Now that the legislative session is over, this week we look at how the Legislature proposes to finance the Fiscal Year (FY) 2026 budget and the resulting impact on Alaska households.

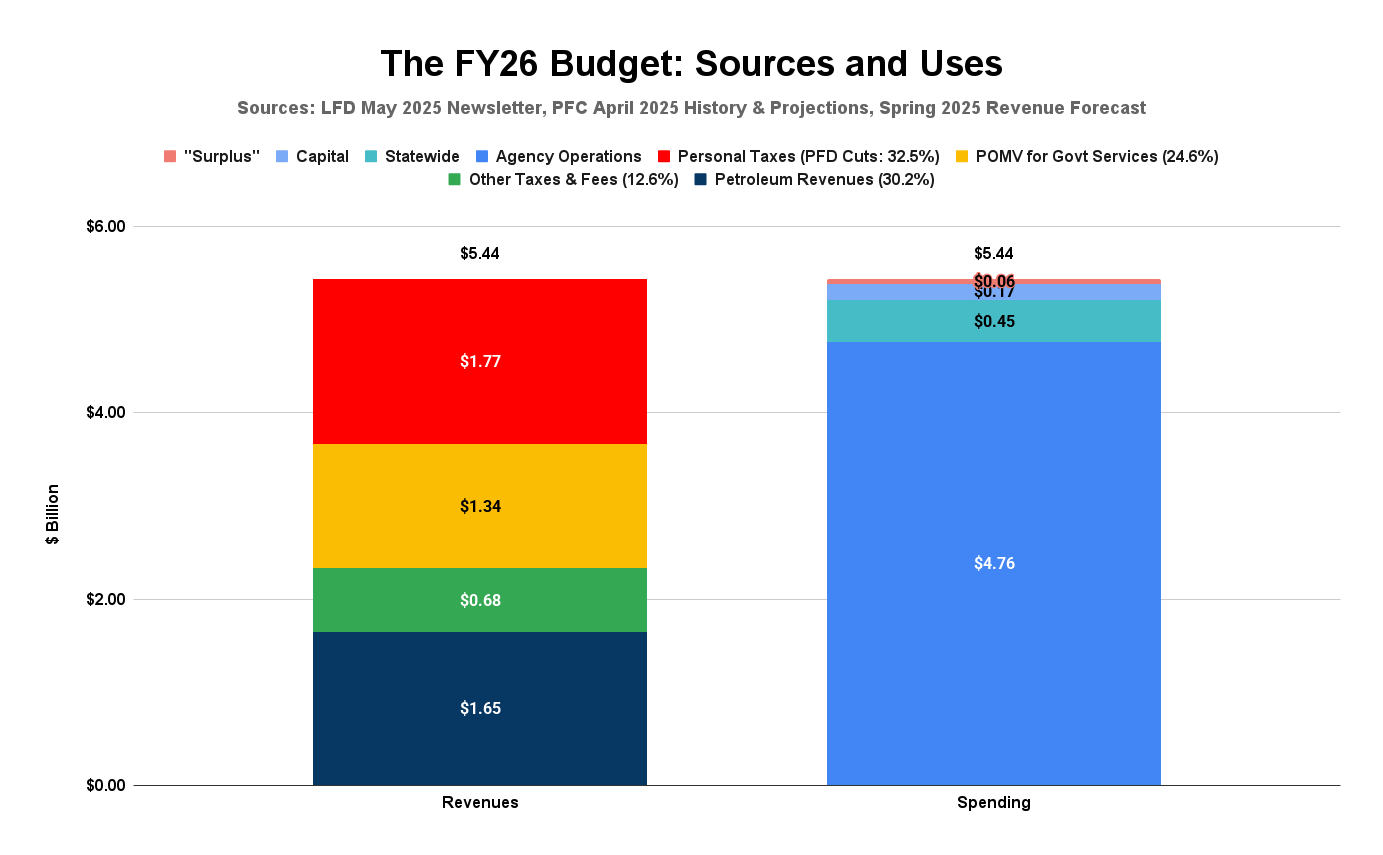

As in the previous seven years since the adoption of the percent-of-market-value (POMV) approach for drawing funds from the Permanent Fund to help pay for government spending, the revenues come mainly from four sources: (1) petroleum revenues, (2) various fees and previously existing taxes that together are referred to as “other taxes and fees,” (3) the portion of the POMV draw statutorily designated to help pay for government services, and (4) a portion of the POMV draw that is statutorily designated for distribution to Alaska residents as Permanent Fund Dividends (PFDs) but which instead is being withheld and diverted also to help pay for government services (commonly referred to as “PFD cuts”).

