One of the carryover proposals likely to receive serious consideration as the Legislature returns this session is the proposed Constitutional amendment to turn the Permanent Fund’s current two-account approach, embodied in Art. 9, Section 15 of the Alaska Constitution, into a one-account approach. The proposed amendment is reflected both in HJR 10, introduced by Representative Calvin Schrage (I – Anchorage), and SJR 14, introduced by the Senate Finance Committee.

The House version has passed through the House State Affairs and Judiciary Committees. It is currently pending action before the House Finance Committee, the last committee of reference before it goes to the floor. The Senate version has already had three hearings before the Senate Finance Committee, its only committee of reference, and is pending further action by that committee.

The proposed amendment would allow the Legislature each year to appropriate from the Permanent Fund to the general fund “five percent of the average fiscal-year-end market value of the permanent fund for the first five of the preceding six fiscal years.” The primary difference between the proposed amendment and current law is that, under the Constitution as currently written, the Legislature is limited to appropriating from the Permanent Fund only the amount held in the Earnings Reserve Account (the “ERA”).

The proposed amendment contains no such limitation and would enable the Legislature to withdraw money from what is currently considered the Permanent Fund corpus if necessary to make up the difference between what the Permanent Fund is actually earning and the 5% standard established in the proposed amendment. Unlike the current Constitutional provision, which limits the use of the Permanent Fund corpus “only for those income-producing investments specifically designated by law as eligible for permanent fund investments,” the proposed amendment would allow the Legislature to appropriate from what is currently protected as the corpus to make up any shortfall between actual earnings and the 5% draw rate.

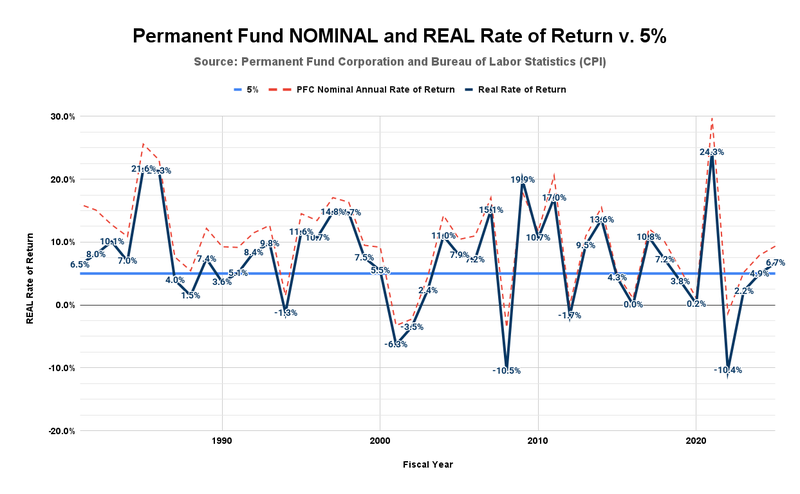

Such draws are not a theoretical possibility. The level of earnings the Permanent Fund generates from year to year varies significantly. The following charts the nominal and real (inflation-adjusted) rates of return earned on the Permanent Fund since its inception, compared with the 5% withdrawal rate (the light blue line) established in the proposed amendment. We use the real rate of return in the remaining calculations in this column to ensure that the portion of the nominal return required annually for inflation-proofing the Fund is retained in the Fund. We calculate the real rate of return, consistent with industry practice, by deducting the inflation rate, as reported for the corresponding period by the federal Bureau of Labor Statistics in its Consumer Price Index (CPI), from the nominal return.

As is clear, the Permanent Fund has generated a real rate of return of 5% or more in only some years. Of the 48 years covered by the chart, the real rate of return has been equal to or greater than 5% only 29 times (60%). It has been below that level the remaining 19 times (40%).

The 25-year period from 2001 to now has been even more variable. Over the 25 years, the Permanent Fund has generated a real rate of return of 5% or more only slightly more than half the time (13 years). The real rate has been below 5% the remaining 12 years.

