The first thing that comes to many, indeed, likely most minds when discussing Alaska tax credits is the per-barrel credits used by the state’s oil producers to reduce their annual production tax obligations to the state.

While not as big as they used to be and as some still think they are, the credits are nevertheless significant. According to the Department of Revenue’s Spring 2025 Revenue Forecast, the Fiscal Year (FY) 2024 credits totaled $925 million, with FY25 and FY26 projected at $648 million and $562 million, respectively. For reference, at those levels, they represent about 17.6%, 11.7%, and 10.4% of total Unrestricted General Fund spending for those years.

As big as those are, however, they are projected to total significantly less in the aggregate over that period than another category of tax credits. At those levels, the projected per-barrel oil credits over the three-year period total $2.14 billion. The projected level of credits we are focusing on in this week’s column totals a little over $3 billion over the same period.

The latter category of credits is those we discussed in last week’s and previous columns. As we explained in last week’s column:

Money taken from the Permanent Fund earnings account through the POMV [percent of market value] draw serves two purposes. The first is to substitute for taxes that would otherwise be required to fund the same level of government spending. The second is to fund the distribution of PFDs [Permanent Fund Dividends].

The first purpose— replacing taxes— primarily benefits the top 25% of Alaska households, non-residents, and oil companies, which would otherwise pay more in taxes than they currently do to support government spending. The second purpose— financing the distribution of PFDs— primarily benefits middle- and lower-income Alaska households, as they receive more in terms of income through PFDs than they do in reduced taxes.

As currently written, the governing statutes allocate withdrawals from the Permanent Fund earnings account 50/50, with each group benefiting equally.

However, PFD cuts significantly alter that equation, redirecting more of the withdrawals to benefit the top 25%, non-residents, and oil companies through tax substitution. Instead of reducing benefits, PFD cuts are nothing more than a transfer of the benefits from middle and lower-income Alaska households to the top 25%, non-residents, and oil companies.

In short, by substituting for taxes they would otherwise pay to cover their share of increased government spending, PFD cuts act as tax credits for the top 20% of Alaska households, non-residents, and the oil companies. Just as the per-barrel credits reduce the tax obligations of the oil companies, using PFD cuts for tax substitution reduces the taxes that otherwise would be borne by the top 20%, non-residents, and, again, the very same oil companies.

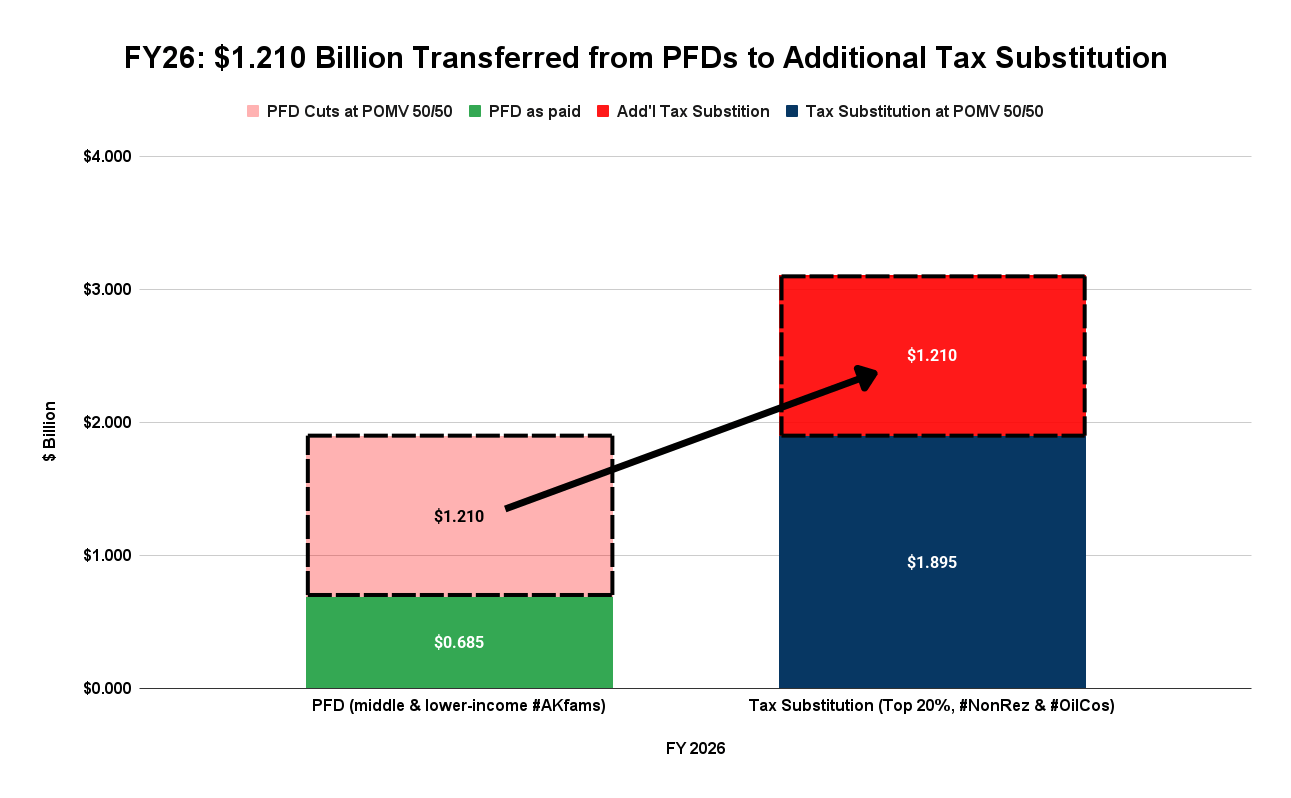

Here is how that works using the FY26 numbers:

