Today, the House debated House Bill 90, a bill introduced last year by Representative Adam Wool (D – Fairbanks) that deals with “rental vehicles; relating to vehicle rental networks; relating to vehicle rental taxes; relating to vehicle rental fees, and providing for an effective date.”

The bill effectively deals with Turo, a tech company that allows people to rent out private vehicles online or through a mobile app. At question is whether Turo, or people who rent cars on Turo, are responsible for collecting and paying the 10% state vehicle rental tax.

Alaska Statute 43.52.050 – Liability for payment of vehicle rental taxes – states:

(a) The taxes imposed by AS 43.52.010 – 43.52.099 shall be collected and paid to the department

(1) by the person who provides the leased or rented vehicle; and

(2) in the manner and at the times required by the department by regulation.

(b) The tax shall be stated as a separate item on the lease or rental contract or other document invoicing payment.

On December 14, 2017 the State of Alaska Tax Division emailed a subpoena to Turo directing the company to produce “all records related to vehicle rental activity in Alaska in the years 2009 to 2017, including all attachments, documents incorporated by reference, and amendments.” The state was looking for the information to see what the unpaid tax liability was for people who rented cars on Turo during that time period. Turo refused to comply, stating they are not a rental car service and therefore not subject to the rental car tax. Their January 3, 2018 response to the state read:

As a preliminary matter, this purported “subpoena” was not properly served, nor is Turo subject to personal jurisdiction in the State of Alaska, Even if the threshold matters of jurisdiction and service were satisfied, the request is overly broad, unduly burdensome, irrelevant, would have provided inadequate time for response, and suffers from numerous other legal deficiencies not the least of which, as I believe you are aware, Turo is a peer to peer car sharing platform, not a rental car service.

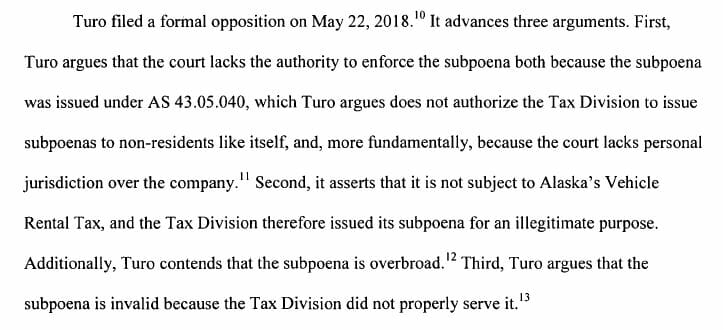

After unsuccessfully trying to negotiate with Turo for the information, the state filed a petition with the Alaska Superior Court on March 8, 2018 that would have forced Turo to comply with the subpoena. Turo filed an opposition on May 22, 2018. In their opposition, Turo argued the court did not have jurisdiction over them, they are not subject to the rental car tax, and that the subpoena was not properly served.

In the decision, the court specifically stated it “will not decide whether Alaska’s Vehicle Rental Tax applies to Turo and therefore will not summarize Turo’s position on the matter.” The court did say the subpoena was “unduly burdensome and overly broad” because it covered an eight-year time period. In his decision, Judge Louis Menendez denied the petition “because the underlying subpoena is overbroad and because, even were it not, the court does not have the authority to enforce the subpoena.” Turo is incorporated in Delaware and its main place of business is in California. The court seems to have said the state would need to issue a subpoena in one of those states to be enforceable.

