Some recent comments reminded us that it’s been a while since we wrote about the Tax Avoidance Dividend (TAD). As we explained in a previous column,

The TAD is the flip side of the Permanent Fund Dividend (PFD). The PFD is the portion of Permanent Fund earnings paid out each year to Alaska residents. The TAD is the portion of Permanent Fund earnings used instead to pay for government.

The effect of the TAD is to shield Alaskans (and non-residents) from paying for the portion of government spending covered instead by Permanent Fund earnings. It is as much of a “free ride” to Alaska residents [and non-residents] as the PFD. By shielding them from taxes, it allows Alaskans [and non-residents] to keep the dollars they otherwise would be required to pay for that portion of government spending in their pockets.

As we explained in previous columns, because they are distributed on a per capita basis, the benefits of the portion of Permanent Fund earnings distributed as PFDs are most significant for middle- and lower-income Alaska families. On the other hand, because the impact of most taxes, even including sales taxes, generally follows income levels, the benefits of the “free money” drawn from Permanent Fund earnings and used as TADs – to shield Alaskans (and non-residents) from taxes – are most significant to upper-income Alaska families and non-residents.

In short, all Alaska families (and non-residents) currently receive significant benefits from the “free money” of Permanent Fund earnings; they just receive those benefits in different ways. The “free money” distributed as PFDs is generally realized on a per capita basis; the “free money” used as TADs is generally realized on an income basis. The higher the income, the more that is shielded from tax by the TAD.

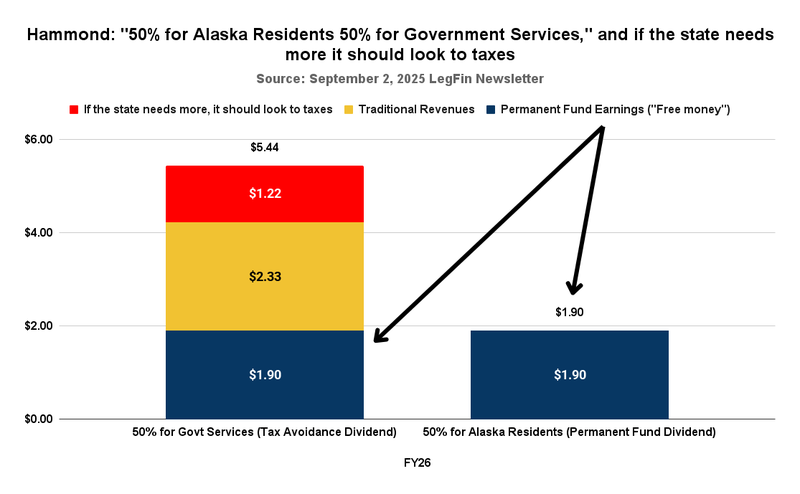

Current Alaska law generally divides the benefits of the “free money” from Permanent Fund earnings equally between the two beneficiary groups. Under AS 37.13.145, “50 percent of the income available for distribution under AS 37.13.140” is to be distributed as PFDs. The remainder is available for use in the general fund. The portion used for the general fund is the TAD. It shields Alaska families and non-residents from paying taxes equal to the same amount.

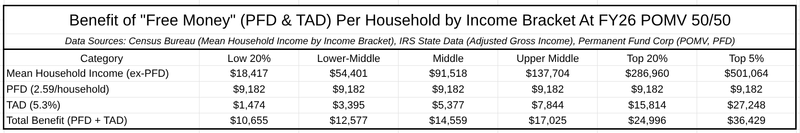

Using the most recent data, if half of the Fiscal Year 2026 (FY26) percent of market value (POMV) draw ($3.8 billion) had been distributed as PFDs, the average Alaska household (composed, according to the latest Census Bureau data, of approximately 2.6 members) would have received roughly $9,000 in PFDs, regardless of income level.

At the same level, the other half of the POMV draw, the TAD, would have shielded about 5% of Alaska Adjusted Gross Income (AGI) from state tax. Put another way, absent the TAD, Alaska households (and non-residents) would have been required to pay, on average, about 5% of their Alaska AGI in taxes (likely sales or income taxes, or a combination of both) to close the resulting state deficits.

Using the average rate, at a household income level of $100,000, the “free money” benefit from the TAD would have equaled about $5,000 (5%) in avoided taxes. At a household income level of $250,000, the “free money” benefit from the TAD would have equaled about $21,500 (again, 5%) in avoided taxes. At a household income of $1 million, the TAD’s “free money” benefit would have been about $50,000 (still 5%) in avoided taxes.