Using the so-called POMV 50/50 approach – the approach that splits the annual POMV draw equally between the two uses – as a baseline, both middle & lower income Alaska households, those who primarily benefit from the PFD, and those in the top 20%, non-residents and the oil companies who are the primary beneficiaries of using the POMV draw as a substitute for taxes, would receive an equal benefit of $1.895 billion.

Rather than splitting the benefits equally between the two groups, however, the FY26 budget reduces the portion allocated to the PFD, and through that primarily to middle and lower-income Alaska households, to $685 million, automatically redirecting the remaining $1.210 billion for use in substituting for taxes, or as additional tax credits.

With the transfer, the top 20%, non-residents, and the oil companies are now protected from the impact of $3.105 billion in taxes, an increase of 64% from the initially anticipated level of $1.895 billion.

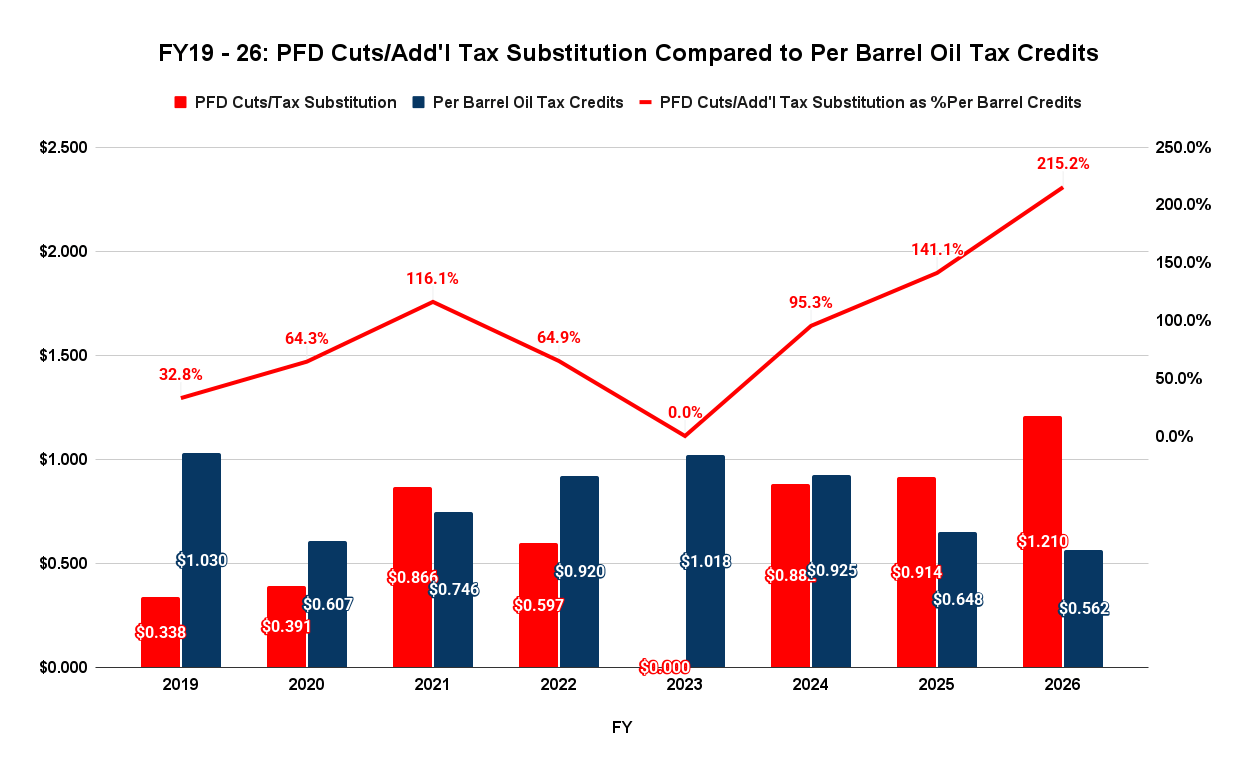

As we mentioned in last week’s column, of course, FY26 isn’t the first time this has happened. Similar transfers have taken place every year except for one since the implementation of the POMV approach in FY19.

But the level of the transfers, or tax credits, has grown significantly from the start until they are now outstripping the level of the per-barrel oil tax credits. This chart traces the level of each since FY19:

Starting in FY19, the level of PFDs diverted for use as additional tax credits was only a third of the per-barrel oil tax credits. Over time, however, as the level of the PFDs diverted for use as additional tax credits has grown, the level of the per-barrel oil tax credits has declined somewhat. The result is now that, as of FY26, the level of the PFDs being diverted for use as additional tax credits is projected to be more than double the level of the per-barrel oil tax credits.

