Monthly, three major organizations publish detailed updates of their views of the global oil markets, which we review carefully.

The updates from two of them – the International Energy Agency (IEA) and the Organization of Petroleum Exporting Countries (OPEC) – broadly discuss developments affecting supply and demand, which impact price. They usually do not discuss price directly, however.

The third, the Short Term Energy Outlook (STEO) published by the US Energy Information Administration (EIA), not only discusses price, but also projects what it sees for price levels through the end of the following year. Reading the three together provides a good overview of the current condition of the oil market and, through the STEO, the impact of that condition on price.

This month’s reports from the three organizations, published earlier this week, paint a disquieting picture. The OPEC and IEA reports go in opposite directions. While OPEC forecasts strong demand growth sufficient to absorb anticipated supply growth from the recently announced rollback of previous production cuts by OPEC+, IEA is much less sanguine about demand, suggesting that demand growth will remain limited as OPEC+ unwinds its earlier production cuts, leaving oil markets “bloated” with oversupply. Given its view of the disconnect between supply and demand, IEA concludes its update with the warning that “it is clear that something will have to give for the market to balance.”

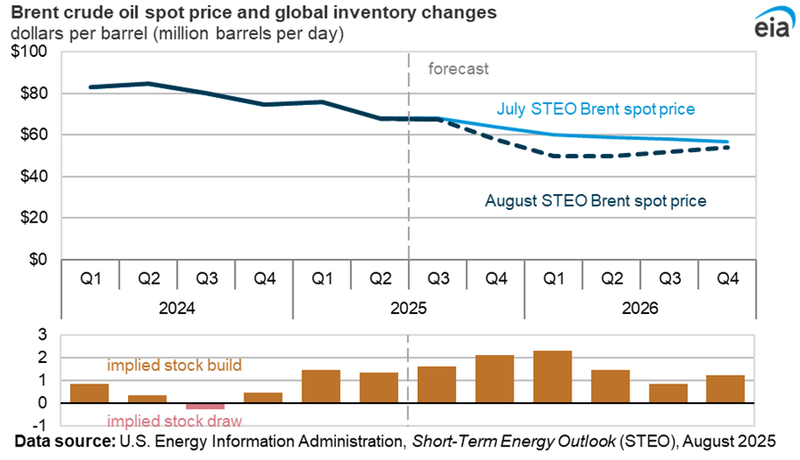

EIA’s August report is consistent with IEA’s view of the supply/demand balance and is clear about what it thinks will “give” in response: price.

In a significant revision to prior reports, EIA’s August forecast drops the projected average Brent oil price precipitously, from an average for Alaska Fiscal Year (FY) 2026 (Q3 2025 – Q2 2026) of $63/barrel in its previous report to $56/barrel, and from a midpoint for Alaska FY 2027 (Dec 2026) of $57/barrel in the last report to $54/barrel.

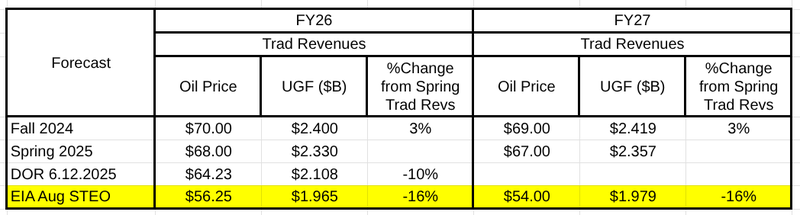

Flowing through the impact of the changed price forecast to projected Alaska traditional unrestricted general fund (UGF) revenues results in a significant change in outlook. The following chart tracks projected FY26 and FY27 oil prices and resulting traditional revenues from the forecast included in the Department of Revenue’s Fall 2024 Revenue Sources Book, on which Governor Mike Dunleavy’s (R – Alaska) original FY25 budget was based, through to the EIA’s most recent forecast.

As the chart shows, each subsequent forecast of both oil price and the related level of UGF revenues is below the previous one. Traditional UGF revenues projected in DOR’s Spring 2025 Revenue Forecast (Spring 2025 RF), on which the Legislature based its FY26 budget, were already 3% below those on which the Governor’s FY26 budget proposal was based.

Due to additional price attrition in the meantime, subsequently, DOR issued a revised revenue forecast for FY26, on which the Governor’s FY26 vetoes were based, which projected an additional 10% drop in traditional UGF revenues over those projected in the initial Spring 2025 RF.

Incorporating the average oil prices now projected in EIA’s August forecast cuts those revenues by an additional 6%, reflecting a total drop in revenues of 16% for FY26 from the Spring 2025 RF. Incorporating the midpoint FY27 oil price in EIA’s August forecast cuts projected FY27 traditional UGF revenues, which will form the basis for the budget considered in next year’s legislative session and at least the early days of the 2026 gubernatorial and legislative races, by a similar 16% from those included in the Spring 2025 RF.

