While not everything the governing statutes require, the fiscal submissions last week and this week by the administration of Governor Mike Dunleavy (R – Alaska) provide enough information to outline a plan to resolve Alaska’s seemingly never-ending fiscal crisis.

The first component of that plan comes from reviewing state oil revenues. While the Department of Revenue (DOR) initially provided only summary tables of the state’s revenue outlook over the next 10 years, DOR replaced that with its complete Fall Revenue Sources Book (RSB) in the middle of this week. Because of their significance to the state’s overall fiscal outlook, as well as the key role they play in any plan to resolve it, this column will focus primarily on projected state oil revenues. We will dive into the other revenue components covered by RSB in future columns.

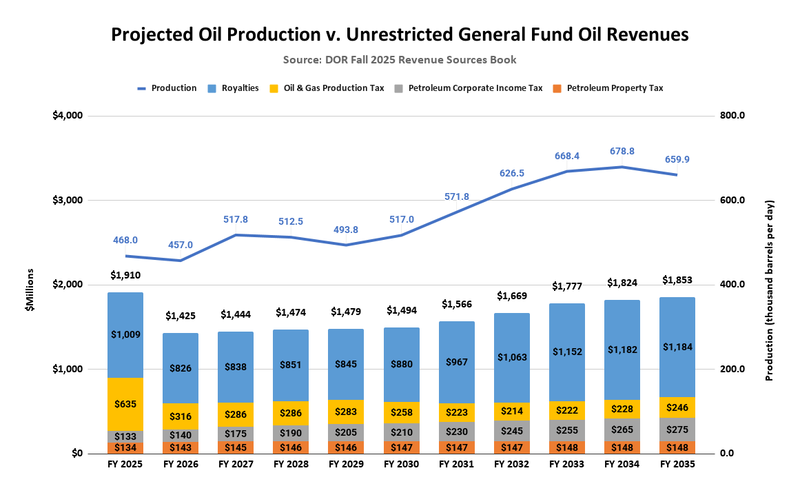

Here’s an overview of DOR’s outlook on oil.

While over the period, production volumes rise by 41%, from 468,000 barrels per day (kbd) in Fiscal Year 2025 (FY2025) to 660,000 in FY2035, unrestricted general fund (UGF) revenues from oil drop by 3%, from $1.9 billion in FY2025 to $1.8 billion in FY 2035.

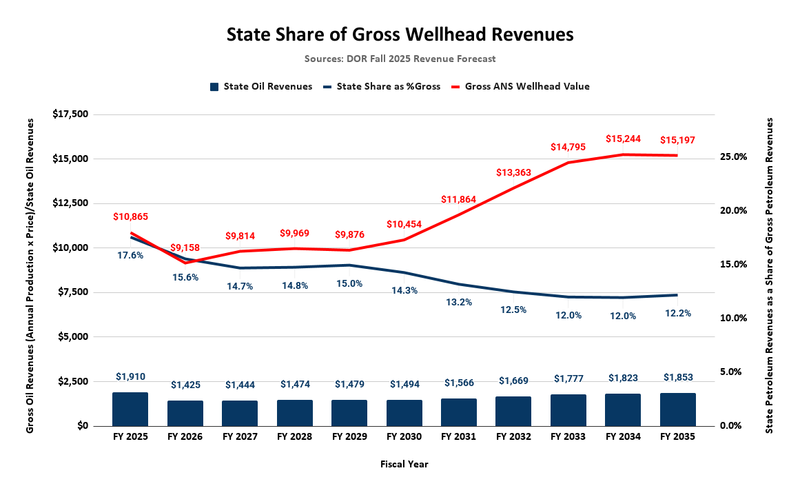

Some quickly attribute the drop to changing oil prices over the period. But while projected oil prices do fall slightly over the period from $74.15/barrel (ANS West Coast), $63.61/barrel (ANS Wellhead), to $73.00/barrel (ANS West Coast), $63.10/barrel (ANS Wellhead), that is a trivial driver. Multiplying wellhead prices by production volumes, gross wellhead revenues, the baseline for measuring revenues, actually rise over the period by nearly 40%, from $10.9 billion to $15.2 billion.

Instead, as we capture in the following chart, what is driving lower UGF revenues from oil over the period is the rapidly falling share of gross wellhead revenues received by the state.

While gross wellhead revenues rise over the period by nearly 40%, the state’s share of the wellhead revenues per barrel drops by over 30%, from 17.6% (as a share of gross wellhead revenues) to 12.2%. In terms of dollars, that’s a drop in state oil revenue of nearly $820 million/year. Had the state’s share of wellhead revenues per barrel remained at 17.6% throughout, state oil revenues would be almost $2.7 billion/year by FY2035, rather than less than $1.9 billion.

