In recent conversations, some have continued to use the impact of federal income taxes on Permanent Fund Dividends (PFD) to rationalize their support for PFD cuts.

PFDs are subject to federal income taxes. The argument, as a result, is that distributing PFDs “leaks” money out of Alaska to the federal government. By cutting PFDs, a portion of that which would otherwise “leak” to the federal government stays in the state, increasing the level of state revenues available to support spending.

But that only examines one half of the issue. The other half is whether there are other approaches that offset or mitigate the leakage. If there are, then the issue becomes much less important, if not moot.

The fact is that there are other approaches that not only offset the leakage but indeed could potentially reduce the burden on Alaskans of meeting the state’s revenue requirements. Either a state sales tax or income tax could be designed to raise the same amount of revenue as is being generated using PFD cuts. Because such a tax would apply broadly, a portion of the revenue would come from non-residents, thereby bringing outside money into the state’s economy.

In essence, the approach would create “reverse leakage,” bringing in revenue that would not otherwise be in the state.

The revenue impact on state revenues from substituting a broad-based tax for using PFD cuts would be neutral if the state tax was designed to raise the same amount of revenue from non-residents as is being “leaked” to the federal government from PFDs through federal income taxes. The amount of outside money coming into the state treasury would equal the amount going out through the “federal leakage.”

But, more importantly, the revenue impact on state revenues would be positive – that is, there would be more outside money coming into the state than the amount “leaking” to the federal government – if the state tax was designed to raise more from non-residents than is being leaked to the federal government from PFDs through federal income taxes. The impact on individual Alaskans would also be positive. Even after accounting for federal income taxes, Alaskans would keep more in their pockets because non-residents are paying a larger share of the costs of government.

The threshold is not huge. According to the most recent state-level data from the Internal Revenue Service (IRS), the average federal income tax rate paid by Alaskans is around 12.7%. If the amount of outside revenue raised by state taxes exceeded that amount, Alaska – and Alaskans – would enjoy a net gain from the trade-off.

Designing a broad-based tax system to achieve that seems easily accomplishable. According to this past February’s edition of the Alaska Department of Labor’s Alaska Economic Trends, “Over the last 30 years, nonresidents have made up about 20 percent of Alaska workers each year on average. While the number does change from year to year, swings of more than a percentage point are unusual.”

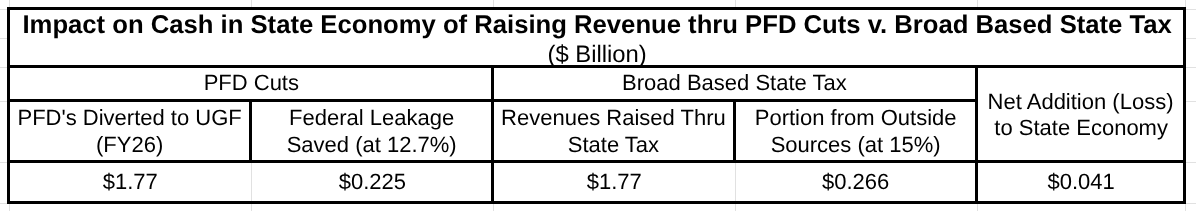

For Fiscal Year (FY) 2026, the Legislature has diverted $1.77 billion from PFDs to support spending. As we explain in the following chart, designing a state tax system that raises 15% of that amount from non-residents would result in a net gain to the Alaska economy of $41 million (or 2.3% of the total revenues raised).

The net benefit could be even larger. In an opinion piece in the Anchorage Daily News written in 2023, Institute of Social and Economic Research (ISER) Professor Matthew Berman described an approach where the PFD could be used as a credit against state taxes, which would enable it to avoid being treated as income for federal income tax purposes. As we outlined in a follow-up column, the approach could significantly reduce federal leakage from PFDs, potentially by more than 50%. Combining the two approaches in developing a replacement state tax for PFD cuts could result in a substantial net benefit to Alaska – and Alaskans.

If such alternatives would result in a net benefit to Alaska and Alaskans – and they would – a reasonable question is why neither the Governor nor Legislature has pursued them. Do they not care about Alaskans having more money in their pockets?

