During a radio interview this time a year ago, Governor Mike Dunleavy (R-Alaska) said, “I am not going to support new revenues. I’m not going to support the taking of money from Alaskans unless they have an opportunity to vote on their constitutional amendment.” Other times, he and various legislators have phrased the commitment as “no taxes.”

What exactly do they mean by that?

Basically this, in two parts –

- An outloud, always emphatic and sometimes shouted part: “no taxes/new revenues…,”

- Followed by an always hushed, under-the-breath part: “… that would take a material amount from the top 20%.”

Let’s explain.

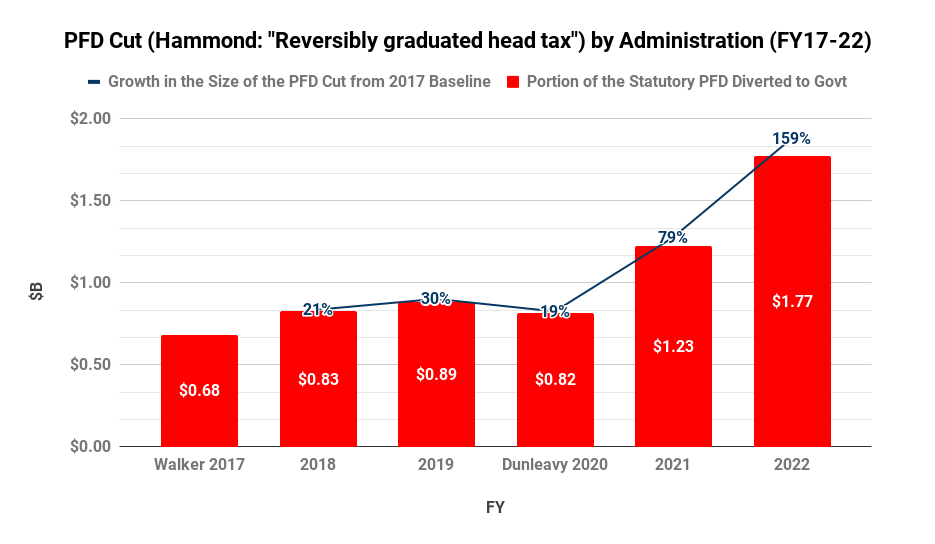

“The taking of money from Alaskans” has been occurring since 2016, when, through veto, then-Governor Bill Walker withheld and diverted to government (think, payroll tax withholding) roughly $700 million from the Permanent Fund Dividend (PFD) then scheduled to be paid to Alaska families.

As we discussed at length in our column two weeks ago, the following year the Legislature took over the approach and, with one exception (Governor Dunleavy’s first budget), has increased the amount diverted every year since.

