AS 37.13.145 is one of the state’s key fiscal statutes. Titled “Disposition of income,” it sets forth the statutory principles that govern the disposition of income from the Permanent Fund.

As statutes go, it’s fairly straightforward. Subsection (a) establishes the earnings reserve account (ERA). Subsection (b) establishes the provisions governing the annual transfers to be made from the ERA for the Permanent Fund Dividend (PFD). Subsection (c) governs transfers from the ERA to cover inflation-proofing. Subsection (d) governs the so-called “Amerada Hess” funds. Subsection (e), enacted as part of Senate Bill 26 in 2018, caps the annual amount that can be appropriated from the ERA to the “general fund.” And subsection (f) similarly caps the combined amount from the ERA that can be transferred pursuant to subsection (b) for the PFD and, by implication, pursuant to subsection (e) to the general fund.

Some occasionally attempt to argue that the statute creates a conflict between the amount to be transferred from the ERA for the PFD and to help cover spending on government services, such that the Legislature is required annually to choose the amounts to go to each. As we explained in a previous column, however, no such statutory conflict exists. While the Alaska Supreme Court’s 2017 decision in Wielechowski v. State makes clear that, under Article IX, Section 7 of the Alaska Constitution, the Legislature has inherent authority annually to appropriate any funds statutorily designated for one purpose to another, there is no confusion in the statute itself.

The purpose of this column is not to rehash that old debate, however. Rather, it is to explore something that we haven’t previously: the ongoing relationship between the amounts appropriated from the ERA for purposes of inflation-proofing and those appropriated from the ERA, first for the percent of market value (POMV) draw and then from the POMV for the PFD.

That issue recently has come to the fore due to concerns being expressed by some about the ongoing stability of the ERA. As we’ve discussed in previous columns here and here, rather than being substantive, we believe those concerns are largely the consequence of the, at least in our view, jerry-rigged accounting approach currently being used by the Permanent Fund Corporation to follow the status of the ERA.

As we’ve explained in those columns, once the accounting is corrected, the ERA appears to be well-funded.

But that hasn’t stopped some from arguing not only that the ERA is in trouble but that it’s somehow the PFD’s “fault” that it is. Basically, the argument is that it’s the payments for the PFD that are causing the ERA to be drained. From that, some also argue that the portion statutorily to be appropriated for inflation-proofing is being short-changed.

Of course, even on the surface, that argument doesn’t hold water. Since the enactment of Senate Bill 26, the portion of the ERA to be transferred for the PFD has been treated under the statute as a portion of the overall annual POMV draw. Recall that under AS 37.13.145(f), “the combined total of the transfer under (b) of this section [the portion for the PFD] and an appropriation under (e) of this section [the portion used to cover government spending] may not exceed the amount available for appropriation under AS 37.13.140(b) [the amount set for the annual POMV draw].”

If that is the problem, it’s the result of the overall level of the POMV draw, not the portion statutorily designated for the PFD.

But the perceived problem with the ERA isn’t even that. To analyze, we’ve looked at the appropriations made from the ERA since the passage of Senate Bill 26 in 2018 separately for inflation-proofing, to cover the POMV draw, and within the POMV for the PFD and to help cover government services.

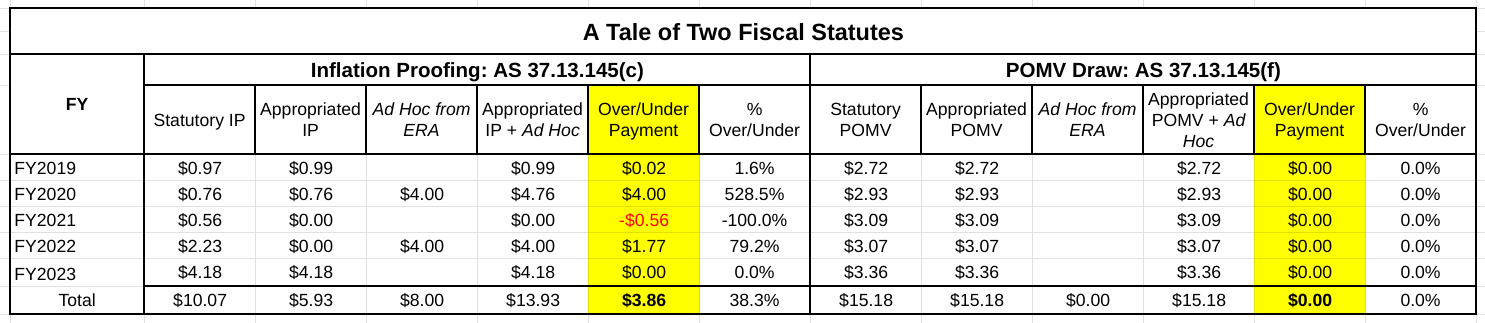

Here are the appropriations made from the ERA over that period separately for inflation-proofing and to cover the POMV draw.

