We understand that earlier this week as part of a debate hosted by the Fairbanks Chamber of Commerce, Representative Grier Hopkins (D – Fairbanks) argued that the way to address the inequity created by using cuts in the Permanent Fund dividend (PFD) to fund government is to “means test” the PFD, presumably paying the full amount to middle and lower income Alaska families but eliminating it for those in higher income brackets.

There are a number of philosophical issues with that approach, not the least of which is that the PFD is intended to be each resident’s share of the wealth derived from the state’s commonly held resources, giving everyone a stake in its administration and preservation, not just those in the middle and lower income brackets.

But there also are serious practical problems as well. The approach doesn’t solve the push and pull on the PFD between those in the top 20%, who view the PFD as an easy give up if it enables them to avoid taxes, and those in the remaining 80%, for whom, working down the income scale, the PFD increasingly serves as a significant part of income. Indeed, weakening the philosophical underpinnings of the program by turning it into, essentially, a means tested welfare program could only make the practical problems even worse over time.

The reason that the inequity of PFD cuts would remain an issue even after adopting means testing is because of the significant size of the deficit that PFD cuts are being used to fill.

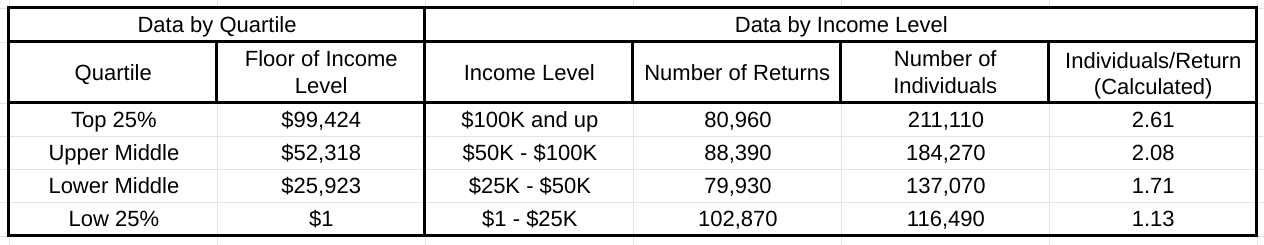

While there is no good way to do it from Alaska data, as we did for a previous column we can approximate the portion of the PFD going to each income bracket from Internal Revenue Service data. In one data set, the IRS breaks down the data for each state into quartiles, providing among other things the adjusted gross income floor for each.

In a second, the IRS breaks down the data for each state by income level, providing among other things the number of returns and, more importantly for this purpose, the number of individuals covered by those returns falling into each.

While not a perfect overlap, because of the close equivalency of the cutoffs at least for calendar year 2019 (the most recent data available from the IRS), using both data sets together allows for a rough approximation of the number of individuals falling into each quartile, something not available from either set alone, but critical to calculating the amount of the PFD falling into each income bracket.

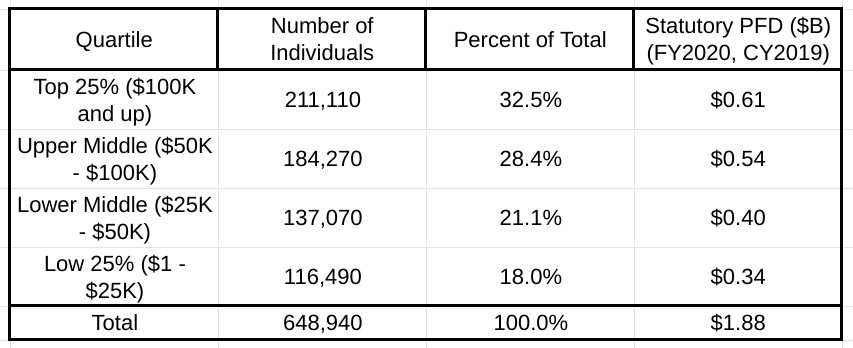

And from that we also can approximate the percent and, continuing to use calendar year 2019 as a base, the amount of the statutory PFD distributed to each income bracket if it had been paid in full.

