Fiscal analysts use multiple lenses to evaluate whether a government budget is “balanced.” One is in an accounting sense of whether overall revenues equal overall spending. But that’s not the only lens.

A second is whether the budget is distributionally balanced, meaning, among other things, whether the impact of the underlying revenue policies is distributed equitably across different income groups.

As the Alaska House and Senate work on this year’s state budget over the remaining weeks of this year’s session, we will hear many references, claims, and media stories related to the first lens. As in previous years, we anticipate hearing virtually no references to the second. The reason is that the budget is not even close to distributionally balanced. No legislator, even those who claim to be concerned about it, will want to go on the record discussing an aspect in which the Legislature, including them when they vote for the final product, is failing so miserably.

While some claim that the largest source of revenues supporting the budget comes from oil and others claim it comes from the Legislature’s percent-of-market-value (POMV) draws from the Permanent Fund, when the revenue side of the budget is disaggregated, it becomes clear that the largest source of revenues actually is money withheld from distribution as Permanent Fund Dividends (PFDs) and diverted instead to pay for government services. The amounts withheld and diverted are more commonly referred to as PFD “cuts.”

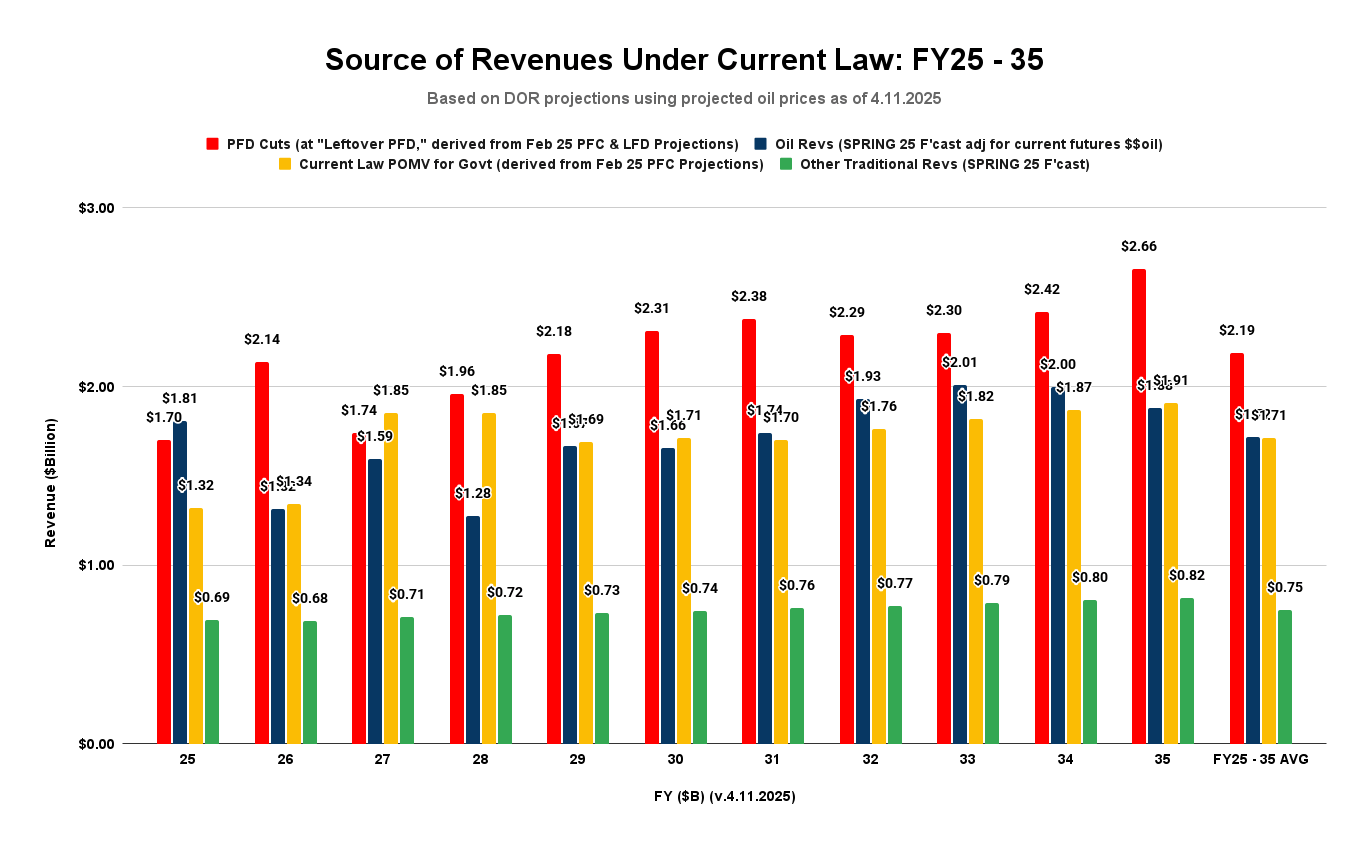

Here are the disaggregated numbers for the 10-year projection period used in the Department of Revenue’s most recent Spring Revenue Forecast, assuming PFD cuts are used to close whatever deficit remains after deducting other revenues from projected spending levels (the so-called “Leftover PFD” approach):

While some think of what many call “traditional revenues” as synonymous with “oil revenues,” traditional revenues actually are composed of two components. One is revenue from petroleum (“oil revenues”), and the other is from other taxes and fees assessed by the state (“other traditional revenues”). To identify their individual significance, we separate them in the chart.