Part of that drop is attributable to the increase in the share of production from federal lands over the period. Because royalties from production on federal lands are paid to the federal government, as opposed to the state government, the state’s share of gross revenues drops somewhat as the share of production from federal lands rises.

But that is also only a relatively small part of the reason. The most significant factor is the plunge in state revenues over the period from state oil & gas production taxes, which apply equally to production from both federal and state lands. As noted in the first chart, revenues from state production taxes were $635 million during the base year of FY2025. This was 5.8% of gross wellhead revenues. DOR projects them to end the period at $246 million, or only 1.6% of gross wellhead revenues.

As we explained in a previous column, both are significantly lower than the share of gross revenues realized through production taxes in the first decade of Senate Bill 21 (SB21), Alaska’s current oil tax code.

If, instead, they stayed flat at the FY2025 level ($635 million), projected FY2035 oil revenues would be nearly $390 million higher, equal to 4.2% of gross wellhead revenues. If they remained at 5.8% of gross wellhead revenues, they would total almost $890 million for FY2035, nearly $640 million more than the $246 million currently projected by DOR.

If they continued at the average level of 6.88% of gross wellhead revenues realized during the first decade of SB21, they would total nearly $1.05 billion for FY2035, more than $750 million more than the $246 million currently projected by DOR. And if they were reset at the 8.4% rate recommended in a recent column – a level designed to stabilize overall state take from oil at 25% of overall gross revenues – they would total over $1.25 billion for FY2035, nearly $1 billion more than the $246 million currently projected by DOR.

Put another way, the drop in the share of gross wellhead revenues raised through state oil & gas production taxes accounts for more than 75% of the difference between what FY2035 oil revenues would have been had the state’s share remained at 17.6% over the period, and the significantly smaller share DOR currently projects for FY2035.

The second component of a plan to resolve Alaska’s seemingly never-ending fiscal crisis comes from reviewing the 10-year fiscal outlook included in the administration’s budget submission.

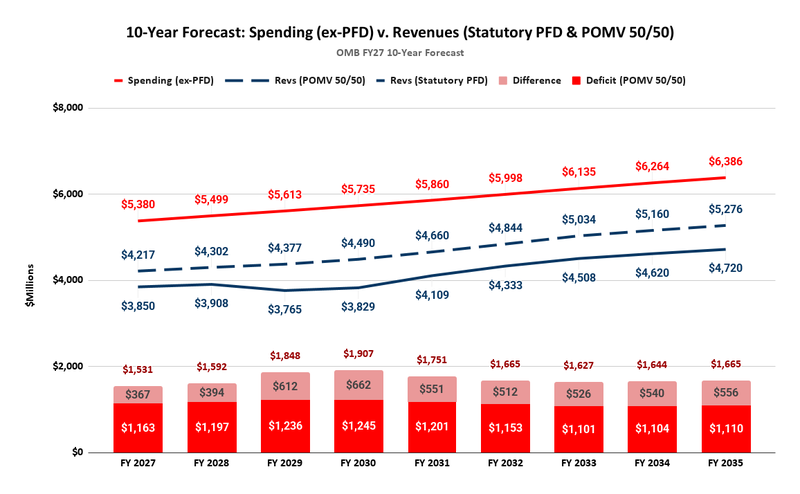

As most readers of this column are likely aware from recent press coverage, the 10-year outlook projects substantial annual deficits throughout the period, rising from $1.5 billion in FY2027 to nearly $1.7 billion in FY2035.

Some attribute the deficits to the projected distribution of Permanent Fund Dividends (PFDs) at statutory levels over the period. But that is seriously misleading.

Under current law, PFDs are fully covered by the annual statutory percent-of-market-value (POMV) draw. The reason for the deficits is that UGF spending continually outstrips the combined revenues available from traditional sources, mainly oil, plus the portion of the POMV draw statutorily remaining for the general fund after accounting for the portion to be distributed as PFDs.

In our view, restructuring the portion statutorily set aside for PFDs nevertheless may play a role in addressing the state’s chronically imbalanced fiscal outlook.

One of the recommendations made by the Legislature’s 2021 Fiscal Policy Working Group (FPWG) was for “the legislature [to] work towards a 50%-of-POMV-draw PFD formula as a part of a comprehensive solution.” By reducing the amount of the POMV draw statutorily required to be set aside for the PFD, restructuring the basis for the PFD from the current statutory approach to one based on “50%-of-POMV-draw” (POMV 50/50) would free up additional funds from the POMV draw for use in covering general UGF spending.

Using the numbers in the administration’s 10-year outlook, this chart examines the amounts.

