Most who were here at the time of the 2018 governor’s race will recall that central to now-Governor Mike Dunleavy’s (R – Alaska) campaign was his repeated criticism of then-Governor (and opponent) Bill Walker’s decision in 2016, and the then-Legislature’s follow-up decision in 2017, to reduce (cut) the amount of the Permanent Fund Dividend (PFD) below statutory levels. Indeed, in the 2018 race, Dunleavy promised not only to “save the PFD” going forward, but also, if he won the election, to repay the amount of past cuts.

While the second was less prominent, he nevertheless repeated both pledges when running for – and winning – reelection in 2022. Although he has since dropped the promise to repay the amount of past cuts, he nevertheless still promises to “save the PFD” going forward. To that end, as part of his proposed budget submission this year, he included paying full statutory PFDs throughout the entire 10-year projection period.

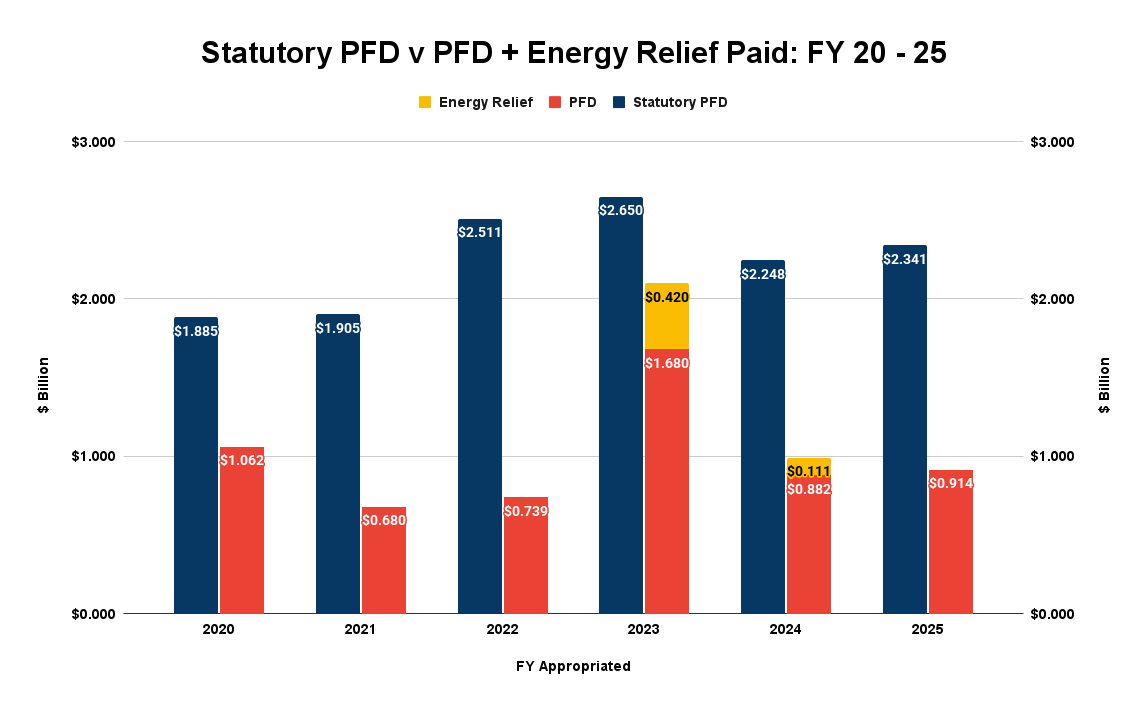

Despite the promises, the Governor has signed budgets throughout his time in office that have continually included significant PFD cuts. Here is a comparison of the amount of the statutory PFD versus what has been reflected in the budgets he has signed.

Even including the “energy relief” payments appropriated by the Legislature and distributed with the partial PFD payment in Fiscal Years (FY) 2023 and 2024, in no year has the amount distributed as PFDs equaled the amount provided by statute. In the closest year, FY2023, the amount distributed, including the energy relief payment, was 79% of the statutory amount. Overall, the amounts Dunleavy has approved and have been actually distributed, including the energy relief payments, have averaged only 47% of the statutory amount.

It’s not that the remainder has been saved. Every year during Governor Dunleavy’s time in office, the full amount of the statutory PFD has been appropriated. However, the difference between the full amount and the amount distributed – in other words, the amount “cut” – has been withheld and diverted to the general fund to help close the deficits created by the level of spending approved in the final budget signed by the Governor.

As the Governor himself has recognized, withholding and diverting the PFD is not the only way to help pay for the level of spending approved in the final budgets he has signed. For example, in the Administration’s FY 2021 10-year plan, the Governor’s Office of Management and Budget described what they called a “balanced approach” for closing the deficits. Like the subsequent recommendation of the Legislature’s 2021 Fiscal Policy Working Group, the Governor’s “balanced approach” proposed a mix of “budget reductions, PFD decreases, and taxes” to close the deficit.

