A recent article in the Mat-Su Valley Frontiersman dredged up some old memories about past “big” capital projects, which, in turn, is causing us to think more deeply also about current ones.

The article was headlined “End of the line for rail link to Port MacKenzie? Borough to pursue conversion to a road.” Reading the article led us to recall some of the early days of the Alaskans for Sustainable Budgets project when we questioned spending on that and other “big” capital projects authorized in the early 2010s.

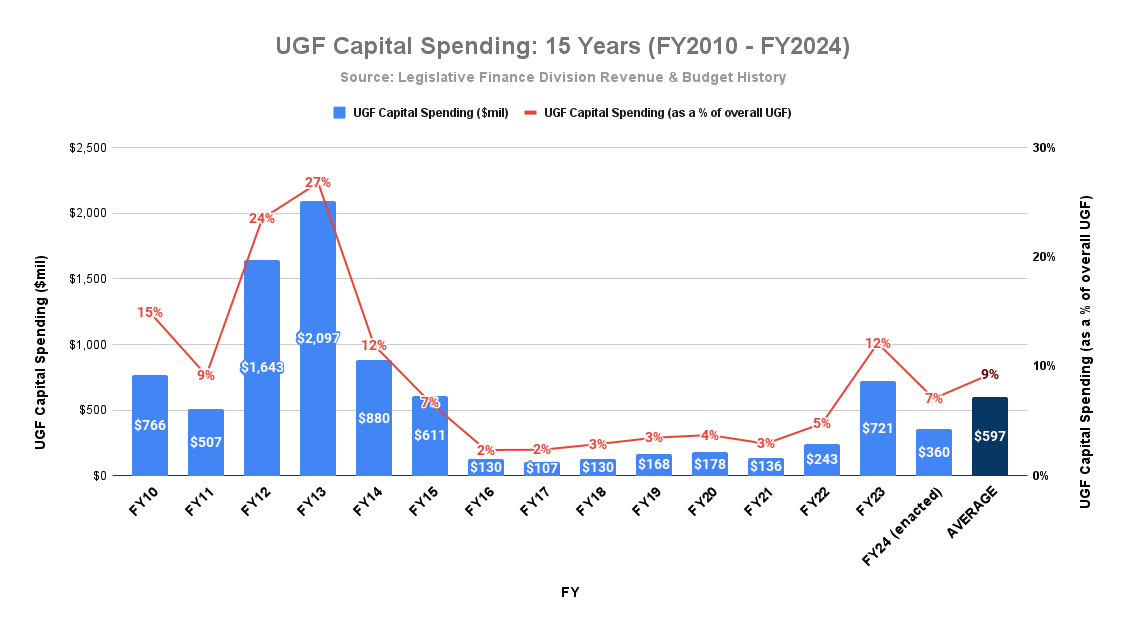

Fueled by one of the periodic run-ups in oil prices, various “big” capital projects were all the rage during that time frame, with the total unrestricted general fund (UGF) capital budget reaching $2.1 billion (or nearly 27% of the overall UGF spending) in FY 2013. Over the 5 year period from FY 2010 through FY 2014, the capital budget alone averaged $1.8 billion per year (or over 17% of overall UGF spending).

Now, the excess of some of that spending is becoming apparent. The project discussed in the article proposed to extend the Alaska railroad from its current tracks near Houston in the Mat-Su Valley to Port Mackenzie. As rationalized at the time, the extension was to create a second (in addition to Seward) and closer outlet for coal exports from Usebelli Mine Inc.’s Healy mine, “but that ended when cheaper coal from mines in Asia took away Usibelli’s customer in South Korea.”

“The state has invested $184 million in the project to link the port to the existing Alaska Railroad, but construction stopped in 2017.” Since that time, various alternate customers have been discussed, including “new copper mines in northwest Alaska … but those are potential customers that still face uncertainties and … Mat-Su officials have been unable to find the money to finish the spur for the near term.”

