Over the past few months, we have written several columns about the significant drop in production tax revenues projected for the coming decade, despite a substantial increase in production volumes during the same period.

As we have explained, the directional difference between the two is wholly inconsistent with the statements made by the proponents of the current production tax code (commonly referred to by its bill number as “SB21”) at the time it was adopted in the legislative session of 2013 and defended during the referendum on it in 2014. There and even now, proponents claimed Alaskans would share in the benefit as production volumes rose through increased revenues.

But that is not what the data is showing. Instead, as we have demonstrated in repeated columns, the data show that even though production volumes are increasing significantly, production tax revenues are declining substantially.

In this week’s column, we examine that issue in another way, by looking at the percentage of gross wellhead revenues raised over various periods through production taxes. Then, building on that, we discuss potential replacements for the current production tax approach that would greatly reduce its current complexity and actually ensure that, as the proponents claimed at the time of the last change in the production tax code, a share of any increases in producer revenues driven by production increases would also flow to Alaskans.

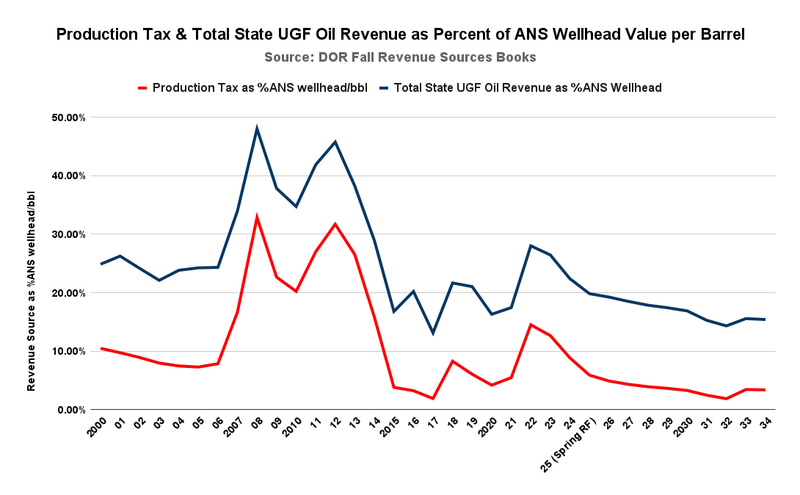

We begin by examining the share of gross oil revenues raised through production taxes by year over the last 25 years (from Fiscal Year (FY) 2020) and then, over the coming 10 years, as projected by the Department of Revenue (DOR) in its Spring 2025 Revenue Forecast, its most recent. The share of gross oil revenues raised through production taxes is in red. For perspective, we include the share of gross oil revenues received by the state as unrestricted general funds from all petroleum sources (royalty, production taxes, corporate income tax, and other) in blue.

To make the results comparable to the percentages used in other oil states with a gross production tax, we calculate the numbers by dividing the amount of production tax received by the state in each fiscal year by the product resulting from multiplying production (net of royalty) by the “ANS Wellhead Weighted Average [Value] All Destinations” reported by DOR in its annual revenue forecasts.

We use the wellhead value because that is the typical point on which gross revenue-based production taxes are based. Because DOR reports only gross production numbers (before the state’s, or going forward, the federal government’s royalty share), we have applied a consistent 12.5% reduction to estimate the net, tax-bearing volumes.

As is clear from even a cursory glance at the chart, the share of gross oil revenues raised through production taxes falls into four distinct periods. The first, from the start of the 25-year period through FY2006, reflects the period before the effective date of the ACES (Alaska’s Clear and Equitable Share) tax regime, which was enacted and took effect during FY2007. We refer to this as the “pre-ACES” period.

The second, from FY2007 through FY2014, reflects the period during which ACES remained effective, before its replacement by SB21, halfway through FY2014.

The third reflects the period from FY2015 through the present, FY2025, as SB21 took effect. With some variability, average production tax levels as a percentage of gross revenues during that period reverted closer to those experienced before the implementation of ACES. We refer to this as the “first SB21 period.”

