In a recent commentary (‘Alaska Permanent Fund account that pays for state budget, dividends is under pressure”), the Alaska Beacon’s Andrew Kitchenman discusses a potential upcoming concern with transfers made from the Permanent Fund earnings reserve account (ERA). As explained by Kitchenman:

For 41 years, Alaskans’ bank accounts have been refilled with dividends – usually more than $1,000 – from the $76.6 billion Alaska Permanent Fund. More recently, the fund also has been the biggest source of money paying for state government. But what if there was no money available for either dividends or the state budget?

Permanent Fund managers have long known the fund could one day have less available to spend than is needed. They now say that day could be coming uncomfortably soon, in perhaps just three years.

On its face, Kitchenman’s commentary is alarming. The lack of available funds would require either even harder choices involving the PFD and annual budget than the state has faced to date or potentially significant changes in the structure and operation of the Permanent Fund (Fund) itself.

But after looking closely at the issue, we believe the concern is unlikely to mature in the coming decade, and, even if it does, only will occur as a result of arbitrary, ad hoc decisions made in the interim by future legislatures rather than any deficiency in the structure and operation of either the Fund or the ERA.

Here’s why.

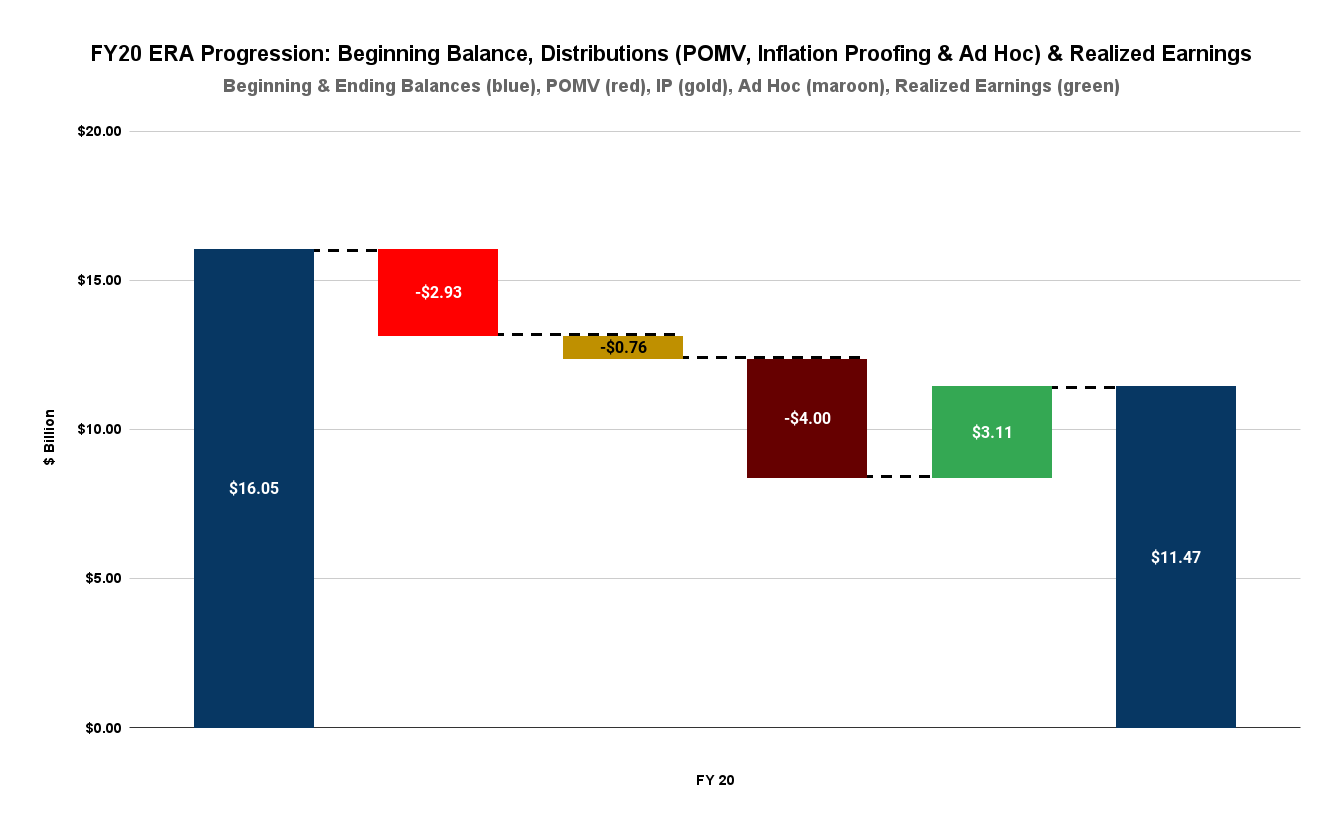

Using FY20 as an example, here’s how the ERA operates.

The column on the left represents the balance of accumulated, realized earnings in the account at the beginning of any given year. According to the “History and Projections” reports published monthly by the Permanent Fund Corporation (PFC), at the close of FY19 (which simultaneously was the start of FY20), the ERA held a balance of $16.05 billion.

