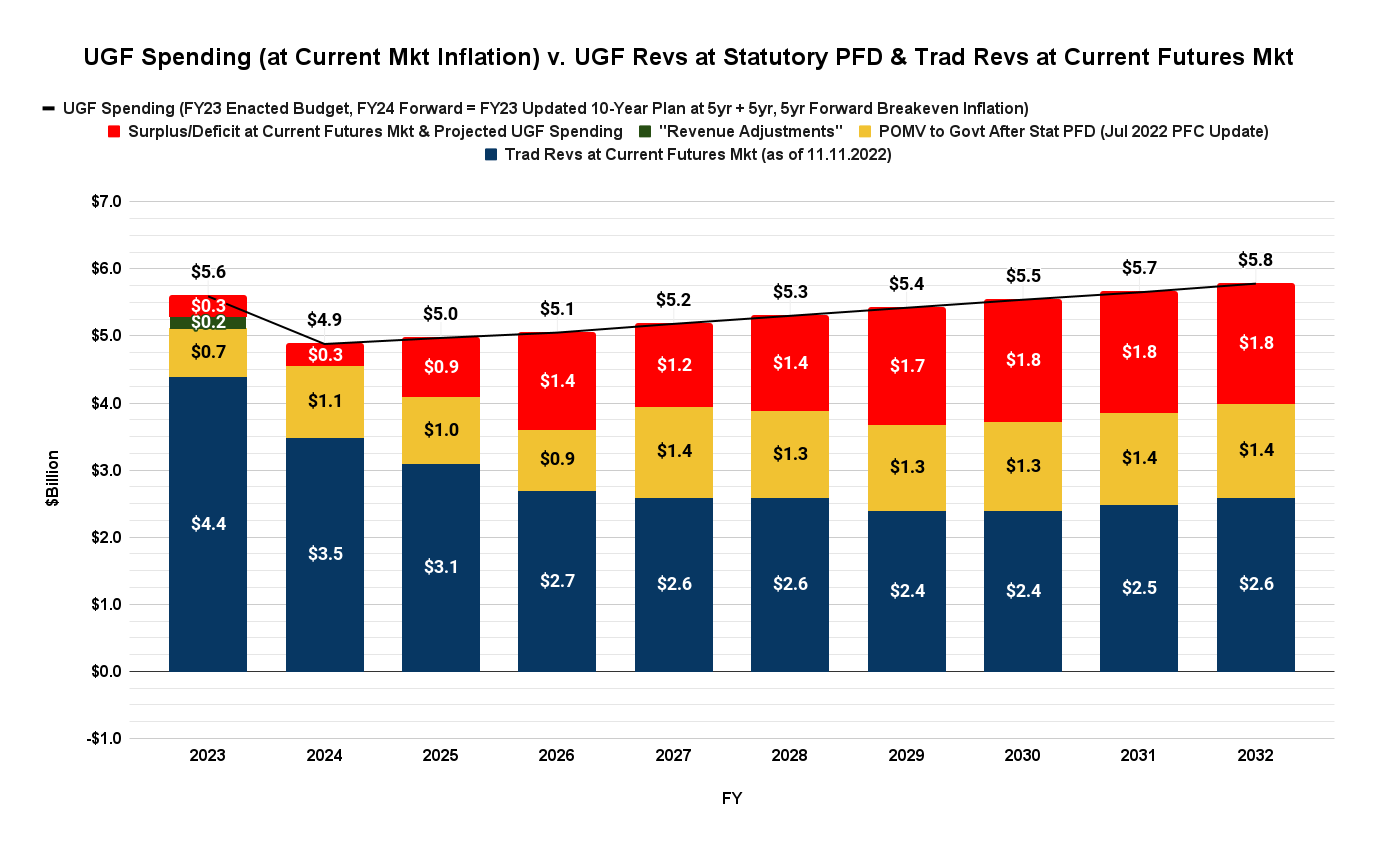

Each Friday we publish what we have labeled our “Goldilocks charts,” which look at the outlook for the period covered by the Dunleavy administration’s most recent 10-year plan based on current oil futures prices, the most recent earnings outlook from the Permanent Fund Corporation and our most recent look at baseline spending levels, adjusted for the market outlook for inflation.

The Friday charts then look at that baseline through three lenses related to the PFD – using the current law (statutory) approach, using percent of market value (POMV) 50/50, the Dunleavy administration’s preferred approach, and using POMV 25/75, the approach pushed by some in last session’s Legislature.