The last 10 years have been even less successful. From 2016 through 2025, the Permanent Fund has generated a real rate of return of 5% or more in only four of the ten years (40%). The real rate has been below 5% the remaining 60% of the time.

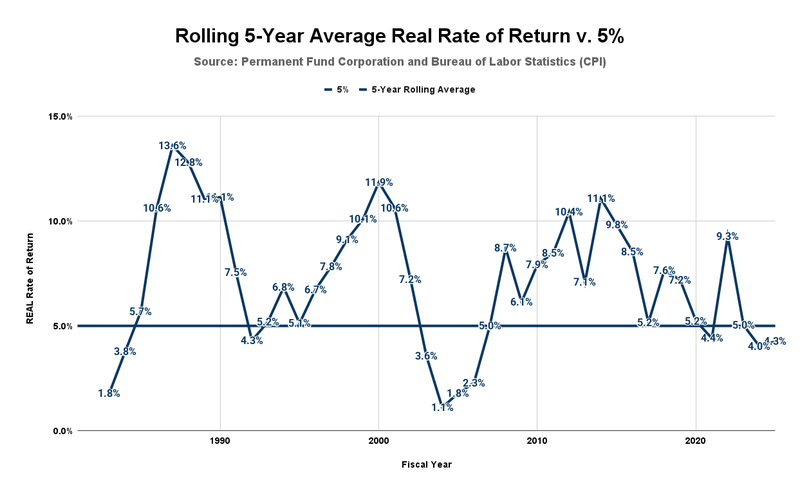

While averaging the returns over five years improves the performance somewhat, it does not eliminate the issue.

Over the full 42 years covered by the chart, the real rate of return has been equal to or greater than 5% on a rolling 5-year average 32 times (75%). It has been below that level the remaining 10 times (25%).

Results over the past 25 years, from 2001 to now, have been lower. Over the last 25 years, the Permanent Fund has generated a real rate of return of 5% or more on a rolling 5-year average only 68% of the time (17 years). Results over the past 10 years have been about the same. From 2016 through 2025, the Permanent Fund has generated a real rate of return of 5% or more on a rolling 5-year average in only seven of the ten years.

Focusing specifically on the last 10 years, average real earnings on a rolling 5-year basis for Fiscal Years (FY) 2021, 2024, and 2025, three of the most recent five years, would not have equaled the 5% draw rate contemplated by the proposed Constitutional amendment. If the Legislature had nevertheless drawn at the 5% rate permitted by the proposed amendment in those years, it would necessarily have deducted the difference from what is considered, under the current Constitution, the corpus.

As we have explained repeatedly in previous columns, we oppose the proposed amendment because it would open the door for the Legislature to draw from the Permanent Fund corpus. One of the primary, if not the principal, goal(s) of establishing the Permanent Fund was to protect a specified portion of the state’s commonly owned wealth for the benefit of future generations. The current Constitutional provision does that by prohibiting the Legislature from appropriating from the Fund’s corpus.

The proposed amendment would change that significantly by permitting the Legislature to appropriate at a 5% draw rate for current use, even if doing so means taking from the portion currently set aside for the benefit of future generations. As some explain it, the change would “protect the spend” (i.e., protect current revenue and, through that, current spending levels) rather than protecting the corpus.

Some have suggested addressing our concern by reducing the 5% draw rate included in the proposed amendment to 4%. While doing so would reduce the potential for the proposed amendment to draw from the corpus, it would not eliminate it. Looking at the above chart, for example, there are still six years (FY1983-1984 and FY2003-2006) in which, on a rolling 5-year average, even a 4% draw rate would have exceeded real earnings, and several more in which a change of just a few basis points in earnings, or inflation, would have caused the same result.