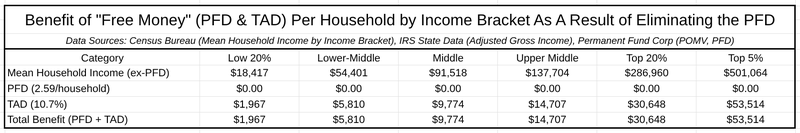

Here is a breakdown of the impact of the two categories of “free money” on the median income household in each income bracket using the latest income data from the Census Bureau. For households in the upper-income brackets and non-residents, the “free money” benefits from the TAD increasingly outweigh those from the PFD. The reverse holds for households in the middle and lower-income brackets.

What has made us realize we should write about the TAD again are recent comments by some that all PFDs should be withheld and diverted to cover government costs before Alaskans and non-residents are asked to pay other personal taxes. As Dr. Matthew Berman of the University of Alaska Anchorage’s Institute of Social and Economic Research (ISER) has pointed out, PFD cuts are themselves personal taxes, indeed, the “most regressive tax ever proposed.” The commentators suggest that those should be raised to their maximum income-confiscating level before any other broader-based, lower-impact personal taxes, such as sales or income taxes, are imposed.

The reason the commentators claim such a step is justified is that the PFD is “free money,” and in their view, as a class, “free money” is of lesser significance. As a result, they claim it should be fully taxed by the government before other sources of income are included in the tax base. In essence, they argue that any benefit from “free money” is unearned and should be subject to state confiscation before those with “earned income” are taxed at all.

But they don’t really mean that. What they avoid addressing is that they are already benefiting significantly from “free money” in the form of TADs, and that their share of that “free money” will increase further if PFDs are cut. All that “PFD cuts” do is ensure that middle and lower-income Alaska families receive less of the “free money,” so that those in the upper-income brackets and non-residents can receive even more than the 50% share already provided to them by statute. They really don’t view “free money” as inferior; they just want more of it for themselves.

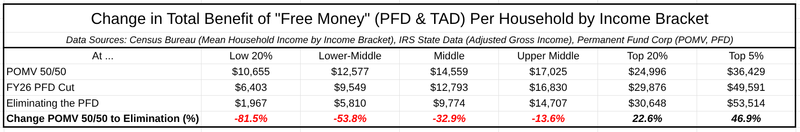

We’ve used (and explained) these charts in previous columns to illustrate the effect. We’ve updated them here to reflect the impact in the current fiscal year.

Under the current statutory structure, 50% of the “free money” available from Permanent Fund earnings goes to the PFD and 50% to the TAD. As such, in the aggregate, both middle and lower-income Alaska families, on the one hand, and upper-income Alaska families and non-residents, on the other, receive an equal share of the “free money,” which in the case of Fiscal Year 2026 (FY26) is $1.9 billion.

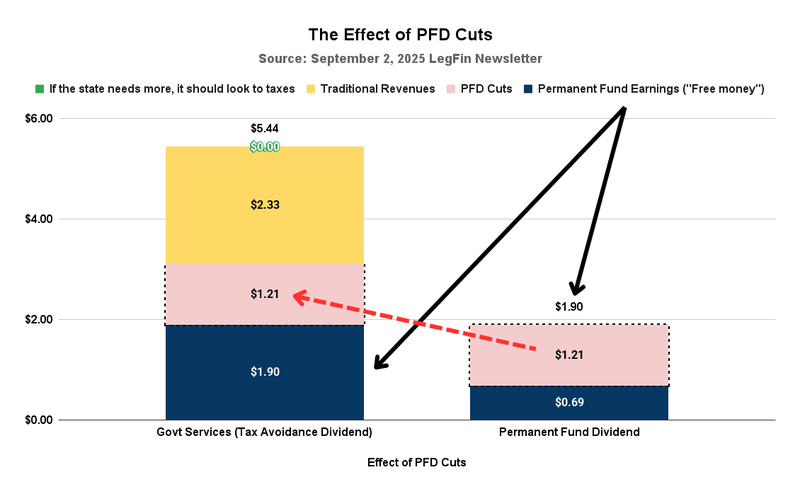

This is what happens when the PFD is cut.

Instead of being divided equally between the two uses, nearly two-thirds of the “free money” statutorily required to be used to fund PFDs – and primarily benefit middle and lower-income Alaska families – is withheld and diverted instead to the TAD. The “free money” doesn’t go away. Instead, the benefit of the amount cut from PFDs shifts to the TAD, and, through that, mainly into the pockets of upper-income Alaska families and non-residents.

Using the FY26 numbers, the benefit of the “free money” is no longer being split evenly between the two groups. Instead, those benefiting from the TAD are now receiving $3.11 billion (approximately 82%) of the “free money,” while those who benefit most from its distribution as PFDs are receiving only $690 million (or 18%).