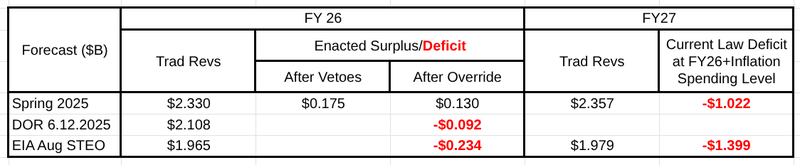

Understandably, the drop in projected traditional UGF revenues also has a significant impact on the FY26 and projected FY27 budgets.

As the chart shows, after the Governor’s vetoes, the Legislative Finance Division (LegFin) projected the FY26 budget would result in a “surplus” (more accurately, an excess cut in the Permanent Fund Dividend) of $175 million. Reversing the Governor’s line item veto for K-12 funding and incorporating DOR’s revised FY26 forecast reduces that by roughly $267 million, resulting in a deficit of approximately $92 million.

Incorporating the further drop reflected in EIA’s August forecast creates an additional shortfall of approximately $143 million, resulting in a total projected FY26 deficit of nearly $235 million.

The outlook for FY27 is even worse. Assuming FY27 spending only grows over FY26 at the rate of inflation – an heroic assumption given the recent past and the amount of spending deferred in the FY26 budget – incorporating the FY27 price forecast reflected in EIA’s August forecast results in a current law FY27 deficit of at least $1.4 billion. Offsetting that entirely through PFD cuts leaves only roughly 13% of the projected FY27 percent of market value draw (POMV), or approximately $530 million (around $800/individual), for the PFD.

Of course, these calculations are based entirely on EIA’s August forecast, which in turn is based on certain assumptions about global supply and demand over the next 18 months. If global demand doesn’t slow or global oil supplies don’t surge as much as EIA’s calculations assume, oil prices may end up higher than projected in the August forecast. Also, Alaska oil periodically commands a premium over Brent, which could mitigate the extent of the impact.

But either of those changes in market direction will likely take some time to become apparent. And Alaska oil sometimes sells at a discount to Brent, which would make the impact worse. For the present, EIA’s August outlook is likely to remain essentially unchanged barring currently unforeseen events, and the view is also expected to be increasingly reflected in the future markets.

Which leads us back to the title for this week’s column: “What every candidate (and campaign manager) should prepare for.”

While Alaska has faced significant drops in oil revenue in the past, many of those have occurred when the state had substantial fiscal reserves in place. During the price drops in the early and mid-2010s, for example, the state was able to call on significant reserves which had previously been banked in both the Statutory Budget Reserve and the Constitutional Budget Reserve. When those ran low, the state started calling on Permanent Fund earnings, first in the form of cuts in the PFD, then even larger amounts in the form of the statutory POMV draws.

At this point, however, with the state’s fiscal reserves largely drained, the POMV draw at full statutory levels and only a minimal PFD remaining, the state has few of its traditional fiscal tools – even the bad ones – to fall back on to soften the impact of a significant oil price drop. Instead, the state will be faced with two choices: (1) implementing huge and, based on the state’s experience in 2019, likely unachievable spending reductions; or (2) developing and implementing new revenue measures that position it to raise additional revenues.

As the 2026 election cycle develops, state candidates should be prepared to address that issue with more than off-the-cuff responses. Given the attention given to the state budget – and the (unfortunate) level of dependence of vast portions of the state’s economy on it – candidates may well be judged on the reality and thoughtfulness of their replies.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

i will be the first to comment, probably the only one. A lot of data points to wade thru, in todays american world, entirely worthless. if the folks currently in charge of the american govt don’t like the reality, then deny it. for example, in juneau the retail price of a gallon of gasoline at the pump has risen from $3.20 in Jan. 2025, to $3.68 gallon as of 8-16. as a purchaser, than reflects almost 50 cents a gallon more. but the official US govt number will say that is actually a 50 cent reduction in the retail price.

Oil is more than a commodity. It’s also a political weapon. As I type, the Trump Administration is working toward shutting down the Russian oil market, with help from Middle East OPEC members. Thus, supply is about to be changed in myriad ways, but more towards where the supply comes from, not so much an increase in overall supply. Another consideration is how it’s a weapon used by our own governments against us. Recently, for the first time in history, Anchorage gasoline prices rose above those of Mat-Su. Then they rose more. This was due to Anchorage passing a muni… Read more »

This post highlights the importance of strategic preparation for candidates, which is crucial in today’s fast-paced political landscape. I’d love to see more discussion on how these tactics can be adapted for grassroots movements. Engaging with constituents effectively could bring about broader democratic participation and strengthen community ties—an essential aspect of our evolving political discourse polytrack.