In his December news conference announcing his proposed FY24 budget, Governor Mike Dunleavy (R – Alaska) sounded as if he was “all in” on protecting the statutory Permanent Fund Dividend (PFD).

‘During this last campaign season, I had countless people come to me, some in tears to be perfectly honest with you, thanking us for the efforts we made to be able to assist them in some very difficult times,’ said Dunleavy, a Republican who won his four-way gubernatorial race last month with more than 50% of the vote. ‘So I’ll always be supportive of the Permanent Fund and the Permanent Fund dividend.’

Indeed, the proposed FY24 budget proposes paying a full, statutory PFD, not only this coming year but, as outlined in the administration’s FY24 10-year plan, throughout the coming decade as well.

But more than words are needed to actually protect the PFD.

Notwithstanding its statutory status, since 2016 the PFD has been used much as the state’s savings accounts were used in the previous half of that decade – as the fiscal piñata to be whacked on an ad hoc basis when supplemental funds are required to balance the budget.

But unlike withdrawals from the state savings accounts, diversions of the PFD from their statutory purpose have a direct and immediate impact on Alaska families. As former Governor Jay Hammond put it in his book on Alaska fiscal policy, Diapering the Devil, the diversions act as a “‘head tax’ on all and only Alaskans.” And as the 2017 report from the Institute on Taxation and Economic Policy to the Legislature made clear, the tax falls far more heavily on middle and lower income Alaska families than on those in the top 20%.

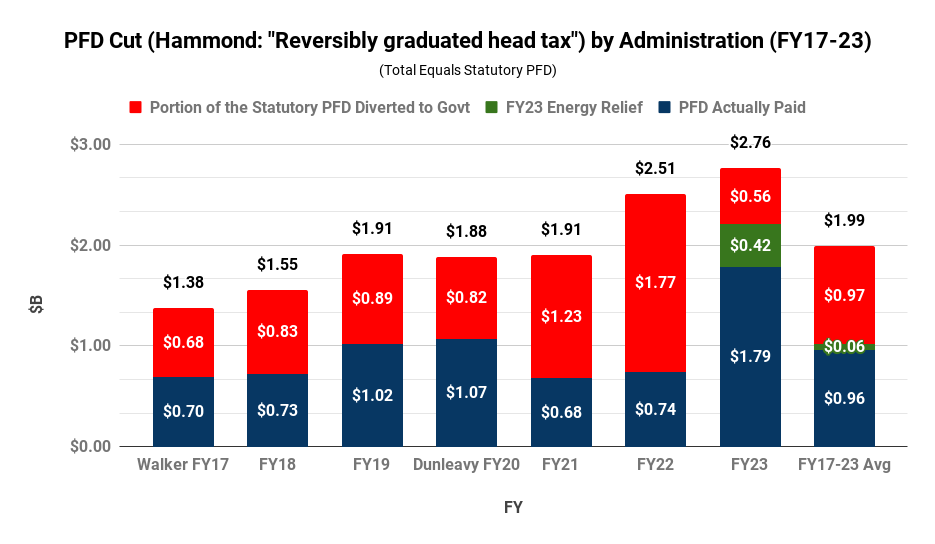

Here’s the level of cuts (“head taxes”) over the years since they first started.

In total over the years, about $6.75 billion has been diverted (taxed) from PFDs to pay for government. Of that, about $4.4 billion has been during the administration of Governor Dunleavy. In total, approximately half of the statutory PFDs since 2016 have been diverted to government. Even with the higher level of distributions last year, that percentage has averaged the same under both the Walker and Dunleavy administrations.

In short, on a percentage basis to date the Dunleavy administration has been no more successful than was the Walker administration in protecting the PFD.

Fundamentally, there are two ways to avoid PFD cuts and the adverse impact they have on Alaska families. The first is to reduce spending to the point that no supplemental revenues are required to balance the budget. The second is to develop alternative, more equitable sources of supplemental revenues to take the place of PFD cuts.

Governor Dunleavy essentially proposed the first alternative – spending cuts only – during his first year as governor, but it was firmly rejected by the Legislature and he hasn’t tried again since.