Because they withhold and divert to government money designated for distribution to Alaska families, some view PFD cuts effectively as personal taxes, the same as money similarly withheld and diverted to government from other sources of investment income to cover the taxes assessed on that income.

Here are the projected amounts in each category:

As enrolled, the budget projects total revenues at $5.44 billion. Of that, petroleum revenues account for 30.2% of the total, other taxes and fees 12.6%, the portion of the POMV draw designated for government services 24.6%, and PFD cuts 32.5%. At that level, PFD cuts are the single largest projected source of revenue for the FY26 budget, exceeding both oil revenues and the portion of the POMV draw statutorily designated for government.

In some previous years, current revenues – those received in the year – have also been supplemented by draws on savings or transfers made from other accounts. While that may come later in next year’s FY26 supplemental budget, no such supplements are included in the initial FY26 budget.

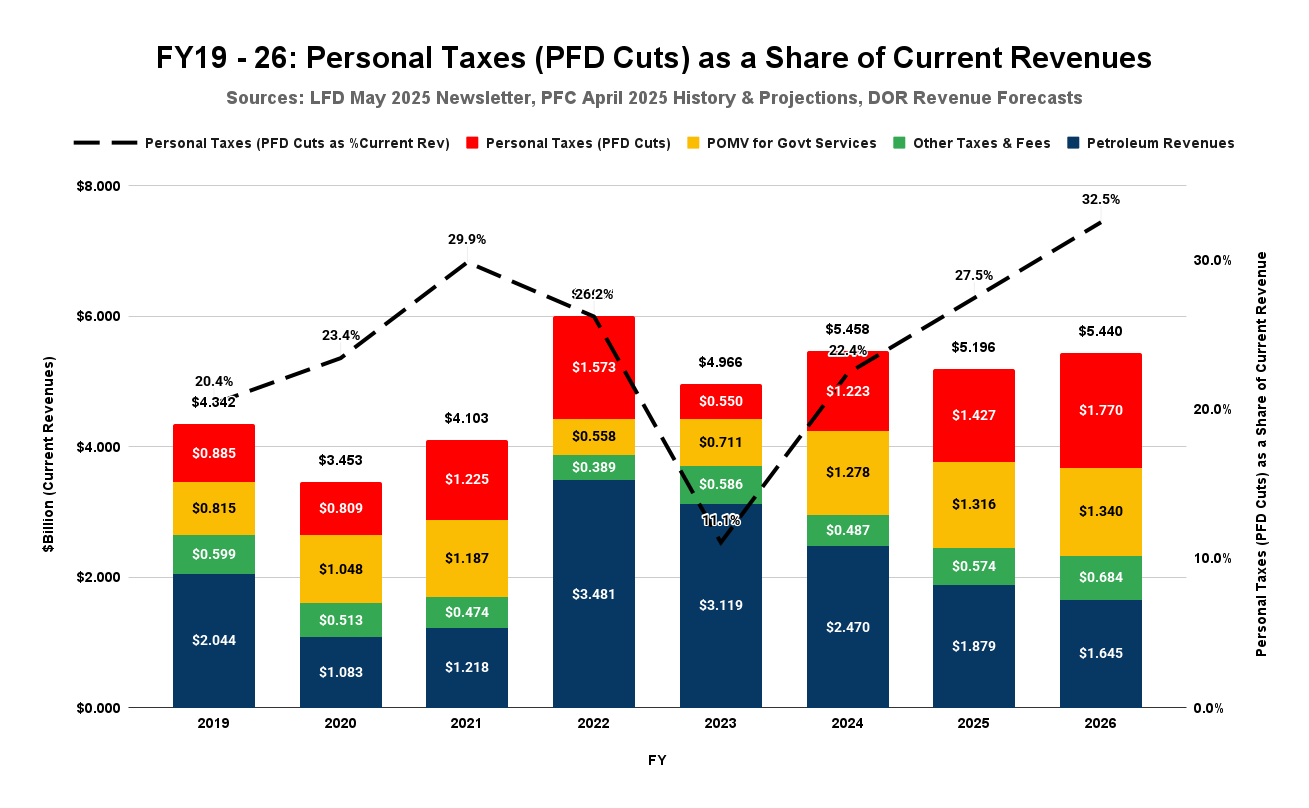

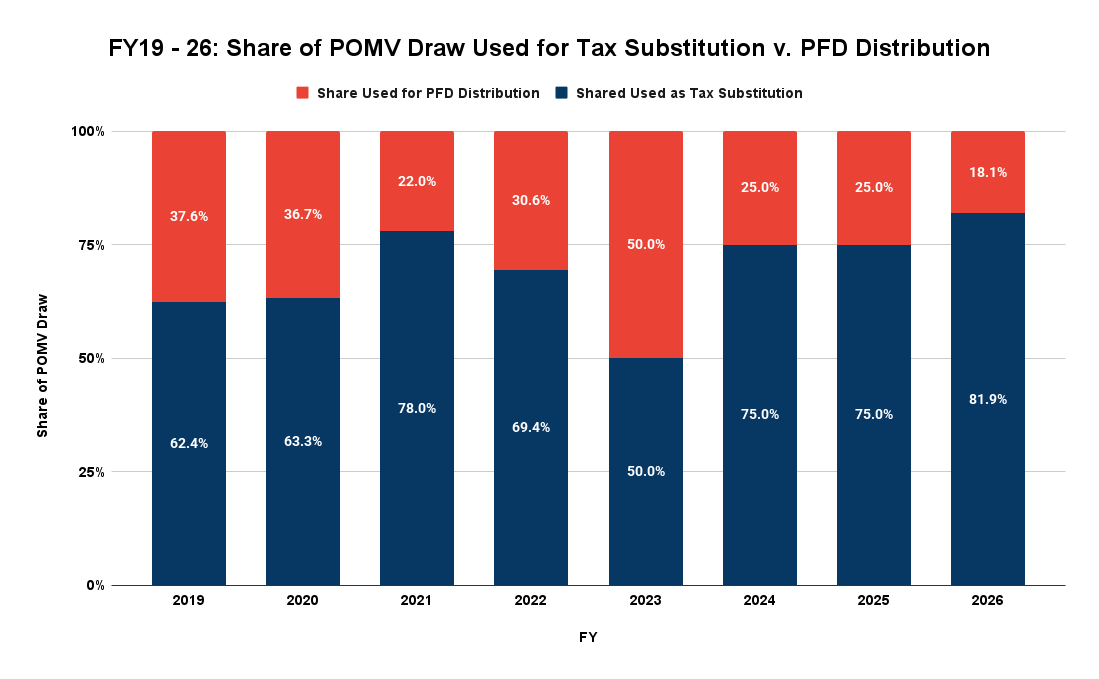

Using PFD cuts to help fund government is not new to the FY26 budget. As the following chart shows, it has occurred in each of the previous seven years since the POMV approach was adopted.

But the share of current revenues derived from PFD cuts is significantly higher in the FY26 budget than in previous years. As passed by the Legislature, nearly a third (32.5%) of all FY26 revenues are projected to be from PFD cuts. The average over the previous seven years has been 23%.

The portion of the PFD withheld and diverted in the FY26 budget is also significantly higher than in previous years.