As a starting point for this discussion, we use the current law version. The location of the red bar indicates whether, using the current law (statutory) PFD, the budget is in surplus (red below) or in deficit (red above). The chart shows that, even at current baseline spending levels (before any increase to K-12), the budget is in deficit in FY24 and remains that way going forward.

So, if the budget is already in deficit, any additional spending on K-12 will require some source of additional revenues.

Where will those come from? There are choices.

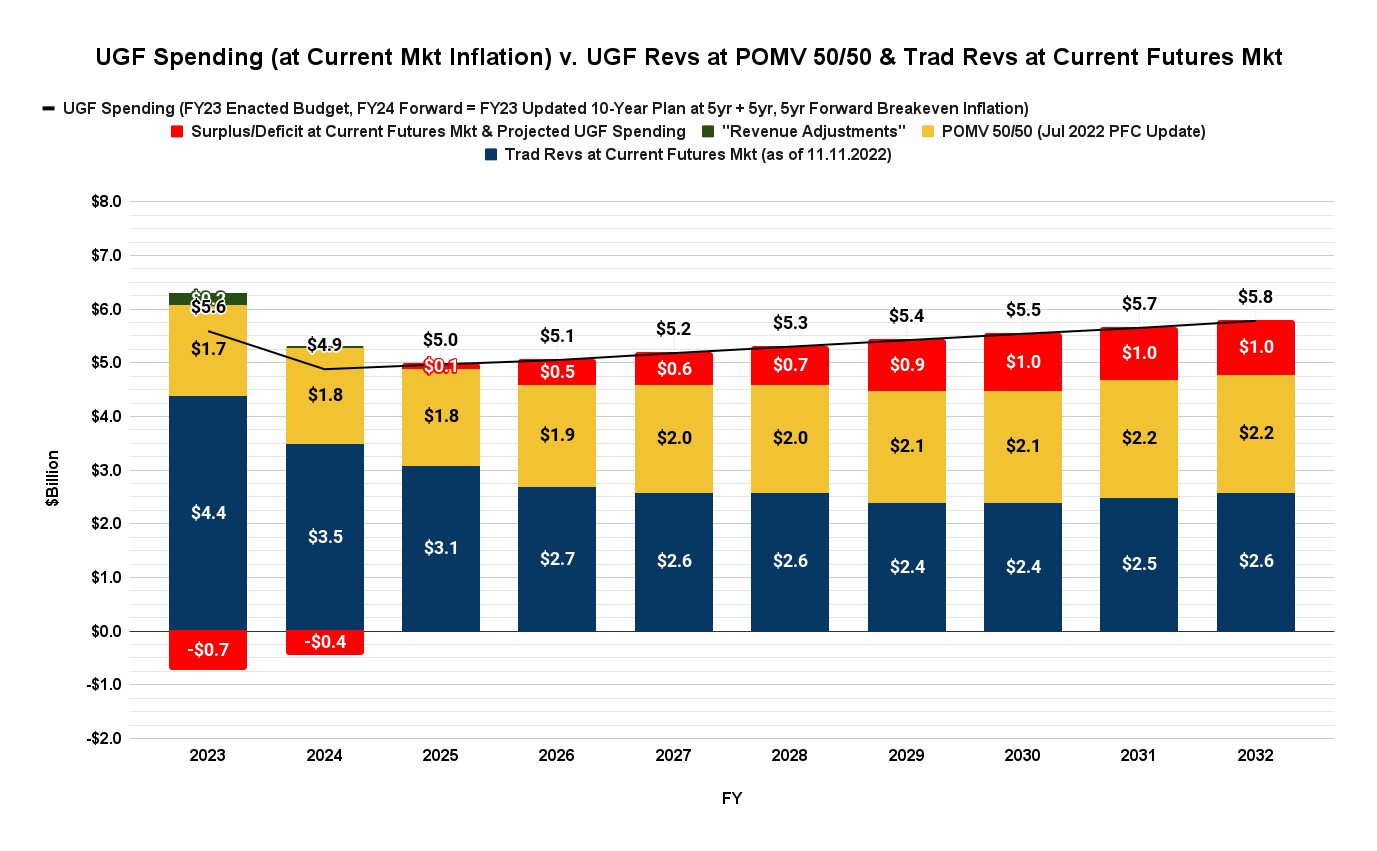

Governor Mike Dunleavy (R – Alaska) previously has provided his answer by proposing to adopt POMV 50/50: PFD cuts.