The same is true of POMV revenues. While some think of it as a single source, as we have explained in previous columns, POMV draws are actually composed of two components under current law. One is the portion statutorily designated for distribution as PFDs. The second is the remaining portion available to help fund government spending. As part of the annual appropriations process, since 2018, successive legislatures have withheld and diverted (what University of Alaska – Anchorage Institute of Social and Economic Research Professor Matthew Berman has called “taxed”) some of the portion statutorily designated for distribution as PFDs for use instead to help pay for government spending. To identify the significance of each, the chart above separates the two segments going to the government.

For those who have not previously disaggregated the revenue streams, the result may be eye-opening. While in some years the relative positions change, on average over the 10-year projection period, revenues derived from PFD cuts far outstrip those from the other sources. On average over the period, revenues derived from PFD cuts are projected to total $2.19 billion annually, more than $450 million (27%) more than either oil revenues or the portion of the POMV draw designated under current law for government spending.

Put another way, on average over the period, PFD cuts are projected to account for 34% of revenues, while oil and the portion of the POMV draw designated for government spending under current law each account for only 27%, and “other” traditional revenues account for only 12%.

It is the substantial reliance on PFD cuts as a revenue source that makes the resulting budgets so distributionally imbalanced.

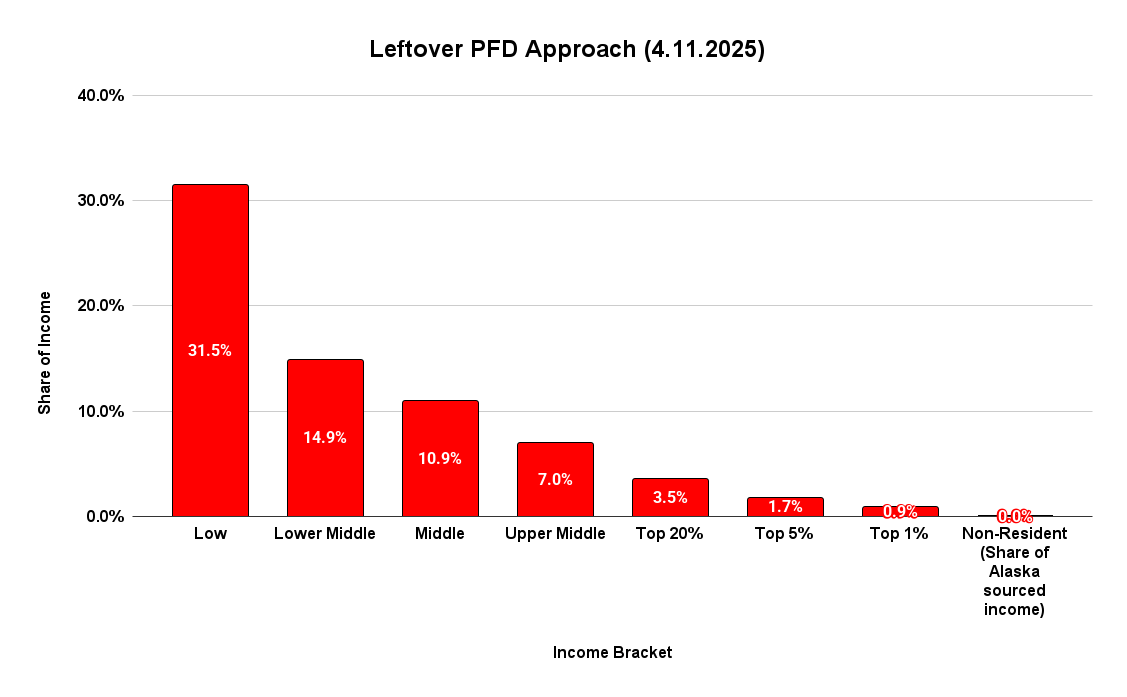

Based on the same numbers as in the previous chart, here is the average impact as a share of income by income bracket from using PFD cuts as a revenue source over the 10-year projection period.