Moving from left to right for each category, we show the annual payment level specified by statute, the level actually appropriated, and any ad hoc appropriations made from the ERA for the same purpose for each year and in total. The final two columns are the amount and percentage of any over- or under-payment made for the category by year and in total.

This analysis shows that inflation-proofing hasn’t been shortchanged at all. Instead, including the two ad hoc contributions made in FY2020 and FY2022, actual appropriations made over the period from the ERA have overfunded the portion statutorily to be contributed for inflation-proofing by $3.86 billion, or nearly 40%.

The portion appropriated for the POMV draw, on the other hand, has remained consistent throughout at the levels provided by statute.

Compared to the statutory limits, rather than the victim, the appropriations made for inflation-proofing, in fact, have been the cause of the ERA overdraws.

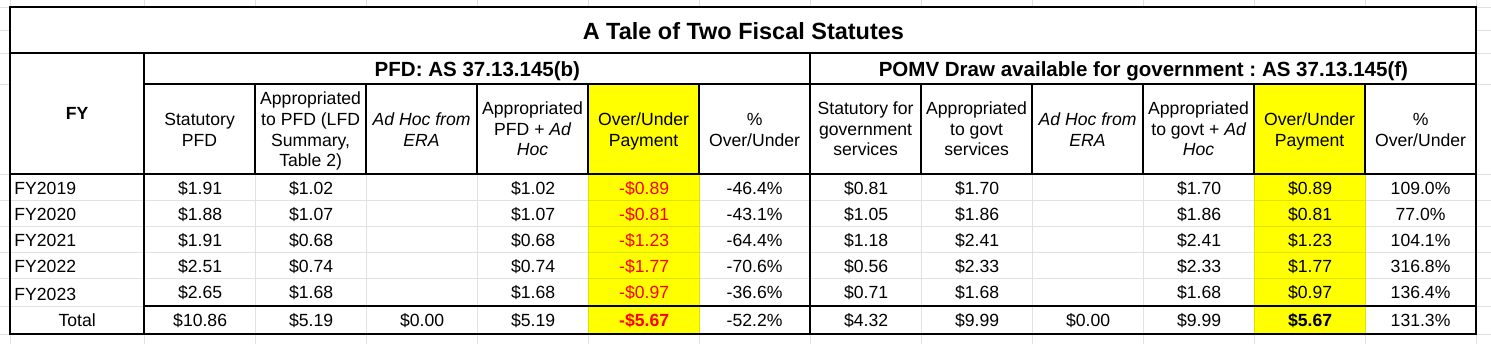

And the PFD also isn’t even the cause of any imbalances within the POMV draw. Using the same approach as above, here’s a look over the same period inside the POMV draw according to the annual appropriations bills passed by the Legislature and signed by Governor Mike Dunleavy (R – Alaska) (as reflected in Table 2 included in the Legislative Finance Division’s annual “Summary of Appropriations”).

Between the two purposes, the portion appropriated for government services has exceeded the statutory limit by roughly $5.7 billion, or over 130%. The PFD, on the other hand, has been shortchanged by the same amount. (The remainder of the PFD paid in any given year, if any, has been backfilled from other sources.)

In short, even within the POMV, the overdraws, compared to the statutory limits, have been for the portion used to help pay for government services. Compared to the statutory levels, the portion appropriated for the PFD has been significantly underfunded.

To be blunt, those who argue that the Permanent Fund needs to be restructured to “protect” inflation-proofing are being incredibly disingenuous. The existing approach not only has fully protected inflation-proofing over the past five years, it has more than fully protected it. The overdraws some claim have put the ERA at risk have been entirely to pour extra funding into inflation-proofing.

And those who argue that the PFD is the cause of any instability in the ERA are equally disingenuous. As is clear, the overdraws within the POMV have benefitted the portion available for government. It’s the PFD that’s been significantly underfunded.

While we appreciate that, under the Wielechowski decision, the Legislature annually can redirect to other purposes any revenues statutorily designated for a specific purpose, we are struck by the highly arbitrary nature of how that’s being applied in this situation.

