On the heels of the Legislature’s expected approval of a $1,000 Permanent Fund Dividend (PFD) for Fiscal Year (FY) 2026 – adjusted for inflation, the lowest in the state’s history – late last month Representative Zack Fields (D – Anchorage) filed a bill not only to cap the PFD permanently at that level, but also to restrict it dramatically.

Under Field’s HB 209, even that dramatically reduced PFD would be paid only: (a) to those with adjusted gross income (AGI) of $50,000 or less (for those filing a federal income tax return as single, married filing separately, head of household, or qualifying surviving spouse), or (b) to those married filing jointly with combined income of $100,000 or less.

Based on the latest state-level data published by the Internal Revenue Service (for tax year 2022), around 275,000 Alaskans would qualify under those criteria. That is between 40% and 45% of those currently eligible.

Applying that to projected FY26 levels (and assuming that the “full” $1,000 is paid to those qualifying), the total payment would amount to approximately $300 million (including the amount to cover administrative costs), or roughly 8% of the projected $3.8 billion percent-of-market-value (POMV) draw. The remaining $3.5 billion would be designated for the general fund. Based on current projections, the share of the POMV draw being distributed as PFDs would decline over time as the PFD level remains fixed, but the level of the POMV draw grows.

According to his Sponsor Statement, Fields attempts to justify the proposal on the basis that “payment of PFDs based on a 1982 formula is no longer practical.” Another statement attributed to Fields adds that “we can no longer afford to issue large PFDs to middle and upper-class families.” Instead, he proposes to focus the benefit “on Alaskans who need it.”

But looking at the numbers, the bill’s real beneficiaries are significantly different.

In addition to providing a cap on the amount of the PFD, the bill would effectively also cap at the loss of their PFD, the contribution toward covering the costs of state government required of those in the upper-income bracket. Compared to the impact of Fields’ proposal on those in the remaining income brackets, the loss would have a trivial effect on those in the upper-income bracket.

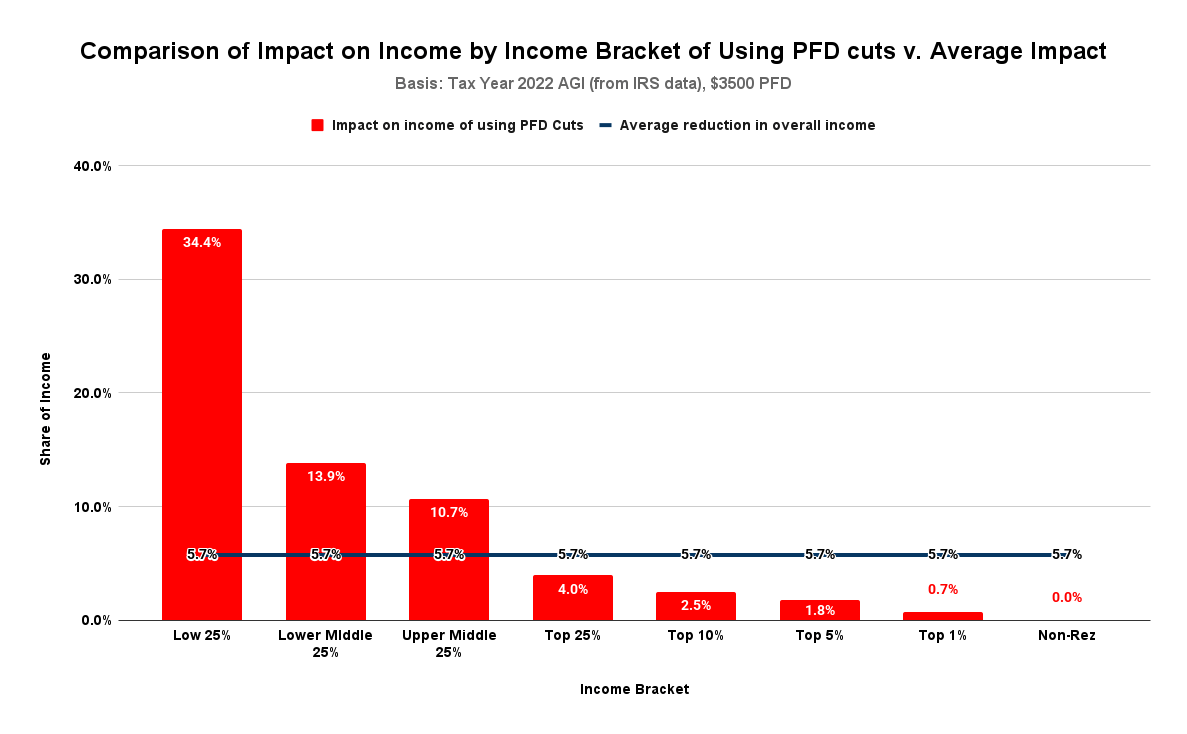

Using the most recent state-level data published by the IRS and a projected statutory PFD level of $3,750 as a base, we estimate in the chart below the impact of the PFD cuts proposed by the bill by income bracket on the average-sized Alaska household, compared to the average impact overall on Alaska income (including non-resident income sourced in the state).