The average impact across all income brackets over the period is roughly 5.2% of adjusted gross income, including income received by non-residents from Alaska sources. Against that average, using PFD cuts is projected to take over six times more (31.5%) from low-income Alaska families, nearly three times more (14.9%) from lower middle-income Alaska families, more than double that from middle middle-income Alaska families and, still, greater than a third more even from upper middle-income Alaska families.

Conversely, families in the Top 20% income bracket are projected to lose only 3.5% of adjusted gross income, a third less than the overall average, with those in the Top 5% and Top 1% even less. Non-residents receiving income from Alaska sources avoid contributing entirely.

No one can reasonably claim that such an approach distributes the revenue burden equitably across different income groups. Indeed, including the impact of PFD cuts, Alaska has the single most regressive revenue structure in the nation.

While the numbers in the previous chart are calculated assuming PFD cuts are used to close the entire deficit remaining after deducting other revenues from projected spending levels, similar imbalances occur even if the level of PFD cuts is set by other means.

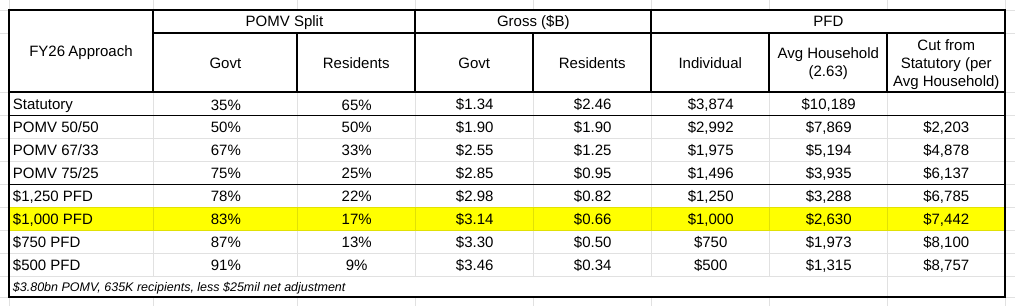

Using Fiscal Year 2026 numbers, here is the amount of income withheld and diverted through PFD cuts at various levels from the average-sized Alaska household. We highlight the level of cuts at the $1,000/PFD mark as an example because that is the level advocated by both House Finance Committee Chairperson Andy Josephson (D – Anchorage) and, surprisingly to us, progressive columnist Dermot Cole. At that level, the POMV draw is allocated 83% to the government and 17% to Alaska families.

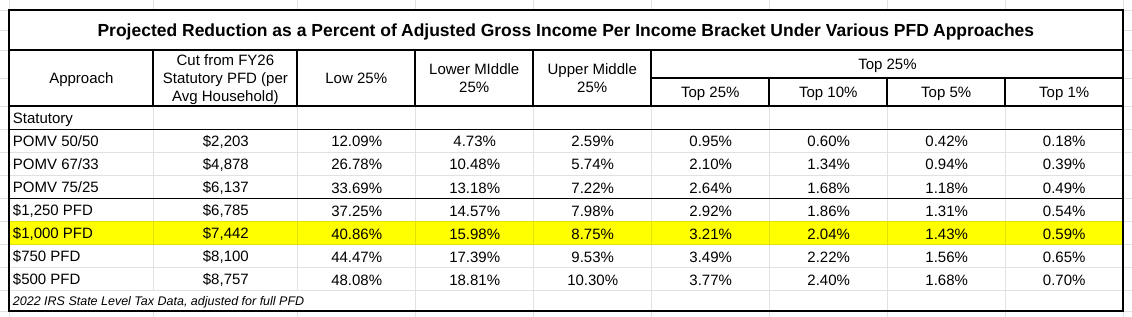

Using the most recent Alaska state-level income data published by the Internal Revenue Service, here is the impact of cuts at those levels on the same average-sized Alaska household by income bracket:

At every level, using PFD cuts takes significantly more from middle- and lower-income Alaska families than it does from those in the upper 25%. The deeper the cut, the greater the spread between middle and lower-income Alaska families and those in the upper income brackets.

