A recent article from Alaska’s News Source focused on a petition on Change.org “to restore and protect [Alaska’s] Permanent Fund Dividend [PFD].” At the time of the story, the petition “was just shy of 16,000 signatures.” As of the time we are writing this week’s column, one week later, it is more than double that and still rising.

The petition asks that “Alaska’s leaders… immediately pay the full statutory dividend.” According to our calculations, a full statutory dividend this year would be approximately $3,700 per person, or, using recent estimates of household size, roughly $9,900 per household. Instead of that amount, however, the Legislature has only appropriated $1,000, or approximately $2,670 per household.

Rounded, that represents a cut of roughly $7,200 per household.

To summarize, some report the cut as a percentage of the statutory amount due. However, that’s not the primary impact of the cut on Alaska households. Instead, the effect varies depending on the income bracket in which the household falls.

For example, for an average-sized household with other income of $35,000 per year, the cut represents a 16% reduction in potential income ($7,200 divided by the sum of $35,000 plus $9,900). On the other hand, for an average-sized household with other income of $250,000 per year, the cut represents a reduction in potential income of only 3%. And for an average-sized household with other income of $750,000, the cut represents a reduction in potential income of less than 1%.

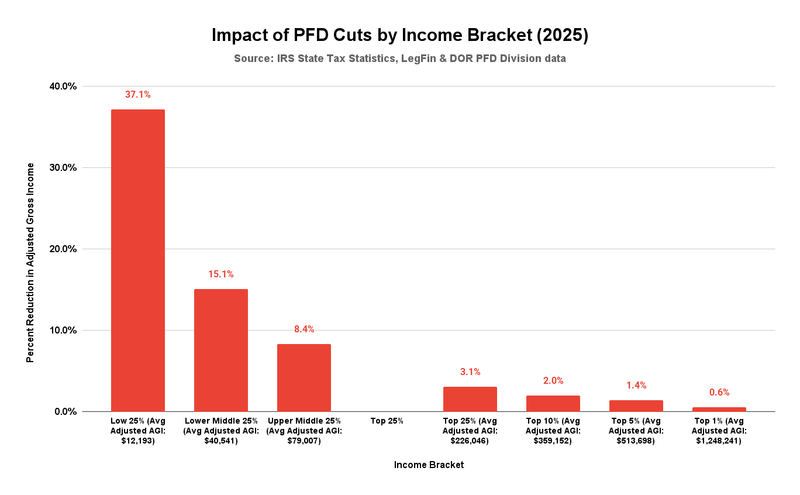

Using the most recent state data available from the Internal Revenue Service (IRS) adjusted for this year’s PFD and cut, the following chart reflects (in red) the approximate impact of this year’s cut on an average-sized Alaska household by the income brackets used by the IRS. The “Adjusted AGI” for each bracket represents the average adjusted gross income (AGI) for that bracket reflected in the most recent state-level IRS data, adjusted for the 2025 statutory PFD and cut.

As is clear, PFD cuts disproportionately impact middle and lower-income Alaska households compared to those in the upper-income brackets. This sort of impact, where middle- and lower-income households pay a larger percentage of income than high-income families, is referred to by economists as regressive.

As a percentage of income, PFD cuts take more than twice as much from upper-middle-income Alaska households, nearly three times as much from lower-middle-income households, and almost 12 times as much from the lowest 25% of Alaska households, compared to those in the Top 25% income bracket.

While not as significant, notable differences exist even within the Top 25%. For example, PFD cuts take less than half from those in the Top 1% than from those in the Top 5% overall, and less than a fifth from those in the Top 25% overall.

