In his first budget back in 2019 Governor Mike Dunleavy (R – Alaska) proposed what he called an “honest budget.” As he said then,

… for too long, politicians haven’t been honest when it comes to the numbers and the seriousness of our fiscal woes. We’ve seen misleading figures and confusing budget tactics…. Today I’m here to say: Those days are over.

To replace “those days,” Dunleavy promised to pursue what he called a “truth-in-budgeting approach,” free of gimmicks and focused instead on a “sustainable, predictable and affordable approach.”

A lot of water has flowed under the bridge since that time, and the aspirations and goals of those early days have changed in a number of ways. Judging by this year’s budget, one of those appears to be this administration’s commitment to the “truth-in-budgeting approach” touted in its early days.

Of course, while it may have more, the use of gimmicks isn’t entirely confined to the administration. The Legislative Finance Division (LegFin) includes a few of its own in its “Overview of the Governor’s Request” (Overview) published last Friday.

This week’s column identifies some of the major gimmicks on both sides that obscure a straightforward look at the state’s fiscal situation.

DGF/UGF

While the Governor’s budget has more, by far the biggest budget gimmick in terms of dollars is LegFin’s unilateral reclassification of the Permanent Fund Dividend (PFD) from Designated General Funds (DGF), where it belongs under LegFin’s own rules, to Unrestricted General Funds (UGF).

LegFin defines what qualifies as DGF in footnote 3 of its Fiscal Summary, as follows:

Designated general funds include 1) program receipts that are restricted to the program that generates the receipts and 2) revenue that is statutorily designated for a specific purpose.

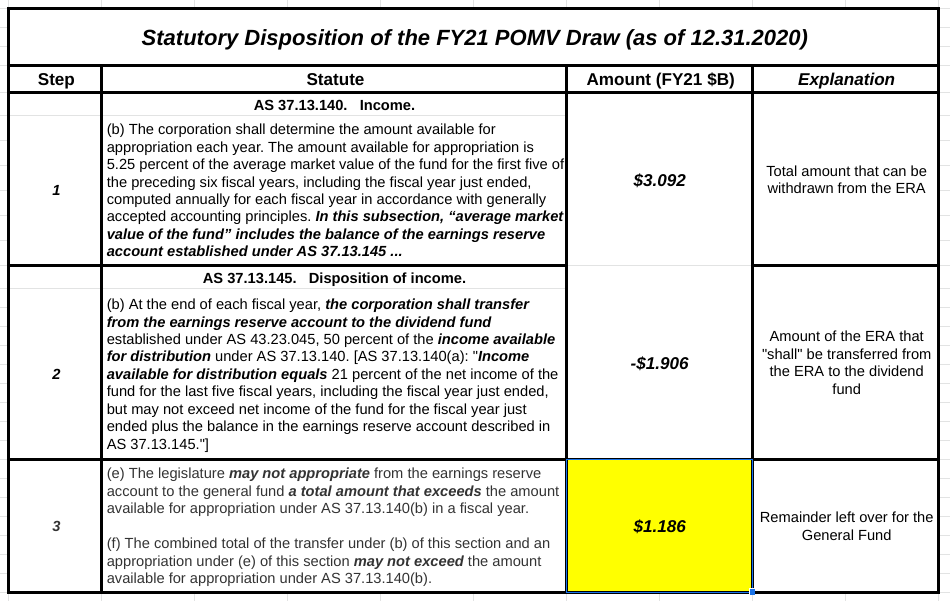

The PFD clearly falls into the second category. AS 37.13.145(b) provides as follows: “At the end of each fiscal year, the corporation shall transfer from the earnings reserve account to the dividend fund established under AS 43.23.045, 50 percent of the income available for distribution under AS 37.13.140.”

There is no clearer statutory designation of revenue “for a specific purpose” on the books.

Some argue that the Supreme Court’s 2017 decision in Wielechowski v. State somehow justifies the reclassification from DGF to UGF, but it doesn’t. The case didn’t involve whether the funds should be classified as designated or unrestricted; it involved instead whether the funds were “dedicated” under the Constitution. The Court’s finding that the funds aren’t Constitutionally “dedicated” didn’t touch on whether they are statutorily “designated.”

Others argue that LegFin’s reclassification is justified because the POMV (AS37.13.140(b)) and PFD (AS 37.13.145(b)) statutes are somehow in “conflict.” But they aren’t. As we have repeatedly shown by charting both together, they are entirely compatible.