Here is the FY24 and forward outlook using POMV 50/50. By diverting an average of roughly $800 million per year from the current law PFD to government, Dunleavy’s proposal not only balances the FY24 budget, it produces a bit ($400 million) of a surplus.

But that is only temporary. Even after adopting POMV 50/50 the baseline budget returns to deficits the following year (FY25), which then continue through the remainder of the current forecast period and beyond.

As a result, while POMV 50/50 may provide enough revenue to cover some additional, one-time K-12 spending this coming year, what happens in subsequent years if, as many urge, changes to the BSA and other fundamentals drive continued increases in K-12 spending in future years?

The answer is obvious, even larger deficits. And where will the additional funding come from to cover those?

Some legislators offered their answer last session: by reducing the PFD even further to POMV 25/75, i.e., by making even deeper PFD cuts and diverting the revenues to government spending.

In short, PFD cuts aren’t acting as a restraint on spending. Neither the governor nor the legislators pushing POMV 25/75 have proposed to curtail additional spending. They have proposed simply to fund it through additional PFD cuts. There’s more than enough in the PFD to cover the additional spending and there’s nothing stopping the Legislature from making the cuts necessary to fund it.

But there’s an alternative. Instead of using PFD cuts to balance the deficits and provide the funding for any increase in K-12 spending, the Legislature could easily draw a line under the PFD, say that it’s not going to make any additional cuts to them and raise the additional revenues through broad-based taxes.

As we have argued, doing so would substitute taxes for what otherwise are likely to be continuing, and even deeper PFD cuts. They would not increase spending; that is occurring on its own. They would simply substitute one funding source for another.

Why should the Legislature substitute broad-based taxes for additional PFD cuts? Simple, because using broad-based taxes takes less from middle and lower income – 80% of – Alaska families than PFD cuts, is still equitable to the top 20% and is better for the overall Alaska economy.

