Recently, we have been spending time diving into Census Bureau data to better understand the impact of various fiscal options across Alaska’s state legislative districts.

As some will know, every year, as part of its regular American Community Survey (ACS) 5-Year Data update, the Census Bureau provides a breakdown of significant economic data by state legislative districts. We have been focusing on the most recent update, which covers calendar years 2019 – 2023 (stated in 2023 dollars) and breaks down the data by the current legislative districts adopted in 2022. Some of that data is also captured on the University of Alaska – Anchorage Center for Economic Development’s website.

Within the ACS update, we have concentrated on two data points in particular. The first is median household income; the second is average household size. Median income means the middle; there are as many households with higher incomes as lower. Average household size is the mean; it’s calculated by dividing the total population by the number of households.

As might be expected, there is a wide spread in income within the state. At $160,717, House District 9 (Representative Ky Holland, I – Anchorage) has the highest median household income in the state; just a few miles up the road, House District 19 (Representative Genevieve Mina, D – Anchorage) has the lowest at $56,484. Statewide, the median household income is $89,336.

There is also a significant spread in average household size. At 3.81, House District 38 (Representative Nellie Jimmie, D – Toksook Bay) has the highest average household size in the state. Somewhat surprisingly, at least to us, House District 17 (Representative Zack Fields, D – Anchorage) has the lowest at 2.08. Statewide, the average household size is 2.63.

Those who read these columns will know that we regularly analyze the impact of various fiscal options by income bracket. Using the ACS data, we can also explore the effect by House district.

We start by calculating the impact of cuts in the Permanent Fund Dividend (PFD) by district. Using data from the Permanent Fund Corporation’s “History and Projections” reports and from the Permanent Fund Division of the Department of Revenue, we have calculated that the average annual PFD cut over the same time period as the ACS data we are using — calendar years 2019 – 23 — is $1,734. Using that, we have calculated the impact per average household within each District by multiplying the average annual PFD cut by that District’s average household size.

From that, we have then calculated the approximate impact of using PFD cuts by median income household within each district, by adding the amount cut to the median household income to approximate total income had the PFD been paid, then dividing the amount of the PFD cut by the sum to determine the impact of cutting the PFD, instead of paying it.

We recognize that the resulting numbers are approximations. Not all households in the state qualify for PFDs, and there may be slight differences in the sizes of the average and median households by district. But the data is close enough to provide reasonable approximations of the impact on those households that do qualify for PFDs.

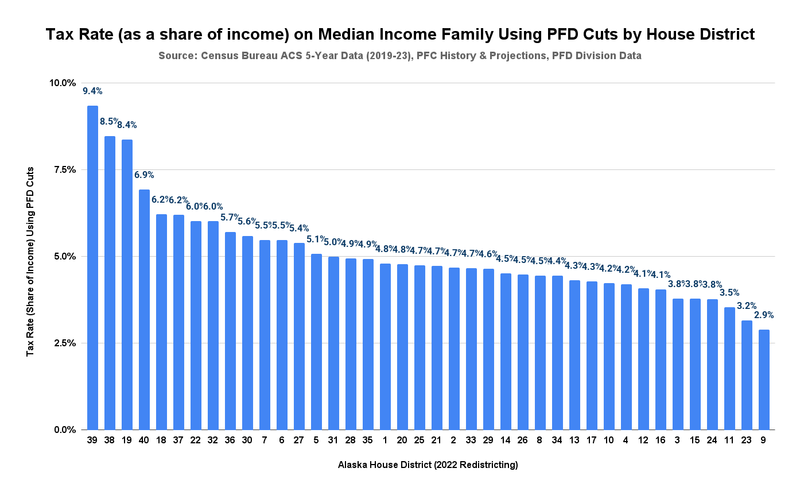

Here is the result by House district. (For those who want a quick way to match district numbers to representatives, use this link to the legislative website.)

The differences are stark. The most significant impact, at 9.4%, is on the median income household in House District 39 (Representative Neal Foster, D – Nome). The second- and third-largest, at 8.5% and 8.4%, respectively, are on the median income households in House Districts 38 (again, Jimmie) and 19 (Mina).

The lowest impact, at 2.9%, is on the median income household in House District 9 (again, Holland). The second- and third-lowest, at 3.2% and 3.5%, respectively, are on the median income household in House Districts 23 (Representative Jamie Allard, R-Eagle River) and 11 (Representative Julie Coulombe, R-Anchorage).

Using the ACS data, the impact on the statewide median income household is 4.86%. The districts coming closest to that are House Districts 28 (Representative Elexie Moore, R-Wasilla) and 35 (Representative Ashley Carrick, D-Fairbanks), both at 4.9%, and House Districts 1 (Representative Jeremy Bynum, R-Ketchikan) and 20 (Representative Andrew Gray, D-Anchorage), both at 4.8%.