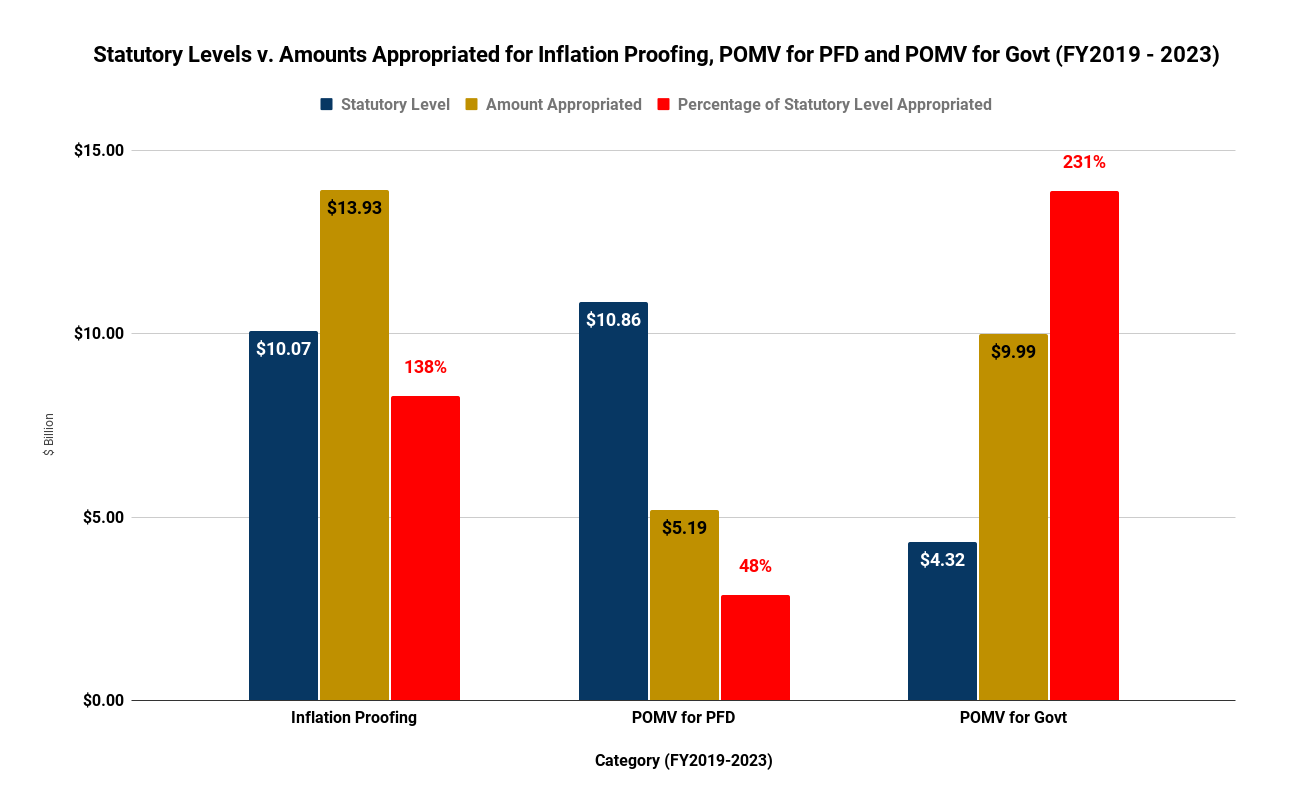

While all three subsections – those governing inflation-proofing, the PFD, and the portion of the POMV to be used for government services – are in the same statute, and two – those covering inflation-proofing and the PFD – are roughly of the same age, the amounts being appropriated to each as a share of the statutory levels are hugely different.

Without changing the statutes, over the five years since the passage of Senate Bill 26, appropriations from the ERA for inflation-proofing have totaled $13.93 billion, exceeding the statutory level by $3.86 billion (38%), and appropriations from the POMV draw for government services have totaled $9.99 billion, exceeding the statutory level by $5.67 billion (131%).

Appropriations from the ERA for the PFD, on the other hand, have totaled only $5.19 billion, $5.67 billion (52%) below statutory levels.

If the overages and underages had been balanced across all three categories, each would have been funded over the five years at approximately 115% of their statutory levels. Put another way, if the overfunding appropriated to inflation-proofing had been used instead to help cover the cost of government services, the amount of cuts to the PFD over the period would have been reduced from $5.67 billion (or 52% of the statutory amount) to $1.81 billion (or 17%).

By putting the burden not only of fully funding but, indeed, overfunding, both inflation-proofing and the portion of the POMV draw used for government services entirely on the back of PFD cuts, the Legislature essentially is requiring this generation of middle and lower-income Alaska families to subsidize not only those currently in the top 20%, non-residents and oil companies, but also the same groups in future generations as well.

So much for the claim by some that they are prioritizing “working Alaska families.”

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.