Those of a certain age will recall the famous line uttered in 1983’s Star Wars Episode VI: Return of the Jedi, when, while attempting a surprise attack on the Death Star during the Battle of Endor, Admiral Ackbar of the Rebel Alliance suddenly realized the Empire was not only aware of the plans but was quickly encircling his fleet.

“It’s a trap!,” he exclaimed.

We had that same reaction while reading last weekend’s Anchorage Daily News (ADN) editorial board op-ed: ”Could this be the first step toward a fiscal solution for Alaska?”

The op-ed argued that:

If we want to escape this PFD-fueled paralysis, we first need a mechanism to ensure legislators won’t overspend in boom years, nor let the dividend cannibalize essential services when oil prices go bust. What we need as a first step toward a budget that works for Alaska’s future is a spending cap.

At first blush the proposal seems a significant step forward. After all, both Governor Mike Dunleavy (R – Alaska) and various conservative legislators have been arguing for years for the adoption of a spending cap. Endorsement of that proposal by the more liberal ADN editorial board seems significant.

But as we read through the op-ed, we realized it’s anything but. What the editorial board proposes is to use the built up momentum and effort for a fiscal plan to push ahead only with a spending cap on its own, instead as one part of the “comprehensive solution” recommended in the Final Report of the 2021 Legislature’s Fiscal Policy Working Group.

As such, the proposal is simply nothing more than the latest salvo by the ADN editorial board in its ongoing effort to push the costs of government largely off on middle and lower income Alaska families – in the process limiting the exposure of the wealthiest 20% – by using cuts in the Permanent Fund Dividend (PFD) – what former Governor Jay Hammond correctly identified as a “head tax” – to cover spending.

How does the proposal do that? Without first fixing and protecting the PFD and providing for alternative revenues to take the place of PFD cuts in funding government spending, the proposal leaves ongoing PFD cuts as the only way effectively to balance the budget in the face of continually declining traditional revenues.

The ADN proposal appears to contemplate including the PFD within the spending cap. Adding the PFD to the cap would both inflate the spending levels included under the cap and have the most substantial adverse impact on the PFD.

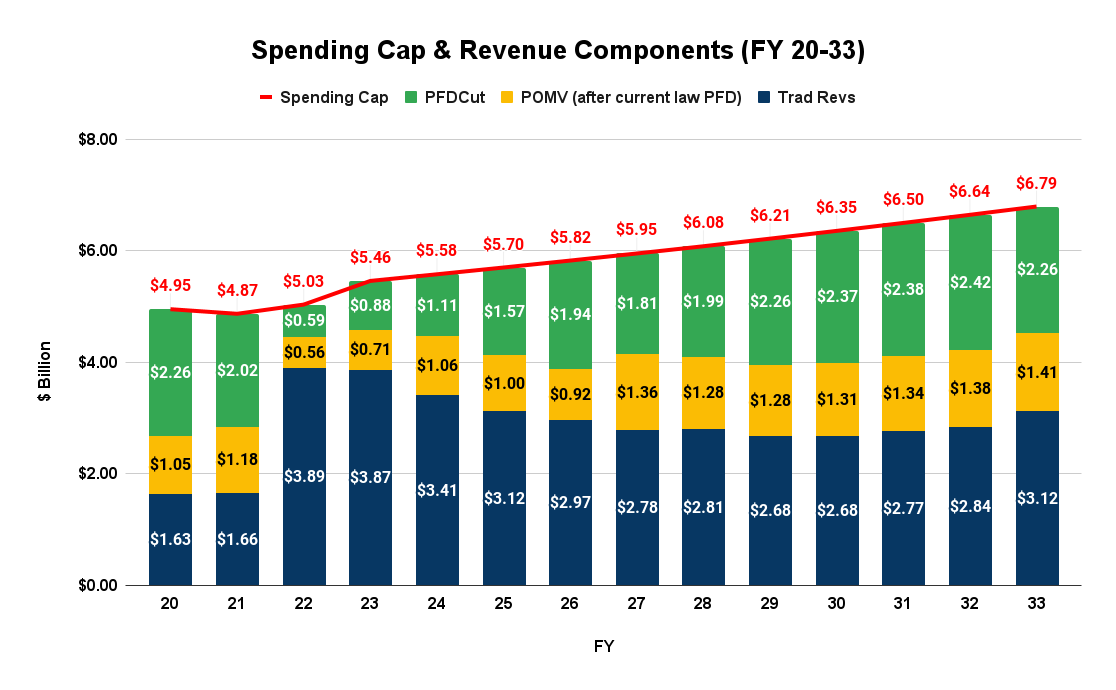

Here’s the result (using the general approach, adjusted for including the PFD in the cap, reflected in soon-to-be-former Senator Natasha von Imhof’s (R – Anchorage) 2018 inflation-based SB 196 (30th Legislature)):

