On Friday (9/14/2018) I wrote an article about a questionable loan the Department of Revenue (DOR) made to an entity called Mustang Operations Center #1 (MOC1) in October of 2015. The article, Questionable Department of Revenue Loan Scheme Leads to Request for Audit from State Senator, gives some background on the loan and the involvement of the Alaska Industrial Development and Export Authority (AIDEA) in the project. It also includes a letter from Senator Bert Stedman (R – Sitka) sent to the Legislative Budget and Audit Committee requesting an audit of the loan.

The article also states that I was made aware of a report that was sent to Stedman from DOR about the loan, and that I had put in a request for it. I was able to obtain the report. It provides answers to many of the questions in the article, and raises more questions.

The entire report can be seen here:

Revenue Report to LB&A re MOC1 Loan 04062018

A Timeline of Events

The report includes a timeline that is very helpful in understanding what happened. The loan scheme, designed to use general fund money to loan to companies who were owed oil tax exploration credits, was first thought up in the summer of 2015. That is when DOR sought a legal opinion from the Department of Law (DOL) to “create a tax credit backed lending program using general funds or constitutional budget reserve (CBR) funds.” This occurred at the same time Governor Bill Walker made his initial veto of the oil tax credit payments.

DOL issued a an opinion about the proposed program on August 12, 2015. The opinion is not available, citing attorney-client privilege. It does say that DOR will provide the opinion to Legislative Budget and Audit for the purposes of the audit.

The loan was made on October 1, 2015. It was a Line of Credit for $22.5 million, at an interest rate of 7%. Principal and interest was supposed to be paid back by December 31, 2016. On October 2, 2015, the first draw was made for $16,184,155. The second draw for $2,480,635.49 was made on December 29, 2015. The third draw of $651,845.07 was made on February 9, 2016.

On June 13, 2016 the maturity date of the loan was extended to December 31, 2017. This extended the original maturity date by a year. Fifteen days later, Governor Walker vetoed $430 million of the $460 million in the budget for oil and gas tax credits. It is likely DOR knew this was coming and this is why they extended the maturity date on the loan.

On July 1, 2016 DOR amended its General Fund and Other Non-segregated Investments (GeFONSI) investment policy to include tax credit loan asset allocation of up to 2% of assets. This is interesting because the loan was made in October of the previous year. Prior to this change the policy allowed for them to invest these assets, not loan them. It appears the policy was amended retroactively to allow for this loan.

On July 25, 2017 the maturity date was extended for the second time to July 15, 2018. Again, this was likely due to the tax credits being vetoed.

On February 5, 2018 MOC1 made an interest payment of $1.66 million to DOR. This is the only payment they have made to date.

In January 2018, Mike Barnhill, Deputy Commissioner of Revenue, was made aware of this loan by staff. He was not at DOR when the loan was made, neither was the current Commissioner, Sheldon Fisher. Randy Hoffbeck was the Commissioner when the loan was made.

On March 1, 2018 Deputy Commissioner Barnhill asked the AIDEA board to assume the loan. They said they would take 30 days to decide. But just 12 days later AIDEA proposed to sell MOC1 assets and liabilities to Brooks Range Petroleum, the operator of the unit. Two weeks after that, DOR recused themselves from the AIDEA board of directors because of the obvious conflict of interest. Two days after that, DOR sent the AIDEA board of directors a letter requesting that AIDEA assume the loan.

What Happened Next

The loan was supposed to be short term. The maturity date has been extended twice since the loan was made. The last extension was to July 15, 2018, which means the loan is currently past due. It is not technically in default because DOR has not sent MOC1 a demand letter yet.

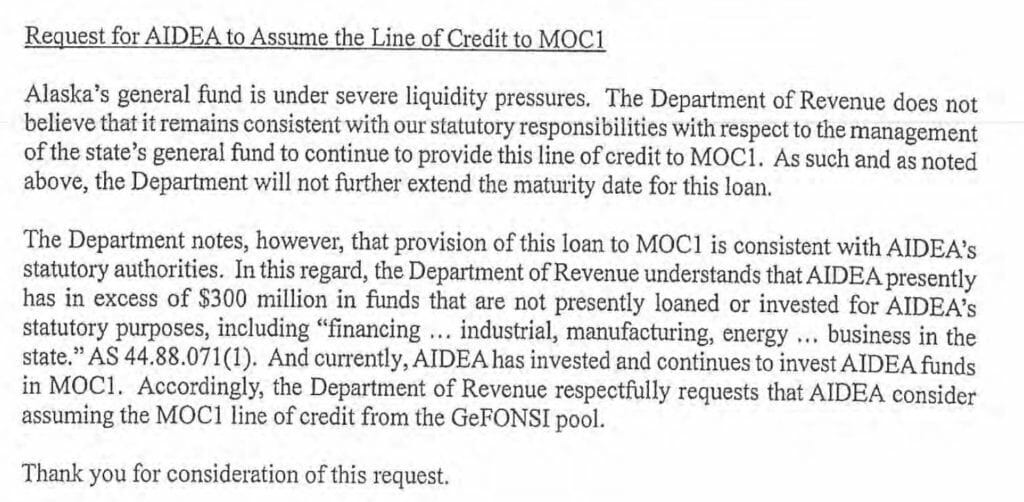

On March 30, 2018 Pamela Leary, Director of the Treasury Division, sent a letter to John Springsteen from MOC1 (he is also the CEO and Executive Director of AIDEA) asking that AIDEA assume the loan. The letter can be found in the report above. Here is the important part:

According to Deputy Commissioner Barnhill, DOR is close to coming to a deal with AIDEA where they will guarantee the loan. When this happens, the maturity date will be extended to a point when the current litigation, over a bill that was passed this session to pay off the outstanding oil tax credits by issuing bonds, is resolved. If the lawsuit is not successful and the bonds are sold, then DOR will get paid back, minus the discount that the bonding bill includes. AIDEA will need to cover the difference, which should be 5-10%. If the lawsuit is successful, AIDEA will need to cut a check to DOR to pay off the loan. Then they will assume the liability. Either way it looks like the general fund will be paid back for the loan. But other questions remain about the loan.

Whose idea was it? Why were no other companies who were owed oil tax credits offered a loan under this program? Did MOC1 get preferential treatment because of AIDEA’s financial interest in the project? Where did the money go? Why did the AIDEA board vote to sell MOC1 assets and liabilities to Brooks Range Petroleum?

According to the report, once the loan is repaid the loan program will be closed. They have already amended their GeFONSI investment policy back to only allow only for investments, not loans. It would be interesting to see what the Department of Law opinion said about the authority to make the loan. If it said DOR had the authority to make the loan, why did they change the policy back?

Many questions remain to be answered about this loan. It seems strange that at a time when the state was facing huge deficits, which Governor Walker partially addressed by vetoing the oil tax credits, a loan was made using general fund assets to only one company. A company that was mostly owned by AIDEA, who has had a long history of investment and involvement in this project.

I reached out to Governor Walker’s office asking for a comment or explanation about why the loan was made and whose idea it was. I also plan on reaching out to AIDEA with some questions. I will provide more information regarding this story as I get it.

Walker and Palin mirror each other. Neither of them believe that investment made by private industry remains private money, that whatever comes into Alaska must belong there and is not owned by who brought it there. Oil companies to them are invaders, while still providing a working environment so their kids can eat. When they can claim that standing up for Alaska is right, while they’ve been on the take too it shows their hypocrisy.

Try and keep the comments reality based.