As the 10-year Plan said in proposing the approach:

The past several legislative sessions have illustrated that solutions need to be moderate to earn the people’s approval. Previous proposals involving budget reductions, PFD decreases, and taxes faced skepticism when the Alaskan citizenry believed that they went too far. Proponents of a balanced approach suggest that everyone give a little so that no group of Alaskans faces undue harm.

The Governor himself repeated his support for that approach in 2023, saying he intended to propose a broad-based sales tax to handle part of the burden:

Dunleavy said he now believes that “a broad-based solution that doesn’t gouge or take huge parts from one sector (of Alaska) or another, or penalize one sector for another is probably the most important thing we can do.”

Notwithstanding those statements, the Governor has never followed through by proposing a revenue alternative for closing the deficit. Instead, the budgets he has signed have continued to rely solely on PFD cuts for that purpose.

At times during his time in office, Governor Dunleavy has claimed that he will “save the PFD” by reducing spending to levels equal to the combination of traditional revenues and the portion of the percent of market value (POMV) draw from Permanent Fund earnings intended under current law to help cover the costs of government.

But that hasn’t happened on his watch either. As is clear from the level of PFD cuts made each year, each of the budgets he has signed has relied in significant part on revenues created by withholding and diverting the PFD. Indeed, the budgets he has signed have grown significantly during his time in office. Through FY2025, unrestricted general fund (UGF) spending has grown by over 12% from the level set during the last year of the previous administration.

As Governor Dunleavy approaches his final year in office, the outlook for the PFD is even worse. To close the anticipated deficit, this week the Senate Finance Committee has proposed cutting the PFD to, according to reporter James Brooks of the Alaska Beacon, the lowest level “in five years and — if adjusted for inflation — the lowest dividend ever.”

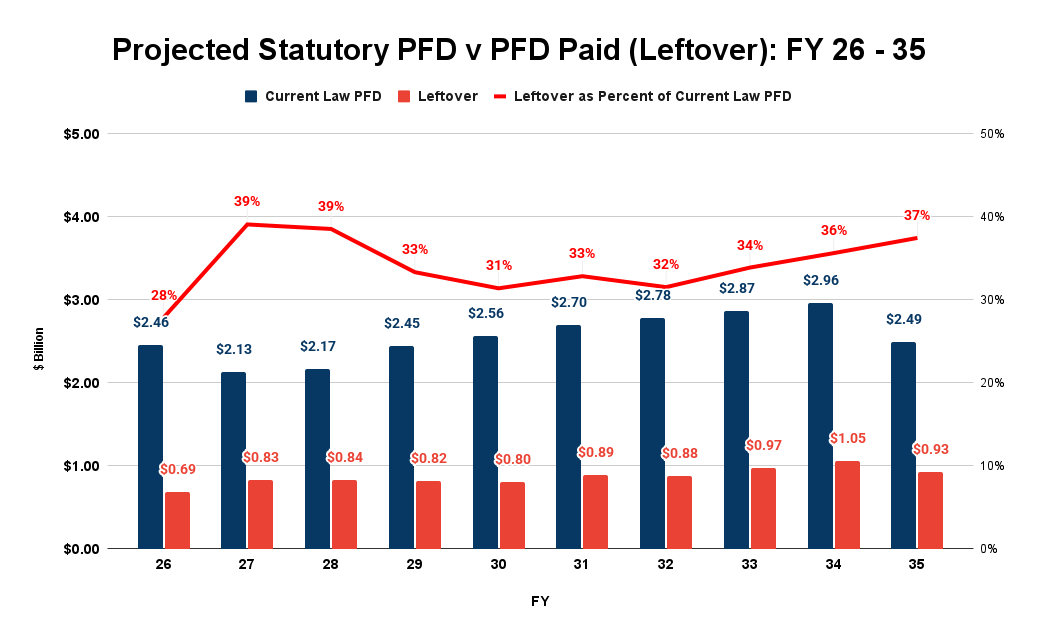

And on the budget’s current track, it only gets worse. Compared to averaging 47% of the statutory amount over the past six years, if it continues to be the only source used for closing the deficits, the PFD is likely to average only a third of the statutory amount, if that, over the next decade. Here’s one projection, based on restraining spending growth to a rate equal to projected inflation. If spending growth exceeds that level, or if traditional revenues decline below projected levels, the actual PFD levels will likely become worse.

This is likely the best-case option for the PFD on its current track. Its survival, even at these reduced levels, is not guaranteed. As Representative Zack Fields (D – Anchorage) said last month, “In the absence of revenue, the PFD is going to go away.”

