Generally speaking, fiscal policy is about balancing government spending wants against willingness to pay.

Just like a kid in a candy store, the aggregate wants are always huge: more spending on schools, or roads, or higher education, or pre-K, or retirement benefits, or parks … or diving boards. The list is almost endless.

But just like the proverbial kid in a candy store, there are limits. In the case of the kid, it’s the willingness of the parent to pay. In fiscal policy, it’s usually the aggregate willingness of citizens – expressed through their representatives – to pay taxes that define the limit.

As former Governor Jay Hammond said in Diapering the Devil: “After all, the best therapy for containing malignant government growth is a diet forcing politicians to spend no more than that for which they are willing to tax.”

But for that to work, all citizens need to be faced with paying. If any are able to avoid – effectively shifting their share of the burden to others – the checks and balances break down. Because they don’t have to contribute to the costs, those that avoid either press for more spending that benefits them or, at best, are indifferent.

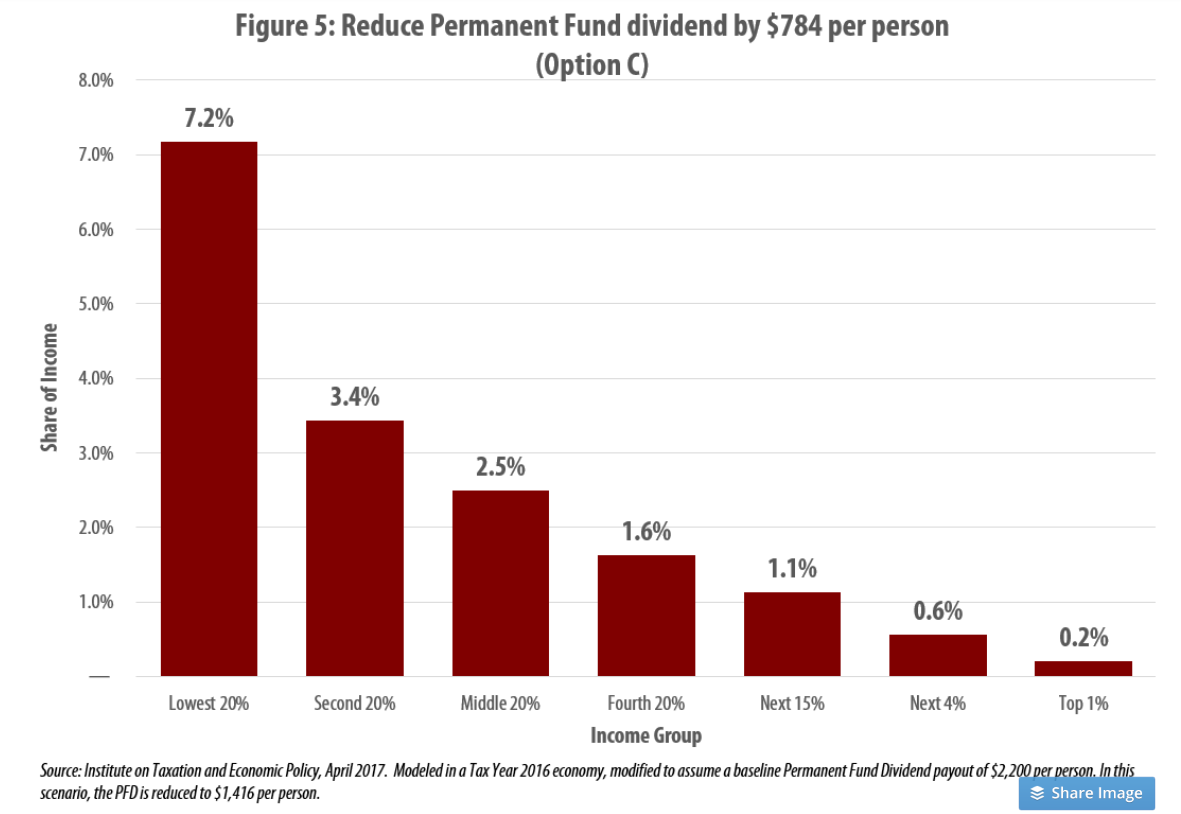

A significant part of Alaska’s fiscal problem is that it suffers from that exact situation. By using cuts in the Permanent Fund Dividend (PFD) to cover the additional costs of government over and above those covered by current statutory revenues – existing taxes plus the “other half” of the Permanent Fund earnings stream envisioned by former Governor Hammond to be used for “essential government services” – the burden of the related spending falls almost entirely on middle and lower income Alaska families.

