In a recent op-ed in the Anchorage Daily News, current Lieutenant Governor – and declared candidate for Governor – Nancy Dahlstrom (R – Alaska) urges adoption of an amendment to the Alaska Constitution to consolidate Alaska’s constitutionally-required two-account Permanent Fund (Fund) into a single account.

But the claims she makes in support of the amendment are grossly misleading and, in some instances, outright false. For example, in both the title and body of the piece, she claims that adoption of such an amendment would “guarantee” a Permanent Fund Dividend (PFD). The title is “An endowment can guarantee a reliable PFD for generations.” In the body, Dahlstrom says this: “It’s [the proposal] about giving families certainty: a dividend you can actually count on every single year — no more $1,000 surprises, no more last-minute fights.”

The reason both are hugely misleading is that neither of the two main bills currently before the Legislature, which embody the proposed constitutional amendment she supports, includes any such “guarantee” of the PFD.

The two main bills currently before the Legislature that would consolidate the two accounts are HJR 10, introduced by Representative Calvin Schrage (I – Anchorage), and SJR 14, introduced by the Senate Finance Committee. The first has passed through the House State Affairs and Judiciary Committees. It is pending action before the House Finance Committee, the last committee of reference before it goes to the floor, when the Legislature returns in January. The second has already had three hearings before the Senate Finance Committee, its only committee of reference, and is pending action there when the Legislature returns in January.

Neither bill even mentions the PFD, much less provides a guarantee of it. Instead, their sole purpose is to change the rules governing the Legislature’s annual withdrawal from the Permanent Fund.

Currently, Article 9, Section 15 of the Alaska Constitution requires that the Permanent Fund be held in two accounts. The first account – what is commonly referred to as the “corpus” of the Fund – is to be used “only for those income-producing investments specifically designated by law as eligible for permanent fund investments.” The second account, commonly referred to as the earnings reserve, holds the income produced from those investments.

Under the current constitutional structure, the Legislature can only appropriate money held in the second account, the earnings reserve. Money held in the first account, the corpus, is off limits to appropriation. That limits the amount the Legislature can withdraw from the Permanent Fund strictly to the amount earned on its investments. It absolutely prohibits tapping into the corpus.

By combining the two accounts, the constitutional amendments reflected in HJR 10 and SJR 14 would change the structure so that the Legislature can continue to draw from the Permanent Fund even if the income earned on the investments is insufficient to cover the amount to be withdrawn. The Legislature would no longer be limited to drawing on the amounts the Fund has earned; the amendments would permit the Legislature to access amounts that, under the current constitutional provisions, are explicitly off-limits to its reach.

In theory, the use of amounts withdrawn from the Fund by the Legislature is governed by statute. Under AS 37.13.145 (which is titled, “Disposition of income”), “50 percent of the income available for distribution under AS 37.13.140” shall be transferred to the Department of Revenue for distribution as PFDs, with the remainder made available to the general fund for appropriation.

But the Legislature has consistently ignored those statutory provisions since 2017, repeatedly withholding (taxing) substantial portions of the amounts required by the statute to be distributed as PFDs and diverting them instead to the general fund to cover the deficits existing elsewhere in the budget.

Nothing in HJR 10 or SJR 14 changes that. If the provisions in either of the bills are adopted as currently proposed, the Legislature would continue to be free to withhold and divert all or any part of the amounts designated for distribution of PFDs to cover deficits elsewhere in the budget. There is absolutely nothing in either proposed amendment that would “guarantee” a PFD, nor, to use Dahlstrom’s words, ensure “a dividend you can actually count on every single year — no more $1,000 surprises, no more last-minute fights.”

Theoretically, another proposed constitutional amendment, introduced last year as SJR 5, would accomplish something along the lines claimed by Dahlstrom by adding some provisions to the Constitution relating to the PFD. Under subsection (c) to be added by SJR 5, the Legislature would be required by the Constitution to appropriate a portion of the amount taken from the Permanent Fund “for dividend payments to eligible residents of the State as provided by law [statute].” The statute governing such distributions, in turn, could be amended to “change[] the amount appropriated for dividend payments” only with voter approval.