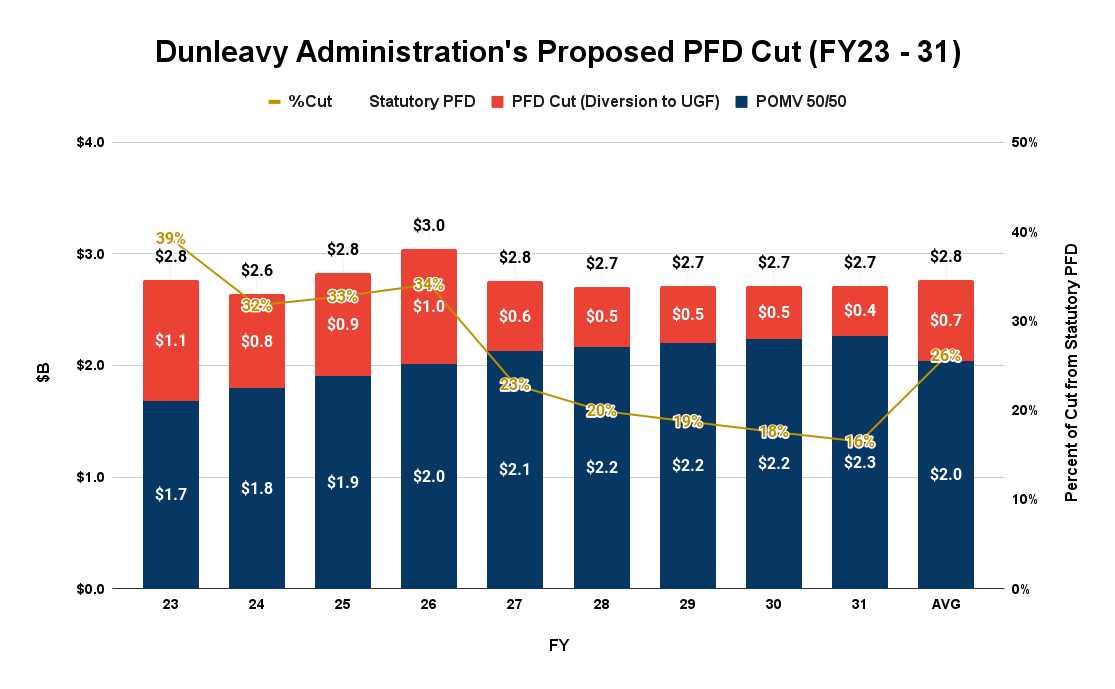

Consistent with the statements made in his year-ago radio interview – “I’m not going to support the taking of money from Alaskans unless they have an opportunity to vote on their constitutional amendment” – last year Governor Dunleavy’s budget and 10-year Plan proposed one more year of a statutory dividend, then following “an opportunity to vote on [his proposed] constitutional amendment,” a reduction to POMV 50/50 going forward.

In this year’s budget and 10-year Plan, however, Dunleavy has abandoned the statutory dividend entirely, proposing himself from the outset to “take money from Alaskans” by cutting the dividend from current statutory levels to POMV 50/50 without a vote.

In short, Dunleavy has violated his own pledge, moving unilaterally from “I’m not going to support the taking of money from Alaskans unless they have an opportunity to vote,” to “I’m not going to support the taking of money … except through PFD cuts.”

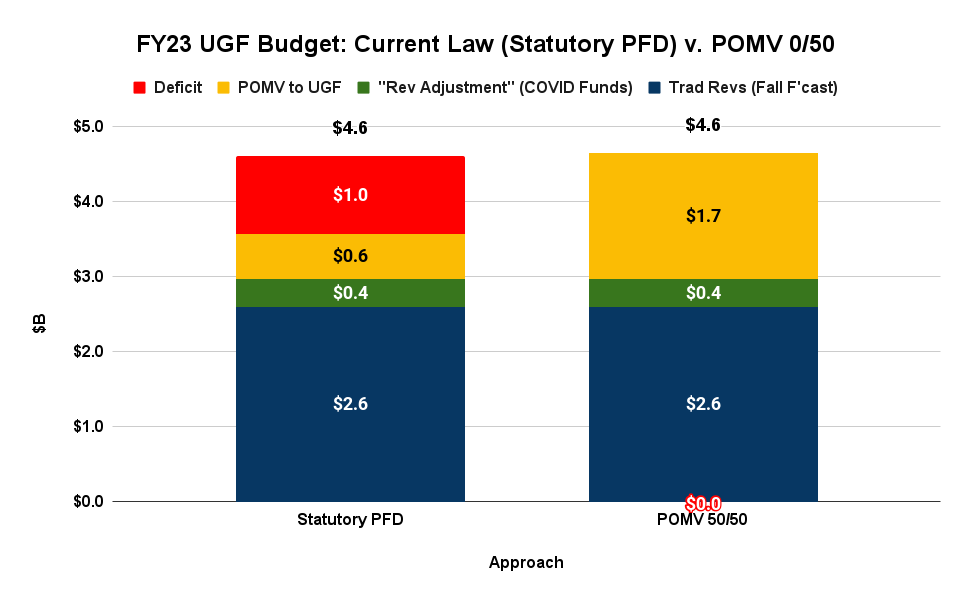

The politics of why Dunleavy has changed his position are clear. Based on oil prices projected at the time it was submitted, absent adopting POMV 50/50 his proposed FY 23 budget initially would have run a huge deficit, requiring him, in an election year, to identify $1 billion in additional revenues (or spending cuts) to close the gap.

Like former Governor Walker and various legislatures before him, unilaterally cutting the PFD is an expedient – if hugely inequitable and economically adverse – alternative to deal with the situation.

But while that explains why, it doesn’t excuse the fact that Governor Dunleavy has, in fact, dramatically changed his position. Even though as part of its budget amendments submitted earlier this week, the administration now projects additional revenues sufficient to pay for government even after taking into account a full, current law PFD, Dunleavy nevertheless continues to cap his proposed PFD at POMV 50/50.

Here is the effect – the amount of new revenues (in red) his FY23 budget proposes to add to government without a vote – over the full 10 year period.

Some attempt to rationalize their continued call for “no taxes” with, at the same time, supporting PFD cuts by arguing that PFD cuts technically aren’t a “tax.” But that’s just word play, attempting to leverage the fact that the approach commonly is referred to as a PFD “cut” rather than a PFD “tax.”

In Diapering the Devil, former Governor Jay Hammond focused instead on the substance of the approach:

“… Reducing dividends to pay for government services would impose what is, in essence, a reversibly graduated “head tax” on all and only Alaskans. The poor would pay a larger percentage of their ‘income’ in taxes than would the rich; transient pipeline workers, commercial fishermen and construction workers would get off scot–free.”

