Thousands of Alaska corporations stand to benefit from an economic stimulus provision in the CARES Act that allows net operating losses (NOL) to be carried back five years. Carryback provisions essentially allow corporations to receive money today from prior losses rather than wait to offset future tax liabilities. The practice of carrying back losses was largely eliminated with the Tax Cuts and Jobs Act in 2017, while carrying losses forward was still permitted. When the CARES Act was passed last year, the carryback provision was reinstated for tax years 2018, 2019, and 2020.

Alaska’s corporate income tax system is tied to the federal tax system, so changes to the federal tax code have significant implications on Alaska’s corporate tax income. When Congress raises the corporate tax rate, Alaska’s rate rises along with it. When Congress reduces the rate, Alaska’s rate also drops. In this case, the rate itself has not changed but the changes in carryback provisions create new financial obligations for the state. The state will lose any interest it would normally collect if the money remained in the treasury. If the carryback provision was not in place, corporations could still carry losses forward. The only difference is the state has to cut a check now if a corporation carries back a loss to offset previously paid taxes.

The financial implications of this change are unclear. Numbers stated by Senator Bill Wielechowski (D – Anchorage) and reported on recently by ADN are only estimates. The extent of corporate losses in 2020 is not fully known yet. For a corporation to carryback a loss they would have had to lose money in 2018, 2019, or 2020 and also would have also had to pay a corporate income tax in one of the previous five years that correspond to the year in which a loss was recorded.

The ADN recently published a story, “Forecast: Oil and gas companies will pay negative Alaska corporate income taxes.” What the article left out was the thousands of other Alaska corporations who stand to benefit from the NOL carryback provision.

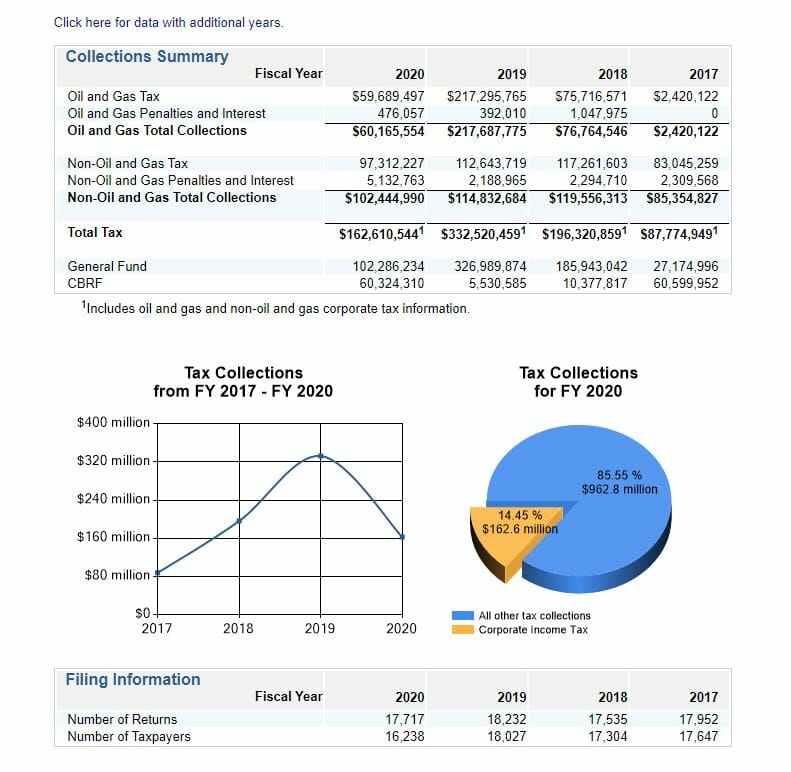

According to the Alaska Department of Revenue’s 2020 Annual Report, 16,238 corporations paid a corporate income tax in Alaska in FY 2020 (tax year 2019). Collections from non-oil and gas tax payers was $102,444,990 in FY 2020, more than oil and gas corporate taxes. As you can see below, FY 2019 (tax year 2018) was the only year in the last four in which oil and gas corporate income tax was more than non-oil and gas. FY 2017 (tax year 2016) only saw $2,420,122 in oil and gas corporate income tax due to low oil prices.

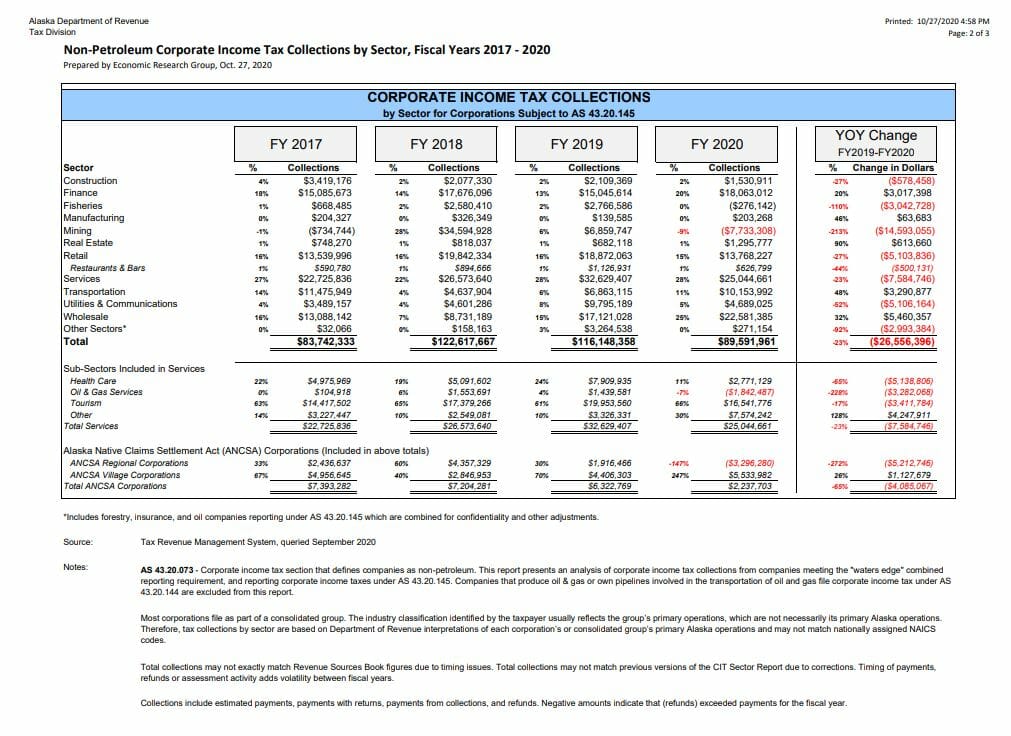

Below is a breakdown from the Department of Revenue for corporate income tax collections by industry for the last four years.

There has been a lot of talk in the Capitol about a bill that would exempt oil and gas companies in Alaska from the carryback provision. So far no bill has been introduced. It’s unclear whether a bill would also exempt Alaska Native Corporations, construction companies, restaurants, healthcare businesses, or the thousands of other corporations in Alaska who pay corporate income taxes.

Interesting article, Jeff, thank you. Just one correction: Although it’s true that Alaska has mostly adopted the federal tax code by reference, we have our own corporate tax rates. The federal corporate income tax rate is currently a flat 22%, while Alaska has a graduated rate schedule. Our rates were significantly lowered without much fanfare at one point in the past decade, I believe at the same time that the legislature enacted SB 21. It doesn’t seem to me that changing NOL rules for just one industry would be constitutional, but it will be interesting to see whether the legislature… Read more »