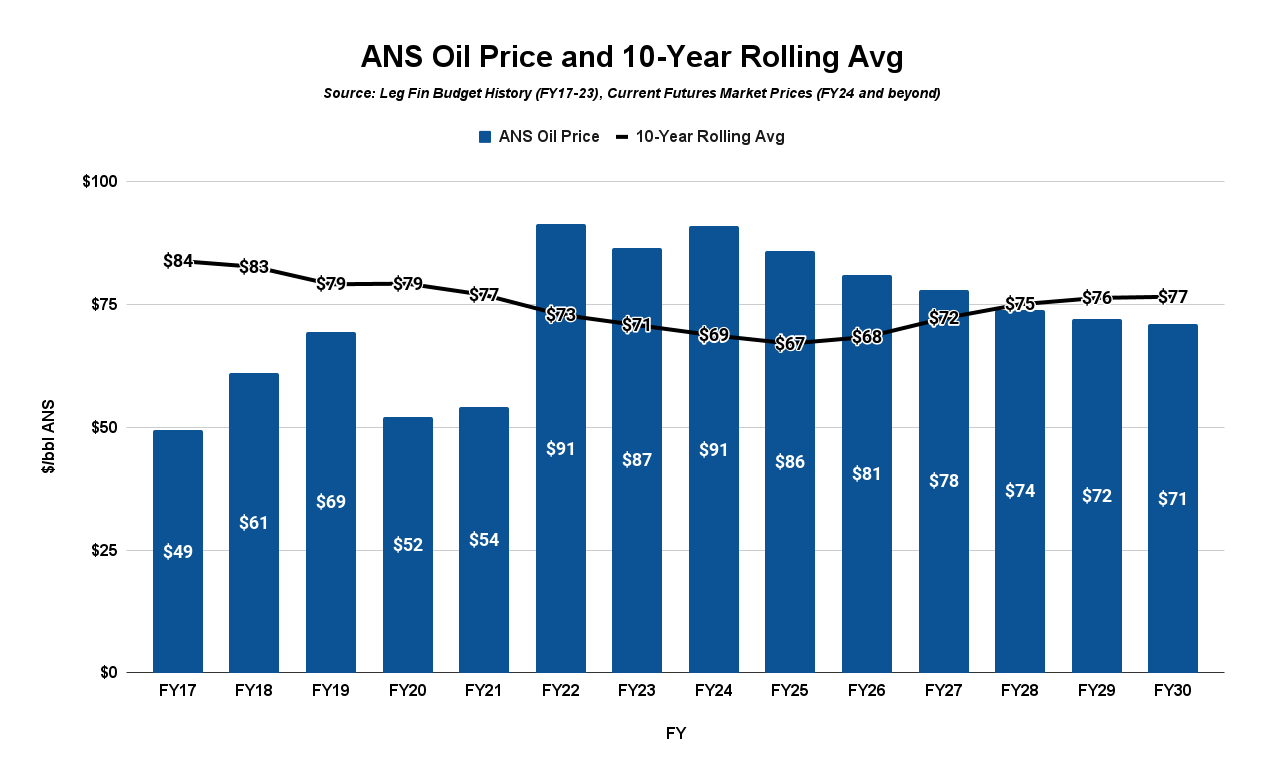

One of the little realized things about the FY2024 budget is that, whether intentionally or not, it is based within one dollar of the rolling 10-year historical average Alaska North Slope (ANS) oil price.

While the Department of Revenue’s (DOR) FY2024 projected ANS oil price reflected in the Spring 2023 Revenue Forecast was $73/barrel, as explained in the June 22, 2023, Legislative Finance Division (LFD) Newsletter, the FY2024 budget itself is based on $68/barrel. The rolling average ANS oil price for FY2014-23, the ten years preceding FY2024, is $69/barrel.

As we have discussed in a previous column, one way to (much) more effectively manage the state’s budgeting process is to base oil revenues on rolling 10-year historical averages. While that and another previous column focused on using a rolling 10-year historical average of traditional revenues, using the rolling 10-year historical average oil price is still better than the, what, in retrospect, often turns out to be nothing more than a finger-in-the-wind guess on which previous governors and legislatures have relied.

As even those who follow oil prices only on a cursory basis already realize, near-term ANS oil prices are currently surging. As part of our regular chart series, we track current and projected oil prices (using the futures market) on a daily basis. As of the day we are finishing this week’s column, the current projected FY2024 ANS oil price is $93/barrel.

The surge is affecting other years as well. The projected oil price for FY2025 contained in DOR’s most recent, Spring 2023 Revenue Forecast is $70/barrel. On the other hand, the projected FY2025 ANS oil price based on the current futures market is $87/barrel.