But only members of the Senate Minority have endorsed SJR 5. It has not received any hearings in the Senate, and there is no companion bill in the House. It is not the legislation consolidating the two accounts that is moving.

Dahlstrom’s claim that adopting a constitutional amendment to merge the two accounts necessarily would “guarantee a reliable PFD for generations” is absolutely false. It does not do so unless there are additional provisions included specifically addressing the PFD. Neither of the two bills moving in the Legislature contains those provisions.

There are other gross exaggerations in Dahlstrom’s piece. She claims, for example, that combining the two accounts “locks the door forever on raids and gives the entire fund the strongest legal protection possible.”

It doesn’t. As we discussed above and explained in detail in previous columns, eliminating the firewall between the corpus and the earnings reserve would explicitly allow raids on what is currently treated as the corpus when the Fund is not earning sufficient earnings to cover withdrawals.

Dahlstrom weakly proposes adding a provision that would “limit the draws to the lesser of 5% or actual realized returns,” addressing what she calls “the fear some have of tapping into and draining the corpus itself.” But neither HJR 10 nor SJR 14 contains any such provision, and the concept of “actual realized returns” is so vague that subsequent legislatures short on funds could drive the proverbial Mack truck through it. It wouldn’t provide anything approaching the absolute firewall that the current two-account system incorporates.

Dahlstrom also claims that changing the structure would enable the Permanent Fund Corporation “to invest aggressively for maximum growth instead of being forced to hold cash ‘just in case’ the Legislature demands it.”

But the Permanent Fund Corporation’s own records demonstrate that they aren’t currently holding any spare cash on the off chance the Legislature might “demand it.” It’s a made-up rationalization.

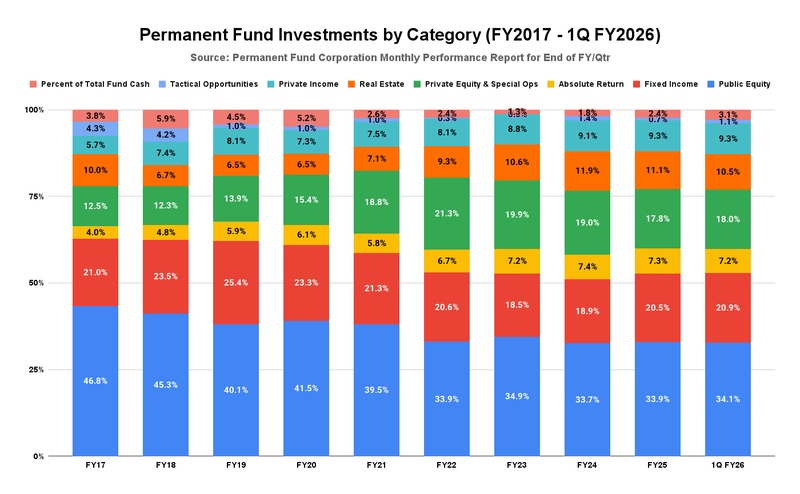

The following chart follows, by percentage, the portfolios (what some refer to as the “buckets”) into which the Permanent Fund Corporation (PFC) has invested the Fund over the nine years the PFC has used its current portfolio classification system in its reports.

The percentage of the overall portfolio held in cash is at the top.