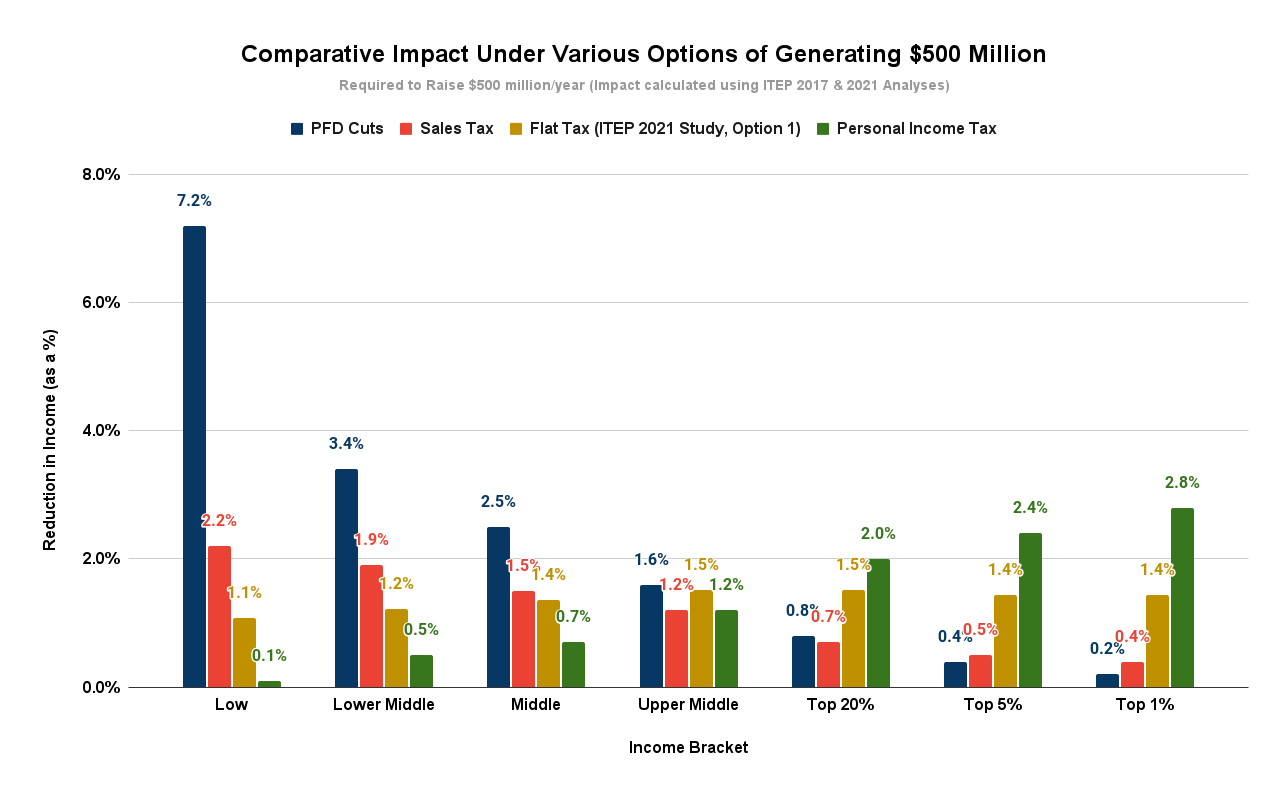

Using the analysis provided in the 2017 and 2021 studies undertaken for the Legislature by the Institute on Taxation and Economic Policy (ITEP) which we have discussed in detail in previous columns, here is the impact by income bracket of raising $500 million per year in additional revenues using various approaches.

The results are clear. Using PFD cuts (in blue) to raise the additional funds takes far more as a share of income from middle and lower income – 80% of – Alaska families than from the top 20%. PFD cuts take 18 times more from the lowest 20% of Alaska families, and six times more from the middle 20% as a share of income than they do from the top 5%. Even upper middle income families contribute four times more than the top 5%.

And that imbalance also has an impact on the Alaska economy. According to a 2016 report prepared by senior economists at the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER), “the impact of the PFD cut falls almost exclusively on residents, and it is highly regressive, so it has the largest adverse impact on the economy per dollar of revenues raised” of any of the revenue options.

Using broad-based taxes instead would reduce the imbalanced take from middle and lower income Alaska families, still be equitable to the top 20%, and through that, reduce the adverse impact on the economy.

Of the three broad-based alternatives – a sales tax, progressive income tax and flat rate income tax – sales and progressive income taxes would still introduce some imbalance and with that, economic distortions.

Although far less imbalanced than PFD cuts, a sales tax (red in the chart above) would still tilt against middle and lower income Alaska families. Using a sales tax would still take more than four times more from the lowest 20% of Alaska families, and three times more from the middle 20% as a share of income than from the top 5%. Even upper middle income families would contribute more than two times more than the top 5%.

Using a progressive income tax (green in the chart above), on the other hand, would create an imbalance in the opposite direction. For example, it would take more than 24 times more from the top 5% than from the lowest 20%. But while imbalanced, it still would be more equitable than PFD cuts. A progressive income tax still would take less from the top 5% than PFD cuts take from the lowest 60% of Alaska families.

The most balanced approach – and because of that, the one we have advocated in past columns – is a flat rate income tax (gold in the chart above). Rather than taking multiple times more from some income brackets than others, it would result in all Alaskan families having the same skin in paying for the costs of government.

But regardless, any of the broad-based alternatives would be better for Alaska families and the overall Alaska economy than continued PFD cuts.

In short, as we explained in a previous column and as the fiscal choices this coming session demonstrate, using broad-based taxes will not result in increasing government spending. That will occur on its own, funded if necessary by ever increasing PFD cuts.

Instead, using broad-based taxes will result in funding the same level of government spending more fairly and with a lower adverse impact on the overall economy.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

What’s you definition of the 7 income brackets you have in that graph.

The income range for each is in the charts at Appendix A of the 2021 ITEP study (referenced in the column).

Thank you.

Very interesting and informative. I had to Google to find out the meaning of: POMV, ITEP, and what is meant by “flat” tax. I had assumed that it meant everyone pays the same amount, but it’s that everyone pays the same percentage–an important distinction. One that I didn’t understand before, and my lack of understanding led me to misunderstand what legislative candidates hoped to do. It would have helped to include this information in the article.

It’s a *flat-out lie* to say that under a flat tax everyone pays the same percentage. Not your lie, or Brad Keithley’s lie, but the lie perpetuated by the top 20%. Keithley’s analysis, while sound, is based upon AGI, or Adjusted Gross Income, which fails to take into account *Trillions* of dollars in tax expenditures which vastly benefit the top 20%. Because the middle class gets some benefit from tax expenditures, they are unlikely to want to end them, even though it would be of great benefit to do so. But until they are ended, the rich will continue to… Read more »

Are you jelly?