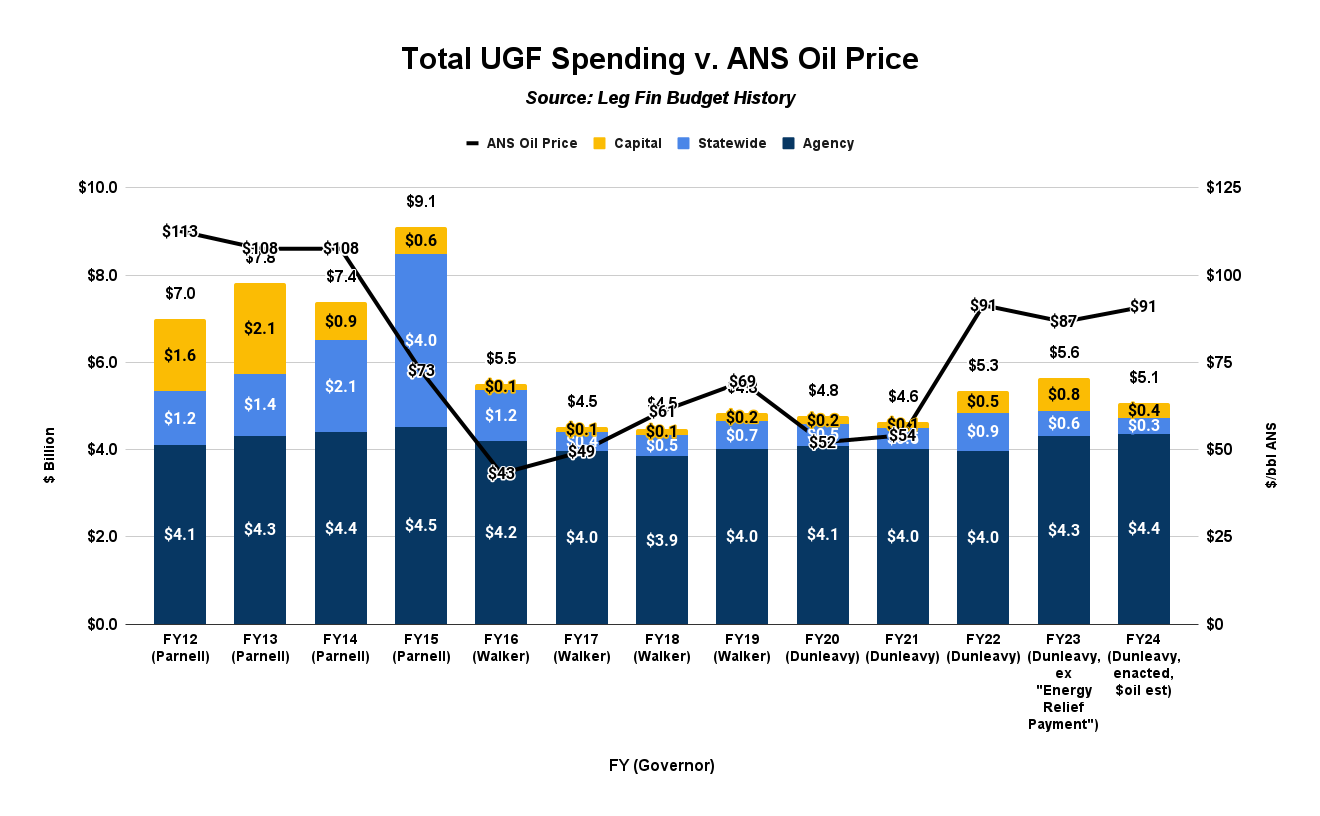

While not always a perfect correlation, the way the Legislature has historically reacted to periodic spikes in oil prices is to spike spending similarly. As the following chart shows, that was certainly the case during the early 2010s. Though to a lesser extent, the experience during the last oil price surge before the current one, during late FY2022 and early FY2023, was the same.

As oil prices shot up during late FY2022 and early FY2023, so did FY2022 and FY2023 spending, from an average of $4.6 billion in the five years before FY2022, to $5.3 billion (15% higher) in FY2022 and $5.6 billion (22% higher than the five-year average) in FY2023.

By using a “waterfall” budget approach, the FY2024 budget may be insulated from the same type of “supplemental” appropriations that have retroactively increased spending during the early years of such previous price cycles.

For example, the FY2022 budget, as “enacted” during the 2021 legislative session, only provided for $4.6 billion in spending, the same as the previous five-year average. After oil prices rose significantly during the course of FY2022, however, the subsequent Legislature meeting in the Spring of 2022 added an additional $700 million in supplemental spending, raising total FY2022 spending to $5.3 billion.

The FY2024 budget is built differently, already appropriating a significant share of any additional revenues that may be received during the course of the year.