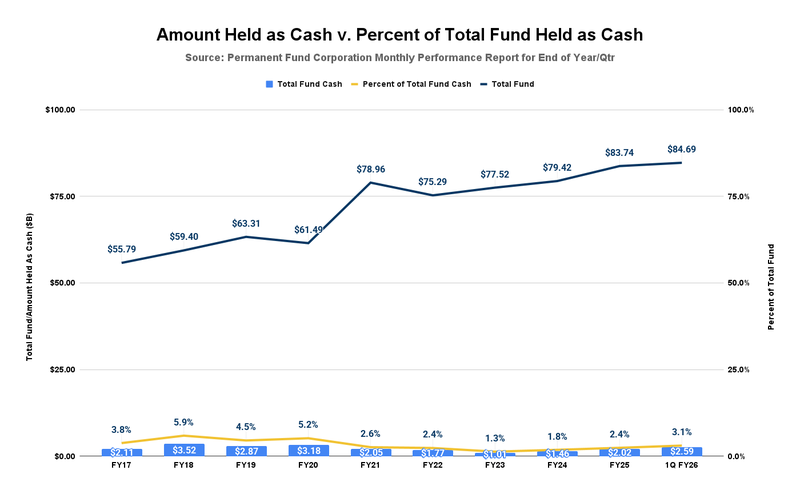

To put those amounts in further perspective, here are the quantities held as cash, broken out separately by amount and as a percentage of the overall portfolio, stated on a scale that compares the amount held in cash to the size of the overall investment on the left, and the percentage of the overall investment held as cash on the right.

In only two of the years has the amount held in cash exceeded 5%, and even then, not by significant amounts. Instead, for the last five years, once the annual percent-of-market-value (POMV) draw routine was established, the amount held as cash has remained consistently below 3%, well in line with the percentages held in cash by other similar funds.

As we’ve explained in previous columns, we agree, to borrow Dahlstrom’s word, that the PFC’s current investment approach is “broken,” but not for the reasons she asserts: that the Fund is holding inordinate amounts of cash or that it is based on a two-account system. As the modeling in that previous column demonstrates, the Fund is not generating more income because the PFC is failing to follow investment strategies that maximize returns and minimize costs.

As we’ve shown repeatedly on these pages and in various periodic charts, delivering more money for POMV draws is dependent on restructuring the PFC’s strategy to maximize returns and minimize costs. It has nothing to do with combining the current two-account structure into a single account.

Reduced to its essence, all that combining the two accounts into a single account does is create legislative access to the amounts currently protected by the Constitution’s current two-account system. Dahlstrom and others are making up spurious claims to obscure what the effort is really about.

The two-account system is unrelated to whether there are PFDs or their amount. That depends entirely on whether there are binding provisions requiring the Legislature to set aside a portion of the POMV draws for distribution, and on the investment approaches adopted by the PFC.

Using false and grossly misleading arguments, Dahlstrom is trying to gaslight Alaskans. She should retract the op-ed, and, frankly, if that’s a reflection of how she approaches fiscal issues, she should reconsider her campaign.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Brad, she’s trying to get elected.

We Alaskans fall for this crap. Over and over.

With a promise of a magical, guaranteed PFD, she might very well pull this off. Keeping the corpus away from everybody’s grubby fingers can’t be violated, or the leeches will suck it dry.

I agree with the author that Dalstrom’s proposal would make it easier for the legislature to spend Permanent Fund earnings rather than pay dividends. But this argument is in service of the author’s wider project, which is to institute income taxes so that a so-called “full dividend” can be paid. His main argument assumes that cutting pfds is just a tax like any other tax. But cutting dividends is not just like any other tax – people get dividends for doing nothing more than living in Alaska for a minimum of one year, while people get earned income from working. It is not fair… Read more »

“……..people get dividends for doing nothing more than living in Alaska for a minimum of one year…….”

For the sake of accuracy, an “Alaskan” can live in Alaska for 181 days per year, then winter in, say, Las Vegas for 184 days per year, and receive a dividend every year.

Dunleavy got himself elected twice by promising blowout PFD checks, and Dahlstrom is simply following the same playbook.

One of the Lt. Governor’s few explicit duties is to conduct free and fair statewide elections according to law. Our last statewide election saw several Northwest villages disenfranchised. This was blamed on the weather; I blame it on Dahlstrom’s indifference to have contingency plans in place, especially since those villages were not thought to be Dunleavy supporters. You can be sure that had a natural disaster occurred in Southcentral, there would have been no-holds-barred to get voters to the polls.

“You can be sure that had a natural disaster occurred in Southcentral, there would have been no-holds-barred to get voters to the polls……..”

Do you remember the general election of November, 1982?

Irrelevant to martin’s Dalhstrom post.