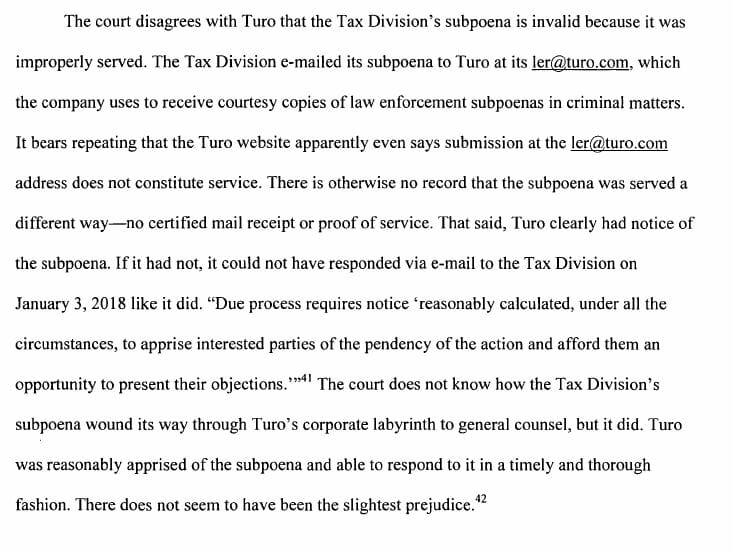

Comically, in response to Turo’s argument that they were not properly served, Menendez wrote, “The court does not know how the Tax Division’s subpoena wound its way through Turo’s corporate labyrinth to general counsel, but it did. Turo was reasonably apprised of the subpoena and able to respond to it in a timely and thorough fashion. There does not seem to have been the slightest prejudice.”

The Department of Revenue has stated it has been receiving tax payments from people who rent their cars on Turo, but added that participation remains low. The statute, although written before ride sharing was around, plainly states the tax shall be collected and paid to the department “by the person who provides the leased or rented vehicle.” The bill seeks to clarify this and also make Turo collect the tax instead of each person renting out their vehicle.

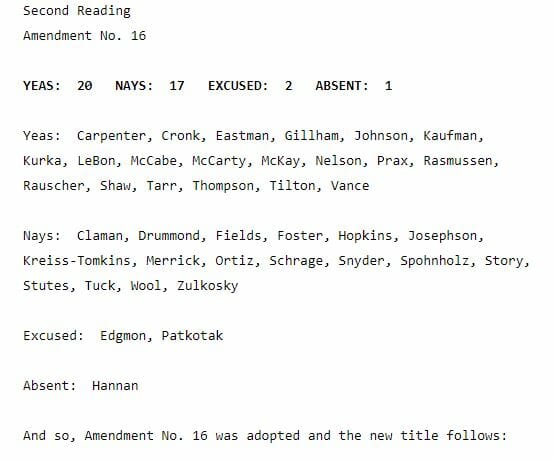

Ken Alper, who served as tax director under former Governor Bill Walker when this issue was in the courts, now works for Wool – who introduced the bill. During floor amendments today, Representative Sara Rasmussen (R – Anchorage), who has rented cars on Turo, offered an amendment that exempts people from the tax who are renting less than four vehicles on Turo. That passed 20-17.

The bill is up on Friday in the House for final passage. If it passes the House, it will head over to the Senate. But regardless if the bill passes, the question remains whether or not Turo, or people renting cars on Turo, are responsible for the 10% state vehicle rental tax. Because the state has no information from Turo, it’s unknown how much has not been collected. There could also be litigation to determine whether or not people using Turo are subject to the rental car tax. In 2016, Delta Leasing agreed to pay $1.5 million to the state after claiming for years it was not subject to the state’s 10% vehicle rental tax.

It seems to me that State law is pretty clear. Those providing the vehicle for rent are responsible for collecting and paying the 10% rental car tax. It would be easier on all parties (except Turo) if the law was changed to make the, for lack of a better word, rental facilitator collect and pay the taxes to the state. As of now, it is the taxpayer’s responsibility to collect and pay those taxes. I also think it is an absolute garbage amendment to the bill to not tax those who rent less than 4 vehicles. If you rent a… Read more »

Escaping local regulation and taxes by hiding behind the internet is eventually going to come to head. It is not fair to make some follow the rules and let others escape them.

Government’s view – ‘If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.’