As the spending cap (the red line, which adjusts with inflation) rises and traditional revenues (in blue) fall, the amount required to be diverted from the PFD to serve as a funding source (in green) necessarily rises, from roughly $590 million (12% of spending) in FY22 to $2.4 billion (37% of spending) by FY30.

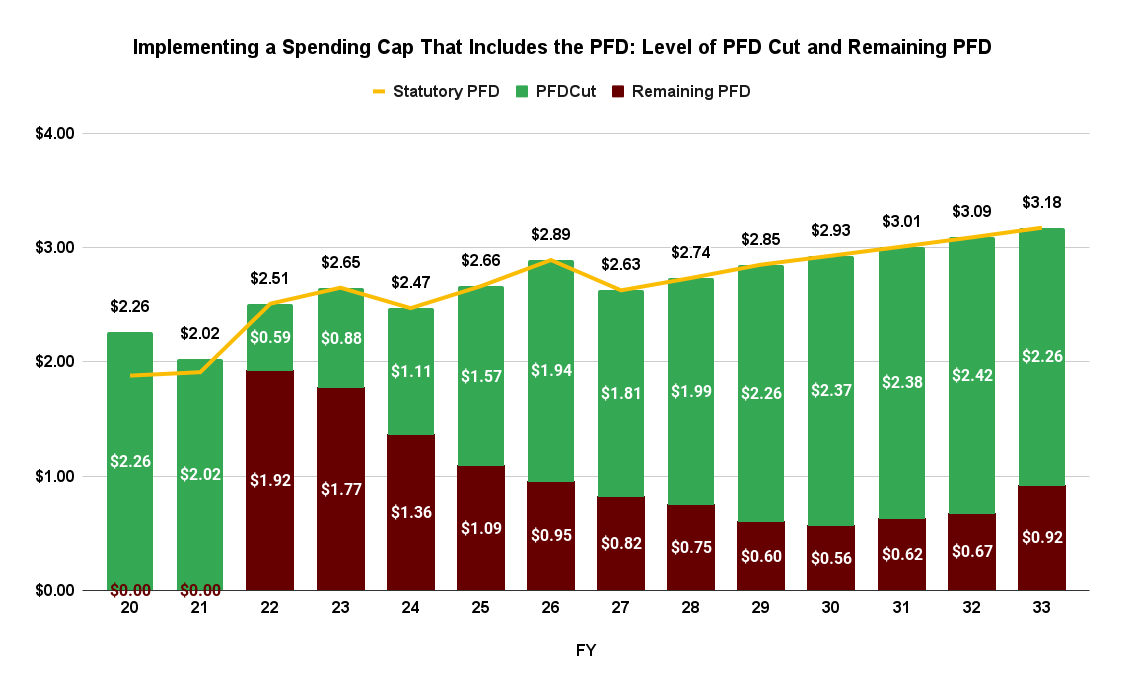

Here’s the resulting impact on the PFD. As the amount diverted to cover spending (in green) incessantly marches upward, the amount remaining to be distributed to Alaska families (in maroon) falls dramatically:

Moreover, even the amounts for the “remaining PFD” are not secure. As have other proposals, Senator von Imhof’s SB 196 excludes both appropriations “required to pay debt obligations of the state” and “for a capital project” from the spending cap. Unless alternative revenues are available, the “remaining PFD” likely would be reduced even further to serve as a funding source for those as well.

Over the course of its term, Governor Dunleavy’s most recent 10-year plan averages about $350 million per year in combined capital and debt repayment. In the absence of alternative revenues, including the PFD in the spending cap and using those revenues which survive further to cover those additional costs would reduce the remaining PFD to not much more than $200 million by FY30. At current numbers, that would leave little more than $250 per PFD remaining.

Far from the PFD “quickly ris[ing] back to current levels” as claimed by the editorial board, the approach instead would condemn the PFD to continued deep reductions, if not, as would have occurred had the approach been in place in FY20 and 21, wiping it out entirely.

