The Landmine has learned that former Revenue Commissioner Adam Crum committed $50 million from the Constitutional Budget Reserve Fund (CBR) to an outside investment firm, DigitalBridge, according to three sources familiar with the matter.

According to sources, Crum signed the contract at the end of July, not long before his last day as commissioner. Crum’s resignation was announced on July 25 by Governor Mike Dunleavy (R – Alaska), and his last day was August 8. Three days later he filed to run for governor.

Crum is one of 10 Republicans currently in the governor’s race.

Surprisingly, officials in the Department of Revenue were unaware of the contract, and only became aware of it when DigitalBridge contacted them with a $50 million cash call. This occurred after Crum had resigned.

The Landmine has submitted a records request for the contract, as well as correspondence on the matter between senior Department of Revenue officials and senior officials in the Governor’s Office.

State statutes give the Revenue commissioner broad authority on investment decisions, and allow for contracting with outside firms for some state assets.

Section (b) of Alaska Statute 37.10.070. Investment of residual money states:

(b) The commissioner may invest on the basis of probable total rate of return without regard to the distinction between principal and income and without regard to the generation of income.

Section (b) (1) of Alaska Statute 37.10.071. Investment powers and duties states:

(b) Under this section, the fiduciary of a state fund or the fiduciary’s designee may

(1) delegate investment, custodial, or depository authority on a discretionary or nondiscretionary basis to officers or employees of the state or to independent firms, banks, financial institutions, or trust companies by designation through appointments, contracts, or letters of authority;

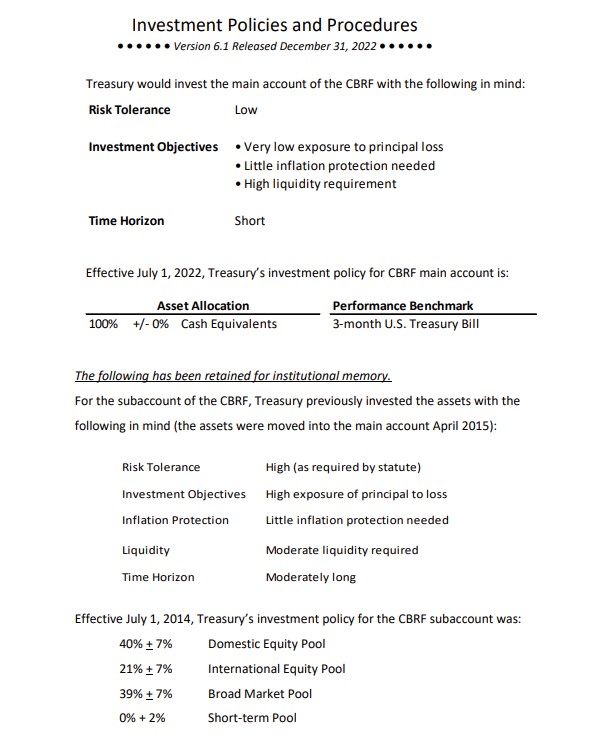

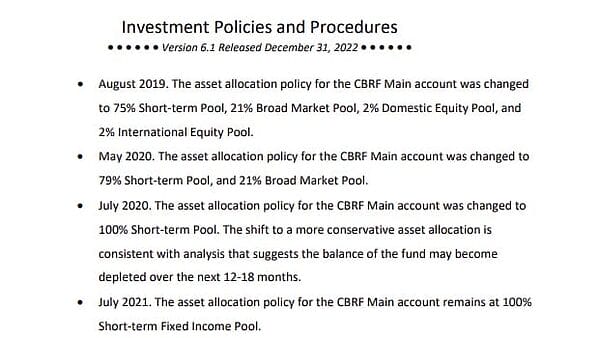

However, the CBR – which is the state’s main savings account – currently holds just $3 billion. Since 2022, the state’s Investment Policy and Procedures manual has recommended a low risk tolerance for the CBR, with a 100% allocation into cash equivalents like 3-month Treasury Bills.

In the past, when the CBR was much larger, asset allocation was more risk tolerant as the state was not as reliant on the CBR for short-term cash needs.

In his last proposed budget, Governor Dunleavy suggested using half of the CBR to pay a full statutory dividend. The Legislature ultimately rejected that because they did not want to spend down the state’s dwindling savings account. And for the Legislature to access the CBR, a three-fourths vote is required (15 Senate, 30 House) – a tough threshold to meet.

For some context, in FY2015 and FY2016, after the price of oil crashed, deficits exceeded $3 billion each year. With a current balance of just $3 billion, it’s important that the CBR remains liquid in the event of a significant deficit or emergency.

Crum’s $50 million commitment from the CBR to DigitalBridge was likely going to private equity – a higher risk and less liquid investment.

Brian Fechter, a past deputy Revenue commissioner, told the Landmine, “Alaska uses Callan to provide capital market assumptions on risk and return to inform its asset allocation decisions. According to Callan, private equity is expected to have the highest risk of any asset class in the investible universe. Private equity is illiquid and hard to sell if cash is needed fast. It is a wholly inappropriate investment for a budget reserve account that needs liquidity to fund the day-to-day operations of government in the event that the price of oil collapses, as it has many times in the past.”

According to sources, state officials have been exploring if it’s possible to get out of the contract. But it’s tricky as the former Revenue commissioner signed a legal contract with DigitalBridge. Sources confirm that the state has encumbered $50 million from the CBR while they are dealing with the issue. It’s not yet clear if any money from the CBR has been transferred to DigitalBridge.