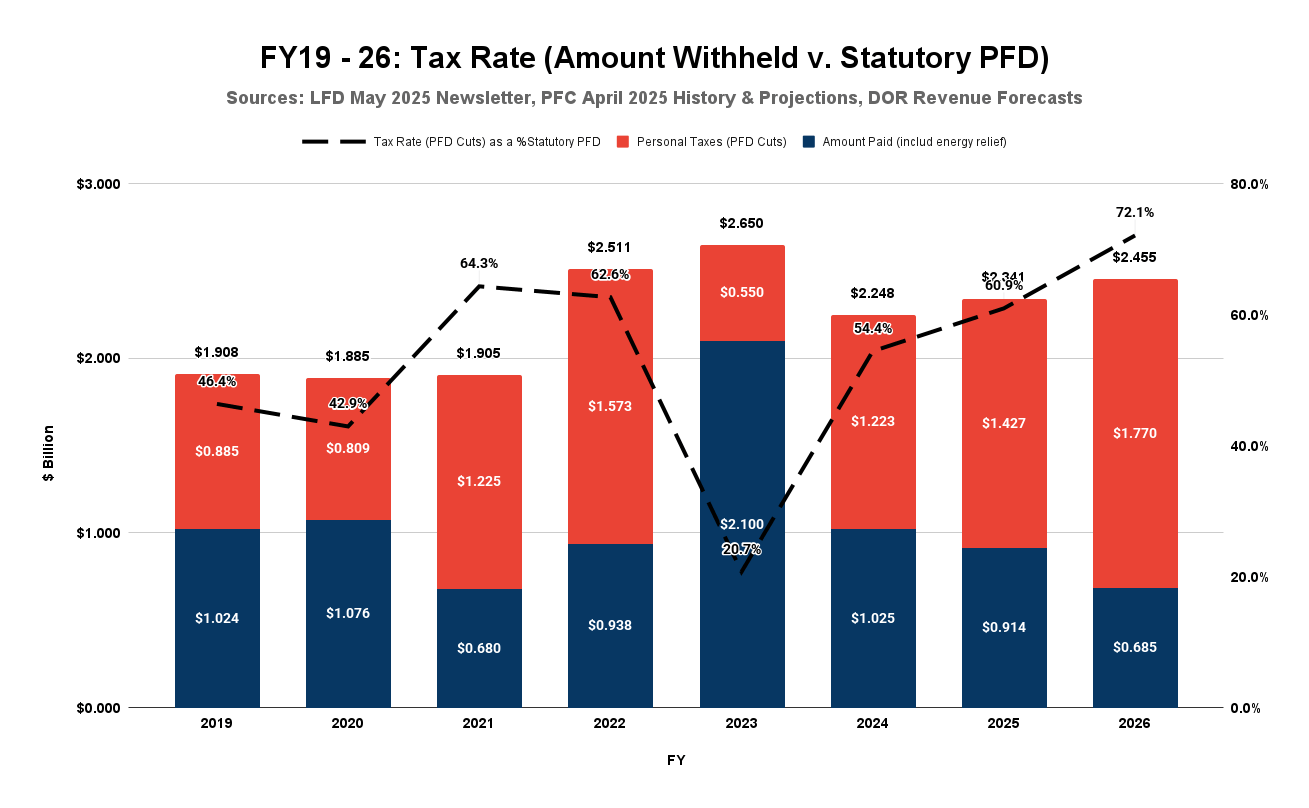

At the levels included in the FY26 budget, the portion of the PFD withheld and diverted to government, which amounts to the effective tax rate on PFD income, exceeds 72% of the statutory level. The average over the previous seven years has been 50%.

