Over the past week we have seen several comments on social media and elsewhere expressing concern about the recent, significant drop in current and futures oil prices and what that may mean for Alaska’s current fiscal year (FY23) budget.

We agree it’s important to stay aware of recent developments and what impact they may have, although this month’s (December 2022) Short Term Energy Outlook from the federal Energy Information Administration (EIA) suggests that the price outlook for the remainder of the fiscal year may not be as bleak as the futures market currently makes it seem:

Despite the recent drop in crude oil prices, we still expect that falling global inventories of oil in early 2023 will push Brent prices back above $90/b by the beginning of the second [calendar] quarter of 2023 (2Q23). Although we expect some downward oil price pressure could emerge in the second half of [calendar year] 2023 (2H23) based on our forecast of rising oil inventories, that pressure will likely be balanced by the ongoing possibility of supply disruptions or production growth that is slower than our forecast. We forecast the Brent crude oil spot price will average $92/b for all of 2023.But as long as we are worrying about the FY23 budget in any event, there’s something else that should be added to the mix.

Oil revenues are the combination of oil prices times production. Just as variances in oil prices cause changes in the outlook for oil revenues, so do variances in production levels. And FY23 production is beginning to look somewhat weaker than the forecast on which the FY23 budget is based.

On Thursdays each week we take a look at recent production data reported by the Department of Revenue (DOR) and compare that to the projected volumes included in the most recent revenue forecast. Here’s this week’s (yesterday’s) assessment:

In the first chart, the dashed blue line is the projection of the FY23 production profile based on the FY22 production curve. The solid blue line is actual FY23 production levels to date. The dashed red line is the projected rolling average of the FY23 production profile based on the FY22 production curve. The solid red line is the actual FY23 rolling average to date.

In the second chart, the solid blue and red lines are the same as in the first chart. The dashed blue line, however, represents the average volume that needs to be realized over the remainder of the year in order ultimately to achieve the annual volumes currently projected for the year.

As the first chart shows, ANS production usually follows roughly along the lines of an inverted parabolic curve, with summer lows and winter peaks. Approaching half-way through FY23, however, the winter peaks aren’t yet materializing, with the result that FY23 production levels are beginning to fall short of those projected in the Spring 2022 Revenue Forecast, the most recent projection made by DOR.

The problem isn’t significant yet. Due to significantly higher than projected July production levels, forty-four percent (44%) of the way through the fiscal year, the current rolling average production level is only about 17 thousand barrels per day (mbd), or 4%, below initially projected levels.

But the trend is concerning. As the second chart shows, in order to reach the currently projected FY23 target, production will need to average 528 mbd from January through the end of the year. That’s not only 7% above the highest monthly average reached so far, and 8% above the current month average, it assumes that production will average over the remainder of the year a production level roughly equal to that at which it was projected at the beginning of the fiscal year to reach only in the peak production month.

What’s going on?

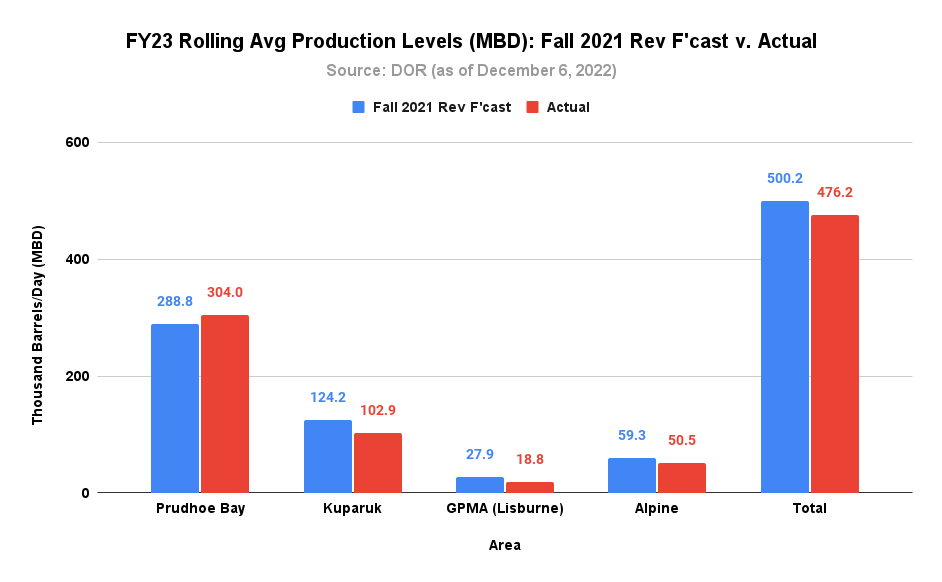

While the data is not entirely clear, it appears that while production from the Prudhoe Bay area is running ahead of projections, production from everywhere else is running materially behind. Each year, DOR’s Fall Revenue Sources Book (RSB) contains projections of production volumes from various production areas. Then monthly, DOR reports actual production from those same areas, aggregated into four regions: Prudhoe Bay, Kuparuk, Lisburne and Alpine.