In calculating the impact, we have assumed that all Alaskans in the low and lower-middle income brackets would receive the $1,000 PFD. This assumption is not entirely correct because, according to IRS data, the upper end of the lower-middle income bracket is approximately $61,000. As a result, although the calculations assume they would receive it, those Alaskans in the lower-middle income bracket with an AGI between $50,000 and $61,000, filing as single, married filing separately, head of household, or qualifying surviving spouse, would not receive a PFD.

Conversely, we have assumed that all Alaskans in the upper-middle and top 25% income brackets would not receive the $1,000 PFD. Again, this is not entirely accurate, however, since, according to the IRS data, the lower end of the upper-middle income bracket is approximately $61,000. As a result, while the calculations assume that they would not, married Alaskans falling within the upper-middle income bracket with an AGI between $61,000 and $100,000 and filing jointly would receive a PFD.

Adjusting for those finer points is not possible given the limitations of the publicly available IRS data. As a result, the impacts within the middle-income brackets reflected below may be off by a few tenths of a percent. Given the size of the differences, however, any changes that might result from more detailed data wouldn’t affect the overall conclusions.

Overall, the bill would permanently reduce adjusted Alaska gross income (including non-resident income sourced in the state) by approximately 5.7%, by withholding and diverting a portion of the PFD to the government rather than distributing it, as currently provided by law, as income to Alaska families.

However, as the chart shows, that 5.7% would not be taken evenly from all Alaskan families (and non-residents). Instead, by raising the money through PFD cuts, the burden would fall much harder than the average on middle and lower-income Alaska families, with impacts ranging from 10.7% of income for upper-middle Alaska families, to 34.4% for those in the Low 25% income bracket.

On the other hand, those families in the Top 25% income bracket would bear an increasingly smaller than average share of the burden, while non-residents would escape, as former Governor Jay Hammond put it, “scot-free.”

As a consequence, rather than benefiting “Alaskans who need it,” as claimed by Fields, the approach, in fact, would mostly benefit Alaska families in the Top 25% and non-residents. While they would not receive a PFD, the loss would have a trivial impact on their overall income. In exchange for that trivial impact, the approach would shift the bulk of the revenue burden to middle and lower-income families, allowing upper-income and non-residents to dodge the obligation to pay even moderate taxes that might lift their share of responsibility toward the overall average impact.

And while lower-middle and low-income Alaska families would receive some PFD, it would come at the expense of extinguishing their statutory claim to more significant levels. Instead, anything above $1000 automatically would be withheld and diverted to the government. They would end up with the short end of the stick, contributing increasingly higher shares than the overall average and, as a result, suffering a much greater reduction in their income than those in the upper-income brackets and non-residents.

In his initial slide deck prepared to describe his proposal to the House Judiciary Committee, Fields described one purpose of the bill as “Maintain low/zero tax burden.” Looking at the impacts, that purpose, which, compared to using PFD cuts, benefits upper-income and non-resident Alaska families far more than middle and lower-income Alaska families, appears to be the primary one.

In short, viewed from the perspective of middle and lower-income Alaska families, Fields’ HB 209 comes across as the proverbial “wolf in sheep’s clothing.” While he attempts to sell it as being driven by a desire to help “Alaskans who need it,” stripping away the disguise, it becomes clear that the bill is really designed to benefit upper-income and non-resident Alaskans by protecting them from virtually any responsibility for increased spending. While middle and lower-income Alaska families would bear impacts well above the average burden, those in the upper-income brackets and non-residents would receive heavily discounted, if not cost-free, government services.

Some have claimed that Fields’ approach converts the PFD into an entitlement program. It does indeed result in “welfare,” but by capping their contribution to Alaska spending at the trivial cost of giving up their PFD, it is welfare for upper-income Alaska families and non-residents, not those in the lower-income brackets.

As we’ve explained in a previous column, there is a much better alternative for those genuinely interested in achieving an even-handed result across income brackets.

In an op-ed published two years ago in the Anchorage Daily News, University of Alaska – Anchorage Institute of Social and Economic Research (ISER) Professor Matthew Berman outlined a plan for raising any revenues needed by the state.

What if our legislators and governor mustered the courage to ask us to pay taxes, and we distributed the statutory PFD as a refundable tax credit? The feds already do something like this with the child tax credit.