The $3.11 billion is nearly 9% of Alaska AGI. Put another way, by shifting it to the TAD, Alaska households (and non-residents) are using “free money” to shield themselves from the almost 9% in Alaska AGI they would otherwise be required to pay in taxes to close the resulting state deficits.

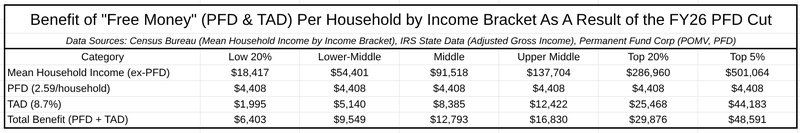

Here is a breakdown of the benefit distribution by income bracket following the PFD cuts, again using the average tax avoidance rate:

As the amount of “free money” distributed as PFDs decreases, the amount of “free money” used as TADs to shield against taxes increases. The result is that households in the middle and lower-income brackets receive less overall of the “free money,” while those in the upper-income brackets and non-residents receive more.

The result of eliminating the PFD and shifting all of the benefits of the “free money” to the TAD is even more dramatic.

Eliminating the PFD would shield nearly 11% of Alaska AGI from state tax. Once again, the result is that households in the middle and lower-income brackets receive less of the “free money,” while those in the upper-income brackets and non-residents receive even more.

Here is a side-by-side comparison of the change in the “Total Benefit” from the three cases by income bracket:

The takeaway is clear. Those complaining about the “free money” being distributed as PFDs aren’t really objecting to “free money.” Instead, they are increasingly dependent on it. As government costs increase and the potential exists that the share used as TADs may no longer be sufficient to protect them from taxes, they want more of the benefit of the “free money” for themselves.

In short, “cutting /eliminating PFDs first” is no more than a smokescreen for transferring increasing amounts of free money to those benefitting most from the TAD. Those pushing for “PFD cuts before taxes” aren’t against “free money”; they just want the benefit diverted to their own pockets instead.

Rather than reducing or eliminating the “free money” drawn from Permanent Fund earnings, PFD cuts shift the basis for the distribution of the benefit from all Alaska families, at least in significant part, on a per capita basis, to an approach increasingly, if not ultimately, entirely based on income. Those with more income to begin with increasingly receive a greater and greater share of the “free money.”

That’s just another way of saying, by redirecting the benefit increasingly in their direction, those in the upper-income brackets are able to use the “free money” to become richer. In contrast, those in the middle- and lower-income brackets fall further behind. The issue isn’t about “fairness” as some try to claim; it’s about the greed of those who want more of the benefit from the “free money” increasingly for themselves.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

This is idiotic reasoning. Income redistribution under another name.

You’re butt-hurt over the very notion of taxes.

You get wifi in your cave?

“……..You get wifi in your cave?………”

I don’t “get” it. I buy it.

Do you “get” wifi in Vegas?

You keep assuming that PDF cuts are just a tax like any other tax. I understand that you want to believe it, i understand that the ISER guy wants to believe it, but what you need to do is convince others of it. You haven’t even tried. I believe that it is not fair to tax income, which is earned through hard work, just to pay dividends to people for doing nothing more than managing to live in AK for a minimum of one year.

Yup, we get that you want more and more of the “free money” for yourself, rather than distributing it to all Alaska families in the same way as the typical oil trust. https://alaskalandmine.com/landmines/brad-keithleys-chart-of-the-week-putting-all-alaska-families-first/

You have a propensity to get ugly with people who recurrently challenge your ideology. As one who repeatedly positions himself as a defender of the middle class and poor, I have to wonder: have you ever held or published a position on the PFDs for minor children? How many children have their PFDs spent on consumer goods for and by parents? Any comments on that? Maybe you’d like to deny that happens for Alaskans (who know better) to read? Government social assistance programs tend to come with requirements. Limits. The PFD comes with absolutely nothing like a requirement (except to… Read more »

“You have a propensity to get ugly with people who recurrently challenge your ideology.“

Extremely hypocritical projection, as even the most casual observer of these comment boards can see.

Yet another sock puppet? Who represents House District 30 in the Legislature?

Kevin McCabe. So we know who this is.

I had to look up McCabe’s position on the PFD. Fully opposite me, he supports a full dividend:

“………. I have always believed in a full statutory PFD………”

So go ahead, Mr. McCabe-Derangement-Syndrome. Run him out of office.

https://kevinjmccabe.com/how-does-the-pfd-belong-to-you/

People with poor arguments tend to engage in ad hominem attacks rather than deal with the substance of the argument. Is this the kind of author you want to be?

Well, that was a good article.