For example, setting the PFD at the same $1,000 mark discussed above results in taking more than 20 times more (40.86% v. 2.04%) from low-income Alaska families than those in the Top 10%, nearly eight times more (15.98% v, 2.04%) from lower middle-income Alaska families, and more than four times more from upper middle-income Alaska families.

Conversely, families in the Upper 5% income bracket are projected to lose only 1.43% of adjusted gross income, more than 40% less than those in the Top 25% overall, with those in the Top 1% losing even less. As before, non-residents receiving income from Alaska sources avoid contributing entirely.

In the coming weeks, we anticipate, as in prior years, that many legislators will claim – and many journalists and others will repeat – that “after great effort,” this Legislature has achieved a “balanced budget.” But it won’t be.

It may (or may not) achieve that in the gross accounting sense, but as long as it relies on substantial PFD cuts as a revenue source, it won’t in the equally important distributional sense. At best, what they will be able to legitimately claim is only that they have achieved a badly unbalanced “balanced budget.” By avoiding any significant financial responsibility for the deficits, those in the upper-income brackets, non-residents, and the oil companies, who either contribute a trivial share or none at all toward covering the deficits, will be significant winners.

Middle- and lower-income Alaska families – those whom many in the Legislature claim they prioritize but then overlook in terms of distributional balance – will remain, as they have for the past eight years, significant losers.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Drug test these people

As normal, let’s tax the productive people who have jobs and made something of themselves so the non workers and vagrants can get a huge amount of money for doing nothing. Predictable column. Thanks for nothing from people who tried to make something of themselves and advocating for people who choose not too, appreciate it.

For our part, we’ve never understood why those in the Top 20% think they are entitled to free or mostly free government services, paid for by disproportionately (and significantly) reducing the income of middle and lower-income (80% of) Alaska families. Those in the Top 20% in every other state contribute something, even if through sales taxes, toward the costs of their state government. Somehow, in Alaska, some in the Top 20% think they should be immune.

As long as this state keeps sending people “free” money, I will be opposed to an income tax. Put forward a small, capped sales tax that excludes certain items, then maybe. That way we capture everyone not just people who are working to support THEIR own family. We shouldn’t have to pay to support another family. It’s hard enough to support your own family.

That (one family is paying to support another family) is occurring, but in reverse. Here’s how. PFD cuts take money mostly from middle & lower-income Alaska families to pay for the increased costs of government services. The “free money” doesn’t disappear; it just goes to pay for increased government services. Upper-income families don’t pay similarly for those increased costs, however; they continue to receive the benefit of government services effectively tax-free. The result is that the income of middle- and lower-income Alaska families is being reduced not only to cover their share of the increased government services, but also to… Read more »

I agree with all these points, but have given up trying to debate the issue with people like Tucker and Reggie. They are adamantly opposed to being taxed in any way yet almost certainly voted (twice!) against the repeal of SB21, which was and is the only way to simultaneously avoid an income tax and/or sales tax and receive a PFD check.

You are incorrect. About several things. I am not against small capped sales tax that excludes certain items. Yes, I am against an income tax. I voted to repeal SB21

My apologies, Tucker. I guess I’ve met too many people with “Like Your PFD? Vote No on 1” bumper stickers.

You are incorrect on several of your assumptions. I am not against a small capped sales tax the excludes essentials like food, healthcare, medicines. I voted to repeal SB21. I am very against an income tax.

Similar to how Tucker replied, I strongly oppose a personal income tax (especially if a PFD is continued to be handed out), and remain strongly skeptical of a sales tax, because it will grow in order to continue the outrageous state spending that is way out of control. If a sales tax is inevitable (it isn’t economically, only politically), groceries and prescribed medication must be exempt, and such a tax should be seasonal in order to catch the summer “Alaskans” and non-residents and spare the real Alaskans who keep this place running from November to May. But, ultimately, this astronomical… Read more »

Hear! Hear!

https://www.dermotcole.com/reportingfromalaska/2025/4/18/j5y1olvuk89axnxw8c2yw24oti5aoo

We need to face facts folks…..we gonna need to pay our own way……that in the end is gonna mean a sales tax and an income tax for the state…..do I want one?……no…….but you want services its how it works….

“……..we gonna need to pay our own way………”

“We” includes everybody, not a percentage (like 1%, 20%, 50%, etc).

“……..you want services its how it works…….”

I’m not interested in $10K+ per student (state and borough combined) indoctrination or most other “services”. I want lots of police, lots of prisons, and road maintenance and repair. Everything else can be dumped.