Some of what we bring to the discussion of fiscal policy has been learned over the years from dealing with utility rate cases.

In those, there are two distinct issues. The first is the amount of the “revenue requirement,” what the utility requires in order to recover its reasonable costs and earn a fair return on investment. The second, and often more important from the perspective of individual consumers, is “rate design,” how the revenue requirement will be recovered from customers.

The same is true with government fiscal policy. The first step in government fiscal policy is (or should be) determining the overall revenue requirement, how much money does government reasonably require to provide the services it is providing.

As with utilities, the second is then deciding how that revenue requirement should be recovered from the various stakeholders. And as with utilities, the second issue – what do I have to pay – is often more important to stakeholders than the first. Many are fine with spending levels as long as they don’t have to pay much of it themselves.

There is a difference in nomenclature. In utilities, the mechanism through which the revenues are recovered are called “rates.” In government, it’s called “taxes and fees.”

But generally speaking the goal for the second step is the same (or at least, should be) for both: to design mechanisms for recovering the revenue requirement that are reliable, fair, simple and promote economic efficiency and other policies deemed important by the regulator (in the case of utilities, the utility regulatory agency; in the case of government, the legislature and governor).

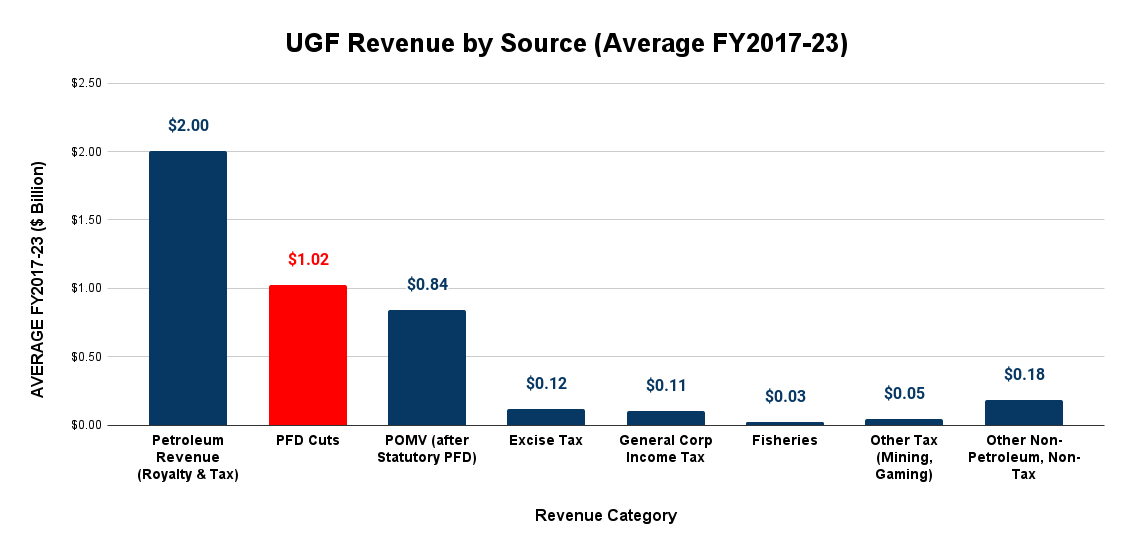

Here are the sources of Unrestricted General Fund (UGF) revenue for Alaska government, averaged over the period from FY17 (when cuts in the Permanent Fund Dividend (PFD) commenced) through FY23. The data, other than for the PFD and the percent of market value (POMV) draw, are taken from the Department of Revenue Fall 2022 Revenue Sources Book. Data related to the the PFD and the POMV draw are taken or calculated from various of the “History and Projections” reports published monthly by the Permanent Fund Corporation and, in the case of PFD cuts, from various Fiscal Summaries and Summary of Appropriations published by the Legislative Finance Division (LFD).

To a degree, Alaska tax policy follows the general theory. Consistent with the policy set forth in Article 8, Section 2 of the Alaska Constitution, oil and other natural resource taxes presumably are designed to be revenue maximizing, to realize the maximum amount of revenue available from such sources for the benefit of the state. (For those interested, an earlier column taking a deeper dive into that subject is here.)

There also are a number of relatively minor corporate, excise and other taxes and fees that also seem to follow the general theory by spreading that portion of the burden broadly among both in-state and out-of-state entities operating in the state so that no one entity – or type of entity – bears an undue share.

