In last week’s column, we looked at the future of the Permanent Fund Dividend (PFD) if current Alaska fiscal policy, which relies on ad hoc diversions of a portion of the statutory PFD (PFD cuts) as the primary revenue source to fill budget deficits, continues on its current trajectory. We concluded that, on that trajectory, the PFD will be reduced to token levels by the mid-2030s, shortly after it observes its 50th anniversary in 2032.

In commenting on the column later, some noted that it only captured the last half of what, by then, will have been a roughly 20-year run of depleting Alaska’s various fiscal accounts in an effort by some to avoid the consequences of continued budget deficits.

To those commentators, the column actually should have started in FY14, when the state first commenced dipping into its various financial reserves to cover its fiscal gaps, and followed the story through the depletion first of the Statutory Budget Reserve (SBR), then the effective depletion of the Constitutional Budget Reserve (CBR) until, in FY17, the state started in on PFD cuts.

Here’s the early part of the story they said we were missing.

Combined, Alaska’s two “rainy day” savings accounts – the SBR and the CBR – peaked in FY13. From there, draws on the two funds in order to offset deficits – and avoid the need for broad-based taxes to close them – rapidly depleted the two funds until FY20, when the SBR was fully depleted and the CBR was at a token level.

Since then the accounts appear to have been slightly rebuilt, but that’s misleading. Overall, the state has continued to run deficits; it’s just that, since FY17, the state largely has shifted to PFD cuts to cover them and in the process, effectively used a portion of those cuts also to restore minimal levels to the SBR and CBR.

The reason some believe this early phase is an important part of the story is because it adversely impacts a different group than we hi-lited in last week’s column.

In last week’s column, we explained that covering deficits through PFD cuts shifts the burden largely to middle and lower-income Alaska families, while the top 20% – the wealthiest Alaskans – contribute a trivial share and, unlike in any other state, non-residents working or otherwise deriving a portion of their income in Alaska contribute nothing toward the costs of government.

Covering the deficits through the depletion of the SBR and CBR, on the other hand, adversely impacts future Alaska generations. While the SBR may be viewed as an intra-generational asset – that is, the same generation that filled it by deferring spending is entitled to drain it by spending later – the CBR is intentionally not.

Art. 9, Section 17 of the Alaska Constitution, contemplates that the CBR periodically is to be repaid in order to provide future generations with the same “rainy day” cushion as previous generations used for themselves. Failing to refill the CBR – as the current generation is continuing to do – leaves the fiscal cupboard bare when future generations ultimately face their own set of fiscal challenges.

It is, in essence, an inter-generational tax. The current generation is converting what is intended to be an inter-generational asset solely to its own benefit, leaving future generations to pay the costs of their fiscal challenges entirely from their own resources rather than being able to cushion them, as this generation has done on a massive scale, through CBR draws.

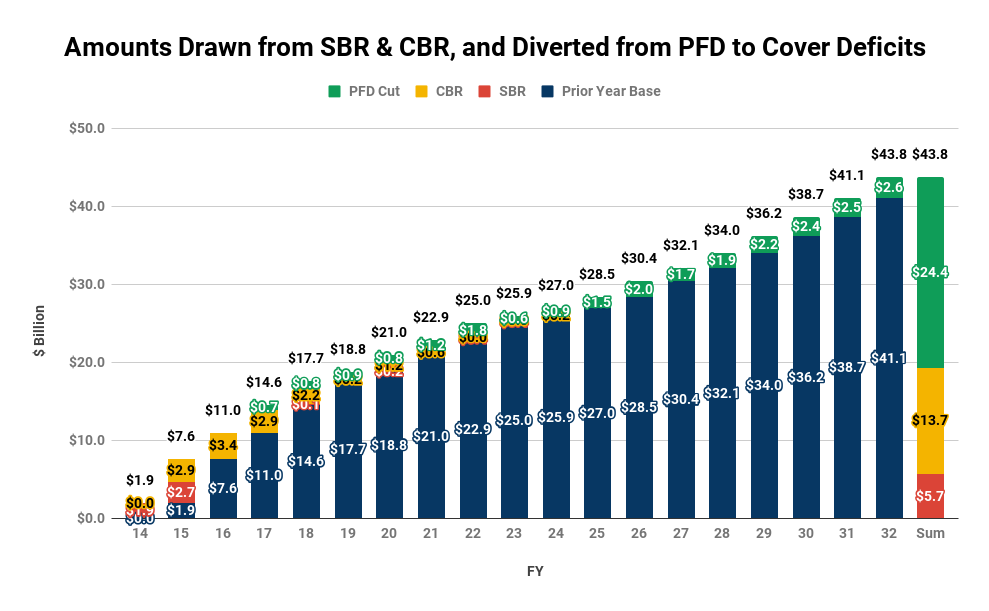

This chart shows the full continuum, from the time the state first started tapping its various fiscal reserves to cover deficits, through the period covered by last week’s column.