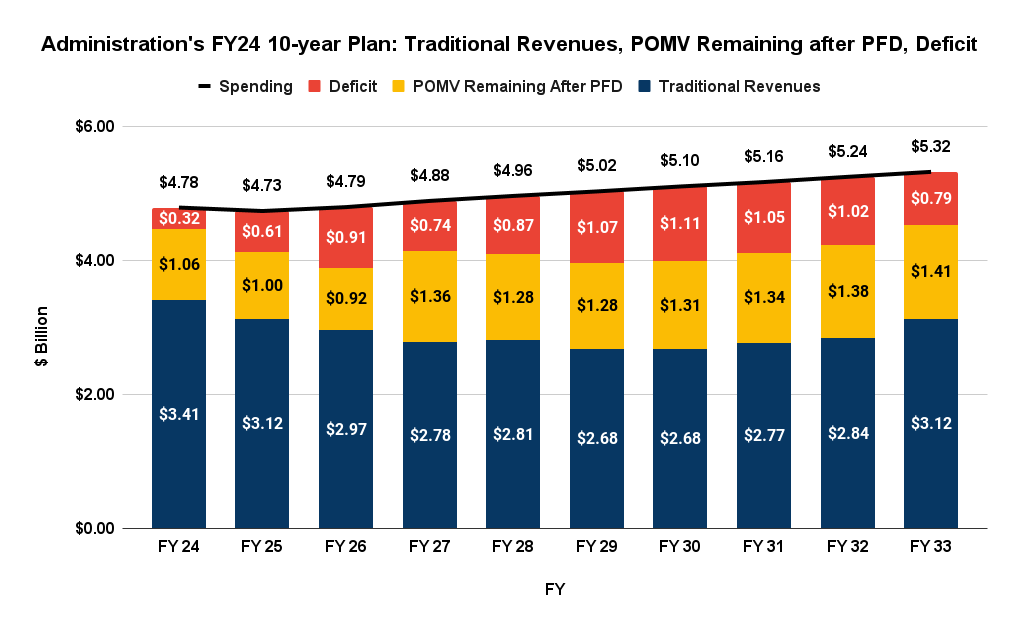

That continues in the current budget. Both his proposed FY24 budget and 10-year plan project current law budget deficits (spending in excess of traditional revenues, plus the portion of the percent of market value (POMV) draw remaining after the statutory PFD) as far out as they go. Dunleavy isn’t proposing to close them through spending cuts.

Here is the level of deficits reflected in the FY24 10-year plan.

Faced with similar deficits, in its earlier, FY21 10-year plan the administration discussed a “balanced approach” to closing the shortfall.

The approach combined some spending cuts, a PFD restructuring to POMV 50/50 (which results in some PFD cuts) and “an additional source of revenue” to provide some supplemental revenues to balance the budget. The “additional source of revenue” was referred to in the accompanying spreadsheet as “new taxes.”

As that 10-year plan explained:

The past several legislative sessions have illustrated that solutions need to be moderate to earn the people’s approval. Previous proposals involving budget reductions, PFD decreases, and taxes faced skepticism when the Alaskan citizenry believed that they went too far. Proponents of a balanced approach suggest that everyone give a little so that no group of Alaskans faces undue harm.

Subsequently, the bicameral, bipartisan Fiscal Policy Working Group created by the last (32nd) Legislature came to the same conclusion, recommending a package that similarly included some spending cuts, some PFD restructuring and some new sources of supplemental revenues, along with various mechanisms to ensure each remained in place.

As did the administration’s FY21 10-year plan, the Working Group (referred to in its report as the “FPWG”) emphasized that all three components need to move together:

The FPWG believes the legislature must pass a comprehensive solution. FPWG members do not support addressing only one or two issues to the exclusion of others.

Despite the corroborating FPWG recommendations, however, since the FY21 10-year plan the Dunleavy administration has backpedaled on the approach it proposed there. Both the administration’s FY22 and FY23 10-year plans relied on only two components – spending cuts and PFD restructuring.

And last year, given the opportunity to approve an “additional source of revenue” by the passage through both the Alaska House and Senate of, ultimately, a very moderate tax on e-cigarettes, Governor Dunleavy threw it back in the Legislature’s face, finding as he vetoed the bill – and despite the approach outlined in the FY21 10-year plan – that “a tax increase on the people of Alaska is not something that I can support.”

All the while, cuts in the PFD – “head taxes” – from statutory levels have continued, even last year as the state collected near record level revenues.

In yet another departure from the FY21 10-year plan, this year Governor Dunleavy has proposed an entirely different tack to balancing the budget, eliminating the proposals to restructure the PFD to POMV 50/50 and achieve some spending cuts. Instead, the FY24 plan proposes to balance the budget almost entirely through an “additional source of revenue,” but not the type of additional revenue discussed in the FY21 10-year plan (“new taxes”).