During the course of any given year, there are various distributions from and deposits made into the account that causes the balance to evolve.

In FY20, there were three distributions.

The first, for $2.72 billion (in red), was the annual percent of market value (POMV) draw from the ERA contemplated by AS 37.13.140 (b) and 37.13.145 (e). Under those statutes as well as AS 37.13.140 (a) and 37.13.145 (b), that draw covers both the amount to be distributed annually as a Permanent Fund Dividend (PFD) and the amount otherwise available to the general fund to help pay for unrestricted general fund spending.

The second distribution, for $758 million (in gold), was for a transfer from the ERA to the principal of the Fund (sometimes also referred to as the “corpus”) “to offset the effect of inflation on the principal of the fund during that fiscal year,” as contemplated by AS 37.13.145 (c). That transfer is commonly referred to as “inflation proofing.”

The third distribution, for $4 billion (in maroon), was an ad hoc transfer from the ERA to the Fund’s principal. In the footnotes of the “History and Projections” reports from the beginning of FY20 through the end of FY21, the PFC describes the transaction in this way: “In FY20, an additional $4 billion was appropriated from the ERA to principal. The intent of the legislation was to forward fund inflation proofing” (emphasis added).

The fourth column (in green) reflects the deposits for FY24 into the ERA. According to AS 37.13.145 (a), ‘[i]ncome from the fund shall be deposited by the corporation into the [ERA] as soon as it is received.” In FY20, those deposits totaled $3.11 billion.

As a result of the disbursements and deposits, as of the end of FY20, the ERA held a balance of $11.47 billion in accumulated, realized earnings, which simultaneously also was the starting balance for FY21