The withholding and diversion of PFDs from their statutorily prescribed flow to individuals instead to government also fits squarely within the common definition of a tax, here provided by the Legal Information Institute: “[a]ny charge of money or property that is imposed by a government upon individuals or entities that are within the government’s authority to collect.”

Others take a different tack, attempting to rationalize that PFD cuts technically aren’t “revenues” (and, thus, increased PFD cuts aren’t “new revenues”). But both the 2016 study by the Institute of Social and Economic Research (ISER) and the 2017 study by the Institute on Taxation and Economic Policy (ITEP) – the two that have looked at the issue in detail – make clear they are.

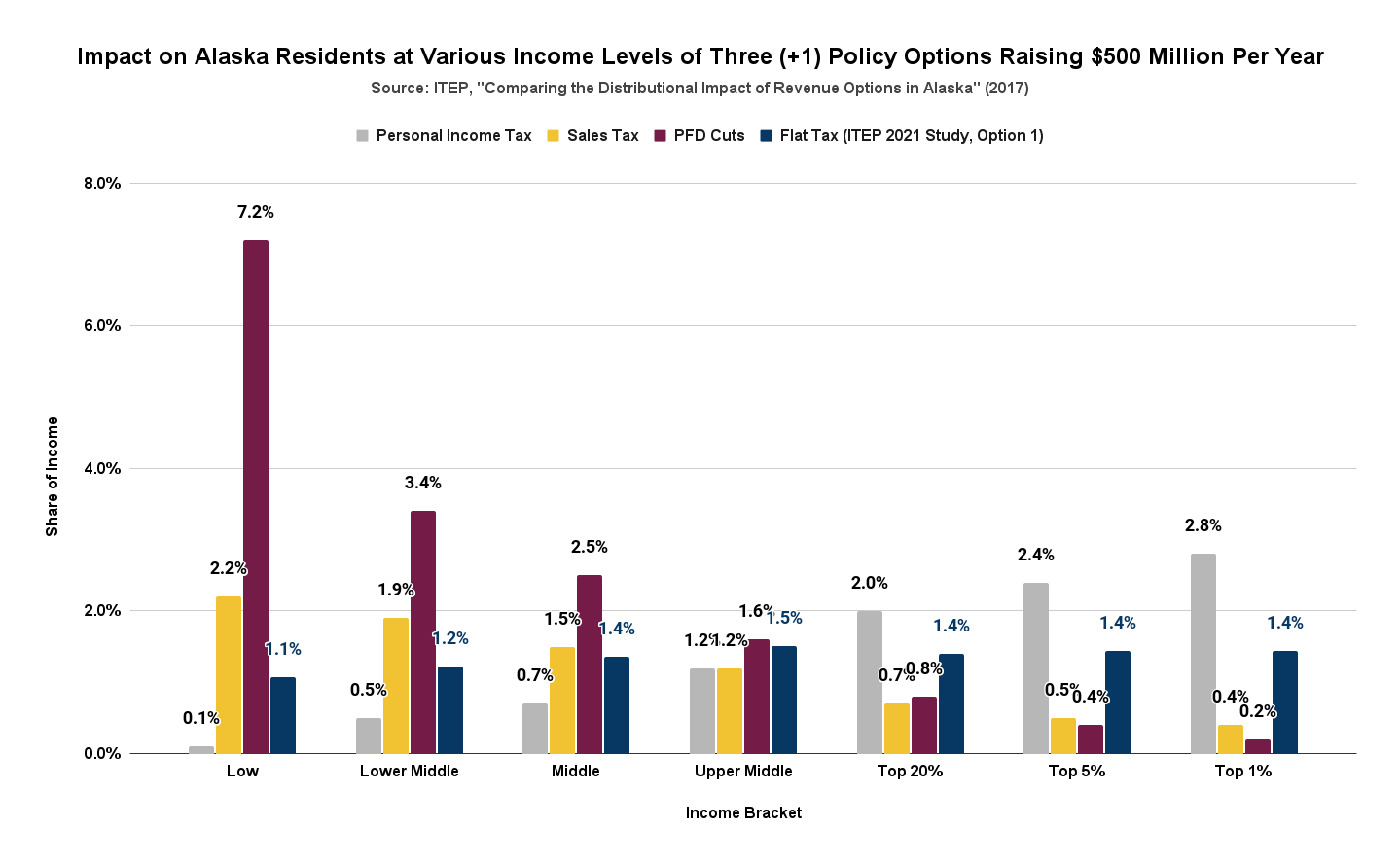

Comparing PFD cuts to other options, ISER concludes: The impact of the PFD cut falls almost exclusively on residents, and it is highly regressive, so it has the largest adverse impact on the economy per dollar of revenues raised.