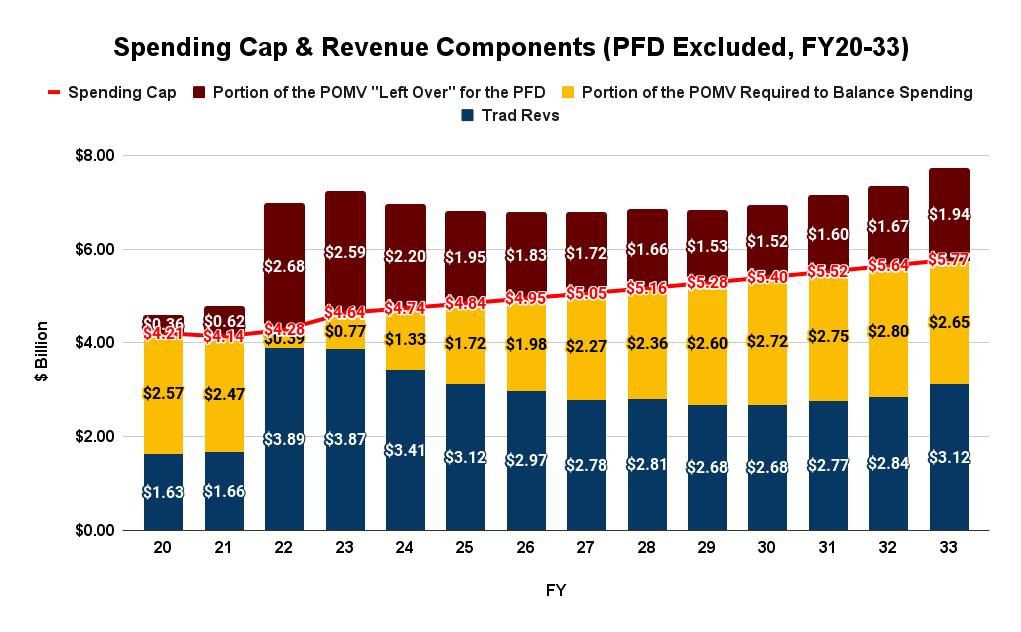

While excluding the amounts appropriated for payment of PFDs from the spending cap – as proposed in Senator von Imhof’s original version of SB 196 – would reduce the amount of the spending cap and, as a result, make the level of PFD cuts somewhat less, the reduction in adverse impact would not be huge.

Unless the portion of the percent-of-market value (POMV) draw from the Permanent Fund required to fully fund the PFD was set aside specifically for that purpose, all that would happen is that most of the portion of the POMV required to fund the PFD would be consumed instead in funding spending.

Here is the result of excluding the PFD from the spending cap using the same assumptions as in the previous chart, save for the exclusion of the PFD. The portion of the POMV draw required to balance the budget is in gold; the portion of the POMV draw that would be “left over” for the PFD is in maroon. As in the case where the PFD is included within the cap, the amount “left over” for the PFD declines dramatically over time as more and more of the POMV draw is used to pay for government spending.

