Replacing cuts in the Permanent Fund Dividend (PFD) with the type of sales tax recently proposed by Governor Mike Dunleavy (R – Alaska) as a funding source for state government would result in reducing the level of government take from the median-income Alaska household in 39 of the 40 Alaska House Districts and all 20 Alaska Senate Districts.

Put another way, the median-income household in virtually all of Alaska’s legislative districts would retain more income – have more money in their pockets – if the state used a sales tax, along the lines recently proposed by Governor Dunleavy, to raise state revenue rather than through PFD cuts.

A significant contributor to that result is the use of a state sales tax, which would materially diversify the state’s revenue sources by including non-residents. By materially increasing the share of state revenue derived from non-resident sources, the need for revenue from Alaskans would decline sharply.

As the recent report from the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) on the “Economic Impacts of Alaska Fiscal Options 2026” explains, using PFD cuts to fill the budget gap reduces Alaskan income by 86% of each dollar raised. On the other hand, using the sales tax proposed by Governor Dunleavy would reduce Alaskan income by only 74% of each dollar raised, resulting in a net 12% reduction in the contributions required from Alaskans to raise the same amount of overall revenue.

At the overall annual revenue level of approximately $775 million projected for the Governor’s proposed sales tax in the fiscal note to Senate Bill 227, that alone amounts to $93 million – or nearly $400 per average Alaska household – in revenue received from non-resident sources that Alaskans would instead keep in their own pockets.

Using a variation of the Governor’s proposal, what the ISER study refers to as “Sales Tax: More Exclusions,” would reduce the state government’s call on Alaskans’ income by even more, to 68% of each dollar raised, resulting in a net reduction of nearly 20% in the revenue required from Alaskans. At the Governor’s proposed revenue level, that would amount to nearly $140 million – or nearly $600 per average Alaska household – in net savings for Alaskans.

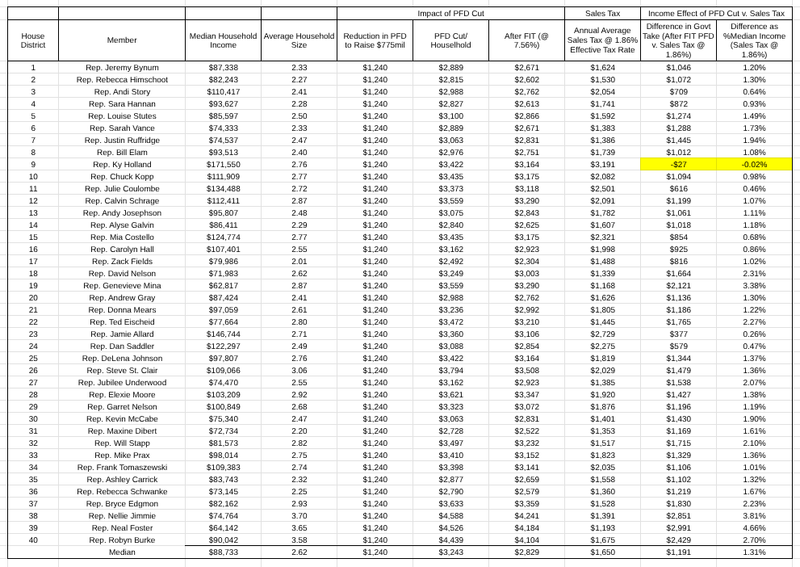

As we indicated, in total, replacing PFD cuts with the proposed sales tax would reduce the level of government take from median-income Alaska households in 39 of the 40 Alaska House Districts and in all 20 Alaska Senate Districts.

The one exception in the House is Representative Ky Holland’s (I – Anchorage) House District 9, the wealthiest district in the state as measured by median household income.

The House districts that would benefit most from substituting the type of sales tax recently proposed by Governor Dunleavy are those in rural Alaska, led by House District 39, represented by Representative Neal Foster (D – Nome), and House District 38, represented by Representative Nellie Jimmie (D – Toksook Bay). The Senate district that would benefit most is Senate District T, represented by Senator Donny Olson (D – Golovin), followed by Senate District S, represented by Senator Lyman Hoffman (D – Bethel).