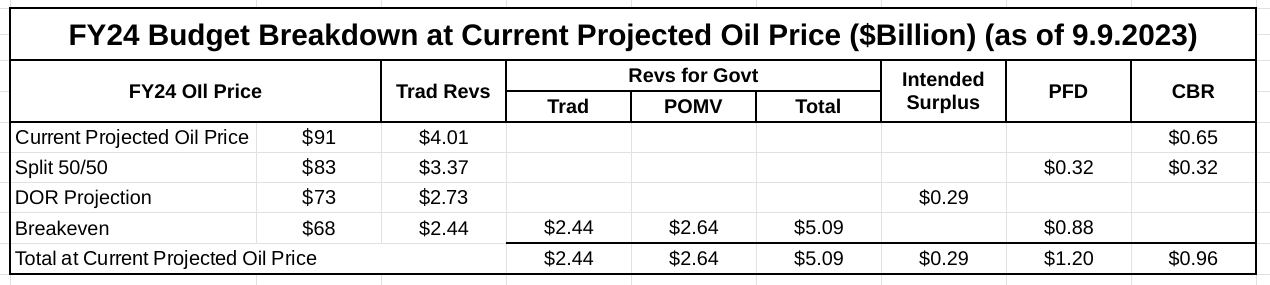

While any additional revenues added between the baseline price of $68/barrel and DOR’s projection of $73/barrel – roughly an estimated $300 million taking into account Governor Mike Dunleavy’s (R – Alaska) FY2024 vetoes – could be used for FY2024 supplementals, additional revenues produced by prices above that level are already directed toward either a supplemental Permanent Fund Dividend (PFD, capped at $318 million) or the Constitutional Budget Reserve (CBR).

We capture the ongoing effect of the waterfall in our newest weekly “Saturday chart”:

But even if that structure effectively restrains additional spending for FY2024 in the face of a significant oil price increase, it does not protect FY2025. Like FY2023, if the oil price spike continues through next year’s legislative session, the run-up could easily fuel substantially higher spending levels in the FY2025 budget.

As we explained in our previous columns on using 10-year averages, allowing spending to follow short-term (and short-lived) oil price spikes is hugely problematic. Among other things, it ignores the need to refill the state’s “rainy day” reserves depleted during the 2010s, which in turn will have significant consequences in subsequent years when, as is inevitable, oil returns to lower levels. It also sets unrealistic expectations – and significant constituent pressures – for continued higher spending levels in subsequent years when oil prices revert to previous levels and the state can no longer afford them.

Moreover, it undermines the goal of intergenerational equity. As we explained previously:

We understand that some want the immediate gratification of enjoying higher oil prices as they become available, but as with the Permanent Fund, Alaska’s oil and resulting revenues belong to all Alaska generations, not just the one that happens to be in place when higher oil prices occur. In our view, spreading the benefit over multiple years through averaging is much more consistent with Alaska’s obligations to both current and future generations than the current approach.

As a result, we urge Governor Dunleavy in drafting his proposed FY2025 budget this Fall and the Legislature thereafter in crafting theirs in next year’s session to continue to use the “precedent” already established in enacting the FY2024 budget and use the 10-year historical average ANS oil price in establishing baseline revenues and, through that, spending levels.

As the following chart shows, that translates to an FY2025 oil price used for budgeting purposes of roughly $67, only one dollar less than that used for FY2024. Using DOR’s most recent price sensitivity analysis, that translates into traditional revenues for FY2025 budgeting purposes of $2.42 billion, only slightly below this year’s (at $68/bbl) of $2.44 billion.