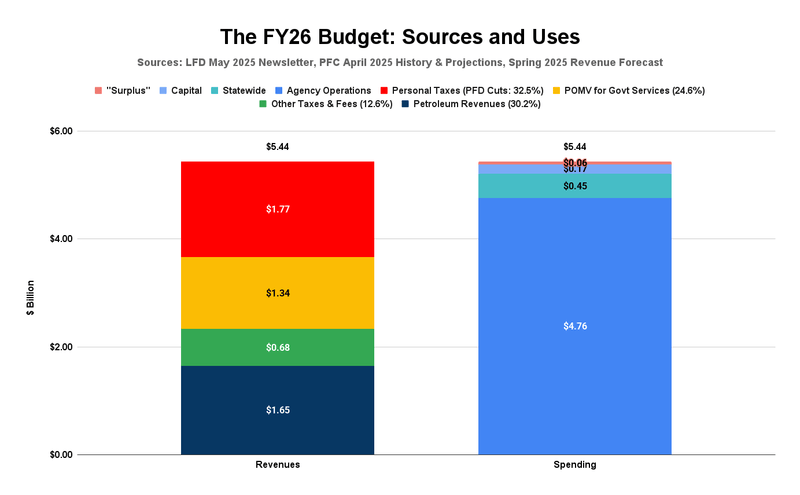

As we have explained in previous columns, these PFD cuts are being used as a source of revenue to fill the gap (deficit) in Alaska state budgets between unrestricted general fund (UGF) spending and the sum of traditional revenues plus the portion of the annual percent of market value (POMV) draw that is designated under current law to help pay for government services, in combination what we refer to as “current law UGF revenues.”

The Legislature creates additional UGF revenue by withholding and diverting a portion of the POMV draw designated for the PFD – the amount being cut – instead to UGF revenues.

This is the chart we developed in connection with an earlier look at this year’s budget that shows the relevant amount of each revenue source being used to “balance” this year’s budget. On the left-hand side of the chart, the blue (petroleum revenues), green (other traditional taxes and fees), and yellow (POMV designated for government services) shares reflect the sum of current law UGF revenues. The red share reflects the additional UGF revenue being created by PFD cuts.

As is clear, the current law UGF revenues only provide approximately 67.5% of the total. The remaining roughly 32.5% comes from PFD cuts, or what University of Alaska-Anchorage Institute of Social and Economic Research (ISER) Professor Matthew Berman has called a tax, indeed, “the most regressive tax ever proposed.”

In the course of its reporting on the petition, Alaska’s News Source said that it “reached out to several lawmakers across the aisle, including [the creator of the petition’s] representative and senator, for comment.”

In response, Representative Calvin Schrage (I – Anchorage), the creator’s representative, said, “I think many people have to recognize that, in order to pay a statutory dividend, we would have to… either implement substantial broad-based taxes or find some other source of revenue or dramatic cuts that I think most Alaskans would not be willing to stomach.”

Given the size of the current law UGF deficits the state is – and is projected to continue – running, Schrage is correct that another source would be required to help supplement current law UGF revenues if the state returns to distributing PFDs in accordance with current law.

However, Schrage fails to point out that substituting other revenue sources for PFD cuts would be a very good thing for 80% of Alaska families and, through them, the overall Alaska economy.

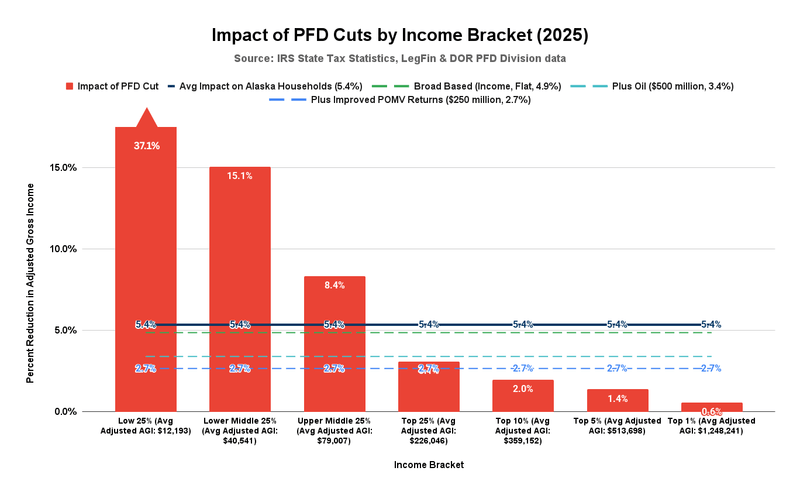

Here is the previous chart showing the impact of using PFD cuts on Alaska households, as well as the impact of some alternatives.

The first alternative (the black line) is the impact by income bracket if, instead of using PFD cuts to raise the needed revenue, the state raised the same amount of revenue on a “flat tax” basis across all income brackets. Instead of the hugely regressive impact created by raising the revenues through PFD cuts, the effect would be proportional, with all households at all income levels contributing approximately 5.4% of income toward closing the state’s deficit.