But very relevant to martin’s post, which is what I quoted. Could you’ be sensitive to that election night fun and games?

Vaguely. What’s your point?

Election night of November, 1982 was snowing. A lot. Before the early evening rush hour, when folks were getting off work (people worked back in those days) to go vote on their way home, somebody shot an insulator at the zMuldoon substation, laying a live wire atop numerous others, and blowing power throughout east and central Anchorage. No traffic signals. Snowing hard. Rush hour. There was s gubernatorial race that year; Bill Sheffield against former Anchorage mayor Tom Fink. Also on the ballot was the regionally divisive initiative of paying for a capitol move to Mat-Su. A couple of days… Read more »

Am still not sure what your point is. Are you implying that Terry Miller, Jay Hammond’s Lt. Gov. was as unconcerned as Dahlstrom when bad weather struck? I remember the political climate being very, very different, Eagle River to Wasilla being sparsely populated, and no ranked-choice voting. Also, weather prediction was much less reliable than nowadays, although I don’t recall hearing about it here in Fairbanks in 1982.

“……..Am still not sure what your point is……….” Let’s review: Your previous statement: “………You can be sure that had a natural disaster occurred in Southcentral, there would have been no-holds-barred to get voters to the polls……….” In 1982, in addition to a heavy snow storm during rush hour, we suffered a terrorist attack. Remember the definition of terrorism?: “……..the unlawful use of violence and intimidation, especially against civilians, in the pursuit of political aims………” I’m not sure how many traffic accidents occurred that evening in all those dark, snowy, uncontrolled intersections, but they happened. I almost got into a few between the polls and… Read more »

“…….Are you implying that Terry Miller, Jay Hammond’s Lt. Gov. was as unconcerned as Dahlstrom when bad weather struck?……..”

Obviously, even though a terrorist attack is what caused the problem exasperated by the weather. Not a word about it. Nada. Zip. Nyet.

And, really, what would they do about it? Hold another election?

Weather is a thing in Alaska. As I type this, I’ve been on a generator for days. And most folks don’t have generators. Only the smart ones do.

Smart people live on the grid and know the difference between moot and mute. They also know the difference between exacerbated and exasperated.

I live on the grid, but sometimes the grid breaks. I hope that doesn’t happen to you and your hair curler doesn’t work. But apparently I’m illiterate. Probably illegitimate, as well, but I really don’t care about that. It’s like being undocumented, right? That’s a cool way to be, isn’t it?

His point is that as long as a white person once experienced voting hardship that it’s okay for a bunch of natives to be disenfranchised. It’s more racism from the liar who claimed to be native, a Juneau resident, and a member of Sealaska corp.

“……..His point is that as long as a white person once experienced voting hardship that it’s okay for a bunch of natives to be disenfranchised………”

LOL. Weather in Alaska is a given. I’ve been on generator power for days now. Should I blame Dunleavy for it? It’s quite another to have somebody shoot my power out intentionally. And what can anybody do about it, anyway, other than try to catch the terrorist. Have a new election?

I live in Mat-Su. Maybe I’m Kevin McCabe? Donald Trump? Vladimir Putin? Let your imagination really go wild!

“…….. It’s more racism from the liar who claimed to be native, a Juneau resident, and a member of Sealaska corp………” If I’m a Tlingit Sealaska share holder in Southeast, then you’re a Muslim Taliban terrorist in Afghanistan whining about white man Infidels. Indeed, you have no idea who or what I am. White? How would you know, Moron? You are as clueless as you appear. I might be Korean or Samoan for all your know. What a moron. I’m more and more inclined to believe that “JJ” is the anonymous mouthpiece of the “brave” psycho Mark Kelsey who uses anonymity… Read more »

Hi Mark Kelsey!

It’s me, the actual resident of Juneau who is 25% Tlingit and lives here in our Capitol City. Took me extra time to shovel all the snow out this morning (got dumped on this weekend, roads are rough), otherwise I would’ve replied back sooner. So, what is your deranged paranoia that thinks Reggie and I are the same person asserting today?