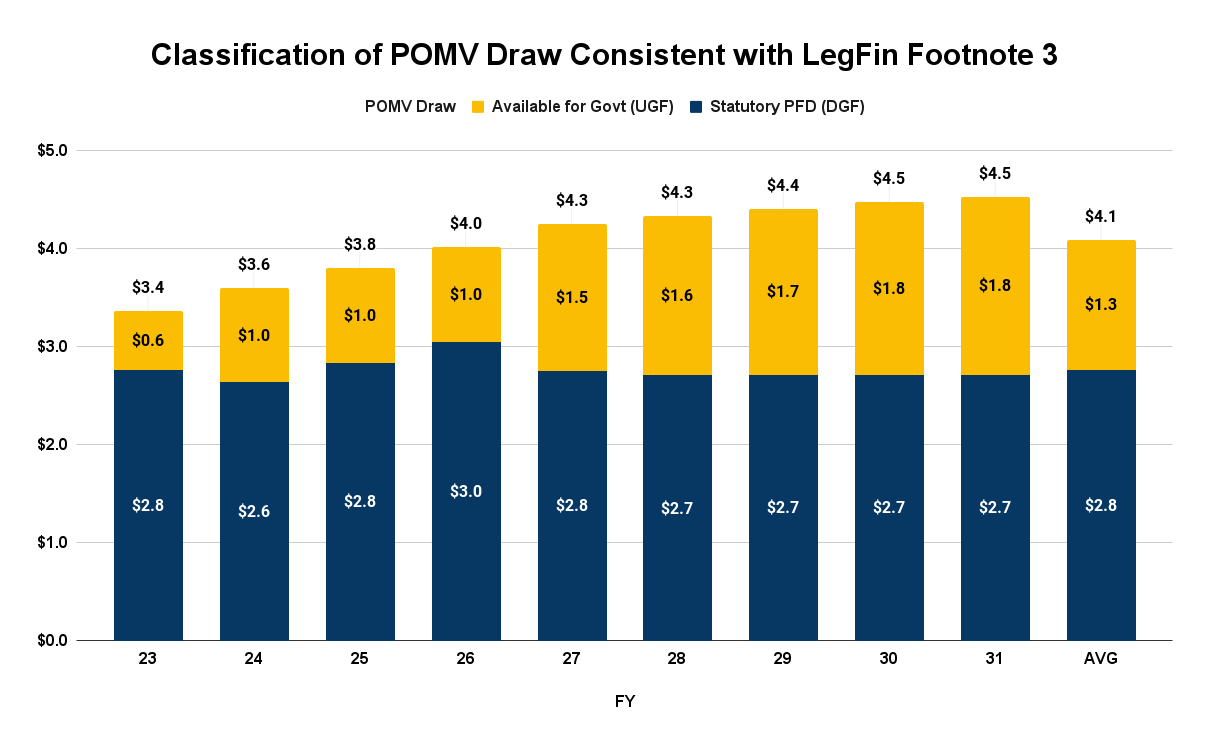

The magnitude of the gimmick can be determined from LegFin’s Overview, which includes projections both for the overall POMV draw, all of which it classifies as UGF, and the portion statutorily designated for the PFD, which should be classified instead as DGF. The amount which should be classified as DGF is substantial, averaging nearly $2.8 billion per year over the period covered by the 10-year Plan. The portion of the POMV draw properly classified as UGF is the remainder, an average of $1.3 billion per year.

Just as the Governor’s gimmicks, the purpose of LegFin’s unilateral reclassification of the PFD is to mislead. By treating all of the PFD as UGF from the start, LegFin’s unilateral reclassification enables the Legislature to avoid a discussion justifying the diversion of designated PFD funds to support general spending compared to other revenue alternatives. By (mis)classifying the funds as UGF from the start, there is no need to explain or justify their diversion.

This is not to say that the Legislature can’t use the funds to support general spending. Under Wielechowski any DGF funds can be diverted. But if the classification test between UGF and DGF is whether the funds can be diverted, the classification is meaningless; there are no DGF funds. By continuing to classify nearly $1 billion in funds as DGF even after Wielechowski, LegFin admits that classification is important. They just want to gimmick their way around admitting the PFD should be treated as DGF.

No New Revenue

One of the goals of the governor’s proposed FY23 budget and 10-year Plan (FY23 10-year Plan) appears to be to demonstrate that, under his policies, the state can continue to balance the budget over the remainder of the decade without the need for any “new revenue.” Unlike the previous FY20, FY21 and FY22 budgets and 10-year Plans, all of which showed a need for new revenue to varying degrees, this one claims that “by the end of the next fiscal year the CBR is projected to have a balance healthy enough to bridge short-term revenue shortfalls for the foreseeable future.”