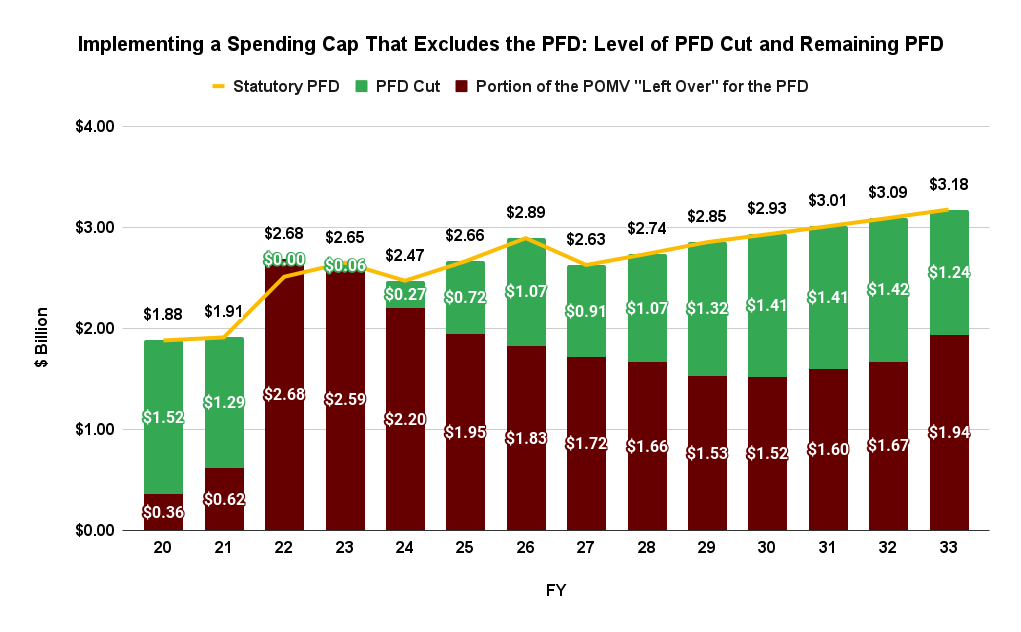

The following chart compares the “left over” amount against the statutory PFD. Under that approach, after the big oil revenue years of FY22 and 23, the amount remaining for the PFD would be only somewhat higher than if included under the cap in the first place:

As with the previous approach, even that likely overstates the amount of the resulting PFD. Assuming the same levels of capital spending and debt reimbursement used above, by 2030 the amount remaining for the PFD would be reduced to about $1.2 billion, or $1,750 per PFD, rather than the $2.93 billion, or roughly $4,500 per PFD, resulting under current law.

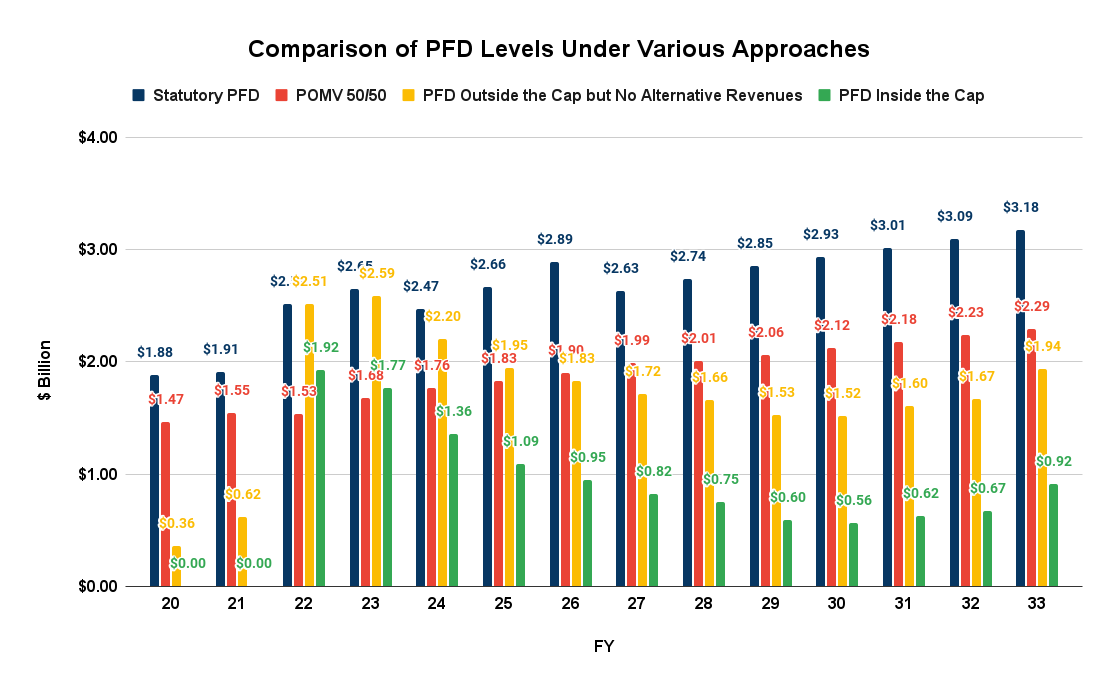

For comparison purposes, here’s the result of each of the above two approaches (including the PFD in the spending cap (in green), and considering it outside the spending cap (in yellow)) by year, compared to the current law (statutory) PFD (in blue) and the 2021 Fiscal Policy Working Group’s (and also, Governor Dunleavy’s previous) proposal of “POMV 50/50” (in red).

From FY26 forward, even the significantly reduced PFD resulting from POMV 50/50 produces an increasingly more equitable result than either of the “spending cap only” approaches.

On the other hand, how does the variously named “comprehensive” (2021 Fiscal Policy Working Group) or “everyone give a little” (Governor Dunleavy’s FY21 10-year Plan) approach we discussed in last week’s column fare against the ADN’s proposal?