As shown in the above chart, the distributional spreads are also significantly regressive. The impact on the median income household in House District 39 is more than 3 times that on the median income household in House District 9, and is still nearly twice that on households near the statewide median. The impact on households near the statewide median is still nearly two-thirds (67%) higher than on households in the least-impacted districts.

To gauge the comparative impact of alternative fiscal measures, we have calculated the approximate impact on the same districts of a broad-based flat (either income or ultra-broad-based sales) tax designed to raise the same amount of revenue. In addition to flattening the burden across income brackets, a significant advantage of a broad-based tax is that it would also raise revenue from non-residents, materially lowering the burden on residents. By reducing the burden on the vast majority of residents, as well as bringing new cash into the state economy, the approach would also materially strengthen the overall Alaska economy.

To calculate the rate, we have reduced the effective impact on the statewide median income household from PFD cuts (4.86%) by 15%, an approximation of the amount that would be raised instead from non-residents through a broad-based tax. The remaining rate is 4.13%. (As we have explained in previous columns, because an ultra-broad-based sales tax would expand the tax base even more, the remaining rate using that approach would likely be even lower.)

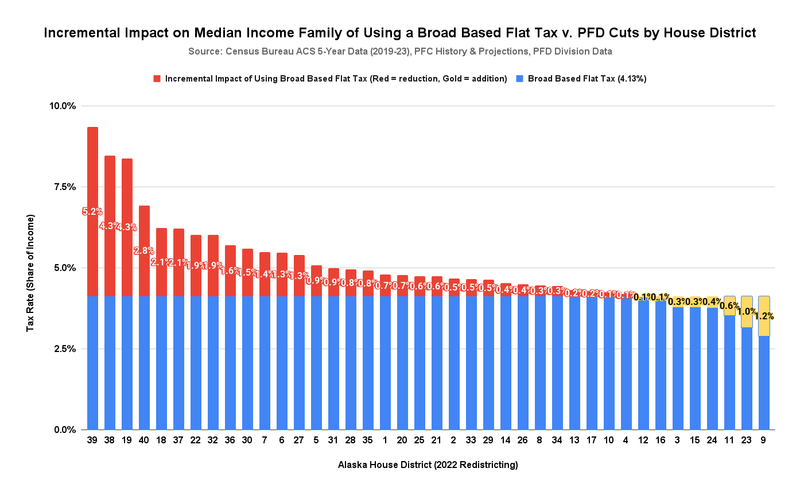

Here is the result of using the 4.13% rate by House district.

The blue bars (or outlines) show the impact of a flat-rate tax across House districts. Every household in every district would contribute the same share of income (4.13%) to cover the costs of state government. The red and gold bars show the incremental change from that approach, compared with the impact from PFD cuts.

For example, the impact of substituting a flat tax for PFD cuts on the median income household in House District 39 (Foster) would be a decrement (reduction) of approximately 5.2% (rounded). The share of income taken to cover state spending would drop from 9.4% of median household income using PFD cuts to 4.1% using the flat tax. That’s more than a 50% drop.

On the other hand, the impact on the median income household in House District 9 (Holland) would be an increase of approximately 1.2%. The share of median household income required to cover state spending would increase from 2.9% with PFD cuts to 4.1% with the flat tax. While an increase, it’s only a fraction of the offsetting impact of the drop in House District 39.

And the households in House District 9 would still only pay the same share of income as those in House District 39. They would not be required to contribute any more as a share of income than everyone else.

Driven in material part by the expansion of the tax base to include non-residents, the median income household in 32 (or 80%) of the state’s 40 House districts would see a reduction in the share of income taken by state government. Of those, the median income household in 10 House districts would see a reduction of 1.5 or more percentage points, and the median income household in 14 more House districts would see a reduction of 0.5 or more percentage points.

Rather than being near the overall, statewide median, the residents of House Districts 28, 35, 1, and 20, also would see their economics improve materially, with decrements (reductions) in state take of between 0.7 and 0.8 percentage points.

Only eight (Districts 9, 23, 11, 24, 15, 3, 16, and 12) would see an increase, and of those, five (Districts 24, 15, 3, 16, and 12) would see a relatively negligible increase of less than 0.5 percentage points. Only three House Districts – the state’s wealthiest in terms of median household income (Districts 9, 23, and 11) – would see a greater increase, and even then, the increase for all three would be less than 1.5 percentage points, far less than the 10 seeing a reduction of the same amount or more.

In short, the median income household in 80% of Alaska House districts – and from the perspective of the Governor, the statewide median income household overall – would be better off economically using a flat rate tax of some sort than PFD cuts to pay for the costs of state government. While the median income household in the remaining 20% of Alaska House districts – the state’s wealthiest – might contribute a bit more, the percentage increase would be far less than the improvement realized by the vast majority of the state’s households; most importantly, those in the remaining 20% would be required to contribute no more as a share of income than anyone else.

Put differently, using the words of Article I, Section 1 of the Alaska Constitution, “all persons [would be] equal and entitled to equal rights, opportunities and protections under the law.” As a share of income, all would have the same “corresponding obligations to the people and to the State” for the costs of state government.