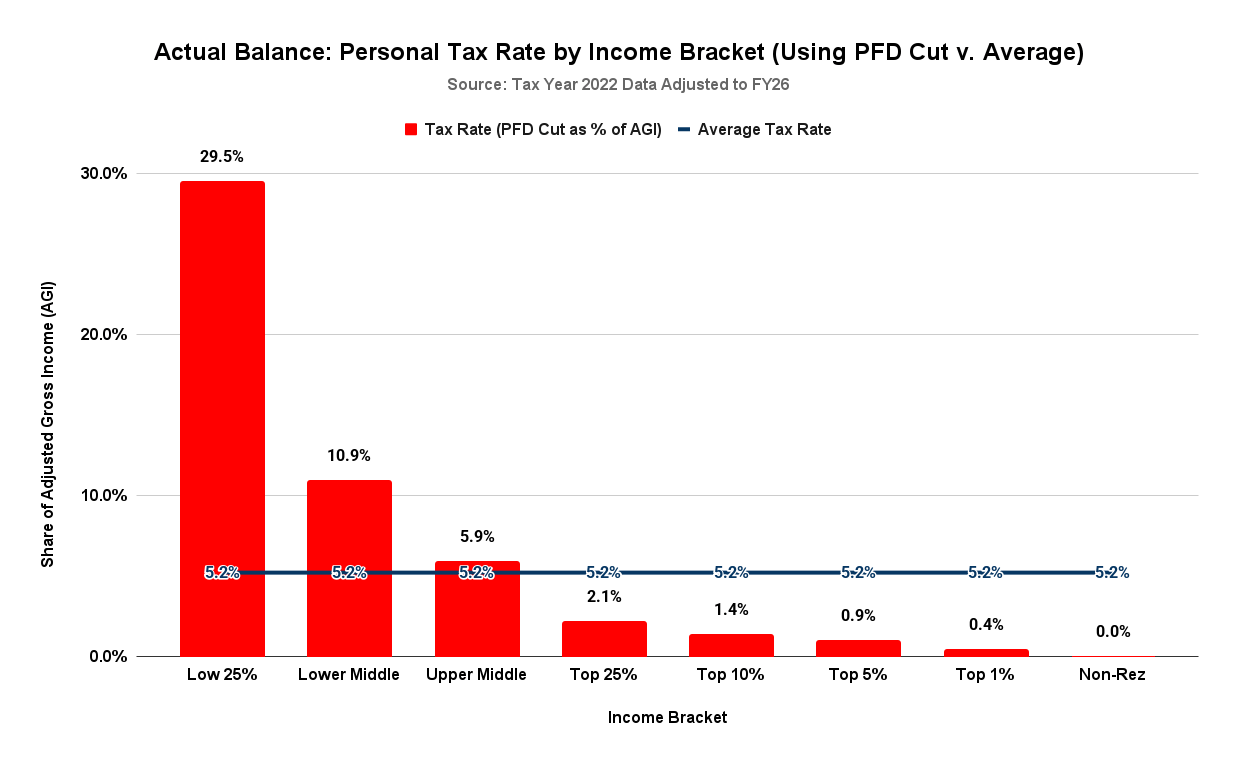

As we have explained in previous columns, PFD cuts are deeply regressive, with the burden falling hardest by far on middle and lower-income Alaska households. Using the most recent state-level income statistics available from the Internal Revenue Service (IRS) as a base, here is the impact of the level of the FY26 PFD cuts by income bracket on the average-sized Alaska household:

As the chart reflects, at the level being made in FY26, using PFD cuts reduces overall Alaska adjusted gross income by approximately 5.2% (the average tax rate). Rather than using an approach, such as a flat tax or an ultra-broad sales tax, that spreads that burden relatively evenly across all income brackets, however, collecting the revenue through PFD cuts tilts the burden heavily toward middle and lower-income (combined, 75% of) Alaska households.

Using PFD cuts, the income of the lower quartile of Alaska households is reduced by 29.5%, that of lower-middle income Alaska households by 10.9%, and that of upper-middle income Alaska households by 5.9%. On the other hand, the income of the top 25% of Alaska households is reduced overall by only 2.1%, and within that, the income of those in the top 10% by 1.4%, those in the top 5% by 0.9% and those in the top 1% by only 0.4%.

Put another way, using PFD cuts, the income of the lowest quartile of Alaska households is being reduced by nearly 22 times more than that of the top 10%, the income of lower middle income Alaska households by over eight times more, the income of upper middle income Alaska households by nearly 4.5 times more, and the income of the top 25% Alaska households overall by over 1.5 times more.

On the other hand, the income of the top 5% of Alaska households is reduced by nearly 30% less than that of the top 10% overall, and the income of the top 1% of Alaska households by almost 70% less.

In addition, by using PFD cuts, non-residents contribute nothing toward the cost of government, or to use former Governor Jay Hammond’s phrase, they escape “scot-free.”

Some call the use of sales taxes as a means of raising revenue unacceptably regressive, even when ameliorated with exemptions for groceries, healthcare spending, and other “basic” goods and services. Ironically, many of those who do, however, support and, in the Legislature, vote for using PFD cuts, even though PFD cuts are much more regressive than sales taxes and include no exemptions.

Others attempt to rationalize the regressive nature of PFD cuts by asserting that “most” of the benefits from state government spending flow to middle and lower-income Alaska households and, thus, structuring the revenue system similarly is justified. But there is no support for the assertion, and indeed, the available evidence is to the contrary. Following the money, Medicaid payments, the most used example behind such assertions, flow mostly into the pockets of top 25% doctors and other health care providers. SNAP (Supplemental Nutrition Assistance Program) payments, also cited by many as an example, are paid entirely by the federal government.

Moreover, even if there is some basis to the claim, the hugely regressive nature of PFD cuts vastly overcompensates for the effects. A sales tax would much better match the claimed revenue responsibility to the distribution of the alleged benefits.

Some argue that PFDs are “benefits,” and instead of being considered taxes, PFD cuts are merely reductions in those benefits. However, this argument fundamentally misapprehends the effect of PFD cuts.

Money taken from the Permanent Fund earnings account through the POMV draw serves two purposes. The first is to substitute for taxes that would otherwise be required to fund the same level of government spending. The second is to fund the distribution of PFDs.