Rather, the administration proposes to cover the budget through what the FY24 10-year plan describes somewhat obliquely as “new, stable, sources of revenue that support State programs without an imposition on Alaskan residents or businesses,” which the Governor subsequently has identified as “carbon management.”

The goal (essentially painless revenues) is laudable, but the likelihood of success is highly suspect. The FY24 10-year plan projects annual revenues from the approach of $300 million in the current (FY24) fiscal year, rising already to $500 million in the next (FY25) fiscal year, then still further to $750 million in the fiscal year (FY26) following that and $900 million in the fiscal year (FY27) following that.

In short, the administration projects annual revenues from the source to jump from $0 to nearly a billion dollars per year in the span of only four fiscal years. At an average price of $75/barrel, in oil terms that’s roughly the equivalent of adding an additional 250 thousand barrels per day (mbd) in oil production (an additional 50% over current production levels) in only four years.

The reason that is hugely suspect is because the administration has provided no evidence to support the state’s ability to achieve anything near those revenue levels. As we explained in a recent column, the Department of Revenue’s (DOR) most recent Fiscal Plan Model values the “Revenue Option” of “Carbon Offset Credits” at only between $10 (FY24) and $20 million per year (FY25 and thereafter). The study the administration produced during its initial round of meetings on the subject with the press only outlines $8-10 million per year in potential revenue.

Looking externally, in a new report released just this week, Shell and Boston Consulting Group have projected the nascent market to grow globally only from roughly $3 billion in 2020 to $10 to $40 billion by 2030. To achieve the revenues projected in the administration’s 10-year plan, Alaska state government alone would almost immediately need to go from complete startup to capturing somewhere between a third (current value) to 4% (topside, 2030 value) of the global market. Tellingly, however, Alaska isn’t mentioned as a significant source either in that report or many of the others that have analyzed the potential market.

Of course, the administration hopes that there is significant upside potential to the approach.

But what happens if, especially as likely at least in the near term, those hopes don’t materialize. As it stands, the administration has proposed no other fiscal alternatives, leaving continued and deepening PFD cuts as the only real fallback. In short, if as is likely the trap door of “carbon management” revenues springs open, PFD levels are headed off into the same abyss in which they have resided since 2016.

That’s not the approach one would anticipate if Governor Dunleavy and the administration really were serious about protecting the PFD. Instead, as with the FY21 10-year plan, one would anticipate at least as backup a supportable, realistic fiscal plan, composed as was that one, of some spending adjustments, some PFD restructuring and some realistic “additional source(s) of revenue.”

It’s not like there aren’t reasonable alternatives available. DOR’s most recent “Fiscal Plan Model,” for example, outlines roughly $800 million per year in much more realistic, supplemental revenue options that the administration already has identified.

And the recently published Legislative Finance Division’s “Overview of the Governor’s [FY24 Budget] Request,” as an additional example, confirms that a flat tax of only 3% would be sufficient to raise $900 million in annual revenue. If, as only one part of the three-part approach proposed in the FY21 10-year plan the need was reduced to only $500 million, only a relatively minor, 2% flat tax rate would be required.

By not proposing any of those, the Dunleavy administration has left the PFD entirely exposed without a safety net in the event the hugely aspirational revenues from “carbon management” fail to materialize.

A favorite quote of ours comparing words with actions is this: “Do you know what words are without actions? Lies. They are lies.”

We’re not quite prepared yet to apply that directly to Dunleavy’s words in support of the PFD. But we do think, in light of the FY24 10-year plan and its significant departure both from the FY21 and FPWG approaches, it’s become timely to ask the question of whether the Dunleavy administration is really serious about protecting the PFD.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Pending a change to the State Constitution, the Supreme Court has ruled any PFD amount is not protected by any statue and is subject to legislative appropriation. Mike Dunleavy was and is keenly aware of that court decision, yet he persists in promising “statutory PFDs”. Therefore, you need not wait any longer to apply to Mike Dunleavy, and others who know better, that quote about equating his hollow PFD promises to the lie that got him and others elected.

Dunleavy proposed three constitutional initiatives in his first term as governor. One was for a constitutional protection for a 50/50 PFD and one was for Alaskans to vote for any taxes introduced. There was also a third constitutional initiative proposal. All three were blocked by the legislature. The problem is not the governor, it is the legislature’s inability to give up its power over the PFD which was granted to it first by Bill Walker’s veto of the statutory PFD during his administration and finally by the courts.