Others have pointed to the language in the proposed amendment that authorizes the Legislature to draw “up to” 5% and suggested that the Legislature would refrain from doing so if it resulted in draws from the current, Constitutionally protected corpus. As those who have watched the Legislature over the last decade and a half first drain the Statutory Budget Reserve, then the Constitutional Budget Reserve, and now, sit on the precipice of eliminating Permanent Fund Dividends know, “that’s just B.S.” to use a favored phrase of Senator Bert Stedman (R-Sitka).

In a column in last week’s Alaska Landmine, Bruce Tangeman, previously dismissive of our concerns, appears now to give them credibility, albeit begrudgingly. As Tangeman says:

The “leave it alone” crowd [which is how he describes us] do bring up an important point that the pro-endowment crowd needs to address… Their main issue centers around the draws exceeding the earnings. If we change the constitution to say a 5% draw is allowed but the fund only earns 4%, then we are not only overdrawing the fund but we are now technically overdrawing the constitutionally protected portion of the fund.

In response, Tangeman proposes a “simple solution” to address the concerns while retaining the other objectives of the proposed amendment. The “simple solution” would be to limit the draw to the lower of “5% OR the average actual earnings of the previous three fiscal years.”

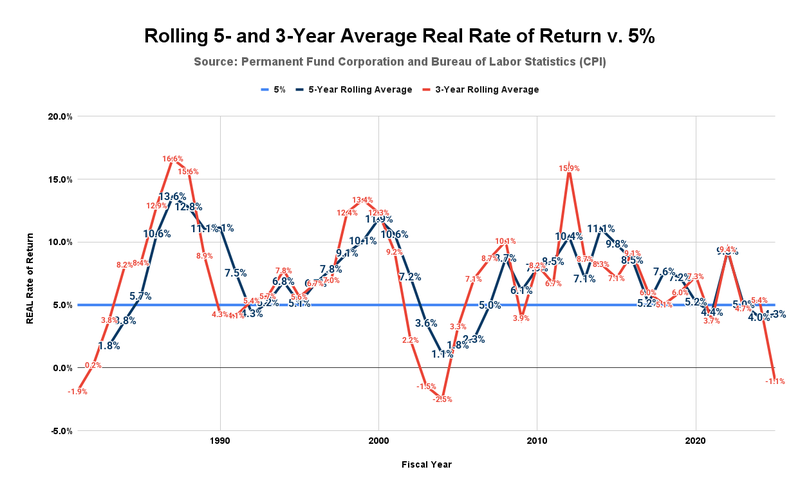

The proposal deserves some attention. As Tangeman himself recognizes, the three years he proposes (as opposed to five in the currently proposed amendment) should be open to discussion.

In running the numbers, it becomes clear that using a rolling 3-year average introduces significantly greater variability in the year-to-year averages, with more years below the 5% threshold – and at considerably lower levels – than using a five-year rolling average.

Based on this analysis, using the 5-year averages does a much better job of generating relatively even draw levels, which is vital for revenue predictability, than a 3-year approach.

A second central point, which Tangeman does not address, but is critical to the proposal’s effect, is what form of earnings is included in the calculation. “Actual” earnings, the term Tangeman uses in his “solution,” are composed of two parts: one part that reflects inflation, and a second part that reflects “real” (after inflation) earnings. If “inflation-proofing” is an essential goal of any Permanent Fund structure – as we (and others) believe it should be – then only the real portion of the earnings should be included in the calculation. Otherwise, in some years, all or part of the earnings needed to “inflation-proof” the corpus will instead be paid out as part of the draw.

To date, the hearings on the proposed amendment have primarily framed the issue as a binary: adopt the amendment, or leave the current constitutional provision in place. If the discussion continues to be framed that way, we remain firmly in the latter camp. The significant damage to future generations caused by opening a back door into the corpus outweighs any benefits claimed for the proposed amendment.

On the other hand, subject to the changes above – the use of 5-year averages and real earnings – and subject to thinking further about the potential for additional unintended consequences, we could potentially see a path to supporting Tangeman’s suggestion if it becomes a viable alternative.