Much of the answer lies in the alternative’s distributional impacts.

As we have explained in previous columns, the impact of using PFD cuts to fund government falls heaviest on middle and lower-income Alaska families. Those in the upper-income bracket contribute a trivial share toward government costs, and non-residents contribute zero. The latter two become free riders on government services, riding on the backs of middle- and lower-income families.

Broadening and flattening the base through the use of a broad-based state tax would change that. Assuming a tax that raised revenues from all income brackets and non-residents proportionately would reduce the current impact on middle and lower-income Alaska families, but increase it for those in the upper-income brackets and non-residents. Rather than continue to free-ride on government services at the expense of middle- and lower-income families, those in the upper-income brackets and non-residents would also bear a material share of the costs.

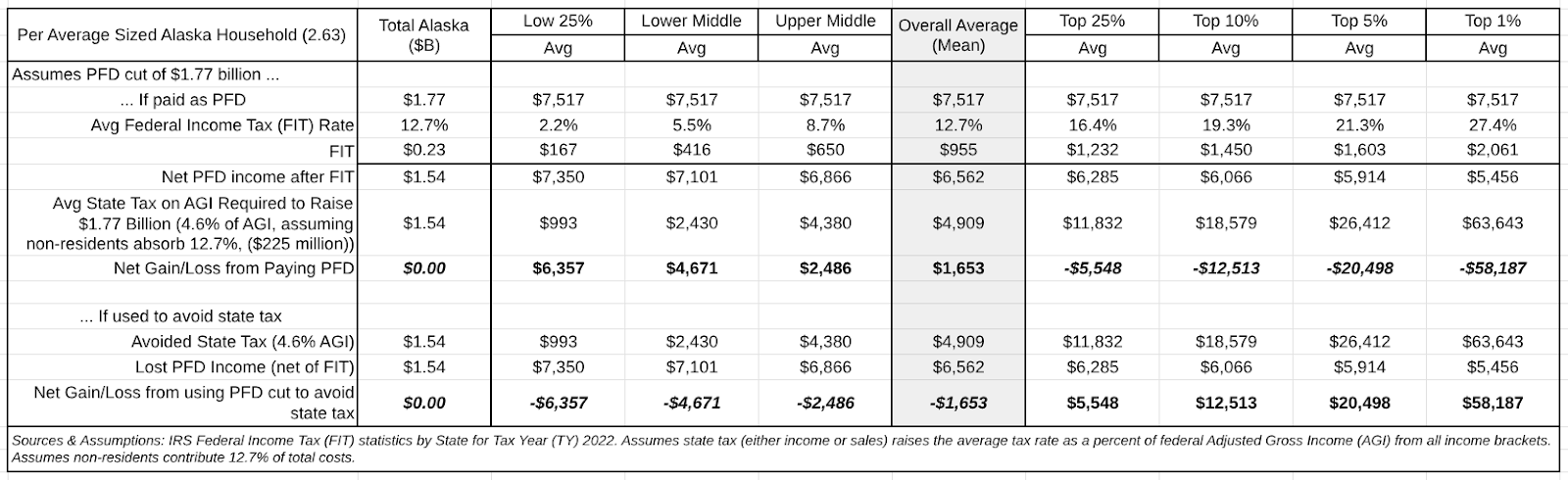

Using the average federal income tax rates paid by Alaskans by income bracket from the most recent IRS data and the FY26 PFD level ($3,858/PFD), the following chart illustrates the impact of the two approaches.

The first half of the chart calculates the impact that would result if the PFD were distributed to Alaska households in accordance with current law, paired with a state tax that raised the same amount of revenue previously generated through PFD cuts. Using the overall average (the area shaded in gray) as an example, households in that range would receive approximately $7,517 in PFD distributions, on which they would pay roughly $955 (12.7%) in federal taxes, resulting in a net gain of $6,562 after federal income tax. As is clear from the chart, the net gain, after federal income tax, would be greater among middle- and lower-income households than the overall average, while it would be lower among upper-income households.