The first purpose— replacing taxes— primarily benefits the top 25% of Alaska households, non-residents, and oil companies, which would otherwise pay more in taxes than they currently do to support government spending. The second purpose— financing the distribution of PFDs— primarily benefits middle- and lower-income Alaska households, as they receive more in terms of income through PFDs than they do in reduced taxes.

As currently written, the governing statutes allocate withdrawals from the Permanent Fund earnings account 50/50, with each group benefiting equally.

However, PFD cuts significantly alter that equation, redirecting more of the withdrawals to benefit the top 25%, non-residents, and oil companies through tax substitution. Instead of reducing benefits, PFD cuts are nothing more than a transfer of the benefits from middle and lower-income Alaska households to the top 25%, non-residents, and oil companies.

Here’s the split between the two uses since FY19:

In only one year (FY23) has the split approached the 50/50 allocation envisioned under current law. In all of the others, substantially more of the benefits have gone to the top 25%, non-residents, and oil companies through tax substitution than to middle and lower-income Alaska families through PFDs.

The FY26 budget is the worst yet. Rather than the benefits being allocated 50/50 between the two groups, the benefits are split roughly 84% to the top 25%, non-residents and oil companies, and 16% to middle and lower-income Alaska families. The average over the previous seven years has been 68/32.

These transfers have significant consequences. At a time when outmigration of working-age Alaska families from the state is already troubling, the Legislature is even further reducing the income of the very income brackets leading that outmigration. At a time of significant concern about Alaska’s business climate, the Legislature is increasing its reliance on the revenue approach that, of the alternatives, has the “largest adverse impact” on the overall Alaska economy.

In short, the FY26 budget raises PFD cuts to historic levels. In doing so, it even more deeply undermines the economic condition of middle and lower-income (combined, 75% of) Alaska households, and, through that, even more deeply exacerbates the economic forces driving outmigration and the adversity facing the overall Alaska economy.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Interesting how you’ve simply ignored federal funding, which is the largest source of state income. This state is simply infected to the core with a spirit of welfare to the point of complete entitlement.

Exactly. And those with the most expansive “spirit of welfare to the point of complete entitlement” are the ones who already have the most, including folks like you and me who benefited from being in the right place & time during economic boom times. 88% of local contributions to state government come from savings (the Permanent Fund) and selling off assets (our natural resources). Those of us with the resources to influence state government in any meaningful way are just fine with welfare, as long as the “socialist distributions” — as you’ve deemed the source of the 40-year suckfest on… Read more »

“……. the ones who already have the most, including folks like you and me who benefited from being in the right place & time during economic boom times…….”

That isn’t me. I was too young and poor to homestead 160 acre parcels. They slammed that door in my face.

Oh , are you talking about the PFD? That thousand dollar per year sprinkling that is shrinking by the year? You think that’s the Big Time?

“……..88% of local contributions to state government come from savings (the Permanent Fund) and selling off assets (our natural resources)………”

That is precisely what the Permanent Fund was set up to do, not to distribute transfer payments. And the state income tax was repealed before the PFD ever paid a cent, so if we have to go back to an income tax, the PFD goes away beforehand. No Universal Basic Income welfare schemes while you tax my income or purchases.

Well, the feds don’t give out annual dividends to Alaskans. Since 2016 this re-allocation of money from the Alaska Permanent Fund Dividend to the State has taken place without much political consequence. Such lack of retribution by the voters means it will continue until they get 100% of it. . Business as usual.

“……..Well, the feds don’t give out annual dividends to Alaskans……….” Actually, they do, but they’re not called “dividends”. Annual Social Security retirement and disability benefits alone are sent to 11% of Alaskans, but yeah, you don’t get that just for breathing. Direct federal donations to the state treasury add up to more than double what the PFD will pay out to Alaskans, and that doesn’t include what the feds will hand out to local governments, NGOs in the state, or federal wages and salaries paid to Alaskan federal employees and contractors working here. The federal portion of the income side… Read more »

For those interested, here’s who the #akleg is protecting by using PFD cuts to pay for spending. https://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-alaskas-super-socialists/

Well, you’d better get after those “super socialists” and leave my income, assets, and purchases alone. I’ll also again point out that when the PFD is gone, a good 15% of the population (including the biggest sponges) will flee as if their tails were on fire, thus saving millions more in legislated appropriated state social spending.