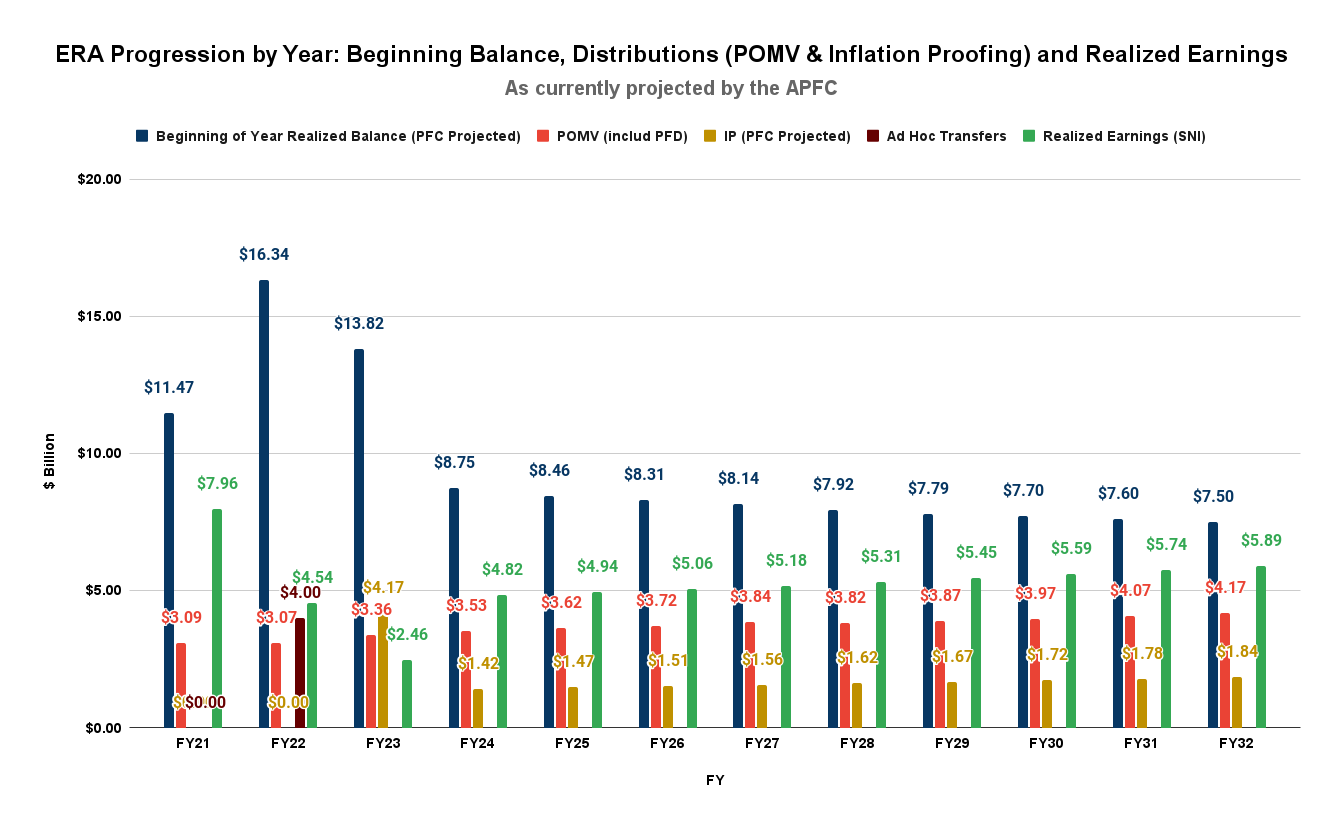

Beginning at that point and tracking forward from there based on current projections, this is how we see the ERA balances developing over the remainder of the current forecast period (through FY32):

With some ups and downs, the balance of accumulated, realized earnings held in the ERA builds over the period from $11.47 billion (beginning of FY 21) to $13.41 billion (end of FY32).

These results are largely driven by three factors.

First, consistent with the footnote explaining the $4 billion ad hoc distribution made from the ERA to the principal in FY20, we initially include zero distributions from the ERA for “inflation proofing” for FY21, 22, 25, and part of FY26.

Only $2.12 billion of the $4 billion in forward funding had been used when the Legislature reinstituted direct contributions for inflation-proofing in FY23 and 24. We use the remainder of the $4 billion to cover the projected amounts for FY25 and part of FY26. Each year, we have offset the annual amounts for “inflation-proofing” projected in the various “History and Projections” reports against the amount set aside for forward funding until the total equals the $4 billion set aside for the purpose.

Second, as the chart shows, the Legislature made an additional $4 billion ad hoc distribution from the ERA to the principal in FY22. Consistent with the logic of the ad hoc distribution made in FY20, we have also treated the FY22 distribution as “forward funding” distributions otherwise to be made in subsequent years for inflation-proofing. Using the same accounting approach as before results in zero distributions from the ERA for “inflation-proofing” for the remainder of FY26, all of FY27, and part of FY28.

Third, we have deposited in the ERA the amount of annual Statutory Net Income (SNI) reported and projected for the Fund for the relevant years in the PFC’s most recent (April 2023) “History and Projections” report. Annual SNI represents the realized income generated by the Fund over the course of the relevant year.