Now, the proposed rail project is effectively being abandoned, with the leftover bits folded into a proposed road project.

Thankfully as oil prices fell, the capital budget fever of the early 2010s moderated. As the above chart shows, even counting the most recent “big” capital spending year of FY 2023, the UGF capital budget over the past five years has averaged only $290 million, less than a quarter of what it did during the FY 2010 – FY 2014 timeframe and a much more reasonable 5.4% of the overall UGF budget over the period.

But unfortunately, that doesn’t mean spending on highly speculative projects has ended.

In some respects, that sort of spending has just been outsourced instead to the Alaska Industrial Development and Export Authority (AIDEA). Perhaps the current poster child for that sort of speculative spending is AIDEA’s ongoing investment in oil & gas leases in the Arctic National Wildlife Refuge (ANWR). As did a few others, in December 2020, AIDEA participated in the federal lease sale for ANWR, successfully winning nine tracts.

But while the other successful bidders have since surrendered their leases and the federal government claims AIDEA’s are suspended, AIDEA has continued to spend in an effort to retain theirs. According to recent news reports, through December 2022, AIDEA has already spent about $13.8 million and authorized an additional $6.2 million to be spent maintaining and defending the leases.

But that is only one of the highly speculative projects in which AIDEA is engaged. Another is the Ambler Road Project. To date, AIDEA appears to have spent about $50 million of the state’s money on the project, with the amount projected to rise to more than $100 million over the next couple of years.

According to the federal Bureau of Land Management’s (BLM) “Frequently Asked Questions” about the project prepared in 2019, “[c]osts for construction of the full build-out of the two-lane access road would be $519 to $992 million, depending on the alternative. Operations and maintenance costs are expected to be $9 to $14 million per year, again depending upon the alternative.” Since that time, other estimates have put the updated construction cost of the 211-mile road well above $1 billion.

Of course, it’s AIDEA’s position that, if built, the road will be financed by 30-year bonds, the costs of which will be fully recovered through tolls paid for by the mining companies using them. But that sounds a lot like the early 2010s justification for the Mat-Su rail extension.

For AIDEA’s claim to be true, a lot more – and much bigger – mining projects will be required than those underway currently. Right now, the only prospect that has been drilled extensively in the area to be served by the road is just one small, short-lived (12-year) project (the Ambler Metals’ Arctic prospect), which doesn’t hold nearly enough reserves to underwrite the cost of the road. Of course, AIDEA anticipates that eventually, there may be others, but those are the same “new copper mines in northwest Alaska … that still face uncertainties” that are insufficient to save the Mat-Su rail extension.

As a recent Bloomberg article quoted a spokesperson for the BLM, “If there’s a feasibility study for Ambler establishing ‘that the minerals could be mined at a profit,’ the bureau hasn’t seen it.” If the minerals can’t be mined at a profit, the mines won’t be built. If the mines aren’t built, the costs of the road won’t be recovered.

Because of the highly uncertain nature of the remaining mines needed to support the financing, the Ambler project is in a much different place than the much shorter (52-mile) DeLong Mountain Transportation System (DMTS) that AIDEA often refers to as a template. Those costs are underwritten by a single project (the Red Dog Mine) that was already far along in the planning process at the time the expenditures for the road were made. That’s very different from the situation in which AIDEA finds itself with the 211-mile Ambler project.

Sure, all of us want Alaska to dream big. But just like the position we took in the early 2010s, we believe those dreams – especially when they involve spending major dollars even to get to the starting point of a project – need to be heavily tempered by reality.

And recent developments may make engaging in such reality checks even more important going forward.

In recent articles, both Alaska Public Media and the Peninsula Clarion have reported on a huge jump in the costs of the Cooper Landing bypass. According to the Alaska Public Media article:

The bypass — officially the Sterling Highway Milepost 45-60 project — is a decades-old plan to divert traffic around Cooper Landing by creating a highway bypass through the mountains north of the town. It includes miles of new highway, plus a bridge over Juneau Creek Canyon that will be the state’s longest single-span bridge and its highest crossing when complete.