The 2017 ITEP study compares the impact of PFD cuts to other alternatives and literally is titled, “Comparing the Distributional Impact of Revenue Options in Alaska.”

So what’s the real economic difference between PFD cuts and the other tax and “new revenue” approaches Governor Dunleavy and others even now continue to assert are off limits?

One thing only – their impact on the top 20%.

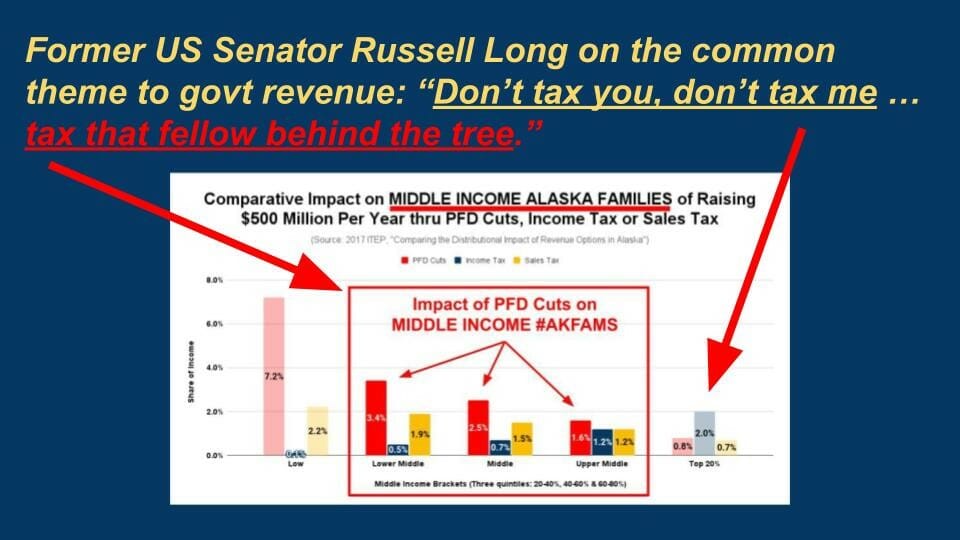

The differential impact is clearly demonstrated by the 2017 ITEP study, which compares the share of income taken (taxed) under the various approaches. Here, we chart the three options currently most discussed – income taxes, sales taxes and PFD cuts – together with a fourth, the flat tax later analyzed by ITEP in its 2021 study.

The results are clear. Of all the options, PFD cuts take the most from 80% of Alaska families. The other tax/new revenue approaches largely pale in comparison.

The relationship is largely the exact reverse among the top 20%. Particularly for the top 5% and top 1%, the other tax/new revenue approaches take the most. PFD cuts are trivial by comparison.

The dog whistle that Governor Dunleavy (and others) are blowing by continuing to spout their “no tax” rhetoric while at the same time pushing PFD cuts is clear: they oppose any revenue approach that takes more than a trivial amount from the top 20%, but are fine if the approach takes substantial – indeed, huge – amounts from the bottom 80% instead

In short, “no taxes/new revenues” is just code for “no taxes/new revenues from the top 20%.” It doesn’t mean “no taxes/new revenues” from the remaining 80% of Alaska families. As Governor Dunleavy has demonstrated through his budget proposals this year, for him taking from them is now fine.

The message reminds of the old quote from former U.S. Senator Russell Long synthesizing what he continually heard from lobbyists and others during the period he served on and as Chair of the U.S. Senate Finance Committee: “Don’t tax you, don’t tax me, tax that fellow behind the tree.”

Translated to Alaska the message is, don’t tax oil or other industry, don’t tax the top 20%, but by using PFD cuts go ahead and tax the hell out of middle and lower income – the remaining 80% – of Alaska families.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Interesting to see how many ways you can graphically portray your same argument.

Ya think, Lynn?

Do you disagree that the way we’ve been distributing our Permanent Fund earnings is inequitable? If so, where, in your opinion, are the flaws in Keithley’s reasoning?

I’ve been living in Alaska for over 38 years, I have never “counter on” the pdf as part of my income. It has always amazed me the type of stuff people spend their pfd’s on. Most will blow their pfd and their kids pfd’s within 30 days. The conversations that are taking place are describing the pdf as Universal Basis Income, which is another way of socialism. If your planning on taxing me more just so you can continue Universal Basic Income, I strongly oppose that!! I have worked my entire life for what I have today! It’s amazon how… Read more »