The cumulative amount pulled from the various fiscal resources up to any given year is shown in dark blue. Layered on top are the additional amounts taken in the relevant year from the various sources: red are the amounts drawn from the SBR, gold are the amounts drawn from the CBR, and green are the amounts diverted (cut) from the PFD.

Through FY23 – the period we skipped over in last week’s column – the cumulative amount the state has pulled from the various resources is $25.9 billion. Of that, $5.7 billion has been drawn from the SBR, $13.5 billion from the CBR, and $6.8 billion has been diverted from the PFD.

By FY32, the cumulative amount the state is projected to have pulled from the various resources on its current trajectory is $43.8 billion. Of that, $5.7 billion is projected to have been drawn from the SBR, $13.7 billion from the CBR, and a staggering $24.4 billion (56% of the total) is projected to have been diverted from the PFD.

And those amounts are likely understated, perhaps significantly. The deficit projected for FY24 in last week’s column, for example, is $870 million, the difference between projected spending (using the Legislative Finance Division’s “current policy” approach) of $4.97 billion and projected UGF revenues of $4.10 billion (ex-current law PFD).

While the projected UGF revenues used in the analysis remain on track, the spending levels are likely to increase significantly given the current push by many in the legislature for increased appropriations in a number of categories. One indication of how much spending may increase is Senator Bert Stedman’s (R – Sitka) recent projection of a $1300 FY24 PFD.

At the FY24 revenue and spending levels projected in last week’s column, the amount remaining for the PFD, after the diversion required to close the projected deficit, would be roughly $1.6 billion, or roughly $2,400/PFD after the deduction of administrative costs (and at 650,000 recipients). Senator Stedman’s projection of a $1,300 PFD implies instead that another, roughly $700 million will be required to close the deficit, in turn implying an ultimate FY24 UGF spending level of $5.7 billion.

Recalculating the future trajectory starting from that higher baseline will add roughly another $9 billion to the amount of PFD cuts over the coming decade, effectively ending the PFD program even earlier than we projected in last week’s column, possibly even earlier than its 50th anniversary in 2032.

While those adversely affected by Alaska’s fiscal policy between the two periods are different – future generations during the earlier period, and middle and lower-income Alaska families during the period we covered in last week’s column – there is one, glaring constant over the entire, nearly 20-year period.

That is that the top 20% and non-residents deriving income in Alaska avoid being required to make any material contribution toward the costs of government during either period. During the earlier period, the burden is shifted almost entirely to future generations; during the latter, the burden is shifted almost entirely to middle and lower-income Alaska families. The missing element in both is the top 20% and non-residents.

Effectively, like some third-world countries, the analysis shows Alaska has been and continues to be run over the entire period as a “no tax, no consequences” haven for its wealthiest and the non-residents working or otherwise receiving income here. There are continuing increases in spending – resulting in ongoing deficits – throughout, but the top 20% and non-residents effectively avoid bearing any of the burdens. By draining savings first, and using PFD cuts later, they are able continually to make it someone else’s problem.

That is not what former Governor Jay Hammond and others envisioned, and we and others still want, but as push has come to shove, it’s the Alaska successive legislatures and governors have and are continuing to create.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Sorry but your whole continued income tax push is bull. I don’t care about the minuscule “out of state” worker thing. I care more about those of us that live in Alaska full time and actually work that you advocate taxing even more. There are too many full time Alaskan residents who already pay nothing since they don’t work. They act like the dividend is their expected income. Those of us who work and pay property taxes ( some of the highest in the country) shouldn’t be stuck with more taxes because we work and made a life for ourselves… Read more »

Paintedpony, you drag out that tired trope of “too man full time Alaskan residents who already pay nothing since they don’t work” when no one who works in Alaska pays any sort of Alaska state income tax. And I don’t know how anyone could survive in Alaska with their only income being the PFD. How does one manage to pay for food, housing, utilities, a car & insurance, plus all the other costs out there on $1114 (2021’s PFD amount) in a year. That year, the PFD barely covered my rent for that month, let alone a whole year of… Read more »

Would have been nice to the changes to tax code matched up against the savings balance.