One of the most troubling aspects of Alaska state fiscal policy is the failure of policymakers and others regularly to consider the issue of “who pays” for government spending as a co-equal fiscal issue with how much government spends and on what.

In other states and nationally, the question of “who pays” for spending at a personal level is not only treated as a co-equal issue but is sometimes even given pre-eminence. Indeed, one national group periodically does an in-depth look entirely focused only on “Who Pays” for government spending at the state and local levels in all 50 states and the District of Columbia.

But in Alaska, the issue rarely rises even to the level of mention during fiscal discussions, much less treated as a co-equal factor. We can’t recall the last time a co-chair of either the House or Senate Finance Committees, the director of the Legislative Finance Division, the commissioner of the Department of Revenue, or the director of the Office of Management and Budget – the central players in Alaska state fiscal policy – even uttered the phrase.

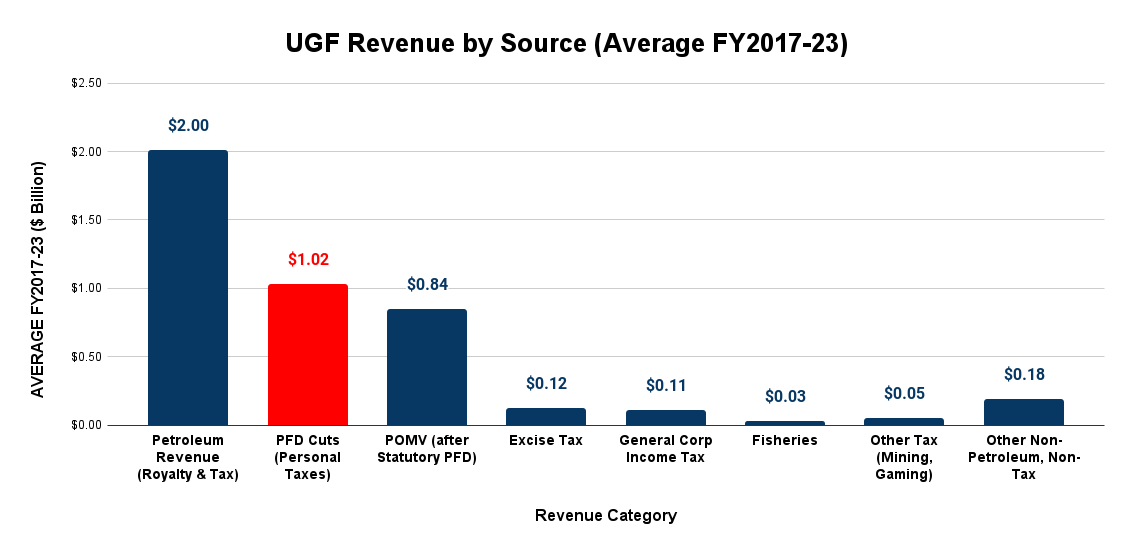

One excuse we sometimes hear is that the issue of personal responsibility for the costs of government is relatively new to Alaska, having reemerged only in 2017 with the beginning of the diversion of a portion of the Permanent Fund Dividend (PFD) to government. But whether new or not, the source has become significant. Over the seven years since they started, the diversions are the second largest source of state revenue, behind only oil royalties and taxes.