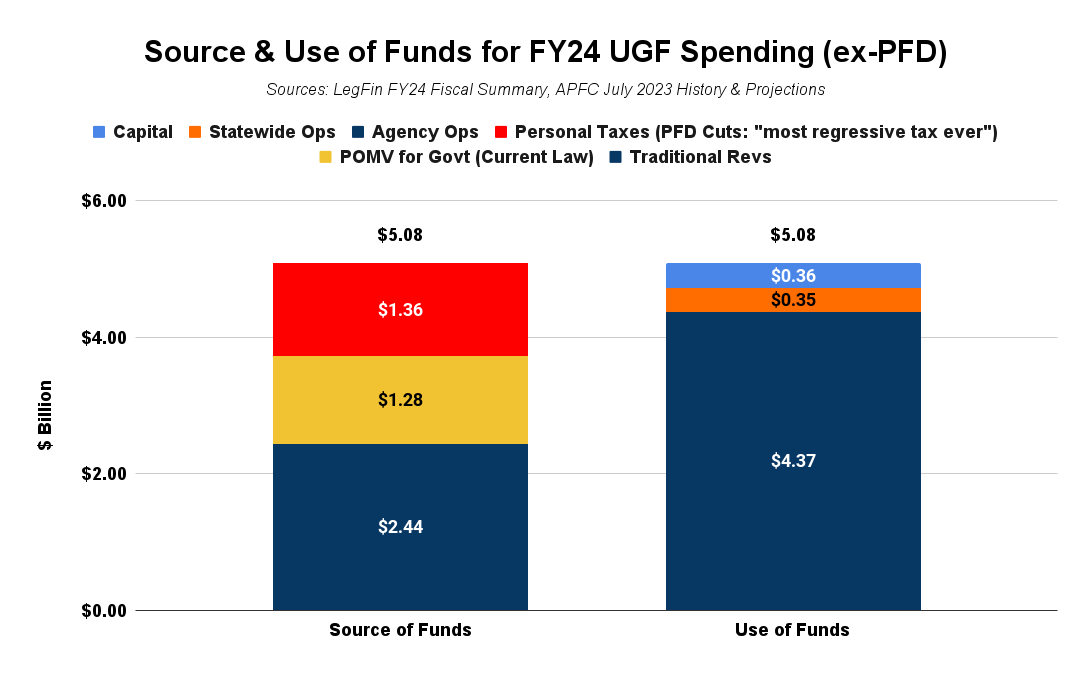

Of course, that step alone is far from a complete solution to Alaska’s fiscal morass. To balance, this year’s (FY2024) baseline budget, for example, relies on nearly $1.4 billion in personal taxes in the form of cuts to the PFD. (For those wanting to argue about whether PFD cuts are taxes, see longstanding University of Alaska – Anchorage Institute of Social and Economic Research (ISER) Professor Matthew Berman’s op-ed earlier this year in which he concludes, “Let’s be honest. A cut in the PFD is a tax …”).

As we’ve explained in previous columns, of the various options, using that approach to balance the budget both has the “largest adverse impact’ on the overall Alaska economy, as well as is “by far the costliest” to 80% of Alaska families.

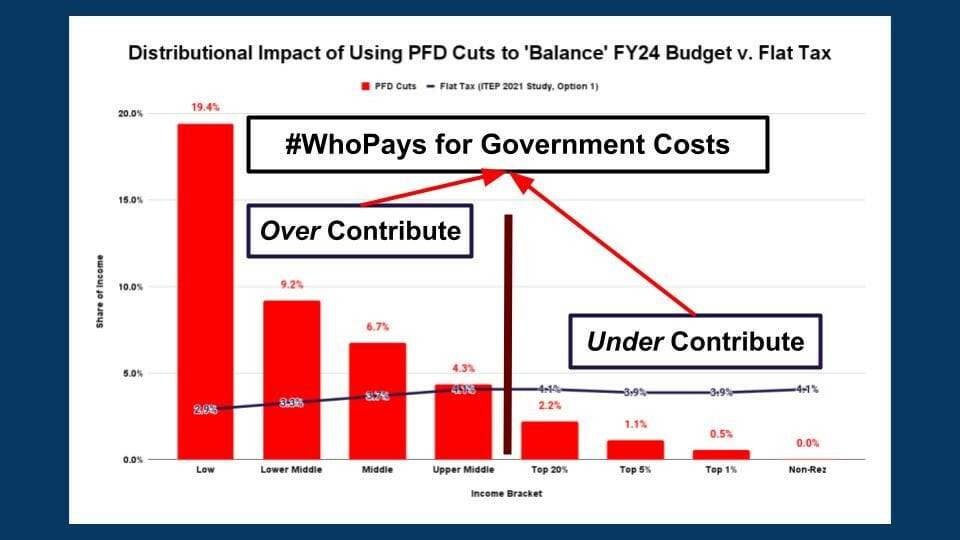

Indeed, as Professor Berman said in his op-ed, not only is a cut in the PFD a tax, but it is “the most regressive tax ever proposed.” Here is the distributional impact of the FY2024 cuts:

Any other alternative approach is better for those truly concerned about the overall Alaska economy and Alaska families – as opposed to those who mouth the words for political purposes.

As we’ve explained in a previous column, the only beneficiaries of the current approach are those in the top 20% income bracket, non-residents, and the oil industry, who are able to keep in their bank accounts the same amount that middle and lower income Alaska families are being overtaxed.

From the standpoint of the economy and the other 80% of Alaska families – the “working” (i.e., middle and lower-income) Alaska families that Representative Maxine Dibert (D – Fairbanks) and others in the Alaska House Coalition purport to champion – literally, anything else is an improvement.

To fully resolve the problems with Alaska’s revenue approach, the state must address both the finger-in-the-wind “guessology” of using current futures-based oil price projections and the inequitable and economically harmful approach of raising revenues through PFD cuts.

As we’ve discussed in previous columns, addressing the issue of PFD cuts will require positive changes in approach.

As explained above, however, addressing the issue of oil prices will only require continuing with the 10-year historical average approach the state already has stumbled into for FY2024. Now that it is there, the state should stick with the approach going forward and avoid reverting to its old, hugely problematic ways.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.