The Department of Law has also been engaged to work on the issue, per sources.

In June, Severin White, a managing director for DigitalBridge, was a speaker at Governor Dunleavy’s annual Alaska Sustainable Energy Conference. He spoke on “The Intersection of Data and Demand.”

DigitalBridge was founded in 1991 as Colony Capital. In 2021, they changed their name to DigitalBridge. According to their website, they have $106 billion in assets under management.

This is a developing story.

You mean “Policy and Procedures Manual,” not “Police and Procedures Manual,” right?

Thanks!

This. This is the kind of reporting the Landmine should do.

Who is Colony Capital?

The USA ambassador to Turkey. 3 seconds on google.

Just say his name or is that not allowed any more. His name is Tom Barrack, he started this hedge fund. Trump appointment, ambassador to Turkey. Follow the paper trail and the money. If you vote Crum for governor you are voting for corruption.

This article certainly bodes well for our $50,000 000 if transferred to DigitalBridge. SEC charges and findings against Colony Capital Investment LLC now rebranded DigitalBridge. SEC Charges Florida-Based Private Fund Adviser for Disclosure and Approval Failures Concerning Related Party Transactions ADMINISTRATIVE PROCEEDING File No. 3-22044 for violations of the Investment Advisers Act.

SEE https://www.sec.gov/enforcement-litigation/administrative-proceedings/ia-6671-s

Not what you know but who you know. And Adam Crum wants to be our next governor with this last minute good ol’ boy move? NOT in my lifetime.

The real question is, is DigitalBridge a reasonable investment? If Crum’s actions were otherwise legal, I’m not sure this is anything more than an awkward hit piece (Oh no, a commissioner acted within their legal sphere of responsibility!). If the investment can be liquidated quickly, and is likely a better return than a 3-month T-bill with reasonable risk, then it’s pretty clear that this was actually a smart move. We do have other options – we can continue to navel-gaze and complain that our investments (like the permanent fund) aren’t keeping up with the S&P without realizing that our policies… Read more »

As Landfield’s article points out, private equity–if that’s where the $50M went–is NOT liquid and is high risk, so there’s your “ifs.” Yes, Alaska should consider (in 2027, post-Dunleavy) changing up our investment approach. Such consideration should include passive investments, aka index funds, which, as Brad Keithly has pointed out in the Landmine, outperform the PF’s active management. But you’re very wrong about what the real question is. It’s not how well the secret, hidden, clandestine, upon-exit investment in DigitalBridge performs. It’s that the commissioner who has for years hidden oil and gas tax audit information from the legislature invested… Read more »

tell us you work for the administration without telling us

Did he do it while he was Bonded or before? He became bonded on April 17th of this spring, after he did his dirty deed at the APFC when he voted to do away with Bylaw Article II section 11 BONDING . What a criminal…

-Some dope who follows David Haeg.

The article above clearly states that Crum signed the contract in late July. Which would be after every April 17th that there ever was.

-Landmine, up there

you seem like a genuinely unhappy individual, try to go outside today.

Thank you for reading me so closely that you’ve formed an opinion of me as a person. Good to know I’ve gotten through.

Sadly, I don’t expect to ever form an opinion of you, person posting today as “touch grass”.

It’s weird that you took the time to send this message instead of getting fresh air and a clear head. Also – why are you so angry? are you okay? want to talk about it, person with a fake name?

Dan ,a dope as you explain without proof can’t read either but worse than that friend , I did know that Answer before you!

Jeff, I hope you tell us what Brian Fetcher has to say about Crum’s funds diversion. This reader is also interested to read what Keithley says about it, if anything.

Maybe Crum hoped/hopes to distinguish himself from the large pack of R gubernatorial candidates if his investment pays big, after which he can crow, “Those other R guber hopefuls talk about managing Alaska’s investments, but I’ve actually done it, and the state is richer for it. Vote for me, and I’ll make more brilliant investments, which will translate into bigger PFDs.”

I’m not sure it does any good to quote policies, rules, or even statutes in an article on Adam Crum or our pfd board. They don’t follow any of them anyways if they don’t want to. A general rule can be applied here, as in virtually all cases. If things are done without transparency, it is very likely nefarious. Adam Crum is a proven rule breaker.

Adam Crum is a god damn crook

Digitalbridge is seriously underperforming the market, per chatgpt: https://chatgpt.com/s/t_68e0033cb81881918c234c32e2f6d987

I think transparency is good. However private equity investments can have liquidity. I have investments in PE that have 90 day liquidity. Most private equity is not that type and can have years of commitment before returns are generated. The details matter in this case. Most reputable PE groups can have significantly higher returns and that also comes with increased risk. I would get more details and most importantly the return history of this group and how we might have expected to benefit from a higher rate of return investment. The timing and lack of transparency with other department personnel… Read more »

Something seems fishy here. Wonder if Crum got some sort of fee from Digitalbridge, (DBRG) like a kickback since it seems to be a very risky investment or more of a long shot gamble to be betting $50 million on. This investment research article thinks DBRG is a SELL not a buy. https://research2.fidelity.com/fidelity/research/reports/pdf/getReport.asp?feedID=1239&docTag=DBRG&versionTag=20251003

O my. Think if Crum gets elected as Governor he’d be duplicitous and sneaky? MMMMM!