The fourth is the period reflected in DOR’s most recent revenue forecasts (FY2025 – 34), as production levels start to skyrocket but production tax levels plunge. We refer to this as the “second SB21 period.”

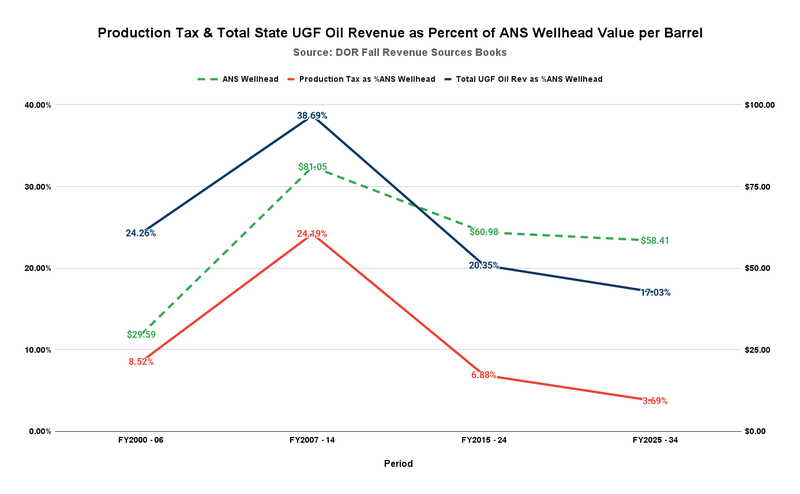

Here are the averages over the four periods. As in the previous chart, we include the share of gross oil revenues raised through production taxes in red and, for perspective, the share of gross oil revenues received by the state as unrestricted general funds from all petroleum sources in blue. To provide additional perspective, we also include the “ANS Wellhead Weighted Average [Value] All Destinations” averaged for the period.

As is clear, the results differ significantly by the time periods. To us, two things stand out. The first is that, while the results during some years of the third period (FY2015-24) reverted to the levels realized during the pre-ACES period (FY2000-06), on average, the results under SB21 during its first decade fell short of those during the pre-ACES period. To the extent that some believed the purpose of SB21 was largely to undo the excessive level of government take realized under ACES and revert to the results during the pre-ACES period, SB21 has failed.

The second is that, despite being governed by the same general approach, the production taxes projected to be realized as a share of gross oil revenues during the second SB21 period (FY2026-34) are significantly lower than those during the first, and lower even still than those during the pre-ACES period. While some have claimed that the lower levels realized under SB21 compared to the pre-ACES period would turn around over time, the projections demonstrate that the levels actually continue to fall further instead.

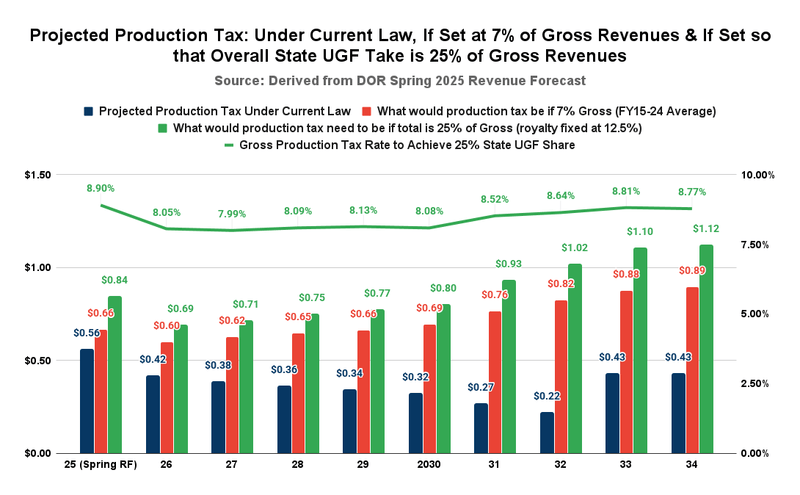

Some have suggested that, going forward, one way to achieve the original objective of SB21 – increasing production tax revenues as production levels rise – is to revert to a simple production tax based on a percentage of gross revenues. The following chart analyzes this approach from several perspectives.

