Most oil and gas lawyers who have spent time practicing in the lower 48 don’t find Alaska’s Permanent Fund Dividend (PFD) particularly novel.

It follows the same approach as a typical lower 48 oil-and-gas family trust. In those cases, oil and gas mineral interests, leases, and, occasionally, working interests are held by a trust that collects, manages, and distributes the commonly owned revenues to the beneficiaries designated by the trust, usually family members. These types of trusts are commonly used in estate planning, wealth preservation, and income distribution for families holding oil & gas rights.

The PFD works the same way. Like the typical lower 48 oil and gas family trust, acting in combination the Alaska Permanent Fund Corporation (APFC) and Permanent Fund Division of the Department of Revenue collects, manages, and by statute, is required to distribute a designated portion of Alaska’s commonly-owned oil-related revenues to the set of individual beneficiaries designated by statute, what we sometimes refer to when discussing these matters as “the Alaska family.”

The only significant difference from a typical Lower 48 trust is that the APFC first invests the oil-related revenues it receives, then distributes the resulting earnings. Even that is not particularly novel, however. Several lower 48 family trusts use the same approach to both build the amounts distributed and, in particular, lengthen the time and generations that benefit from the wealth.

Former Governor Jay Hammond’s vision behind PFD was clear. As with lower 48 trusts regarding their assets, the goal was to ensure that the beneficiaries—Alaska families— directly received a material share of Alaska’s commonly owned wealth. As he wrote in Diapering the Devil:

I wanted to transform oil wells pumping oil for a finite period into money wells pumping money for infinity. … [And once the ‘ money wells’ were pumping:] Each year one-half of the account’s earnings would be dispersed among Alaska’s residents. … The other half of the earnings could be used for essential government services.

While some now claim that the portion set aside for Alaska families was intended to be temporary —only until the state needed more revenue —Hammond was clear that wasn’t the case. Again, as he wrote in Diapering the Devil:

Those legislators who would prefer to use the money now going out in dividends argue that government can spend those funds more efficiently than can individuals. … [But] in the past [before the PFD], those who knew how to play the game were able to secure subsidies for their pet projects, many times at the collective expense of all other Alaskans. …

As a guiding principle, I … place paramount our constitution’s mandate to manage our resources for the maximum benefit of the people. That to me means all our people, not simply the fortunate or recipients of subsidized jobs or state services. Nothing … better meets that mandate than our dividend program.

… under Alaska’s Constitution, that money and the resources it comes from, belong to all Alaskans; not to government nor to a few ‘J.R. Ewings’ [the wealthy] … Alaska’s founding fathers wanted every citizen to have a piece of the action.

In short, Hammond’s vision was to put all Alaska families first in terms of distributing the commonly owned wealth, avoiding “the common past practice of selectively benefiting the favored few at the expense of the many.”

As he put it in another book, Tales of Alaska’s Bush Rat Governor, “the dividend is capitalism that works for Alaska. In a state where locals traditionally watch in frustration as most resource wealth goes Outside,” the approach would keep at least a portion of that commonly owned wealth at home, in the hands of Alaska families “to determine how to spend some of his or her share.”

A later look by noted Alaska historian Professor Stephen Haycox reinforces the conclusion. In a 2018 op-ed in the Anchorage Daily News, Professor Haycox said this:

… the dividend program… is how all Alaskans receive some personal benefit from the development of their natural resources. Would it please the designers that the state Legislature has now diverted into state coffers… a large portion of what used to be the people’s direct benefit. No!… Hammond said clearly that the fund’s earnings should go into the people’s hands, not the Legislature’s.

In Hammond’s view, if the state needed more revenues, then it should look to “user fees and taxes. … After all, the best therapy for containing malignant government growth is a diet forcing politicians to spend no more than that for which they are willing to tax. … Let’s leave dividends in the people’s pockets.”

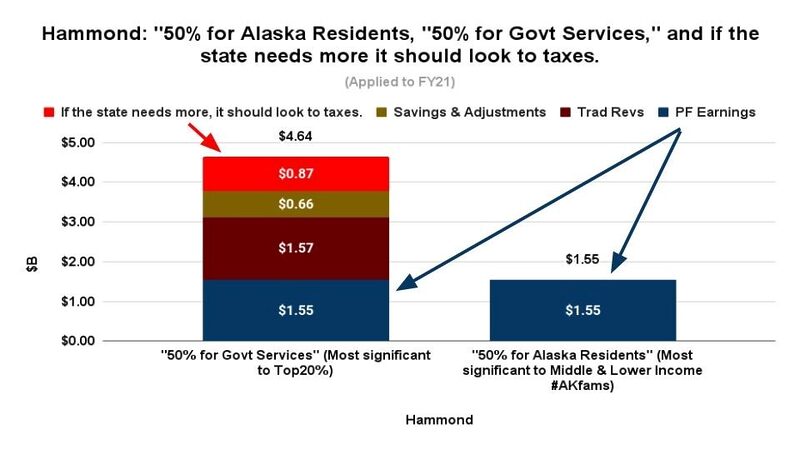

As we explained in a previous column, this is how the Fiscal Year 2021 budget, for example, would have looked using that approach:

If Alaska families had been put first, they would have received direct distributions totaling $1.55 billion. If the state needed more than that to help meet the requests of the various special interests coming to the Legislature —which it did, in the amount of approximately $870 million —then, using Hammond’s words, it would have used “user fees and taxes.”