As is clear, roughly 80% of Alaska households – those in the Low 25%, Lower Middle 25%, and Upper Middle 25% income brackets, plus a portion of those at the lower-income end of the Top 25% – would pay significantly less as a share of income under such an alternative than they do using PFD cuts. While those in the remainder of the Top 25% bracket would pay more than using PFD cuts, they would contribute no more as a share of income than any other Alaska family. All Alaska households would have the same “skin” in dealing with the state’s deficits.

The second alternative (the dashed green line, at 4.9%) reflects the impact by income bracket if, instead of PFD cuts or the first alternative, the state raised the same amount of revenue using a broad-based approach that also reached non-residents. Using PFD cuts imposes the revenue burden solely on Alaska households.

By shifting a portion of the revenue requirement to non-residents, the burden on Alaska households would be materially reduced. The drop from 5.4% to 4.9% reflects the impact if the share of Alaska-sourced income received by non-residents equals 10% of overall Alaska income. If the number is higher, as recent data suggests, the remaining revenue burden on Alaska households would be even lower.

The third alternative (the dashed teal line, at 3.4%) reflects the impact by income bracket if, as we discussed in last week’s column, the state updated oil taxes to return production tax levels to the same share of gross revenues as experienced in the first decade under SB21. While the incremental impact on revenues would vary from year to year, we have assumed in this calculation that the update would raise roughly an additional $500 million per year in revenues.

The effect would be to reduce the burden on Alaska households by an additional 1.5 percentage points, from 4.9% to 3.4%.

The final alternative we have included (the dashed blue line, at 2.7%) reflects the impact by income bracket if, as we have discussed in earlier columns, the Permanent Fund Corporation were to revise its investment approach to more closely reflect the “Buffett 90/10” approach. While the impact would build over time, for the purposes of this week’s column, we have assumed that the shift would result in an additional $250 million per year being available from the annual POMV draw.

For those interested, the impact would be the same if, instead of increasing the size of the POMV draw by that amount, or in combination, the state reduced spending by $250 million per year from projected levels.

The effect would be to reduce the burden on Alaska households by an additional 0.7 percentage points, from 3.4% to 2.7%.

As is clear, by using only PFD cuts to fill the state’s budget gaps, the burden of Alaska’s deficits is falling almost entirely on middle- and lower-income households. Those in the upper-income brackets, the oil companies, and non-residents are contributing little to nothing to help resolve them. As repeated studies by ISER researchers have made clear, among the various alternatives, using PFD cuts to resolve the deficits is “by far the costliest measure for Alaska families” because it shifts almost all of the burden directly to them.

Moreover, as repeated ISER studies have also made clear, “lower-income Alaskans typically spend a higher share of their income than higher-income Alaskans do, so more regressive measures will have a larger adverse effect on expenditures. [Because] the impact of the PFD cut falls almost exclusively on residents, and it is highly regressive… it has the largest adverse impact on the economy per dollar of revenues raised.”

To avoid these consequences, previous efforts to resolve Alaska’s continuing budget gaps have focused on a comprehensive approach that utilizes multiple tools.

For example, as the Legislature’s own 2021 Fiscal Policy Working Group (FPWG) said in its final report, “The FPWG believes the legislature must pass a comprehensive solution. FPWG members do not support addressing only one or two issues to the exclusion of others.”

And as Governor Mike Dunleavy (R -Alaska) said himself in 2023, “a broad-based solution that doesn’t gouge or take huge parts from one sector (of Alaska) or another, or penalize one sector for another is probably the most important thing we can do.”

Like Schrage, in recent comments, some have seemed ready to throw in the towel on the issue and, despite the fact that the approach is “by far the costliest measure for Alaska families,” and, of the alternatives, would have the “largest adverse impact on the economy,” let the PFD slip into oblivion.

But, while that may appeal to those segments who would benefit from continuing to shift the entirety of the state’s ongoing budget gap away from themselves and onto middle- and lower-income (again, 80% of) Alaska households, it should make no sense to those, like us, genuinely concerned about the long-term economic well-being of all Alaska families and the overall Alaska economy.

Just because Alaska hasn’t found its way yet to a comprehensive solution doesn’t mean it should forget that’s the goal.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“……The petition asks that “Alaska’s leaders… immediately pay the full statutory dividend.”……”

Fascinating. When news of this movement first came out, I figured for sure that it would be a proposed constitutional amendment, which will be the only way to force this raid on state resources. I’m forced to admit to myself that the petitioners are smarter than I thought, because a constitutional amendment will fly like a lead balloon……….just like this “petition”………