As we’ve discussed in previous columns, while using PFD cuts to fund government has a trivial impact on those in the top income brackets, it has an increasingly significant adverse impact on middle and lower income Alaska families. So, since it has a trivial impact on them anyway, for purposes of this discussion let’s draw Representative Hopkins’ means-testing line at $100,000, with those below that level continuing to receive the full statutory PFD and those above the line not.

Here’s the problem. Using that approach still wouldn’t provide the additional funding necessary to balance the budget. The amount of the PFD cut made by the Legislature and signed off on by the governor for FY2020 (CY2019) was $816 million, a third higher than the amount going to the top 25%.

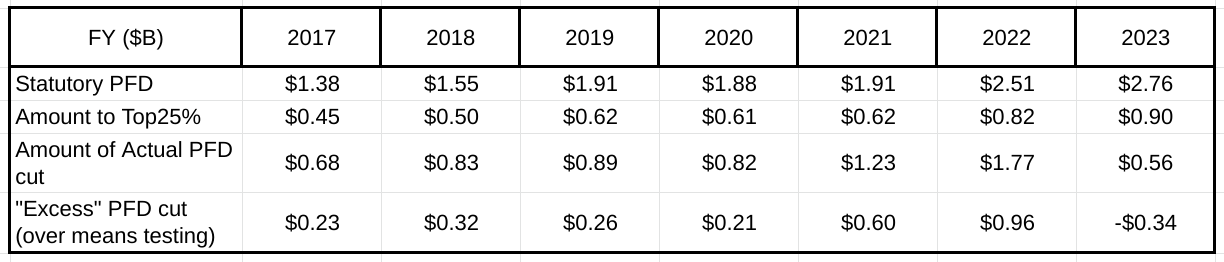

And that’s not an isolated result. Applying the quartile percentages calculated from the 2019 IRS data, here’s the amount of the statutory PFD owed to the top 25% compared to the amount actually diverted to government in each of the other years since calendar year 2016, the year that PFD cuts began.

In only one of the seven years (FY2023) would “means testing” the PFD have produced enough revenue to balance the budget. And that’s only because the 2022 Legislature focused all of the FY22 and FY23 revenue on the FY23 PFD (not surprisingly, an election year). If it had balanced out the payment between the FY22 supplemental and FY23 budgets the way that it did for other budget categories, every year would have ended up with an “excess” PFD cut.

As a result, while the numbers would have been smaller, the issue that has stumped state policymakers, now for the last seven years – how to pay for the additional costs of government equitably – still would have remained even after “means testing” the PFD.

And, going forward, adopting “means testing” likely would only make future debates even more difficult.

That is because, at least in the eyes of some, “means testing” the PFD would turn it from what it is now, a form of joint inheritance distributed to all Alaskans in equal share, into a welfare program, designed specifically for middle and lower income Alaska families.

As a result, the PFD would likely become even more of a target when the state needed additional funding than it has been in the past. It’s easy to anticipate many arguing, for example, that rather than raising additional revenues to provide any additional funding, the budget should be balanced instead by cutting the “welfare” a little more, either by lowering the “means testing” threshold even further or, like now, making ad hoc cuts to the per PFD amount to generate the necessary amount of additional funding.

Through these additional cuts it’s easy to visualize the PFD over time declining to near zero in the same way as have the Statutory and Constitutional Budget Reserves over the last decade.

Of course, that approach would contradict the purpose of adopting “means testing” in the first place, to preserve the full PFD for those for whom it constitutes a material share of income. And, although “means testing” would reduce the remaining amount required, still taking an additional amount out of those below the line would reinstate the regressive effect which justified the approach initially.

Even with the elimination of the portion going to the top 25%, lower income Alaska families still would bear a larger burden of providing the “additional funds” than middle income Alaska families and, at a certain level, middle income Alaska families still would bear a larger burden (as a share of income) even than those in the top 25%.