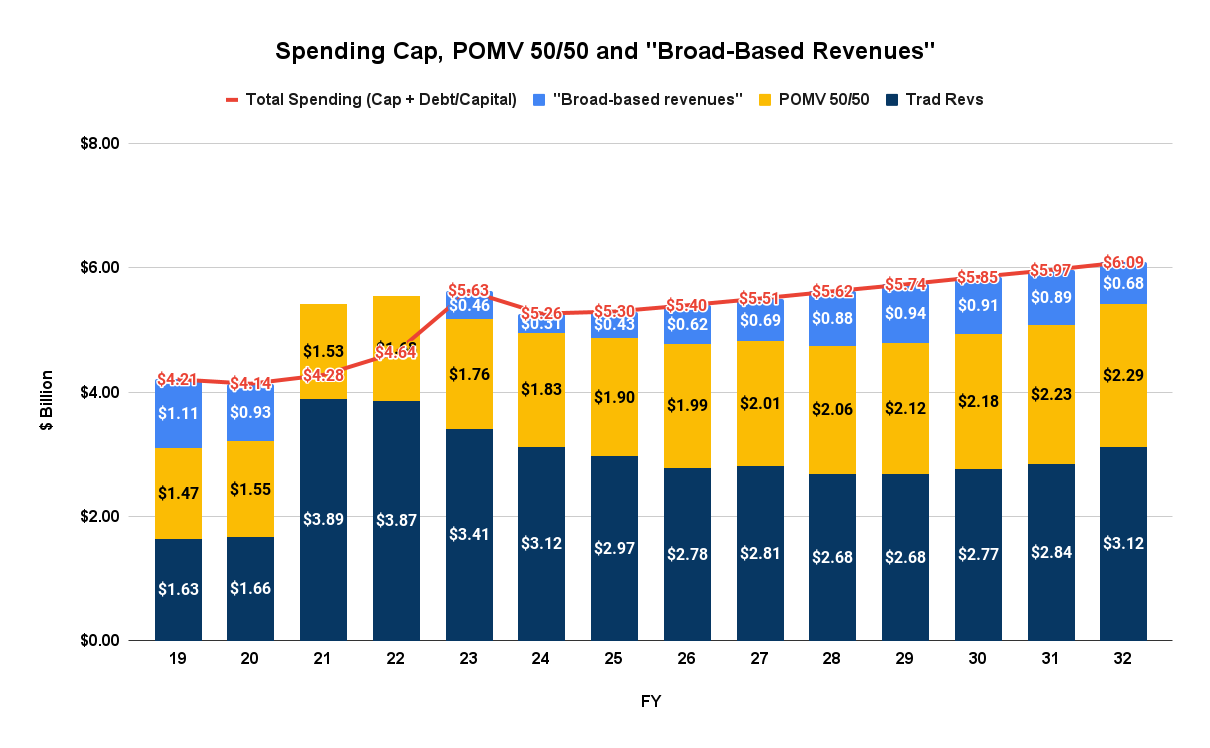

As last week’s readers may recall, rather than the “spending cap only” approach proposed by the ADN editorial board, the “comprehensive” approach contemplates simultaneously reducing (and fixing) the PFD at POMV 50/50, implementing a spending cap and using alternative, broad-based revenues to fill in the remainder.

Here’s what that approach would look like (including also the additional amounts for capital spending and debt coverage from the start). Only the reduction to the structured POMV 50/50 approach would be required of the PFD. The remainder of the fiscal gap would be covered through more equitable, broad-based revenues (in light blue).

By fixing and protecting the PFD and providing for alternative, broad-based revenues to take the place of additional PFD cuts (beyond POMV 50/50), ongoing government spending is paid for through a balanced approach of PFD cuts and broad-based revenues.

