In February, the Department of Natural Resources (DNR) approved a 76% decrease in royalty payments for HEX/Furie, owned by John Hendrix. This applies to gas leases he holds in the Cook Inlet, known as the Kitchen Lights Unit.

The state normally charges a 12.5% royalty, but agreed to reduce it to 3% starting September 1, 2024. According to the Findings and Determination Regarding the Kitchen Lights Unit Royalty Modification Application obtained by the Landmine, the royalty won’t go back up to 12.5% until a gross revenue target of $712 million is met. So it’s going to be a while.

Hendrix is also expected to drill more wells as part of the deal.

Hendrix had long been asking for a royalty reduction form the state. He put in his application on September 5, 2024 after working with DNR for sometime. DNR Commissioner John Boyle approved the royalty reduction on February 4, 2025.

The Landmine has learned from DNR that the royalty reduction was backdated to September 1, 2024. DNR told the Landmine, “The Kitchen Lights Unit (KLU) royalties above the 3% level paid between the effective date of September 1, 2024 and the date of the Final Finding and Determination of February 2, 2025 have been placed in a suspense account by the Alaska Division of Oil & Gas, and are being credited to currently-due royalties. This amount was less than $2 million.”

DNR has not responded to a follow-up question asking for the exact amount of money in the suspense account.

The $2 million represents a period of just over five months from September 1, 2024 to February 2, 2025. That works out to approximately $400,000 a month in royalty payments. At the 76% reduction, Hendrix will not have to pay any royalties to the state for around 20 months, unless he produces more gas and the royalty payments increase.

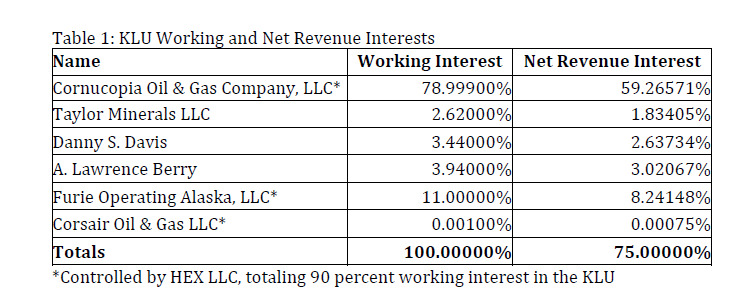

Hendrix controls 90% of the working interest of the KLU. Three others own the other 10%.

Oil and Gas Production Tax Reports show that since Hendrix bought HEX/Furie out of bankruptcy in 2019, he has received more than $103 million in cashable credits that were previously owed to the former owners. It’s not clear why he could not or did not use those funds to drill more gas wells in Cook Inlet.

In 2021, Hendrix tried to get the Department of Revenue to cut his property tax payment by 90%. The State Assessment Review Board (SARB) ruled twice against Hendrix, first in May 2021 and again in May 2022. Both times, they upheld the state’s assessment. Both were unanimous decisions. Hendrix then sued in court and lost. This Landmine article provides more detail.

Brian Fechter, who was deputy commissioner for the Department of Revenue when Hendrix was demanding the massive property tax reduction told the Landmine, “One of the most surreal moments of my career was walking into a meeting and being told to the dollar how much John Hendrix contributed to the Governor’s reelection campaign, but no one could tell me how the 90% tax cut in perpetuity he’d argued for in front of SARB didn’t violate Alaska’s prohibition on settling future tax debts under AS 43.50.060.”

Sec. 43.05.060. Agreements with department respecting liability states:

The department may enter into an agreement with a person relating to the liability of the person, or of a person or estate the person represents, for a tax, license fee, or excise tax for a period ending before the date of the agreement. If the agreement is approved by the attorney general, the agreement is final and conclusive and, except upon a showing of fraud or malfeasance, or misrepresentation of a material fact, the case may not be reopened as to the matters agreed upon or the agreement modified. In a suit or proceeding relating to the tax liability of the taxpayer the agreement may not be annulled, modified, set aside, or disregarded.

State lawmakers and officials have been concerned about dwindling gas production in Cook Inlet from Hilcorp, who produces the vast majority of gas in Cook Inlet. Hilcorp has not asked for any tax or royalty reductions, and has made substantial investments in Cook Inlet since they operating in 2012.

DNR told the Landmine, “The well that was drilled and activity last fall has already increased production at KLU, and DNR anticipates more drilling to commence in the near future this season consistent with the current Hex/Furie Plan of Development commitments. This production will accrue royalty at the 3% rate until the KLU royalty modification terminates.”

Hilcorp has not asked for any tax or royalty reductions because as an S Corp they benefit from a loophole that allows them to avoid paying state corporate income taxes.

It’s not a ‘loophole’ if it is legal per the law.

Exactly. We’re holding the door open for them and then accusing them of malfeasance when they walk through it.

“We have found the enemy, and he is us.”

Wait, isn´t that the definition of a loophole?

Hendrix wasn’t asking for a tax cut. He was asking for a different valuation. The valuation methodology in the statute is ridiculous.

An interesting decision from DNR, especially considering the current economic situation. Supporting such companies can play a dual role – both as an incentive for the industry and as a controversial precedent regarding the allocation of budget funds. Everything, as always, depends on implementation and control.

And if someone is more interested PayDaySay in personal finance, here is a good overview of alternatives to Lendly, it may be useful.