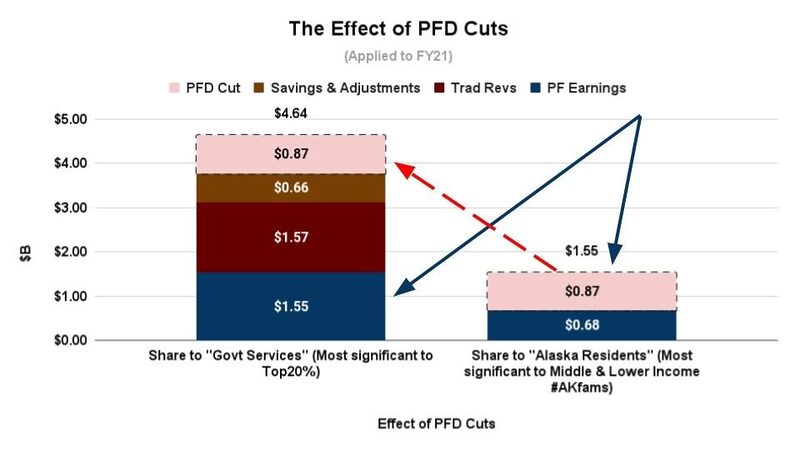

But that’s not how the FY2021, or, indeed, any budget since FY2017, has played out. As Hammond feared, instead of putting all Alaska families first, ”those who knew how to play the [legislative] game” have prevailed, diverting a portion of the PFD to benefit themselves in one way or another. Instead of putting all Alaska families first, the Legislature has put the special interests Hammond warned about first instead.

Here’s the result:

Instead of implementing the “user fees or taxes” contemplated by Hammond, in FY2021 and most other years, the Legislature has diverted a substantial portion of the amount designated by statute for the PFD “out of the people’s pockets” and, directly or indirectly, into the hands of the special interests.

Who are the special interests that benefit?

At the top of the list are non-residents. Hammond warned that using PFD cuts to fund government instead of “user fees and taxes” would allow “transient pipeline [and oil] workers, commercial fisherman and construction workers [to] get off scot-free” from paying for government services. To that list, we would also add seasonal workers in the tourist industry and non-resident government and other contractors.

Using broad-based “user fees and taxes” to raise the additional revenues needed to cover the state’s budget deficits, rather than PFD cuts, would shift a significant portion of the burden to non-residents. Depending on the tax approach, doing so could reduce the burden on Alaska families by 10% – 20%. By failing to do so, the non-residents instead have been able to keep in their own pockets the difference between what they would have paid had the deficits been closed using the broad-based “user fees or taxes” contemplated by Hammond and the zero they currently pay.

Simply put, by using PFD cuts to close government deficits instead of broad-based “user fees and taxes,” Alaska families effectively have subsidized the income of non-residents. Alaska families have been last in line, even behind non-residents.

Also on the list are the non-resident oil companies (and in the case of Hilcorp, its non-resident owner) that have been able to dodge paying a share of their revenues equal to the “maximum benefit” provided by Article 8, Section 2 of the Alaska Constitution. Using PFD cuts to fill budget gaps has reduced the pressure to implement the reforms to the state’s oil tax structure necessary to achieve the Constitutional “maximum benefit” standard. The consequence is that, like other non-residents, they have been able to pocket the difference between what they should be paying and the lesser amount they actually pay.

Again, Alaska families are being put last, even behind the oil companies.

The special interests benefiting from the use of PFD cuts to close the deficits are not just non-residents, however.

The list also includes discrete subsets of Alaskans.

As we’ve explained in previous columns, for example, the list includes the “J.R. Ewings” mentioned by Hammond in Diapering the Devil – the wealthy who, by using PFD cuts to cover the state’s deficits, can shift the burden for funding government away from themselves and onto the backs of middle and lower-income Alaska families. The same as non-residents, they pocket the difference between what they would have paid had the deficits been closed using the “user fees or taxes” anticipated by Hammond and the trivial amount they contribute through PFD cuts.

The list of beneficiaries also includes various subsets tied to the construction, infrastructure, and other state-funded industries, as well as to governmental service segments such as corrections and grant-related programs, which might have received less funding absent the use of PFD cuts to close deficits. By using PFD cuts to fill the gap, all Alaska families have received less, while those in the legislatively favored subsets who, as Hammond put it, “know how to play the legislative game,” have received more.