The solid red line reflects the projected UGF spending levels included in the 10-year outlook. The solid blue line reflects the combination of traditional revenues, plus the portion of the POMV draw remaining for the general fund after accounting for the portion statutorily required to be distributed as PFDs. The resulting deficits are the numbers at the tops of the bars at the bottom of the chart, increasing from $1.5 billion in FY2027 to $1.7 billion by FY2035.

The combined revenues that would be available for the general fund if the portion of the POMV draw to be distributed as PFDs were restructured to POMV 50/50 are reflected in the dashed blue line. Instead of the $3.85 billion projected for FY2027 in the current 10-year outlook, combined revenues available for the general fund would total $4.22 billion. At the other end of the period, instead of the $4.72 billion projected for FY2035 in the current 10-year outlook, combined revenues available for the general fund would total nearly $5.28 billion.

The difference between the two approaches and its impact on projected deficits are reflected in the bars at the bottom of the chart. For FY2027, restructuring the current statutory formula to POMV 50/50 would generate an additional $367 million in general funds, reducing the projected deficit from $1.53 billion to $1.16 billion. At the other end, in FY2035, restructuring the current statutory formula to POMV 50/50 would generate an additional $556 million in general funds, reducing the projected deficit from $1.67 billion to $1.10 billion.

The third component of a plan to resolve Alaska’s seemingly never-ending fiscal crisis is to develop a mechanism to address the portion of the deficit remaining after the reductions outlined in the first two steps. As reflected in the 10-year outlook, the projected current law deficit ranges from a low of $1.53 billion in FY2027 to a high of $1.91 billion in FY2030. The deficit averages $1.69 billion over the period.

Restructuring the PFD to POMV 50/50 would reduce the average deficit by about $524 million annually, representing 31% of the projected average deficit in the administration’s 10-year outlook.

Restructuring oil & gas production taxes to raise the same share of gross wellhead revenues as in the first decade after the passage of SB21, which, as we have previously discussed, was around 6.9%, would similarly reduce the average deficit by around $530 million annually, another 31%. Adding to that, closing the current Subchapter S loophole in the petroleum corporate income tax would reduce the average deficit by an additional estimated $150 million annually, or around another 9%.

At those levels, the two steps combined would reduce the projected overall average deficit by about 70%, leaving approximately $500 million annually to be closed by other means.

As reported in the most recent state-level data published by the Internal Revenue Service, Alaska Adjusted Gross Income (AGI) was approximately $30 billion for tax year 2022. Adjusting that amount for non-resident income, projected PFD growth, and inflation, overall Alaska AGI, including the share of non-resident income sourced in Alaska, is projected to average around $41 billion over the coming decade.

At that level, either a broad-based sales or income tax designed to raise around 1.25% of Alaska AGI would be sufficient to close the remaining $500 million in projected deficits over the period.

Combined, we refer to this approach as the “a third, a third, and a third” plan because it would be composed, roughly, of a third raised from needed reforms to oil taxes, a third from the restructuring of the PFD, and a final third raised from a minimally-sized broad-based tax.

As Governor Dunleavy once said, “a broad-based solution that doesn’t gouge or take huge parts from one sector (of Alaska) or another, or penalize one sector for another is probably the most important thing we can do.”

By spreading the revenue burden broadly, the approach would do precisely that.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

In several recent articles you seem to have proposed that income taxes should be used to pay the so-called “full dividends” advocated by Dunleavy. I objected, saying that we should not tax income, which is earned through work, to pay dividends to people for doing nothing more than living in AK for a minimum of one year. In this article, you are IMHO doing a much better job of analyzing the problem and coming up with solutions. Here you are proposing that we pay lower dividends than Dunleavy’s “full dividend,” as a way to close part of the fiscal gap. I agree. You also are… Read more »

I completely oppose a “dividend” paid simultaneous to any state taxing, whether income or sales. The argument of “unfair to the poor” is a sham because the state and feds have layers of welfare spending, which is partially why both budgets are so wildly out of balance. The PFD isn’t welfare and was never meant to be welfare. As the largest single spending line item, it can be slowly reduced to balance the budget, and if you don’t like that reduction, demand competing spending to be reduced so you can get your check and buy stuff.

Too bad you lack the courage to speak out against the socialistic PFD in Juneau.

How would you like me to do that? Fly down, schedule a joint Legislative session, and speak from the podium? Would you be satisfied if I just talk about it with my delegation? (I’ve done so with my previous legislators, and will with my brand new ones).

If I (from Mat-Su) talk about it with, say, the state senator from Kodiak, do you think it would do any good?

“The smart ones let the others do the vetoing,” right? The cowards hide behind BS anonymous online statements and lie to their constituents about what they really believe, then cry foul when they’re rightfully called “PFD thief.”

November can’t come soon enough.

Deflection from SB21. It would be interesting to see how much re-distribution of wealth that bad bill would be.