Those in the top 20% escape largely unscathed. Indeed, the higher the income, the lower the impact. As this chart from the 2017 study for the Legislature by the Institute on Taxation and Economic Policy (“Comparing the Distributional Impact of Revenue Options in Alaska”) demonstrates, by using PFD cuts to fund the additional costs the top 1% are only required to contribute 0.2% of their income to support each $500 million of additional government spending, while the lowest 20% are required to contribute 7.2%, thirty-six times more.

While some in the top 20% may give lip service to the need to restrain spending, most remain, at best, indifferent to the issue.

While allowing any significant segment to avoid contributing creates issues, excusing the top 20% is especially problematic. As we discussed in a previous column, two-thirds of the members of the current Legislature are in the top 20%. And almost all, if not all, of the significant campaign donors – those with the most impact on the legislators – are as well. Minimizing – if not eliminating – the link between spending levels and personal financial consequences for most legislators and their significant donors results in significant indifference about spending levels in the very segment best positioned to do something about it.

Because someone else is paying for it, the legislators and their top 20% supporters are able to say without consequence, “of course we need additional spending.”

Unfortunately for middle and lower income (80% of) Alaska families – those bearing the burden of the result – both political parties also are largely indifferent to the result.

Republicans are able to complain about government spending levels – providing them with a perennial campaign issue – without actually having to do anything about them. By using PFD cuts to fund government, there is no impact on – and thus, no pressure from – their donor class to actually achieve cuts. As long as they continue to talk a good game, there largely are no adverse political consequences to Republican legislators – or governors – from losing on the issue.

Similarly, Democrats are able to push for additional government spending – providing them also with a perennial campaign issue – without any significant limitations. Republicans give lip service to opposing, to preserve it as a campaign issue on their side, but face no consequences from their donor class from losing and, thus, are fairly easy rollovers when it comes time to do battle.

And top 20% Democratic candidates – or Democratic candidates financed by top 20% donors – can push ahead without any concern about having to contribute themselves toward the costs. Government employee unions and others benefiting from government spending also can push ahead knowing that any personal contributions required of their members will be capped at a small fraction of their state-generated income.

This is not to say – as some sometimes claim we do – that we prefer a progressive income tax as a remedy, shifting the burden mostly to the top 20%.