The median Alaska household in each district represents the midpoint. There are equal numbers of households in the district with incomes above and below the median. If the median-income household in a district benefits, then those with lower incomes would benefit as well, to an increasing degree. In districts where the median-income household benefits, some households in the upper half of the income distribution also benefit. If the median-income household in a district benefits, the majority of the households in the district will also benefit.

In previous columns, we have estimated that, statewide, 80% of Alaska households, those in the middle- and lower-income brackets, would benefit from replacing PFD cuts with the type of sales tax recently proposed by Governor Dunleavy. Only non-residents, who currently contribute nothing toward the costs of state government but would under Governor Dunleavy’s proposal, and those in the upper-income brackets, who currently contribute only a trivial amount to the costs of government using PFD cuts, but would contribute at least some more using a sales tax, would contribute more than they currently do.

But even then, those groups would still contribute less as a share of income than middle- and lower-income households.

By ensuring that non-residents contribute, Alaska would also treat non-residents coming to the state the same way Alaskans are treated when traveling to the other forty-five states (plus the District of Columbia) that have a sales tax. By paying sales taxes on goods and services purchased while in those states (including major destinations such as Arizona, Florida, Hawaii, Texas, and Washington), Alaskans contribute to those states’ government revenue, thereby reducing the burden on their residents. By implementing a sales tax of its own, Alaska would similarly require non-residents purchasing goods and services in Alaska to contribute to the costs of Alaska’s state government, reducing the burden on Alaska families.

In short, it would help balance the current one-way street, in which Alaskans contribute a portion of their income to reduce the cost of distant government when visiting another state, but those states’ residents don’t reciprocate when visiting here.

Here are the results by House District. Results for Senate Districts can be calculated by combining data from the two House districts within each Senate District.

In the chart, the median household income and average household size for each district are taken directly from the most recent Census Bureau 5-year data, covering 2019 to 2024.

The per-PFD reduction is calculated by dividing $775 million, the average annual amount projected to be raised by Governor Dunleavy’s proposed sales tax, by 625,000, the approximate number of current PFD recipients. The result is the amount by which each PFD would need to be reduced to raise the same amount of revenue as projected for the Governor’s proposed sales tax.

The per-household PFD cut is derived by multiplying the per-PFD reduction by the district’s average household size. The result approximates the impact of using PFD cuts on the median-income household in each district. Because the amount realized by restoring the PFD would be subject to federal income tax, we reduce the impact of restoring the PFD by the level of federal income tax that would be paid on it (7.56%), calculated at the average effective tax rate applicable to middle-income Alaska households, into which the median household would fall, from the most recent state-level data published by the Internal Revenue Service.

The sales tax projected to be paid by the typical median-income family is estimated by multiplying the median household income by a 1.86% effective tax rate. The 1.86% rate is based on the assumption that the overall average effective tax rate on goods and services covered by the Governor’s seasonal tax proposal is 3% (the average of the proposed seasonal differentials of 2% and 4%). That rate is not the effective rate on overall income at any income level, however, in large part because the tax does not apply to housing costs, which constitute a significant share of any household budget. Because the share of income spent on taxed goods and services declines as income rises, the effective tax rate as a share of income also declines.

We estimate the effective tax rate for middle-income Alaska households by using the distributional curve reported for the South Dakota state sales tax (“General Sales – Individuals”), on which the Governor’s proposal is patterned, as included in the most recent “Who Pays” state tax analysis from the Institute on Taxation and Economic Policy (ITEP).

We then compare the impact on the median-income household in each district of raising the projected $775 million in revenue by either cutting the PFD or restoring the PFD cut and substituting the Governor’s proposed sales tax. The numbers in the far-right columns reflect both the absolute dollar differences and the differences expressed as a share of income. A positive number means that using a sales tax takes less than using PFD cuts; a negative number (applicable only to House District 9) means that using PFD cuts would take less.

Keep in mind that these numbers reflect the impact on the median-income household in each district. The negative impact of using PFD cuts rises at income levels below the median; at some point, the negative impact of sales taxes will exceed that of PFD cuts at income levels above the median. The effect on the majority of households in each district (positive or negative) will be in the same direction as the effect on the median-income household.

