Some argue that paying taxes while continuing to distribute a PFD “doesn’t make sense.” A recent op-ed by Carl Marrs in the Anchorage Daily News is a good example:

Imposing taxes — sales and income — just to pay for a bigger dividend doesn’t make sense to most Alaskans. Sure, if we need taxes to pay for critical state services like schools, roads, police and prisons — like every other state — that may be a necessity in the future. But why would we set up more expensive bureaucracy to collect taxes just so we can send out a bigger dividend check?

But the argument is self-serving and badly flawed. Instead, if your focus – as is ours – is on the impact of various fiscal options on the overall Alaska economy and Alaska families, paying taxes to cover the additional costs of government instead of cutting the PFD makes the most sense of any of the current options.

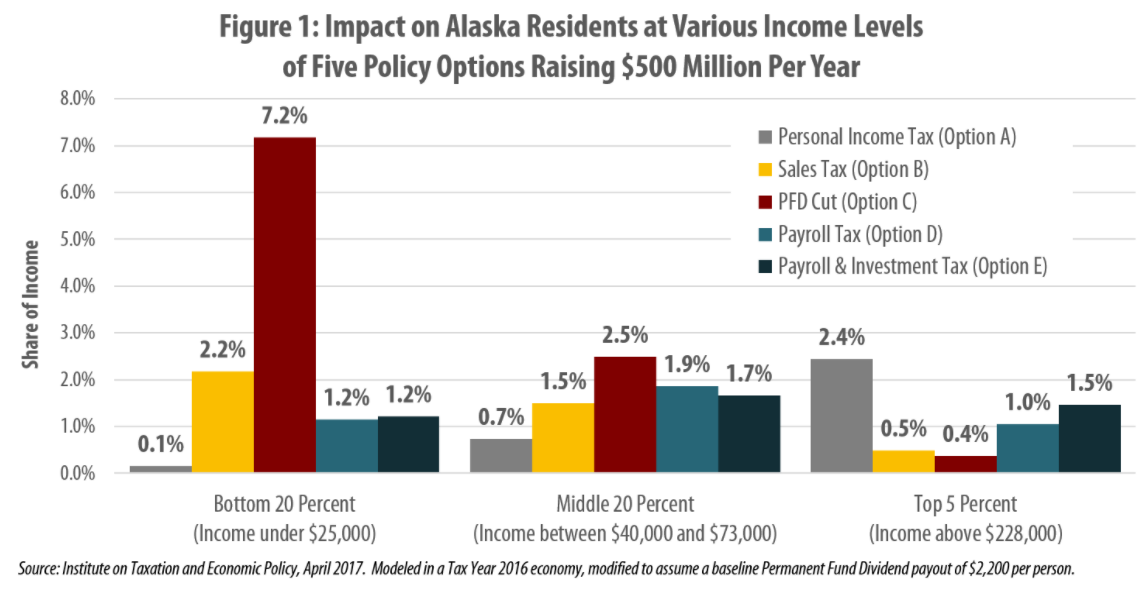

First, as we’ve explained in a previous column, an income tax takes less out of the pockets of 80% of Alaska families than PFD cuts. Sales taxes do the same. The only income bracket which benefits by using PFD cuts over taxes is the top 20%.

As a result, we suspect the “Alaskans” Marrs is talking about fall, like him, largely in the top 20%. While that may be most in Marrs’ social circle, that isn’t “most Alaskans;” it’s just those in the top income bracket, who benefit from a self-serving approach that nakedly pushes the burden of funding government almost entirely off on the remaining 80% of Alaska families so that they can continue to pay less.

Second, in his effort to justify the self-serving outcome, Marrs attempts to rewrite history. As Senator Lyman Hoffman (D – Bethel), by far the longest serving member of the Legislature whose period of service extends back into the 1980’s, explained on the floor of the Senate last year:

Going back to people’s reference to … I don’t want to tax somebody to turn around and give it out as a dividend, I don’t believe that to be the case. As was stated by several people before me, the letter of intent that Sen. Adams put into that bill setting up the Permanent Fund Dividend … [said the Permanent Fund Dividend] is the first call.

So if the dividend, whatever that amount is, is placed into an operating budget, and what is spent on government is placed into that budget, the first call is for the dividend. … [I]f we are going to have to tax people, it’s not taxing people to give them a bigger dividend check, because they receive the first call. It’s taxing people to the level of government we are voting on in this budget.