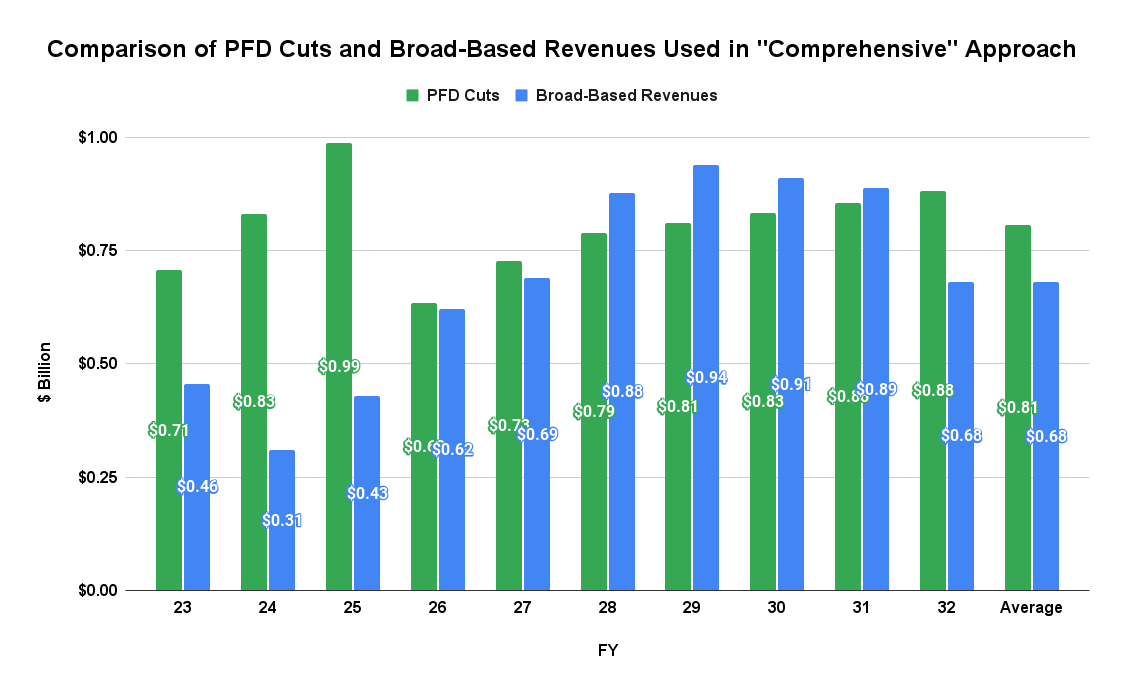

Indeed, as demonstrated on the following chart, averaged over FY23 to FY32, the contribution made by PFD cuts (in green, from statutory levels to POMV 50/50) and broad-based revenues (in blue) are roughly the same.

Put another way, the average level of PFD cuts ($810 million, 54% of the total), which have their largest impact on middle and lower income Alaska families, and broad-based taxes ($680 million, 46%), which likely have their largest impact on the wealthiest 20%, carry roughly the same burden in balancing the budget. No one segment (or segments) of the Alaska income bracket are asked to carry all of the burden.

On the other hand, by advocating a “spending cap only” approach, the ADN editorial board is proposing to push the entire burden onto PFD cuts, and through that, largely on middle and lower income Alaska families.

Including the spending cap as one part of a comprehensive approach that includes also fixing and protecting the PFD, as well as providing for some broad-based revenues to fill the remaining gap, avoids the “trap” envisioned by the ADN editorial board and instead, spreads the burden much more equitably among all Alaska families, and well as non-residents engaged in Alaska-sourced financial transactions.

Star Wars fans will know that, although things looked grim at times, General Ackbar not only survived the “trap” sprung by the Empire but ultimately was on the prevailing side in the Battle of Endor.

Protection of the PFD – and through that, an equitable fiscal end result for all Alaska families – should be as well.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Many of the Permanent Fund investments this year will not earn the “dividends” they had in years past. We the people had “skin” in those investments and now stand to absorb the inherent risk. No such analogy exists for your cash handout which you call a “dividend” instead of what it is – a cash handout with no risk by the individual at all other than to not get the free cash for doing nothing but consuming oxygen in Alaska. Regardless of how much you paint over that reality, that is the reality.

All of the earnings from the Permanent Fund are “free cash.” Current law makes half available to substitute for taxes, mostly benefiting the top 20%, and distributes the other half as a PFD, mostly benefiting middle and lower income Alaska families.

All that’s going on now is, now that their half isn’t enough any longer to keep them entirely tax free, the top 20% want to take an increasing share from the other half. We explained that further in a previous column.

All that is truly going on is that we are running out of money. Do you realize that a few years ago the earnings from oil were exceeded by earnings from Permanent Fund investment? That was a major “paradigm shift” which many still choose to deny. At that point those Permanent Fund earnings were no longer the “gravy” they once were to be saved or handed out as a bribe to stay in office. Want proof? Look at our savings balances. Realize that local government bond debt is no longer being reimbursed. by the state as was the case in… Read more »

But the answer is not alternative revenue streams. The answer is to cut spending. We have an obese bloated out of control spending habit that grows every year. We must learn to cut.