* * * * *

Separately, we published a slide deck earlier this week that includes our “Top 5 Fiscal Priorities for the 2026 Legislative Session.” It should come as no surprise that opposing the proposed constitutional amendment to the Permanent Fund’s current two-account structure is the first on the list. For those interested, the slide deck addressing all five fiscal priorities for this legislative session is available here. They were the focus of this week’s discussion during our segment on The Michael Dukes Show. The podcast of that discussion is available here.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Brad, a very good and fair synopsis of my article and what I am trying to point out. Your suggestions are exactly what I was referring to as far as getting reasonable input on making it a more workable solution. 5 year rolling average plus real returns is a great place to start. The fact that your camp is open to entertaining solutions like this is great! Now, will the pro-endowment side agree to discussing something like this? I would hope so. If they push back or poo-poo the idea, I would be forced to assume that their goal truly… Read more »

Buy and Hold a stock for ten years (assuming zero dividends) means zero realized earnings for distribution even if the stock goes up 10000%. Buy a stock at 9am, then sell at 3pm – you realize your earnings or losses every day. Realized Earnings is a weird metric to use. No one else uses it for a reason.

Callie … To be clear, the returns and earnings levels referenced in the column are full accounting earnings (realized and unrealized gains and losses). Limiting the discussion to realized earnings applies only when discussing the statutory PFD (which, by statute, is based solely on realized earnings).

Alaskans are making the explicit decision to live off of savings while turning our backs on multiple potential streams of revenue. Worse, we’re spending a portion of our savings on financial support for nonresident workers, businesses, and the states and foreign countries from which they hail. (If you’re harvesting profits here and not paying tax here, you’re paying state or foreign taxes on those profits to the locale in which you’re based.) We are simultaneously pretending that it’s necessary to tightwad our current and future citizens (who, by the way, are the named beneficiaries of our savings account). What responsible… Read more »

Agree with a lot of this.

But not this:

-Guest

Not one Alaskan has ever had any legally-recognized personal interest, beneficial or otherwise, in any state savings account.

No personal interest in the:

Simply not true, though frequently told as a corrosive lie,

And Alaska has residents, not citizens,

“……..Not one Alaskan has ever had any legally-recognized personal interest, beneficial or otherwise, in any state savings account……..”

I rarely plus you, Dan, but do when you deserve it. That comment was golden.

“……..Bonus points for explanations that don’t include the acronym “PFD”………”

I don’t get “bonus points” on these pages, so……….

While I’m not much into resentment to those who winter elsewhere, I’m not averse to taxing them along with residents to pay for state services and costs. But after the PFD is gone.

You may now click away at the negative sign below my comment……….

-Reggie Taylor

The PFD IS gone.

Our legislature passed a budget creating the most recent one last spring. It became law, and the checks went out last fall.

That’s all gone.

A new one is fairly likely this year. But until new laws create a new one, no PFD presently exists.

Our governor recently proposed to increase spending on this year’s PFD by 365%. Seems preposterous, but much of what he does seems preposterous.

“…….. until new laws create a new one, no PFD presently exists………”

I’m not sure why this is so difficult for folks to understand…….or accept. The PFD existed well before the 2016 Wielechowski decision, we have received dividends since the Wielechowski decision, and we will receive dividends each year the Legislature appropriates money to pay it and the governor signs the appropriation. All that is fine and good with me, but I oppose any/all new or renewed taxes levied on Alaska residents until there are no more PFD appropriations, and the program has a silver bullet shot through its heart.

I suppose I need to fully outline what should be obvious about what I just posted above. The Wielechowski decision has put the PFD problem back on the shoulders of the legislature and governor on an annual basis. The problem is that he/she who openly advocates reducing or eliminating the dividend to pay for state spending will be pounded for it during subsequent political campaigns. Indeed, we already see elected officials who oppose the former “statutory dividend” (which has mercifully been ruled unconstitutional by the Supreme Court) as “PFD thieves”. Ditto the advocacy of new/renewed taxes, especially while continuing to… Read more »