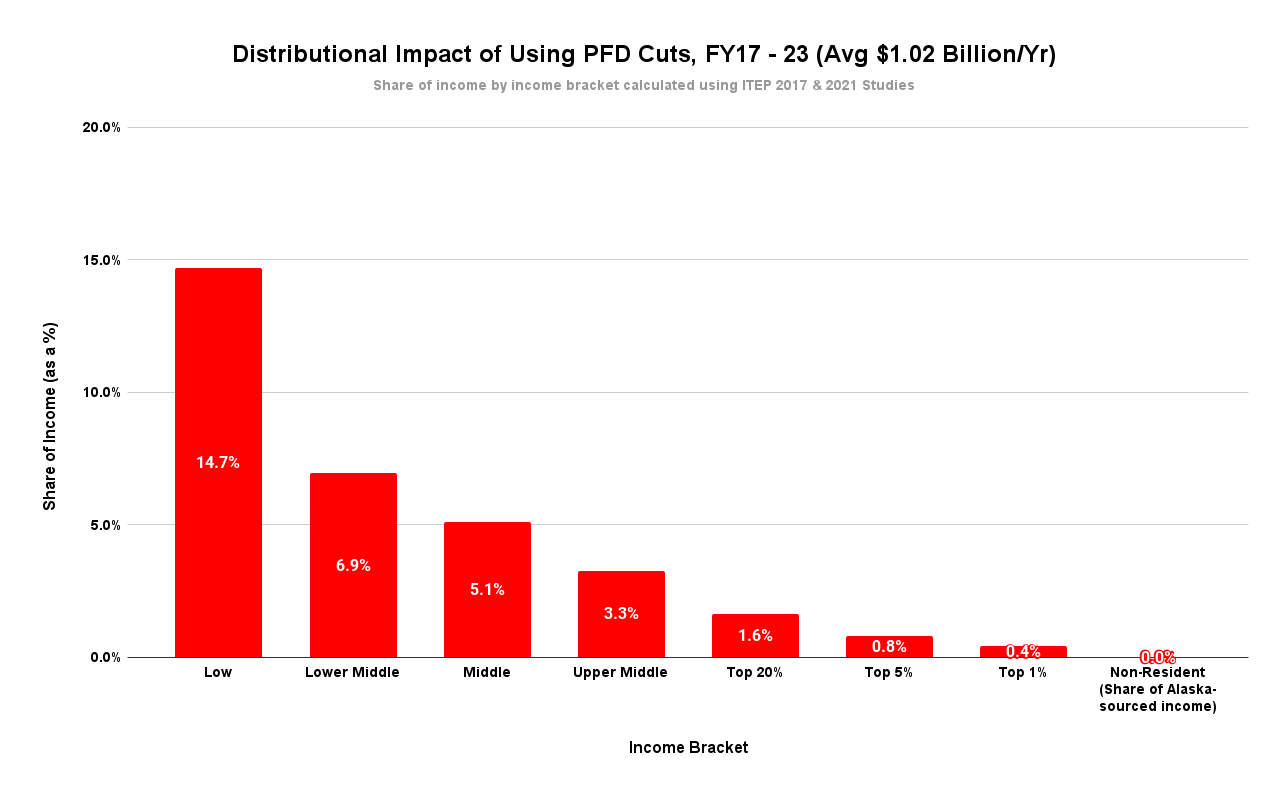

At that level, roughly 4% of overall Alaska Adjusted Gross Income (AGI) has been diverted over the period from the state’s private sector to government. But the impact of that diversion has been hugely imbalanced. Using numbers derived from a 2017 study by the Institute on Taxation and Economic Policy (ITEP) for the Legislature, middle and lower-income Alaska families have been required to contribute far more as a share of income toward government costs during that period than those in the top 20% and non-residents.

There are significant reasons why “who pays” for government at a personal level is critical to fiscal policy. The first is fundamental fairness regarding who bears the costs of government services.

The principle of equity goes all the way back to Adam Smith, the father of capitalism. In Book V, Chapter 2, of his seminal book, “An Inquiry into the Nature and Causes of the Wealth of Nations,” Smith identified what he termed the “four maxims with regard to taxes” critical to helping achieve the objectives of capitalism. Generally speaking, they are “equity, certainty, convenience, and efficiency.”

He said this on the principle of “equity”:

The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state.

Today, this “proportionate” approach is commonly called a “flat tax.”

The second reason “who pays” is a critical factor is its economic impact. The way that the burden is distributed can have a significant impact on the economy.

If the tax burden is too heavy on low- and middle-income earners, it can lead to a decrease in consumer spending. This can slow down economic growth. On the other hand, if the tax burden is too heavy on high-income earners, it can lead to a decrease in investment. This can also slow down economic growth.

It is important to find a balance in the tax burden that promotes economic growth without being too burdensome on any one group of taxpayers.

Alaska’s current approach to “who pays” at a personal level – using PFD cuts to fund government – is off the spectrum in terms of its adverse impact on both.

As University of Alaska-Anchorage’s Institute for Social and Economic Research (ISER) Professor Matthew Berman explained in a recent commentary, “A cut in the PFD is … the most regressive tax ever proposed. A $1,000 cut will push thousands of Alaska families below the poverty line. It will increase homelessness and food insecurity.”