As is clear from the chart, instead of declining as described in the Kitchenman commentary, the balances grow over most of the remainder of this decade, reaching $13.83 billion by the beginning of FY29 before starting to decline slightly thereafter as full distributions are again made for inflation proofing.

The scenario and concerns described in the Kitchenman commentary, which is based on recent versions of the PFC’s “History and Projections” report and a discussion that occurred at the May 17 meeting of the PFC Board (Board), differ from our outlook in two significant respects.

The first is that the remaining portion of the ad hoc distribution made by the Legislature from the ERA to the principal of the Fund in FY20 and all of the ad hoc distribution made in FY22 are treated solely as extraordinary, discretionary diversions to the Fund principal of money otherwise to be held in the ERA. They are not treated as forward funding of inflation proofing or anything else.

This change in treatment was foreshadowed by an unexplained change made at the beginning of FY22 to the previous footnote describing the FY20 distribution. As we noted above, before that point, the footnote read: “In FY20, an additional $4 billion was appropriated from the ERA to principal. The intent of the legislation was to forward fund inflation proofing.”

At the beginning of FY22, however, the footnote was changed to drop the second sentence and simply state, “In FY20 and FY22, an additional $4 billion was appropriated from the ERA to principal.” Subsequently, the “History and Projections” reports have been calculated by including additional charges for annual distributions from the ERA to the Fund principal for inflation-proofing rather than treating them as covered by forward funding.

As shown on the following chart, which reflects the “new” view of the PFC and was the basis for the discussion at the May board meeting, this change significantly reduces the balances held in the ERA.

Instead of climbing from $11.47 billion (beginning of FY21) to $13.41 billion (end of FY32) as we project by applying the remainder of the Legislature’s FY20 and all of the FY22 ad hoc distributions as forward funding, the accumulated, realized earnings fall over the period from $11.47 billion to $7.38 billion.

It is important to understand that these reductions are not due, as suggested in the Kitchenman commentary, to an infirmity in the earnings stream. As demonstrated in the earlier chart, combined with the accumulated, realized earnings from past years, the earnings stream seems more than adequate to service the ERA’s obligations at least over the next decade, if not well beyond.

Rather, the reductions are due entirely to presumed ad hoc decisions of future legislatures unilaterally, without any statutory requirement or basis, to continue to distribute additional amounts for inflation-proofing without any offset for the remaining balances of the ad hoc distributions previously made from the ERA. By essentially double dipping for inflation-proofing, that is the action that positions the ERA for failure.

The second way in which the scenario – and concern – described in the Kitchenman commentary differs from our outlook is with respect to the level of the annual earnings stream from FY24 forward. Our and the current PFC outlooks are based on the earnings forecast in the current “History and Projections” report.

But the Kitchenman commentary, based on the discussion at the May PFC board meeting, explores what happens if, rather than as projected in the PFC’s latest “History and Projections,” future Fund earnings fail to rebound from the low levels experienced in FY23. Of course, if, in combination with continued distributions for inflation-proofing without a subsequent offset for the earlier ad hoc ERA withdrawals, earnings fail to rebound from the low levels experienced in FY23, the ERA could be headed for difficulties.

But again, that is not the fault of the structure or operation of the Fund or the ERA. Rather it is the ad hoc decision of future legislatures to continue to drain the balances of realized, accumulated earnings otherwise to be maintained in the ERA without a subsequent offset for inflation-proofing. Draining significant ERA reserves without any offsetting benefit makes the ERA much weaker.

As we said at the outset, we believe the potential issue described in the Kitchenman commentary is unlikely to develop at any point in the near and mid-term future. Even if Fund earnings fail to rebound from the low levels experienced in FY23, treating the previous ad hoc distributions as forward funding of inflation-proofing in subsequent years should provide more than ample cushion for an extended period for continued POMV distributions.

As explained above, we believe that the situation described in the Kitchenman commentary will develop only if artificially induced by the failure of future legislatures to treat the previous ad hoc distributions as forward funding for inflation-proofing.

Just like a personal bank account, if you double dip for big expenses, problems will inevitably arise.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.