Some argue that the PFD is “free money” and that Alaska families should be okay with receiving less of it, even if there are lower-impact alternatives for the vast majority of households to raise the same amount of revenue.

But as we’ve explained in previous columns, the money doesn’t become less “free” when it’s redirected, directly or indirectly, to others. Instead, it’s the others – including non-residents – who, by avoiding making proportionate contributions to government costs, receive the “free” benefit instead of Alaska families.

Redesigning how the state raises revenue would ensure that all Alaskan families benefit equally from the funds. We continue to struggle to understand why the Legislature and Governor haven’t pushed forward with an approach that would materially improve the economic situation of the vast majority of their constituents.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“……..Some argue that the PFD is “free money”……….the money doesn’t become less “free” when it’s redirected, directly or indirectly, to others………” No shit. It never becomes “less free”. It is free today, yesterday, and tomorrow as long as it’s dispensed. The problem is when the “free money” continues to be dispensed and new or renewed taxes must be instituted in order to continue because earnings from current corporate taxes, royalties, and investments aren’t enough. If you want to play the poor people bleeding heart game, that’s nothing new, either. If people need welfare, we already have multiple layers and programs… Read more »

I’m not cued into whatever deal Trump made with China but I’m sure it’s something along the lines of the oil companies sell china crude for a 20% discount and then china sells us the gasoline back at full price.

Not a great deal. It would be smarter to create a department of oil, build a refinery in Anchorage, add value to the product and keep the profit.

And I would encourage anyone who would level the accusation of “communist” at me to explain how triangular trade with the Chinese Communist Party is embodying the ideals of free market capitalism. I simply think we’re getting screwed.

Only a silly person would advocate for a flat sales tax on food, housing, and fuel. Are we really going to tax low income earners at a flat rate? Sus. They can hardly get by today. Brad is not serious and makes mistake after mistake after mistake in his analyses.

A broad-based flat tax would take less from middle- and lower-income families (80% of Alaska families) and the median-income family in 80% of Alaska House Districts than PFD cuts would. Restoring PFDs and using a broad-based flat tax to raise the same revenues instead would increase the income of middle- and lower-income families, and the median-income family in 80% of Alaska House Districts, and with that, improve the overall Alaska economy. Some seem to prefer continuing subsidies (below average revenue rates) to the Top20%, non-resident driven industries, and oil companies at the expense of 80% of Alaska families and the overall Alaska… Read more »

“……..Restoring PFDs and using a broad-based flat tax to raise the same revenues instead would increase the income of middle- and lower-income families………”

How can you look yourself in a mirror after telling people that paying taxes will increase their income? Do you really think we’re that stupid?

I’m not arguing against your core position. Consumption or income taxes are effective tax policy. That’s why billions of people have it in place. Rather your analysis is poorly done and recommendations are weak. A few comments that might help… Your analysis would benefit from specific examples, not aggregates. No one identifies as the “Median District 35 Resident” they do identify as making $50K and spending x% of income on X, Y, Z… You have countless small assumptions in your post and it’s easy to pick them apart and critique. Try to make your work more simple and less “Assume… Read more »

“……..Consumption or income taxes are effective tax policy……..”

They sure are, and effective at numerous effects, too, including tax sheltering, purchasing behavioral changes, and population shifts. Anybody paying attention can recognize what has happened to California, New York, and Illinois over the past decade.

But new or renewed personal tax impositions while we have a negative tax in place (and while many scream for that negative tax to triple in amount) is economic insanity. It’s a Universal Basic Income scheme.

Appreciate your work on this, Brad. Must be like assembling a giant Leggo puzzle, directions may not all be there, parts may not all be there, but spectators …plenty of them, no? . Should these factors affect your calculations: . (1) predictable increase of sales and income taxes above initial rates as PFD’s are gradually absorbed by the State, . (2) the statistically significant effect that the proliferation of non-profit organizations and Native corporations eligible for sales and corporate income-tax exemptions will have on the “broad-based” aspect of a broad-based tax, . (3) actual cost of living calculations when comparing… Read more »

How about a flat state-wide income tax on adult residents and adult non-residents? The State income tax for residents would be based on your taxable income from all sources (based on adjusted gross income-AGI after deductions, adjustments, etc). The income tax for nonresidents would be based on taxable income (same AGI as above) from Alaska sources. You earn less, you pay less tax. You earn more, you pay more tax. No limit on upper income earned that can be taxed. The State income tax would be tax deductible on your tax returns.File IRS Form 1040 and itemize deductions on Schedule A. There… Read more »

“…….How about a flat state-wide income tax on adult residents and adult non-residents?…….”

How about a flat tax on all Alaskans who receive free money?:

Your tax is the same amount as the PFD.

You were doing great until you described a new tax regime as equal protection of the law. The Alaska Constitution does not guarantee the even distribution of wealth across the population. If it did, those people making $160k per year wouldn’t be getting PFD checks. Stop making the PFD an instrument for social engineering.