Shannon McCarthy, a spokesperson for the state transportation department, said … the project was originally estimated to be a $350 million endeavor in 2018. By 2021 that number was closer to $500 million. By 2022 it had risen to almost $700 million. A new assessment this year shows the current cost to be $840 million, almost two-and-a-half times the original price tag.

The plan for the next year was to begin work on the bridge over Juneau Creek Canyon, as well as another leg of the highway. But McCarthy said now, with rising costs, it’s not realistic to work concurrently on those parts of the bypass — together, their costs would have been roughly equivalent to the department’s yearly budget for the whole state, so moving forward on that work would cause delays across Alaska.

According to the Peninsula article, “Alaska Department of Transportation and Public Facilities [DOT&PF] Deputy Commissioner John Binder … attributed the cost increase to inflation. ‘Alaska DOT&PF has seen inflationary pressures on construction costs throughout the state over the past two years,’ Binder said. ‘We will be making considerable effort to ensure we can keep the project on schedule despite these challenges.’”

While both articles mention that DOT&PF is attempting to tap additional federal funds to cover the cost increase, neither claims those efforts will prove successful. And even if they are with respect to the Cooper Landing bypass, there is no suggestion that federal funds will be similarly available to cover the rising costs of the department’s other construction projects.

We are not objecting to the Cooper Landing bypass. That’s a needed update to one of Alaska’s main arterial highways. But in times when the regular capital budget is already under pressure, it becomes even more important to rein in spending on highly speculative projects, such as ANWR, Ambler Road, and a variety of other projects currently housed in AIDEA.

Some argue that the regular capital budget and the projects pursued by AIDEA are separate and shouldn’t be looked at as a single continuum. But that argument elevates form over substance. AIDEA receives a substantial part of its budget, at least for the initial funding for various of its projects, through appropriations from the state budget. And any funds that AIDEA holds in its hands that can be better put to use as part of the state budget can easily be returned to the general fund through dividends.

Both of those mean that expenditures by AIDEA are better viewed as an extension of the state budget rather than as something separate, which brings us to our final point: whose money are we speculating with?

Back in the early 2010s, when the state was running large capital budgets, the state was spending money that either, viewed from the perspective of building a long-term sustainable budget, should have been put into savings or, from FY 2013 on, was being pulled from savings. In current times, however, the budget deficits the state is running are being covered by cuts in the Permanent Fund Dividend (PFD), in short, as we’ve explained in previous columns, on the backs of middle and lower-income Alaska families.

It’s one thing to fund highly speculative projects out of savings when those making the decision to spend arguably can rationalize that the potential beneficiaries – future generations – are the same as those ultimately bearing the costs.

It’s quite another to fund highly speculative projects when it’s clear the burden is falling hardest on those least positioned to bear it and who are quite unlikely to be significant, or even slight, beneficiaries even if the projects prove successful.

Going forward, we believe the state should become much more circumspect about spending money on highly speculative projects. But if it believes it should continue to do so, then at a minimum, it should adopt funding mechanisms that spread the burden and risk of those expenditures much more equitably across all Alaska families, including those in the top 20%, as well as the many – and according to this week’s three-year economic outlook report released by the Anchorage Economic Development Corp, a growing number of – non-residents engaged in some manner in the Alaska economy.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Wow! I agree with you this time! Here in Fairbanks and other communities along the route, the State of Alaska has committed huge amounts to the ‘improvements’ and subsequent maintenance of the Alcan, Richardson, and Steese Highways, and local roads for the minimal return the Tetlin mining project will provide Alaskans. We get Bupkus.

By huge- over 1/2 billion on bridges alone

In the “Good Old Days”, a 4-lane highway could be built in Alaska for $1,000,000 a mile which, back then, seemed extravagant.