As we noted in last week’s column, some do not agree that PFD cuts function as tax credits for the top 20%, non-residents, and oil companies. They view them instead solely as reductions in the benefits being received, primarily by middle and lower-income Alaska families.

Others attempt to skip over the issue by purporting to trace what the additional revenues from the PFD cuts are spent on. Doing a lot of unsupported arm waving, they claim the PFD cuts are justified because, in their view, the additional spending they finance largely benefits middle and lower-income Alaska households.

But both arguments deliberately focus on only one side of the coin. While they acknowledge middle and lower-income Alaska households are bearing an increased share of government costs through a reduction in income, they don’t consider who, on the flip side, is avoiding those increased costs. The real economic beneficiaries are those who would otherwise contribute toward the costs but avoid them by using the cover of the PFD cut-funded tax credits instead.

Those beneficiaries are the top 20%, non-residents, and oil companies. Their share of the costs is covered by credits funded by middle- and lower-income Alaska families.

The benefits they are receiving from those tax credits are huge. As former Senate President Rick Halford once explained, some at the far upper end of the top 20% may be dodging what would otherwise be $100,000 annual tax bills. In a previous column, we estimated that, in the aggregate, non-residents may be avoiding upwards of $160 million and oil companies more than an additional $500 million in taxes. Rather than helping contribute to the additional costs of Alaska spending, they are avoiding responsibility through the credits they are receiving, which we described in that column as a tax-free Alaska “bonus.”

We understand nobody wants to pay taxes. But if some are going to contribute to the additional costs of government – and, by using PFD cuts, middle and lower-income Alaska families are through reductions in their income – then everyone, including the top 20%, non-residents, and the oil companies, should contribute. Those at the upper end of the income bracket shouldn’t be shielded by additional tax credits created by taking disproportionately more from middle and lower-income Alaska households.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

“…….. some at the far upper end of the top 20% may be dodging what would otherwise be $100,000 annual tax bills……..” You obviously are talking income tax here. So what tax rate would that be, and how many Alaskans earn enough to pay a $100K income tax? If the income tax rate was 10% (which would destroy much of the middle class), an Alaskan would have to EARN $1 million in a year. How many Alaskans EARN $1 million per year? The ” the far upper end of the top 20%”? Would that be your magical 1%? One percent of Alaskans… Read more »

The important factor isn’t how many Alaskans, specifically, are earning enough to pay a significant amount of tax. It’s how many individuals total, including Outsiders and foreigners, are earning enough to do so. And there are plenty. If a business isn’t organized as a C corporation, the income it generates lands on a personal tax return. Since Alaska doesn’t have a personal income tax, such a business escapes state taxation right alongside the locals who squeal so indignantly at the prospect of being weaned from their government teat after 40 years. Cabela’s, Bass Pro, the Walmart Pharmacies, Alyeska Resort, major… Read more »

“……..Cabela’s, Bass Pro, the Walmart Pharmacies, Alyeska Resort, major hotel properties (including many branded with national names), car rental companies, medical facilities with multiple branches, oilfield service companies, and car dealerships are just a few of the nonresident businesses organized to escape the obligation to pay their fair share………” Hello? This is why the tax will burden ME. By U.S. law, they will use all the tricks they always do to avoid the tax. This is why all the claims if them “not paying their fair share” fall to the wayside. Moreover, retail corporations like Cabelas, et al, are among… Read more »

Let’s see. According to the most recent available IRS data, the average AGI for those in the Top 1% was $1.25 million, with a floor of $541 thousand. That means the top-end AGI is likely at least $1.96 million (assuming perfect distribution within that span) and probably more. Using a tax rate of 5.2% (the average tax rate required to close FY26’s projected $1.77 billion current law deficit), those at the upper end of the income bracket likely are avoiding at least $102 thousand in taxes by using PFD cuts instead. That’s an interesting way of looking at it; we’ll… Read more »

“………According to the most recent available IRS data, the average AGI for those in the Top 1% was $1.25 million……..” Again, the Alaska Department of Labor & Workforce Development estimates that the population of Alaskans aged 18 and older is around 576,464: https://labor.alaska.gov/news/2025/news25-1.htm One percent of these earners would be 5,764 souls. At an average of $1.25 million AGI each, and if you taxed their AGI at a rate of just 5% (not taxed a percentage of their federal tax liability like before 1980 here in Alaska), that would total $360.25 million in tax receipts, or just under enough to pay… Read more »

I paid income taxes in Alaska pre-oil. If I remember correctly, it was a percentage of our federal tax liability. I forget the percentage, but I believe it was somewhere between 5%-10%. (I didn’t earn much money back then, even though it was a good wage. Money had value then). Thus, just like businesses (corporate or private), those adept at avoiding individual federal taxes would avoid new Alaskan income taxes……………unless you’d like to set up yet another huge state agency for these new taxes to pay for………….