Standing in stark contrast to the general theory, however, is Alaska’s approach to taxes on individuals, which come in the form of cuts to the PFD (what former Governor Jay Hammond called “head taxes”) and are the second largest source of UGF revenues over the period. (For those interested, Ed King has recently published a piece that does an excellent job of adding to Governor Hammond’s explanation of why PFD cuts are taxes.)

The general principles of taxation have remained consistent since first set out in Adam Smith’s – often referred to as the Father of Capitalism – seminal book, “An Inquiry into the Nature and Causes of the Wealth of Nations” (1776).

In Book V, Chapter 2, Smith set out to discuss issues related to “The Sources of the General or Public Revenue of the Society.” There, in Part II of that Chapter, he identifies what he terms the “four maxims with regard to taxes in general” that are important to helping achieve the objectives of capitalism. Generally speaking, they have been summarized as “equity, certainty, convenience and efficiency.”

On the principle of “equity,” what others often refer to as fairness, he says this:

The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state.

Today, this “proportionate” approach is most commonly referred to as a “flat tax.”

Alaska’s approach to individual taxes doesn’t even remotely meet this test of fairness. Instead, rather than designing its individual tax approach to collect revenues “in proportion to the revenue which [the individuals] enjoy under the protection of the state,” Alaska uses a heavily regressive approach which produces the exact reverse.