But it does so only through the use of a series of gimmicks, the most significant of which is to assume away the current PFD statute and replace it with POMV 50/50 instead. The effect is unilaterally to enact by stealth what former Governor Jay Hammond referred in Diapering the Devil to as a “reversibly graduated head tax” that diverts the difference between the PFD statute and POMV 50/50 to current UGF revenue, enabling the governor – at least facially – to claim that the budget is “balanced” without relying on any taxes.

Somewhat like Fight Club, if you don’t talk about PFD cuts – effectively a targeted tax on PFD income – then they don’t exist.

The magnitude of the gimmick can be calculated from LegFin’s Overview, which includes projections for the PFD both under current law and using POMV 50/50. It is substantial, averaging over $700 million per year in additional “new revenue” over the period covered by the FY23 10-year Plan.

Just like LegFin’s unilateral reclassification of the PFD to UGF, the purpose of the Governor’s unilateral PFD cut (“reversibly graduated head tax”) is to avoid a discussion justifying the diversion of a portion of the PFD to support general spending compared to other revenue alternatives. By (mis)treating the difference as UGF from the start, there is no need to explain or justify the diversion.

Inflation

A second gimmick the administration uses to show a “balanced budget” over the period covered by the FY23 10-year Plan is to claim that, to a large extent, spending isn’t affected by inflation. According to the Plan:

An analysis of historical trends … does not indicate a strong correlation between CPI and State government spending and find that expenditure trends are more closely aligned with the availability of revenues and the policies of incumbent administrations. Given the Governor’s commitment to fiscal prudence, and projections indicating adequate but constrained future revenues, OMB uses a 1.5 percent inflation rate for non-formula programs.

Basically, the administration’s argument is “inflation” is whatever we say it is. The explanation in the FY23 10-year Plan admits that the number has been backed into by calculating the difference between projected revenues and baseline expenses, and using that difference as the projected “inflation rate.”

Of course, that is not what inflation is. According to business website Investopedia, among others, inflation is a measure of the extent to which general level prices for goods and services are rising.

What the FY23 10-year Plan essentially is saying is, notwithstanding inflation, we will hold spending at reduced levels through spending cuts from the actual, inflation-adjusted levels. The correct way to show that in budgeting is to show projected expenses as growing by inflation, offset by, in this case, unallocated spending cuts. But for political reasons, the Governor doesn’t want to propose “spending cuts,” so just like he is using stealth PFD cuts to avoid discussing alternative revenues, he is using a contrived “inflation rate” to avoid showing spending cuts.