In our view, the commitment to those original purposes would likely dim over time, however, as more and more increasingly thought of the remnants of the program as welfare.

So, if the result ultimately was to minimize, if not undo, the PFD program, who would benefit?

You know the answer already: the top 20%.

Yes, using means testing they would initially incur the loss of their share of the PFD. But that would create a protection also.

Means testing would have the same impact on the top 20% as the old, now largely discarded proposal of capping any tax at the level of the PFD. It would cap the extent of the top 20% ‘s share of responsibility for the additional costs of government at a trivial level, effectively insulating them from further increases in government spending levels.

Said another way, it would buy them insurance at a very cheap price.

In future debates over who pays the additional costs, the top 20% would be armed with the additional argument that by giving up their (trivial) share, they’ve satisfied their responsibility. Whatever additional funds are required beyond that – and the last six years demonstrates they will likely be substantial – would be “someone else’s problem,” a euphemism for the remaining 80%.

The top 20% could agree to, or even drive, spending increases (or revenue decreases) with impunity, comfortable that their share of responsibility is fixed at a trivial level.

It’s just a different road to the same place we are now, a deeply broken fiscal policy that favors the top 20% and fails to create incentives for all Alaskans to engage in efforts to control spending.

There are better ways. As we’ve explained in previous columns, substituting taxes for PFD cuts to raise any additional funds would create an environment in which all Alaska families have a stake in government spending levels, and thus, are likely to push back on spending levels beyond what they believe are appropriate.

As former Governor Jay Hammond said in Diapering the Devil: “After all, the best therapy for containing malignant government growth is a diet forcing politicians to spend no more than that for which they are willing to tax.”

Moreover, by applying also to non-residents, a tax would raise a portion of any needed, additional funds from non-residents, materially reducing the amount required from Alaskan families.

Neither of those would be achieved by means testing. Alaska’s fiscal approach would continue to lack incentives to restrain spending and, by failing to tap non-residents, Alaska’s families would continue to pay materially more than they should.

Ultimately, the remaining 80% of Alaska families would gain little. Even if the commitment to pay the full PFD to those qualifying is written in statute, nothing would prevent the Legislature in subsequent years from either lowering the “means tested” level, exposing middle income Alaska families to even deeper cuts than under the current approach, or continuing to do as it does now and cutting the per PFD amount in order to cover the additional costs of government.

In short, means testing would not make the issue go away. Rather, it would just morph into something even more favorable to the top 20% and those that want to continue to insulate the top 20% from engaging in efforts to restrain government spending.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

You nailed it, Brad. If it’s means-tested, it’s welfare. Good idea or bad, it’s antithetical to the philosophy of the PFD as we’ve always known it.

It’s welfare either way. The “moral hazard” of a handout cuts at the trust funder just as it cuts at the vagrant. Still, the benefit of a handout is real to the person who is hungry. So, we manage these competing costs and benefits by means testing.

Handing out unearned money is welfare, any way you slice it.

Is it welfare when we hand out free services to Outside and foreign enterprises? How does the de facto PFD that Hilcorp receives (or Lowe’s, or Cabela’s, or the Canadian-owned Alyeska Resort, or QAP, etc.) compare to your PFD, or mine?

It appears that the total number of Alaskans accounted for in the IRS data is only about 649,000. Am I correct that a large portion of the remaining 70,000-80,000 (about 10% of Alaskans) don’t have a filing requirement because they are disabled or elderly? If so, how does including them change the picture?

The CY2019 IRS data fairly closely matches the number of PFDs actually paid in CY2019 (630,037). While there is a lot of noise in all of them, the higher numbers cited as the population numbers include those who, while present in the state, don’t claim residency for either PFD or tax purposes. Because of their relative closeness, because it seems unlikely someone claiming a PFD wouldn’t also use Alaska residency for IRS purposes (and because they are about all there is in terms of residents per income bracket), we are comfortable using the IRS breakdown as a rough proxy for… Read more »