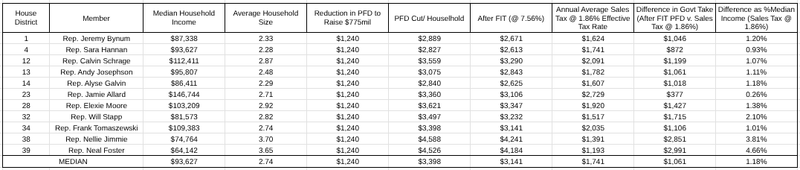

To assess whether there are significant differences, we also analyzed the impact on the districts represented by members of the House Finance Committee (HFIN) separately from the impact on the House as a whole.

Interestingly, the median income of the House districts represented on HFIN is somewhat (5%) higher than the median income of the House districts as a whole. Understandably, as a result, the positive impact of using a sales tax to substitute for PFD cuts on the median income of the House districts represented on HFIN is materially (11%) less than on the median income of the House districts as a whole. While the results remain strongly supportive, they suggest that HFIN members may be less inclined at the margin to support using a sales tax to offset PFD cuts than the House and the state as a whole.

At the HFIN hearing last week on the Governor’s proposed sales tax, some members of HFIN expressed concern that layering a state sales tax on top of local sales taxes could increase the economic burden on their constituents.

The above analysis shows the opposite, at least for the median-income household in each district. By pairing a restored PFD with the sales tax, the median-income household in almost every district in the state would have more money in their pockets, improving their economic situation and, indeed, even partially reducing the adverse impact of local sales taxes.

Some also argue that the Governor’s proposal would use sales tax revenue to fund a PFD. As we have explained elsewhere, that is “fake news,” to use the current vernacular. Under Alaska’s current statutes, PFDs are fully funded entirely from the state’s annual draws from Permanent Fund earnings. What is lacking is full funding for government services. Sales tax revenues would help to fill that hole in a manner that would result in more income in the pockets of the median-income Alaska family than the current approach in 39 of the 40 Alaska House districts, and all 20 Alaska Senate districts, including that of Senator Mike Cronk (R – Tok/Northway), one of those who recently has made the “fake news” argument.

In any event, to the extent that there is a “redistribution of wealth,” as some have falsely claimed, a significant portion of the redistribution would come from non-residents, increasing the amount of overall income remaining in the pockets of Alaskan households.

Others have also claimed that restoring the PFD would lead to spending cuts. But that is another “fake news” argument. As the above analysis demonstrates, using a sales tax would raise the same amount of revenue to support spending while imposing a materially lower cost on the median-income Alaska family in virtually every Alaska legislative district.

In short, by using a state sales tax to raise the required level of revenue, Alaskans would realize the same level of state spending at a lower cost to themselves.

The net result of using a sales tax along the lines proposed by Governor Dunleavy is that the median-income Alaska family in nearly all of the state’s legislative districts would not only retain more income in their pockets, but the state as a whole would benefit by significantly diversifying its sources of revenue and materially reducing the level of government take from Alaska families.

That, in turn, would free up a significant amount of additional Alaska income to circulate in the state’s economy.

It’s hard to see why any Alaskan, especially legislators from those districts that would benefit, would oppose that outcome.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“……..to the extent that there is a “redistribution of wealth,” as some have falsely claimed, a significant portion of the redistribution would come from non-residents……….”

So, let’s see………It’s false that it’s a “redistribution of wealth”, but a “significant portion of that redistribution” (that isn’t real) “would come from non-residents”, so that makes the not-real thing immediately wonderful.

This isn’t even an opinion piece. It’s economic fiction.

At least it’s original and not dishonest AI-generated crap like that RINO jerk McCabe sends to Downing’s blog.

“………At least it’s original……….”

I have to agree that Mr. Keithley does regularly generate original comedy routines to attempt the same tired punch lines.

My issue with the state sales tax is that my community, Sitka, we already have a summer seasonal sales tax of 6% so adding the summer seasonal state sales tax would result in a 10% sales tax. I also take issue with exemption of jet fuel from the sales tax but not marine or highway fuels.

yeah for a 12% difference – lets ignore the multitude of deleterious effects of the Dividend. It is taxed by the feds -wasting 10-20% of its impact. It hyper inflates and distorts our real economy. It is the most socialist of all the socialist State programs in the country appealing to human greed and resentment that socialism depends on for its “appeal”. It wrecks the legislative process taking all the air out of the room for the things on which we should really focus. I could go on and on but I will leave you with the most capitalist solution… Read more »