Some argue that the PFD is “free money” and Alaska families should be okay with receiving less of it.

But the money doesn’t become less “free” when it’s redirected, directly or indirectly, to others. Instead, it’s the others – non-residents and the favored subsets of Alaskans – who are receiving the benefit of it instead of all Alaska families, as Professor Haycox put it, the “designers” intended.

Some also argue that the PFD would cause a wealth transfer, with the money coming out of other people’s pockets. But that’s also wrong. As with a typical lower 48 oil-and-gas family trust, the money comes from invested oil royalties. As Hammond made clear, any money for “user fees and taxes” taken from people’s pockets would be used to cover government costs.

In short, those who have decided to divert the money to benefit non-residents and favored subsets of Alaskans have intentionally put all Alaska families last in line.

As Hammond mused, perhaps the result is inevitable. Perhaps those who “know how to play the game” always win.

But if so, it’s a sad result. The PFD does a lot for Alaska families. It reduces poverty levels, provides middle- and lower-income Alaska families with a material buffer against a significant and widening income gap, and, by providing additional income to those with the largest marginal propensity to spend, generates additional private-sector economic activity.

Also, as we’ve explained in previous columns, among the various revenue alternatives, cutting the PFD has the “largest adverse impact” on the overall economy and is “by far, the costliest measure for Alaska families.”

Because of these significant benefits and problematic downsides, we hope that, in the future, the state’s politicians revert to putting all Alaska families first when it comes to revenues designated for the PFD. We are not suggesting that they stop spending, only that, consistent with Hammond’s vision, they use “user fees and taxes” to balance the budget when they do, leaving the PFD in the “people’s pockets.”

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

The big difference between Alaska and the oil patch states in the Lower 48 is, obviously, that (1) private individuals don’t own oil rich ground here, and (2) they never will. Alaska is still fighting between federal, state, and native land holders on the final details of lands selections and easements since statehood. Many of us were here when the feds locked up millions of acres of lands in classified parks and monuments and well remember the fight. Just 1% of Alaska’s lands are in private ownership, and precisely none of that is in oil rich ground. Political leadership has… Read more »

Private ownership of land can be a very good thing, no question.

But understand this:

There is no greater lock-up of land than private ownership.

“………There is no greater lock-up of land than private ownership………”

Agreed, and my comment above was not to cast aspersions on land status in Alaska. It was just to point out the obvious differences between the Alaska oil fields and those in the Lower 48, which clearly affects ownership of the resource.

On the other hand, the concept of government ownership and “our” ownership clearly needs to be fleshed out with a lot of very confused folks. That education process is ongoing……..right along with more propaganda……….

Fair points, thank you.

Cut state spending. By 50% to start. Let’s try that.

Collect fair revenue for Alaska oil as per the Alaska Constitution. We already had that and it worked fantastic until those fuckhead repubelicans got SB21 passed.

Alaskan oil production costs are significantly higher than the vast majority of regional competitors even before taxes and royalties are factored in, and they always will be. You simply do not haven the economic power to dictate production costs, thus your power to tax is limited. You can cry about it forever, but either economic pressure or economic suicide will overcome your emotions.

You mean fuckhead democrats that ran as a Republican or voted with the Democrats I think

This is perhaps the stupidest comment I’ve ever read on the Landmine.

What, you’ve never read over one of your own comments before posting ever Speeds?

And its never been Alaska legislators place to judge how the individual Alaskan chooses to spend the dividend received Some spend it on a new car, some pay bills, some go on vacation, some spend it on drugs, alcohol, and women, some spend it on heating oil and food, some spend it on Christmas, Gov Hammond is right that the dollars do in some way get into the hands of another Alaskan even the one going out of state for a vacation. Even that passenger is serviced by a company that employs Alaskans to serve passengers flying out of state… Read more »

You ignore the reality of the state budgetary corner we’ve painted ourselves into. If you demand free money, the Legislature is going to have to either cut state spending elsewhere or increase taxes on somebody to pay for it. If you increase taxes on somebody else (me), they’re going to fight. It’s really that simple.

Well, shit…. I’m gonna move to Houston, change my name to Hildebrand and tell the family trust to start cutting me an annual check – if that is how family trusts work.

Just kidding, I’ll take the money but won’t be moving to Texas. But, I wouldn’t mind if a couple transplants from Houston moved back there.

More seriously, the APFD isn’t like a family trust because the money belongs to all of us and should be used wisely, not blown on air travel and cocaine.

When we asked to become a state, the biggest hurdle we faced was convincing the nation that we could support ourselves. Anerica didn’t want another welfare state.

So as part of the bargain, we Alaskans agreed to continue the territorial rule preventing private ownership of the subsurface estate.

We should continue to honor our end of the deal.

Great piece, Brad, and timely. Keep up the good work.