Here’s how it would work: We start paying a state income tax, perhaps a flat percentage — say 15%, for example — of our federal income tax liability. The PFD would be paid as a credit against the state taxes owed. If the PFD exceeded our individual tax liability, the state would issue us a check for the difference. Alaskans earning too little to pay income taxes get the whole PFD. Nonresidents would pay the state a lot more, because they would not get the tax credit. Higher-income Alaskans would come out ahead, too. A PFD tax credit isn’t taxable income, so the feds couldn’t tax it.

We oppose Berman’s notion of basing a state tax on a share of federal income tax liability. That would simply flip the excess burden from middle and lower-income Alaska families to those in the upper-income brackets.

But the idea of using the PFD as a tax credit is powerful. Looking at the chart above, if the contribution rate were set for all income brackets at the average rate (the line across the chart at 5.7%), all Alaska families, as well as non-residents (to the extent of their Alaska-sourced income), would bear the same impact of the additional revenue HB 209 proposes to raise. Using the PFD as a tax credit would reduce the direct impact on those in the upper-income brackets. Those in the remaining income brackets would have no out-of-pocket costs and continue to receive the remainder of their PFD at levels increasingly higher than the minimal $1,000 proposed by Fields.

As we’ve explained in greater detail in a previous column, the approach would also significantly reduce, if not eliminate, the federal tax leakage from the PFD that is of concern to some.

However, regardless of whether some want to pursue Professor Berman’s or other options (such as an ultra-broad-based sales tax), no one truly concerned about revenue structure should support Fields’ HB 209. Far from advantaging lower-income Alaska families, it serves mainly as a financial bailout for upper-income Alaska families and non-residents. They continue to benefit from government services without any significant contribution toward paying for them.

Looking at the end result, it is welfare for the rich, funded on the backs of middle- and lower-income families.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

No taxation while the PFD is transformed into yet another welfare program. Kill the PFD completely and watch the welfare class fly south before the autumn migratory fowl.

The class receiving the biggest welfare payout from the state consists of foreign investors receiving hundreds of millions in free services funded by the Permanent Fund and our oil. The class receiving the second biggest welfare payout is made up of Alaskans of means who have fooled themselves into believing that their 40-year tax-free ride hasn’t cost the state anything. A single notable recipient has been receiving an annual de facto PFD of $150 million while we’ve been gutting basic services and pretending that cutting off an annual distribution of a little more than $1,000 to the designated beneficiaries of… Read more »

“…….. Your fantasy of flushing the lower economic classes down the drain is already playing out……..”

It isn’t my “fantasy”, but yeah, you’d better believe it’s playing out. It’s inevitable, any your fantasy of Universal Basic Income isn’t going to stop it. A $3500 annual welfare check isn’t going to save anybody, and it can’t last long anyway for what should be obvious reasons.

How is any sort of income tax that includes a PFD distribution not socialism? We are redistributing wealth from contributing members of society to people that make less money. Again, how is that not socialism? It’s because people got used to this payment and think it is an entitlement, it’s not. You are not entitled to this money. As a resource extraction state, the fund was smartly set up to fund government when resources ran dry. The PFD came later as a benefit during high revenue times. But we’re not there anymore. People say the PFD is enshrined in law.… Read more »

The argument starts from a false premise. The PFD isn’t redistribution. Instead, it’s the direct distribution of commonly owned wealth to Alaska residents. No one else is paying for it. It comes from Permanent Fund earnings that were built with royalties from oil. Some suggest withholding a portion of that wealth set aside for distribution directly to Alaska residents and diverting it instead to pay for government. The beneficiaries of that are those who, due to their income or spending, would pay more in taxes to cover government costs than they are contributing by diverting a portion of their PFD.… Read more »

“……..The argument starts from a false premise. The PFD isn’t redistribution. Instead, it’s the direct distribution of commonly owned wealth to Alaska residents………” A “direct distribution of commonly owned wealth” IS socialist distribution. Your socialist ideology has even blinded you from the vocabulary. Government distributing/redistributing money has been a growing problem since Karl Marx took up the pen. It results in the kind of garbage you can see with your own eyes in Davis Park in Anchorage. Just stop it. Force people to produce or move on. Government is supposed to provide public safety and common infrastructure, not economic prosperity… Read more »

Prorating PFD payouts is not going to happen. Google Zobel.

Zobel was based on discriminating against those moving to Alaska. It has nothing to do with differentiating between different classes of persons within Alaska.

https://supreme.justia.com/cases/federal/us/457/55/

“……..Alaska’s reasoning could open the door to state apportionment of other rights, benefits, and services according to length of residency, and would permit the states to divide citizens into expanding numbers of permanent classes. Such a result would be clearly impermissible. Pp. 457 U. S. 61-64……..”

This is precisely what you repeatedly do with your “1%” and “20” garbage. Keep it up. I’d love to get rid of this class warfare.

History has no power over ideological extremism. Those suffering such ideological disease must repeat the inevitable.

Impressive amount of words to say “We want to impose an income tax.”

Answer is NO.