The reason that is the case – and what Marrs and others who make the “taxes to pay for dividends” argument try hard to obscure – is the source of the dividend. The actual source of the dividend isn’t “taxes” that oil companies or, potentially, individuals may contribute toward the costs of government; it’s money that has been received in a separate stream as royalty on the state’s commonly owned mineral wealth and the subsequent earnings on the investment of those royalties.

Thus, the dividend isn’t in any sense – as Marrs attempts to imply and others sometimes explicitly claim – the “re”-distribution of private income paid through taxes. Instead, it is the initial distribution of income earned from a commonly owned resource.

As former Governor Jay Hammond explained in Diapering the Devil, the goal of creating the Permanent Fund was “to transform oil wells pumping oil for a finite period into money wells pumping money for infinity.” Then, once that was done, “[e]ach year one-half of the account’s earnings would be dispersed among Alaska residents …. The other half of the earnings could be used for essential government services.”

The objective was for all Alaska families – rich, poor or somewhere in between – directly to share in half of the state’s commonly owned wealth in the same way as beneficiaries share inheritance income from any other commonly held trust fund. Government would receive the “other half” potentially to eliminate, but if not, at least to reduce the need for taxes.

Despite the efforts of some to repeal (and others to ignore or obfuscate) the state’s statutes, current law continues to tie the PFD directly to Permanent Fund earnings:

AS 37.13.145 (b): At the end of each fiscal year, the corporation shall transfer from the earnings reserve account to the dividend fund … 50 percent of the income available for distribution under AS 37.13.140.

As Senator Hoffman explained in his floor speech last year – and as Governor Hammond before him explained in Diapering the Devil – if government continues to need additional money on top of that “other half” to pay its bills, it should look to taxes – not cuts in the first half targeted directly to Alaska families – to fill the gap. Put graphically, this:

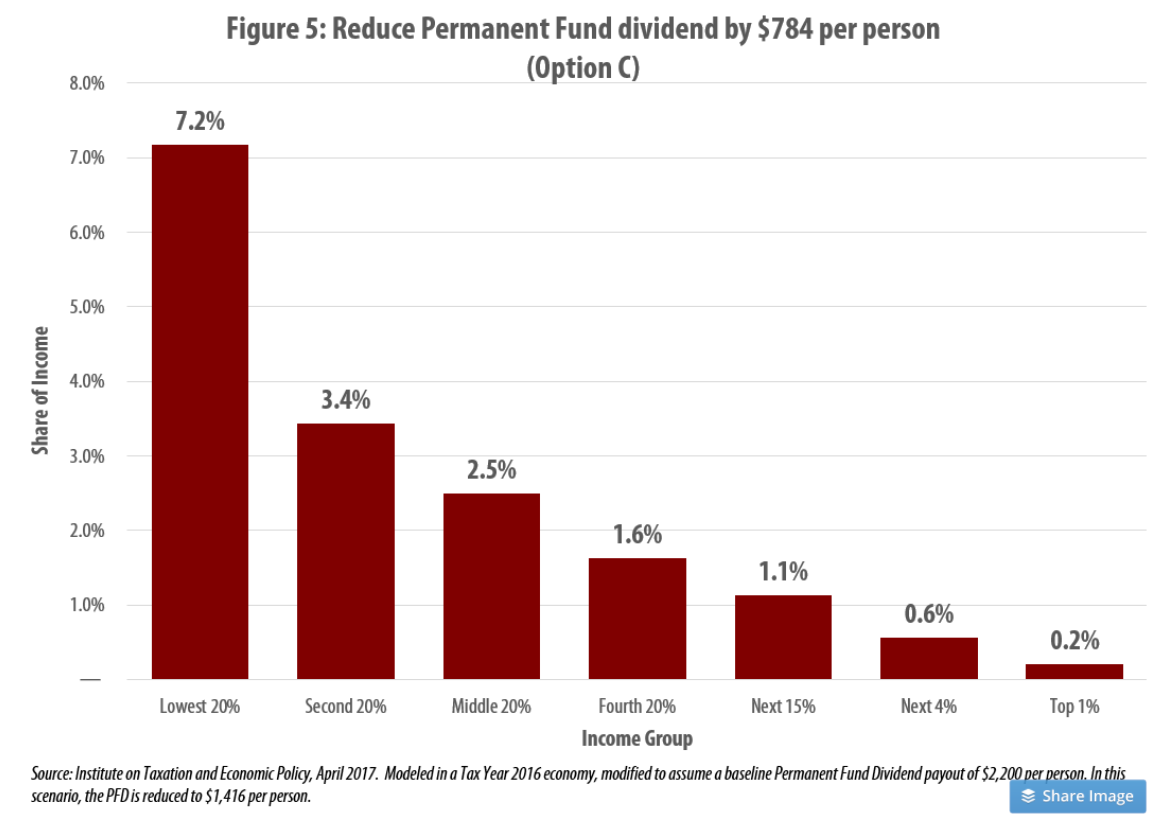

As we’ve explained above and discussed in previous columns, Marrs and others in the top 20% self-servingly oppose this approach because, to them, using PFD cuts to fund the additional amount needed by government takes the least from them. Even though some taxes take less from them than others, as a 2017 study for the Legislature by the Institution on Taxation and Economic Policy (ITEP) demonstrated, PFD cuts take less from the top 20% than any tax.

But the impact solely on the top 20% shouldn’t be the determinant of what “makes sense.” The cumulative impact on all Alaska families and the Alaska economy should be.

And as the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) concluded in its 2016 and, follow up, 2017 studies, PFD cuts both have the “largest adverse impact” on the Alaska economy and are “by far the costliest measure for Alaska families” of any of the various revenue sources it analyzed.

Using another of the revenue options that is better overall for the vast majority of Alaska families and the Alaska economy to raise the additional amount required by government makes the most sense. Indeed, it’s using PFD cuts – the approach that has the “largest adverse impact” on the Alaska economy and is “by far the costliest measure for Alaska families” – that doesn’t “make sense.”

Now, we agree that the pendulum can swing too far in the other direction. A tax approach that, for example, takes 9 times more from the top 20%, or more than 3 times more from the middle 20%, than the lowest 20% creates concerns in the other direction. And, frankly, fear of an overcorrection in that direction – which some describe as “unfair” – may be the real concern driving Marrs and others to seek to stop any movement toward taxes dead in its tracks.

But fear of a potential overcorrection doesn’t justify sticking with the approach that has exactly the same 9 and 3+ times tilt in reverse and, through that, the “largest adverse impact” on the overall Alaska economy and Alaska families. If it’s “unfair” to tilt the balance heavily against the state’s higher earners, it’s similarly unfair to tilt it as heavily against middle and lower income Alaska families as do PFD cuts.

Instead, if that’s the concern, substituting at least a flat-er, if not a fully flat tax that avoids either extreme makes the “most” sense of the other alternatives.

For those, like us, that are focused more on the impact of the state’s fiscal policies on Alaska families and the overall Alaska economy than protecting their own individual bottom line, using PFD cuts to fill the need for additional government revenues makes the least sense. As intended by Governor Hammond, acknowledged by Senator Hoffman and supported economically by both ISER and ITEP, using taxes to raise the funds necessary to cover any additional needs over and above the “other half” already committed to government, makes the most.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

I despise the “solemn duty argument” the Alaska Fiscal peeps declare. I do see how taxes link us to our representatives; if we hate the tax-funded portions of the state budget, we replace the elected official. So when taxpayers say no through elections or if our voice is heard by our representatives does this mean excess spending is dead? How does special interest get their cut? Will it be from the PFD or from the Taxpayer end?

What prevents the AKLEG from adjusting the people’s 50% through fuzzy math? What prevents us from getting Micciche’d at the last moment?

A significant income tax upon individuals could annually raise $500- $700 million depending upon the taxation method, such as whether deductions are allowed or whether percent of gross earnings is enacted. $1,000 PFDs per resident cost Alaska about $675 million. The $8 per barrel credit costs Alaska about $1.2 billion per year. A modern revenue share to the landowner/taxing authority is in the range of 30% [combined royalty and production revenue streams] of the gross for extraction of non-renewable resources like oil. A thought for consideration is whether changes to modernize Alaska’s revenue share for… Read more »

After dealing with the issue for several years I’ve become convinced, at least, that the legislature is never going to push for oil tax (or any other revenue) revisions until the Top20% (i.e., the “donor class”) are faced with otherwise having to pay a significant share of the costs themselves. As long as they can continue to push the burden largely off on middle & lower income Alaska families through PFD cuts, they will continue to do so, rationalizing, like Marrs, as they go. Broadening and flattening the revenue base to include the Top20% (and non-residents) not only would be… Read more »

Thank you for the explanation.

I agree with your analysis of current politics in Alaska.

Something must soon occur to achieve fiscal stability, with all revenue streams fairly contributing.