Objectively distributed, the major share of the responsibility for the demise of the PFD over his time in office lies mainly with the Governor. As is clear from his administration’s FY 2021 10-year plan and the Governor’s own statement in 2023, he is fully aware that there are alternatives to filling the deficits created by the budgets he has signed. Yet, despite actually promising to do so in 2023, he has never proposed any of them. Indeed, more recently, he has actively opposed them.

As James Brooks explained in another recent story in the Alaska Beacon, “even if a bill were to pass the House and Senate, Dunleavy would still have to OK it.” And as Brooks reports, Dunleavy told reporters during a news conference earlier this month, “I told legislative leadership, I’m not interested in new taxes. I’m not interested in a program that taxes and spends, taxes and spends.”

Yet, ironically, that is precisely what Dunleavy has approved during his time in office. As Professor Matthew Berman of the University of Alaska – Anchorage’s Institute of Social and Economic Research (ISER) has said, “Let’s be honest. A cut in the PFD is a tax — the most regressive tax ever proposed.” As we have explained in previous columns, it is a tax that falls hardest on middle and lower-income Alaska families, while allowing those in the Top 20% income bracket, non-residents, and the oil companies, largely, if not entirely, to escape making any contributions to cover the deficits the Governor has approved.

By signing the budgets during his time in office, the Governor has repeatedly approved programs that “taxes and spends.” It’s just that the taxes have fallen mostly on one group, or to use the Governor’s own words from 2023, utilized an approach which has taken “huge parts from one sector (of Alaska) or another, or penalize one sector for another.”

Objectively construed, what Dunleavy really meant during his press conference last month is “I’m not interested in new taxes” that would require the Top 20%, non-residents, and the oil companies also to contribute toward closing the deficits. Instead, contrary to his promises during his 2018 and 2022 campaigns for Governor and his statement in 2023, his actions demonstrate that he’s fine with a budget approach that relies on making deep PFD cuts and continues to “penalize” one sector (middle and lower-income Alaska families) to protect others (the Top 20%, non-residents and the oil companies).

Of course, the Governor isn’t solely to blame. Some legislators also claim to support “saving the PFD.” Many who do, however, essentially hide behind the Governor, claiming that they don’t do more because any efforts to raise alternative revenues are doomed to failure once they reach the Governor’s desk.

But as the Legislature appears to be proving this session with its efforts to pass a permanent increase in K-12 spending, such efforts are not necessarily doomed. They may only require an iterative process in which the Legislature seeks and finds a level of support that has a broad enough base to overcome any threatened veto. Their failure even to begin the search for that level belies their claimed support of the PFD.

During his first campaign, Dunleavy claimed that, with respect to the PFD, he viewed himself as a successor to former Governor Jay Hammond, one of the “fathers” of the PFD.

In office, however, he has largely continued the work started by his predecessor, former Governor Bill Walker, killing the PFD bit by bit. Those in the Top 20% income bracket, non-residents, and the oil companies likely appreciate those efforts. The remaining 80% of Alaska families – those in the middle and lower-income brackets that would pay less as a share of income using either an income or ultra-broad-based sales tax than they lose with PFD cuts – shouldn’t.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

I don’t know how you like to define the “top 20%” (whether you’re talking income or assets), but yes, I certainly appreciate Governors Walker and Dunleavy and all the coming governors and Legislatures resisting the drumbeat of Universal Basic Income while government taxes my income, assets, or purchases. They will continue to do so, too. You’d better get used to it.

The PFD tax has been in effect for eligible applicants in Alaska at least eight years and the budgets (Capitol, Operations & Maintenance, Mental Health) have not been cut. Without political consequences of being tossed out of office by their constituents, status quo will continue to rule.

Way to earn that $84,000 for 120 days of “work” in Juneau (not including tax free per diem, free moving expenses to and from Juneau, pocketing every AK Airline mile into their personal accounts for doing the State’s business).

I’m not sure about the mental health budget, but the operating and capital budgets have most definitely been cut, a lot, since 2015. The legislative finance division can provide graphs showing those budgets over time. Such graphs may even be online at akleg.gov.

I think it’s time to vote some new folks in, Governor Jay Hammond would be pissed if he were alive today! They just keep stealing Natural Born Alaskans money, and expect us to be ok with it, and Dunleavy Is A Liar! Hanging out with Thieves…it started with that moron walker and crooked judge, and just keeps on going until we Alaskans are broke because of Them.

“Natural Born Alaskans”. LOL. I suppose those are yet another special type of person? Obviously, that wouldn’t include an Alaska Native born in, say, Seattle. It wouldn’t include an American born Outside, then moved into Alaska in infancy, lived and produced in Alaska for 75 or more years, then died here. Obviously a “Natural Born Alaskan” wouldn’t include the vast majority of current PFD recipients.

Special people are………..well,…….just special……….

READ MY LIPS: STATUTORY PFD.

READ OUR LIPS: NO NEW TAXES.

Especially not as money is mailed out like 4th Class mail ads..