He also explained in a 2017 study that compared to alternative approaches, “A cut in PFDs would be by far the costliest measure for Alaska families.”

Using PFD cuts is also off the spectrum in terms of its adverse impact on the economy. As explained in a 2016 study prepared for the then-administration of Governor Bill Walker by researchers at ISER, including Dr. Berman, this is for two reasons.

The first is that using PFD cuts puts the entire burden of paying for government at the personal level on Alaskans. As is clear from a review of the most recent “Who Pays” study by ITEP, every other state uses an approach that raises at least some part of its revenue requirement from non-residents, reducing the burden on the in-state residents.

According to the ISER study, using such approaches in Alaska would raise between 6.5% and 11% from non-residents, materially reducing the impact of government costs on the Alaska economy.

But using PFD cuts means that non-residents contribute zero to government costs. At a personal level, Alaskans – Alaska families – bear the entire burden, taking all of the money from the state’s own economy.

The second reason that using PFD cuts has such an adverse impact is for the same reason they are inequitable, because they are hugely regressive. As the 2016 ISER study explained, “Lower-income Alaskans typically spend a higher share of their income than higher-income Alaskans do, so more regressive measures will have a larger adverse effect on expenditures.”

The combination of the two is deadly from an economic perspective. According to the 2016 ISER study, “The impact of the PFD cut falls almost exclusively on residents, and it is highly regressive, so it has the largest adverse impact on the economy per dollar of revenues raised.” Using PFD cuts to pay for government costs leads to more reductions in both jobs and income than any other revenue option.

The failure to discuss the issue isn’t partisan. The silence on the issue of “who pays” extends across Alaska’s political spectrum and leads to hypocrisy on both the left and right.

Political moderates and progressives claim to prioritize policies that positively impact working (middle and lower-income) Alaska families and to focus on increased spending to meet identified needs.

But they largely go silent when it comes to who pays for that spending, leaving the burden to increased cuts in the PFD, which, of all the options, is “by far the costliest measure” for the very same Alaska families they claim to prioritize.

Political conservatives claim to prioritize policies that positively impact the economy and focus on legislation and actions they claim will help grow the economy.

They are vocal when they fear upper-income families or resource and other corporations may be required to pay, but, like moderates and progressives, go largely silent when the discussion shifts to using increased cuts in the PFD which, of all the options, has the “largest adverse impact” on the very economy they claim to prioritize.

The result is a reality that directly undermines what both sides claim to prioritize. The hypocrisy of their positions is palpable.

Occasionally both sides will feign interest in pushing for more equitable and lower-impact approaches by proposing what they claim to be replacements.

House Coalition members Representatives Zack Fields (D – Anchorage) and Alyse Galvin (I – Anchorage), for example, each have proposed bills that would adopt a small income tax on high-income earners. But as we explained in analyzing Fields’ bill, both bills would only produce a thin veneer – a whitewash – of lower impact revenues. By far, the vast bulk of revenues – and impact – would still come from PFD cuts.

On the other side, while Governor Mike Dunleavy (R – Alaska) several times has talked about pushing a more equitable, lower impact sales tax as a replacement for PFD cuts, he has yet to follow through by actually filing the bill. Last session, House Ways and Means Chair Representative Ben Carpenter (R-Nikiski) did offer a bill but then significantly watered down the effect by proposing to use a material portion of the revenues to pay for a corporate income tax reduction instead. In the end, not even the watered-down version passed out of a Republican-led committee.

And both sides don’t even feign interest when it counts most – when they propose increased spending.

Moderates and progressives have written numerous op-eds pushing increased K-12 spending, among other things. None have discussed who they propose to pay for the increases.

For his part, Governor Dunleavy also has proposed increased K-12 spending by pushing bonuses for teachers tied to longevity. But in a recent interview, Dunleavy never mentioned who would pay for the increase, and the media didn’t even bother to ask.

The impact of government spending levels on Alaska families and the strength of the Alaska economy are hugely important issues. Who pays for government at a personal level significantly impacts both.

Consistent with the causes they claim to prioritize, both sides of the Alaska political spectrum should be talking about it – and the media should be asking about it – on a co-equal basis with spending levels and the other pieces of fiscal policy.

It’s hugely troubling that they aren’t.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.