As the replacement for PFD cuts, we have utilized a state tax designed to raise the same $1.77 billion in revenue that is being diverted this year through PFD cuts. Assuming 12.7% of the revenue (the same as the “federal leakage” from paying a full PFD) is recovered from non-residents, the tax rate would be approximately 4.6%. As the chart demonstrates, even after accounting for the offsetting state tax, the net gain realized from distributing a full PFD to those falling around the overall average would remain positive, at approximately $1,653, with the net gain even greater among middle and lower-income Alaska households.

While those households in the upper-income brackets would pay more under the alternative than they do using PFD cuts, using a flat rate of 4.6% to calculate state taxes, they would pay no more as a share of income than middle and lower-income Alaska households. It only appears that they would pay more using state taxes because they have been contributing disproportionately less than middle and lower-income households through PFD cuts.

The second half of the chart calculates the impact that results from continuing the current approach of using PFD cuts to fund government. By enabling them to avoid state tax, this approach continues to result in a benefit for those in the upper-income brackets. That benefit comes at the expense, however, of the roughly 80% of Alaska households falling around the overall average and in the middle and lower-income brackets.

In short, assuming the replacement for PFD cuts was designed to raise at least as much from non-residents as the amount of the “federal tax leakage” from distributing PFDs (the neutral case), Alaska as a whole would come out the same, and roughly 80% of Alaska households – those falling in the middle and lower-income brackets – would fare better by distributing PFDs and using a state tax to recover the same amount instead.

If the replacement for PFD cuts were designed to raise even more from non-residents than the amount of the PFD-related “federal tax leakage,” both the state as a whole and the same, roughly 80% of Alaska households, would fare even better. Those in the upper-income brackets would also fare better than in the “neutral” case as a result of increasing the revenue raised from non-residents. Because non-residents are contributing more than in the neutral case, Alaskans would contribute less. Even then, though, those in the upper-income brackets and non-residents would still pay more than using PFD cuts.

This helps answer the question of why neither the Governor nor the Legislature has pursued the various alternatives to PFD cuts that would result in a net benefit to Alaska and Alaskans. While such alternatives would at least be neutral, if not beneficial to, the state – and with it, roughly 80% of Alaska families – by leveling the contributions among income brackets and non-residents, they would increase the contributions currently required of those in the upper-income brackets and non-residents.

Together, they currently seem to have a much stronger voice with the Governor and the Legislature than the remaining 80% of Alaska households.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Good Lord.

“,,,,,,, Either a state sales tax or income tax could be designed to raise the same amount of revenue as is being generated using PFD cuts………”

The solution to losing money to taxes is to instill yet more taxes. You’re a freaking genius.

Not more; different, more equitable and lower impact replacement taxes. (Because of their massive regressivity, PFD cuts – which, like tariffs, also are taxes by another name – have the “largest adverse impact” on the overall economy and are “by far the costliest” approach for Alaska families. Either a state sales or income tax would have far lower impacts on both.)

“…….Not more; different……..”

How are you going to magically do away with the federal income taxes levied against PFD’s? You clearly offered the “solution” of new state taxes to offset the loss represented by federal income taxes on PFDs to the state economy. If the federal taxes remain, and new state taxes are levied, it is “more”, “additional”, “increased”, taxation on individuals.

Please stop the word games, Mr. Lawyer.

Hahahaha, you must be having problems with english. Let us help. The state tax is a replacement for PFD cuts/taxes. One tax minus (replacing) another = zero “more,” “additional,” or “increased.” Basic math. But then, your comments repeatedly appear to struggle with that. ¯\(ツ)/¯

“……..you must be having problems with English……..” I’ve always had difficulty with the English used by lawyers. Again, you started this article whining about federal income taxes paid by individuals (as unarmed income) to the feds and how that money left Alaska for Washington DC,. You then proposed a state tax to regain that money for the state,, and you do it again in the paragraph above this one. I ask how you are going to do away with the federal income tax. Of course, you don’t simply say that the PFD will be done away with (must be, eventually)… Read more »

Why not just rebrand the PFD as a cost of living allowance? Then it could be made tax exempt.