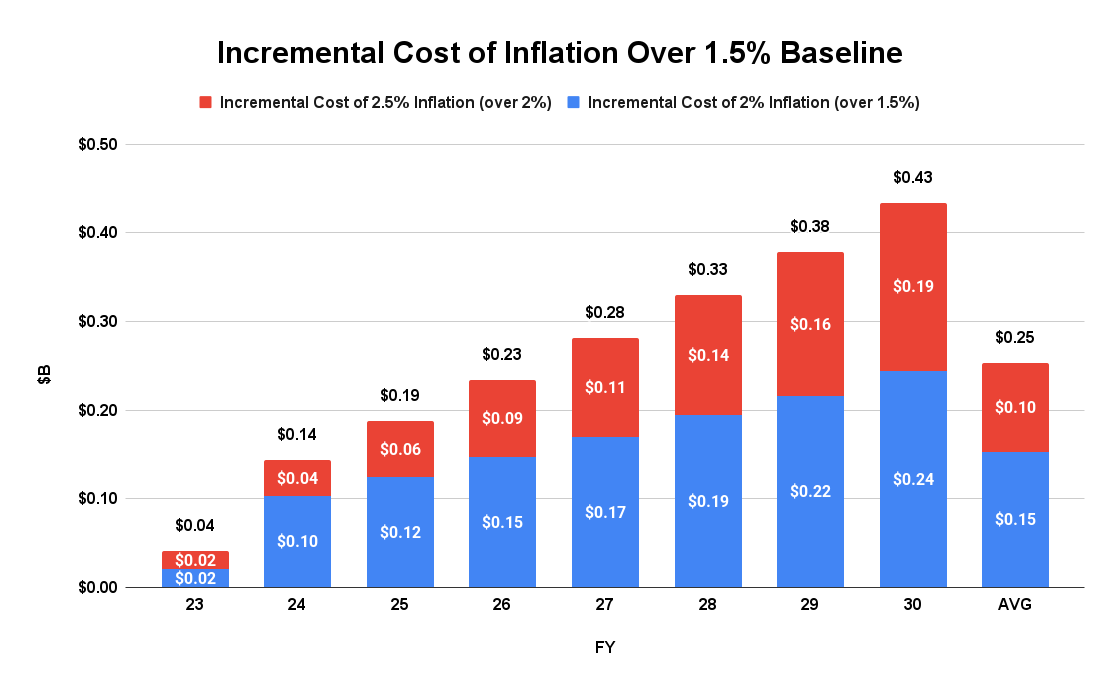

As we explained in an earlier column, there are various sources of projected, future inflation rates. In that column we used a market-based approach, which currently projects inflation at 2.5%. In its analysis of the Governor’s budget, LegFin uses a lower, 2% factor. We calculate the difference between those and the 1.5% so-called “inflation rate” used in the Governor’s budget by toggling the appropriate switch on the Department of Revenue’s November, 2021, “Fiscal Model.”

Regardless of which actual projected inflation rate one assumes, the difference is more appropriately viewed as a proposed unallocated spending cut for the relevant year. Using LegFin’s 2% rate, the unallocated spending cut averages $150 million per year over the 10-year Period. Using our 2.5% market-derived rate, the unallocated spending cut averages $250 million per year.

Leaving Some Costs Out Entirely

Under the recently enacted federal infrastructure bill – the Infrastructure Investment and Jobs Act – Alaska will receive significant additional federal dollars over the next five years. And as the Governor’s FY23 10-year Plan recognizes, some of that funding “will require increased State match.”

While the exact numbers are still being determined, the text of the Governor’s FY23 10-year Plan indicates that the Plan “includes a $200 million unrestricted general fund capital appropriation each year through fiscal year 2027” as a placeholder for the likely spending.

But it doesn’t. Looking at the spreadsheet which encapsulates the Plan, after a one-time bump in FY22 partially offset by including federal COVID relief funds to supplement UGF, the capital budget remains fixed at a constant $154.7 million over the remainder of the period.

In a budget that is so tightly balanced, the missing amount is significant. Even overlooking the other gimmicks included in the Governor’s FY23 10-year Plan, this absence alone understates the net savings draw by $1 billion, masking a reduction in even the Governor’s otherwise optimistic CBR projection virtually to zero by FY27.

One More

As has become increasingly common over the past four years, there are a number of other gimmicks of various sizes included in the Governor’s proposed FY23 10-year Plan. In its Overview, LegFin points out a number, concluding that “the State’s fiscal picture only appears rosy if [various] laws continue to be ignored in the budget process (or if they are changed).”

In concluding this column, however, we want to point out one more, again on the LegFin side and also related to the PFD.

At the outset of reviewing various “New Revenue” options in its Overview, LegFin states that “equity, economic impacts, efficiency, and other considerations are not presented here but should be addressed if the Legislature chooses to explore revenue options” (emphasis added). As readers of our past columns will readily appreciate, we agree that type of analysis is critically needed.

But it’s an analysis which, even when squarely called for, LegFin has never undertaken.

In its 2017 report to the Legislature, the Institute on Taxation and Economic Policy evaluated five “revenue options” the legislature then was considering for balancing the budget. One of those “revenue options” was PFD cuts.

While the Legislature continually has enacted PFD cuts since, to our knowledge LegFIn never has provided an analysis of the “equity, economic impacts, efficiency and other considerations” related to the approach.

Moreover, in just this Legislature alone, various committees have heard several revenue proposals, including two we have discussed in previous columns, House Bill 37 and House Bill 4003. Again, to our knowledge, LegFin has not provided an analysis of the “equity, economic impacts, efficiency and other considerations” related to any of those bills.

We absolutely agree with LegFin that any revenue approach receiving serious consideration by the Legislature should be accompanied by such an analysis. But to make that statement meaningful, LegFin actually has to follow through. It hasn’t. Until it does, the statement is just another gimmick designed to misdirect. If you say you should address such issues when they are significant, there must not be anything to worry about when you don’t.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

I don’t understand all of this and will need to revisit several times, to be sure, but Thanks a million times to Brad Keithley for this and his past columns on the budget. The legislature must act and Leg. finance must do their jobs providing the needed analysis. Kathrin McCarthy

Brad wants to create an income tax!

Well, Petey, there will be the day of inevitability that this will happen in your life if you actually live here. We are about twenty years into this due date being delayed.