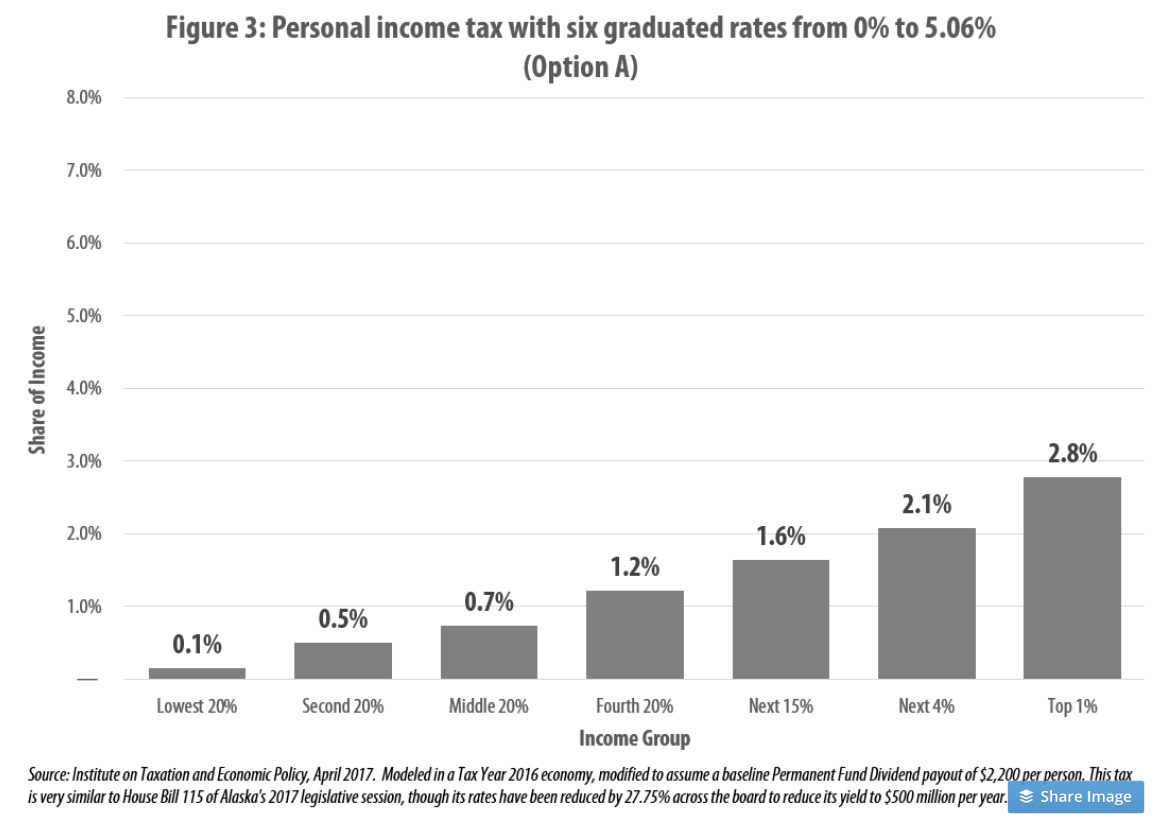

As this chart from ITEP’s 2017 study for the Legislature demonstrates, that has the same flaws as the current approach, only in the reverse.

This time, it’s the lowest 20% that are effectively exempted. While the top 1% are required to contribute 2.8% of their income to support each $500 million of additional government spending, the lowest 20% are only required to contribute 0.1%, twenty-eight times less.

As a consequence, just as are the top 20% using PFD cuts, the lowest 20% and others similarly situated are positioned using a progressive income tax to push for more government spending without facing any significant financial consequences. The identity of those doing the pushing and those affected may change, but the overall outcome is largely the same as using PFD cuts.

Instead, to us the approach best designed to address the situation is a proportionate, or what we often refer to as a “flat,” tax.

Such an approach dates back to Adam Smith, the father of capitalism who, in his seminal treatise, The Wealth of Nations, said this:

The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state. The expense of government to the individuals of a great nation is like the expense of management to the joint tenants of a great estate, who are all obliged to contribute in proportion to their respective interests in the estate. In the observation or neglect of this maxim consists what is called the equality or inequality of taxation. …

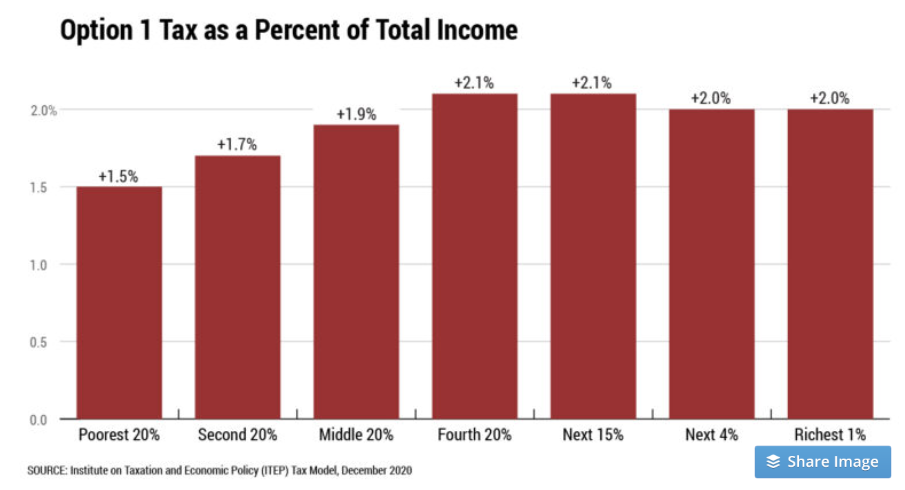

While not perfectly flat due to the inclusion of some personal exemptions and exclusions, following up on their 2017 study, in 2021 the Legislature asked for and received from ITEP a report which outlined various flat tax options designed for Alaska (“Comparing Flat-Rate Income Tax Options for Alaska”). The broadest-based, and thus, flattest, was this:

(Note: While the approaches analyzed in ITEP’s 2017 study were designed to raise $500 million, Option 1 in the 2021 study is designed to raise $696 million. As a result, the Option 1 tax rates in the 2021 study should be reduced by roughly 30% lower if compared to those developed in the 2017 study.)

Using that approach, all Alaska families have comparable “skin in the game.” Every increase in spending requires a proportionate additional contribution also from everyone. No one group is able to push spending – or to sit out the discussion – without facing the consequences; all have a reason to be involved – to have a voice – in balancing government spending wants against willingness to pay.

In our view, Alaska will never solve its fiscal challenges – finding a durable balance between aggregate “wants” and “willingness to pay” – until all Alaska families, including the top 20%, are required to have roughly the same, proportionate skin in the game.

Candidates who talk a lot about “holding the line on spending” but fail to propose an approach which incentivizes all Alaska families to come together in the effort aren’t really serious about the issue. Like the legislative Republicans, they just want to be able to talk a good game without facing any consequences for their failure to deliver.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.