Here’s a comparison of the projections made in DOR’s 2021 Fall RSB for FY23 with the actual production levels thus far reported for the year by DOR.

As we said, while Prudhoe appears to be running ahead of forecast (by roughly 5%), production from the remainder – Kuparuk (17%), Lisburne (33%) and Alpine (15%) – are all running behind.

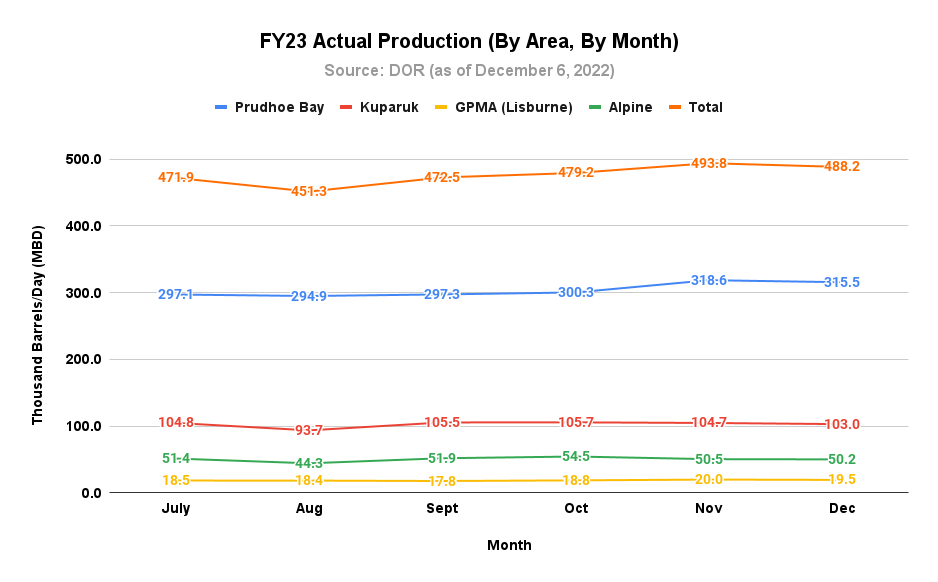

There’s also a second trend that may help explain some of what’s happening. While production levels from all of the areas typically follow a rough inverse parabolic curve (summer lows and winter peaks), thus far this year only Prudhoe appears to be following something along that path. Kuparuk and Alpine actually have produced less in November and thus far in December than they did in July, and on an absolute basis, GPMA (Lisburne) is up only slightly. Even Prudhoe is lagging its normal seasonal differential.

Of course, there is time for the outlook and final results to improve. But it’s an uphill climb. In a November column last year we expressed somewhat similar concerns about the then-outlook for FY22. While the addition of some new sources later in the fiscal year made up some of the deficit about which we expressed concern, ultimately FY22 production came in roughly 11 mbd (2%) below the projection made in the Preliminary Fall 2021 Forecast, the baseline we assessed in that column.

The reality is if production levels get off to a slow start over the first third of the year, it’s hard to make all of it up.

Given the size of the drop in current and projected oil price levels from those included in the Spring 2022 Revenue Forecast, a potential shortfall in FY23 production levels is only a second order concern. At current and projected oil price levels, traditional FY23 revenues already are likely to be down substantially from those projected last Spring.

Using the same approach to evaluate the impact of changes in production levels as we did in an earlier column, at an average annual price of $90/barrel, a 5% shortfall in production only adds roughly an additional $175 million to the fiscal gap.

But as the fiscal gap widens due to oil price declines, every dollar suddenly takes on an added significance and as one of our advisors put it when reviewing this column, $175 million isn’t “chicken feed;” indeed, it is equal roughly to $275/Permanent Fund Dividend (PFD), or more than $1,000 in PFD income annually to a family of four.

As with oil prices, we will find out DOR’s most recent outlook for production volumes in the updated, Fall 2022 RSB due to be released in the next few days.

But keep in mind that, last year, even after the slow start, DOR still included in the Fall 2021 RSB projected FY22 volumes that ended up nearly 10 mbd higher than the actual, final level. They anticipated a production recovery that never really happened. As we said, if production levels get off to a slow start, it’s hard ultimately to make all of it up.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Slope production facilities are almost always maxed out on gas handleing rates. The limiting factor is the available compression power for pressurizing associated produced gas for artifical lift and EOR. The turbines used to power said compressors are able to provide more power when ambient temperatures are lower and this has been a primary driver of seasonality in North Slope oil production rates. You should be able to correlate out the impact of air temperatures using historical data. Once you’ve removed the temperature related variance the production picture should be a bit clearer.