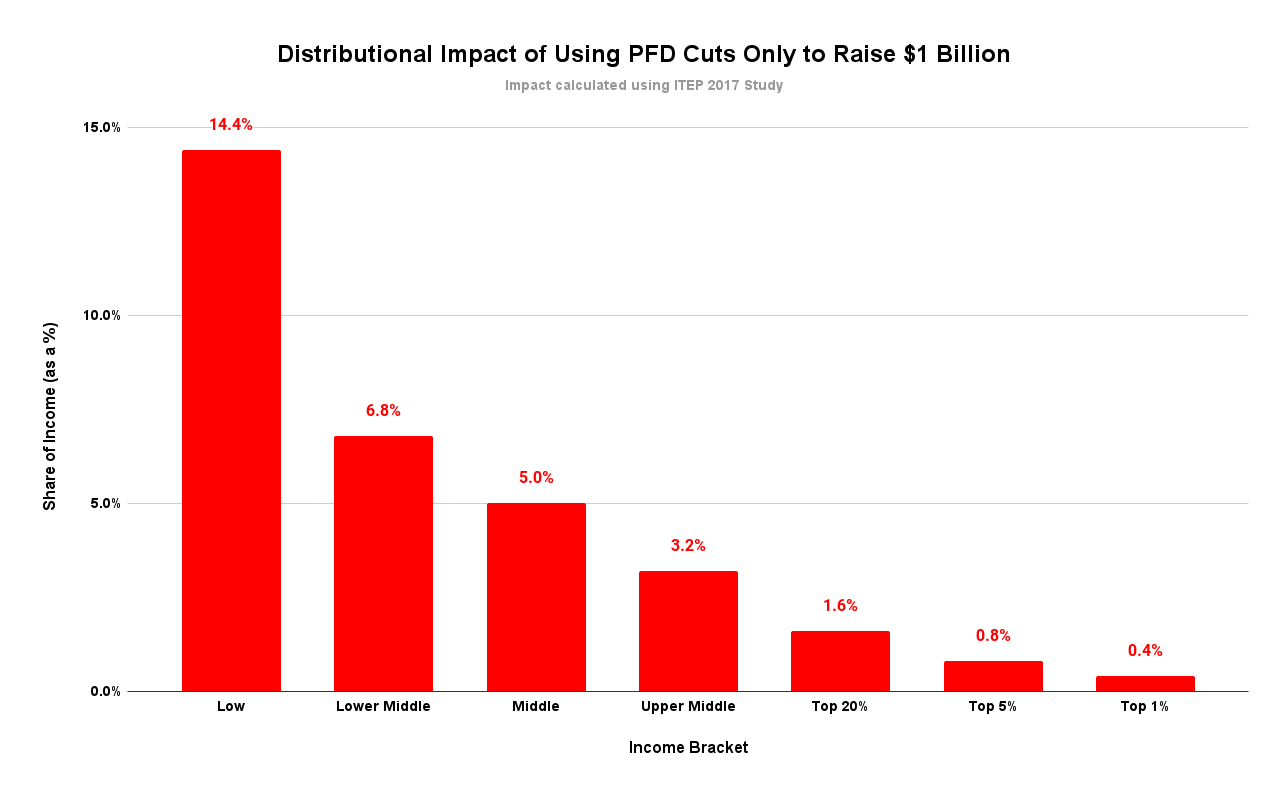

Applying the methodology adopted in the 2017 report on “Comparing the Distributional Impact of Revenue Options in Alaska,” prepared for the Legislature by the Institute on Taxation and Economic Policy (ITEP), here is the impact of Alaska’s current individual tax approach by income bracket resulting from raising through that means $1 billion/year, the annual amount of PFD cuts averaged during the period from FY17 through FY23. The numbers are the percent of income taken from households in each bracket.

Under the state’s current individual tax approach, the lowest 20% of Alaska households contribute 14.4% of their income and the middle 20% contribute 5% of theirs, compared to only 1.6% for the top 20% and even less, 0.8% for the top 5%.

Put another way, the lowest 20% of Alaska families contribute nine times more toward the costs of government as a share of income, and the middle 20% three times more, than the top 20%. The disparity between those brackets and the top 5% is even more extreme. The lowest 20% of Alaska families contribute 18 times more, and the middle 20% six times more, than the top 5%.

How does that compare to the results under a “proportionate” or flat tax?