The first column, in blue, displays the level of production tax by year from FY2025 through FY2034, as projected in the DOR’s most recent revenue forecast. As reflected in the previous charts, this represents an average level of 3.69% over the period of gross oil revenues.

The red column reflects the level of projected revenues if, instead of the current approach, production taxes are set simply at 7% of gross revenues, roughly the same level as the average level realized over the past 10 years (the first period) under SB21. For perspective, this is also the same base state production tax approach and rate as used in Oklahoma.

The result of substituting that approach for SB21 is that, instead of declining over the period as projected under SB21, projected production tax revenues rise by nearly 35%, equaling the rate of increase in overall gross revenues, from $660 million (FY2025) to $890 million. Instead of averaging only $370 million per year over the period as is projected under SB21, production tax revenues would average approximately $720 million per year.

An alternative to establishing a replacement for SB21 is to focus primarily on the overall level of state unrestricted general fund (UGF) revenue derived from oil as a percentage of total gross revenue, rather than solely on the level of production tax revenue. After all, the Constitutional mandate guiding the state’s natural resource policy, as provided in Article 8, Section 2, does not focus on any given component. Instead, the mandate is that, overall, “the legislature shall provide for… the maximum benefit of its people.”

The blue line in the first chart reflects the overall level of state unrestricted general fund revenue derived from oil as a percentage of total gross revenue on a year-to-year basis. The blue line in the second chart reflects the same number averaged over the four periods.

The results are largely the same as for production tax levels. The overall levels realized in the first period under SB21 are lower than those in the pre-ACES period, and the overall levels in the second period under SB21 are even lower than those in the first period.

In the third chart, we calculate the level of production tax that, when added to projected oil-related revenues from other sources, would produce over the next 10 years overall UGF revenues from state lands equal to 25% of overall gross revenues, roughly the same amount as achieved during the pre-ACES period. The tax rate applied to production from federal lands would be the same, ensuring that, for production tax purposes, production from those lands is treated no differently than production from state lands.

The projected amount realized from the resulting production tax is reflected in the green bars. The amount stated as a percentage of total gross revenue – in other words, the production tax rate – is reflected in the green line.

The average production tax rate over the period is 8.4%. Calculating the production tax rate in this manner also would offset any deficiencies in the state’s other sources of oil revenue, such as the current issues arising from the limitation of the petroleum corporate income tax to only “C” corporations. From the state’s perspective, it would realize roughly 25% of overall gross revenues as unrestricted general funds regardless. This approach would be the only fix required to solve all problems.

Some, no doubt, will argue that converting to one of these, or another simple approach, will undermine the complex series of overlapping and compounding incentives and rewards built into SB21.

We view that as a “feature, not a bug,” however. It is that very complexity that is undermining the intended objective of SB21 – for Alaskans to share in the upside of increased oil production. The sooner the state sheds those, the sooner Alaska – and Alaskans – will realize its original objective.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Replacing SB21 will go nowhere until Dunleavy is gone. We can only hope someone more reasonable will replace him so that Alaska can resume actually making money from Alaska oil as per the Alaska Constitution.

Always an opportunity to learn more from you Brad. You should start your own Alaskan economics blog/podcast – I guarantee you’d have success and numerous guests including those who’d be glad to engage in lively debate. I wish I had a better understanding on budgetary matters. My only light critique is that you could probably stand to dumb it down a little bit for those of us that are not the same level of wonk.

So this is great economic information………….if you could only understand it?

Reggie – go fuck yourself bro

Yeah, I’m sorry, Tiger. That was really unfair. Of course you couldn’t understand it, because it was almost complete lawyeresque bullshit. It can’t be “dumbed down”, because it has no meaning. It’s the kind of bullshit that is intended to confuse and confound. Don’t take it to heart. In fact, don’t take it at all.

11220 Kaskanak Cir, Eagle River, AK, 99577

801 N Wasilla-Fishhook Road, Wasilla, AK 99654