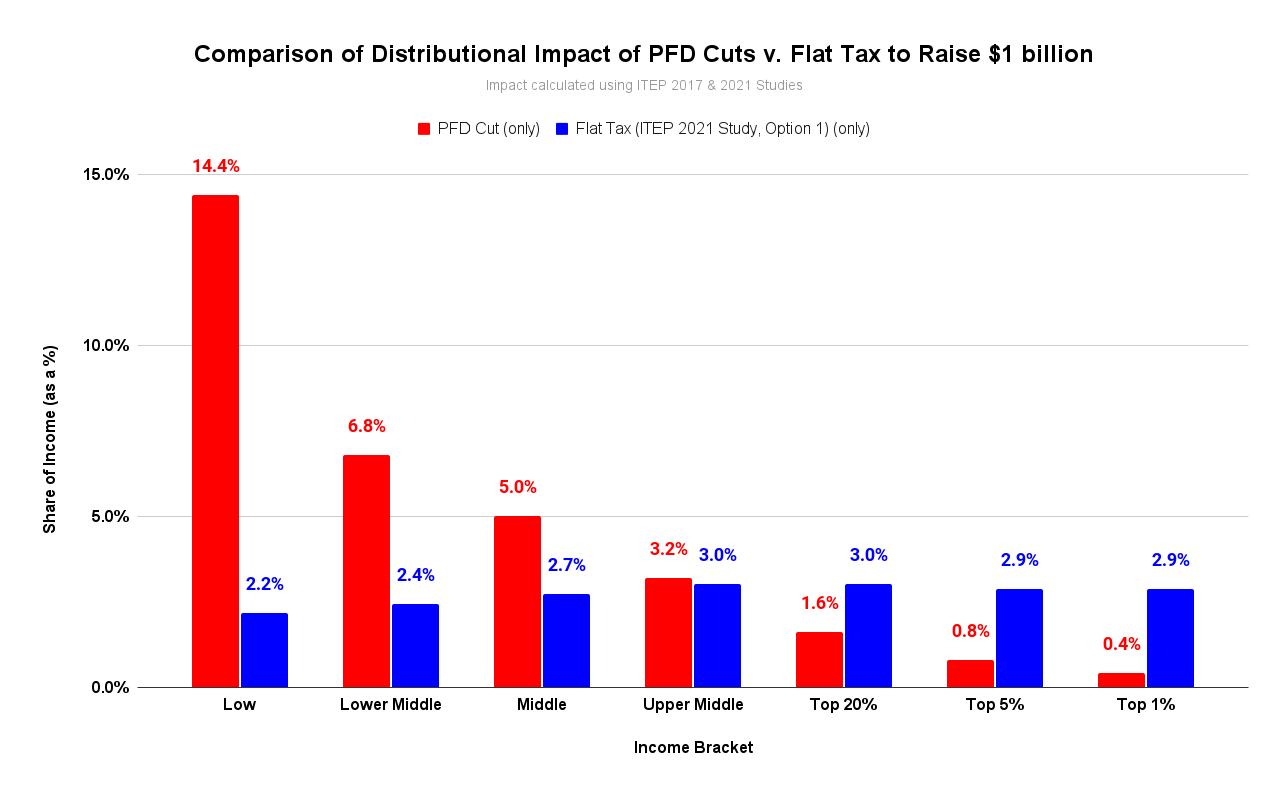

In a 2021 follow-up report for the Legislature, “Comparing Flat-Rate Income Tax Options for Alaska,” ITEP looked at various options for implementing a flat tax in Alaska. Scaled to the same $1 billion in annual revenue, the distributional impacts of Option 1, the “flattest” of the alternatives (i.e., the one with the least number of exemptions and deductions), are shown here (in blue):

While those in the top 20% would pay somewhat more under a flat tax than they contribute using PFD cuts to raise the same amount of revenue, 80% of Alaska families – those in the low 20% through the upper middle 20% – would pay less. And while the top 20% would pay somewhat more under a flat tax than they contribute using PFD cuts, even under a flat tax they would still pay less than the remaining 80% contribute using PFD cuts.

Regularly, some accuse us when we discuss adopting a flat tax on these pages and elsewhere of wanting to raise more revenues for government so that it can spend more.

That’s wrong. None of our discussions ever have proposed increasing the overall revenue requirement for government. That’s an entirely different discussion with its own set of issues.

Instead, our discussions always have been focused on the second step of fiscal policy, revenue design – how to fairly and efficiently recover the costs of government – whatever those are – from stakeholders.

Using PFD cuts to raise the portion of revenues designated to be taken from individuals violates virtually every principle of revenue design there is. As a share of income it takes the most from those with the least to give. Unlike in every other state – and unlike Alaska’s other taxes – using PFD cuts raises revenues only from Alaska families; non-residents receiving income sourced in Alaska contribute nothing.

And from an incentives perspective, by essentially holding harmless from the consequences of increased government spending those with the most political power to control it, the current revenue design encourages more government spending, not less. By using PFD cuts as the source of individual taxes, those in the top 20% are free to support and encourage additional spending safe in the knowledge that the bulk of the burden will be shifted to middle and lower income families.

If this sort of revenue design were proposed in front of a utilities commission it would be tossed out on its ear. The fact it not only has not been tossed out on its ear, but adopted by the Alaska Legislature is a testament to the raw political power of the top 20%.

It’s the epitome of the tax approach former United States Senator and Chairman of the United States Senate Finance Committee Russell Long once described as “don’t tax you, don’t tax me, tax that fellow behind the tree.” Applied to Alaska, it’s don’t tax me and my friends in the top 20%, tax the other 80% behind the tree (i.e., who don’t have lobbyists in Juneau).

Separate and apart from the issue of whether Alaska needs more or less government revenue, Alaska does need a new, more equitable and more efficient revenue design for raising the portion to be contributed by individual Alaskans. The current one not only is neither fair nor efficient, it’s the farthest from achieving those two policy goals one can imagine.

Recovering from the days of poll taxes, other states have long since abandoned the use of highly regressive “head taxes” to raise revenues. Alaska’s use of the approach to raise roughly 25% of UGF revenues is a significant stain on its overall fiscal policy.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

About half of Brad’s articles read like a one trick pony. Repeat over and over again that you believe the PFD is income and any reduction would be regressive. Do you have anything else to say? PFD is a government transfer. Reducing that transfer would be regressive, but you will never resolve the ambiguity of whether it is a tax or not. Perhaps write about the distributive effects of a broad based income tax or sales tax geographically instead of just income brackets. Any broad based tax would redistribute income out of Anchorage to the rest if the state. Is… Read more »

Ed King has served our information needs well and I would like to add a few things. Since we edited and published “Diapering The Devil, by Jay Hammond I have had many dicussions about his views and always point to his actual text. He was disappointed by the repeated reduction in what oil revenue would go into the Fund. As Mr. King says he did advocate for 100% of oil revenues but felt forced to acept much less. The final straw was the elimination of severances taxes which cut the intended 25% of oil revenue in half. The actual transfer… Read more »

This column is like a broken record. All you want to do is tax productive working folks. The dividend was not meant to be relied upon income for anyone. It should be the first thing thought of for revenue. Not punishing people who work.