As some readers of this column may recall, we have written several times previously about the proposed constitutional amendment, currently embodied in Senate Joint Resolution 14, to change the current two-account structure of the Permanent Fund into a single account. We oppose the amendment because the current two-account structure protects the corpus (the permanent part of the Permanent Fund) by putting a hard stop on withdrawals if the Fund isn’t generating enough earnings over time to cover them.

The proposed change would put the Permanent Fund at risk by eliminating the hard stop and creating a mechanism for siphoning money from the corpus to continue the legislature’s percent of market value (POMV) draw from the Fund for government spending, even when the Fund is not generating enough earnings to cover it. The proponents argue that the amendment would prevent taking more than 5% from the Fund in any given year, and that may be true depending on the wording of the amendment.

But the amendment wouldn’t prevent overdraws compared to actual earnings. For example, if the Fund only earned 4% after inflation in a given year, the amendment would still permit the Legislature to take 5% from the Fund, making up the difference by drawing from the corpus. As we have explained, if continued over time, such an approach could cause a substantial impairment, if not the ultimate depletion of the Fund, in a way that is prevented by the current constitutional provisions.

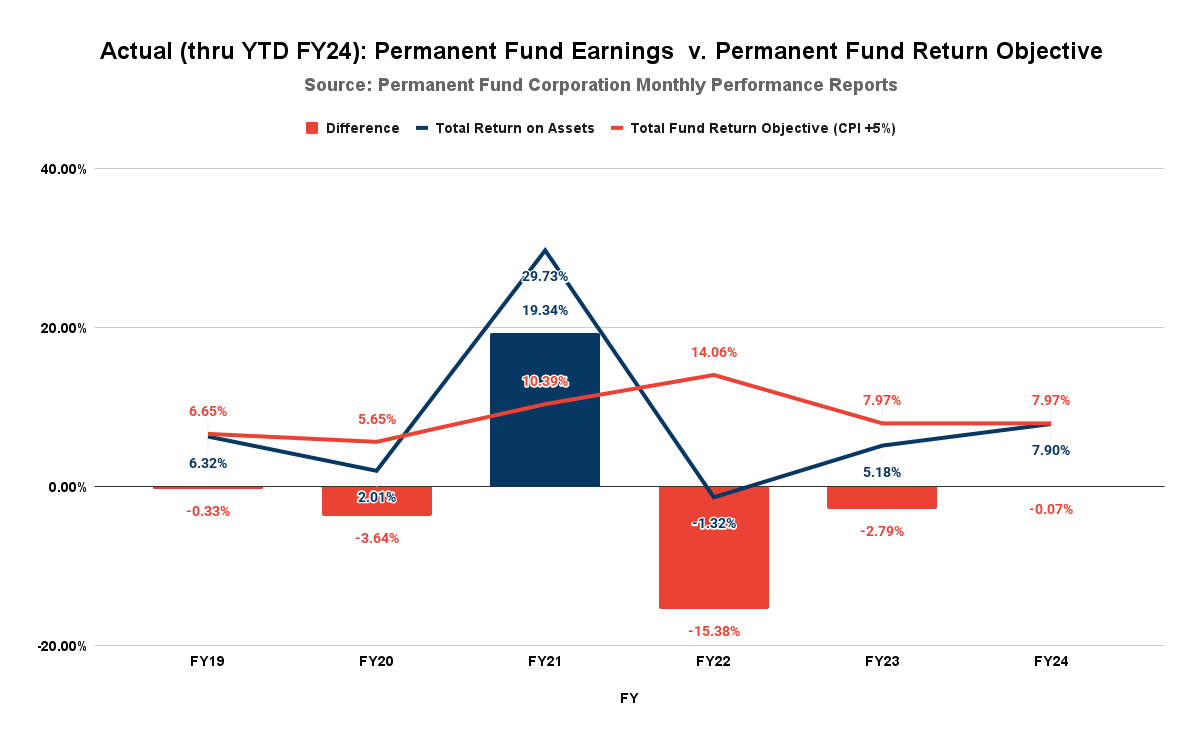

This is a real risk. Since Fiscal Year 2019 (FY19), the first year of POMV withdrawals, the “Total Return on Assets” achieved by the Permanent Fund Corporation (PFC), expressed as a rate of return (the blue line), have covered annual draws on the Permanent Fund, calculated using the Permanent Fund’s “Total Return Objective” for the same year (the red line), in only one of the six subsequent years (FY21). Here are the results, with the amount of the difference shown by the bars:

Year-to-date results for FY25 are no different. According to the PFC’s February 2025 Monthly Performance Report, the Fund’s Total Return on Assets was running somewhat ahead of the Total Return Objective. Since then, however, the Fund’s results have deteriorated significantly, ending March with year-to-date net income $560 million less than at the end of February. The PFC will report on what that means in terms of total return on assets for the year-to-date shortly after the first of next month.

As we have explained in previous columns, thus far, the shortfalls have been mainly absorbed by reductions in the Permanent Fund’s earnings reserve account. Over time, the earnings reserve account has built up a reserve that has enabled it to cushion an extended period of underperformance.

But that may not always be the case. If the underperformance continues for an even more extended period, the earnings reserve could be depleted. Under the Permanent Fund’s current constitutional structure, there would be a hard stop at that point, protecting the corpus of the Permanent Fund for future generations. After that point, the Legislature would be able to draw only what the Permanent Fund actually earned. The current generation would be limited to whatever the Permanent Fund was currently earning. Any shortfalls in revenue would need to be made up by the current generation through other means.

As intended by the framers of the Permanent Fund, the corpus would continue to be preserved for future generations.

The constitutional amendment proposed in SJR 14 would change that, however. Essentially, it would reverse the priorities, permitting the Legislature to make the POMV draw regardless of whether the earnings from the Fund were sufficient to cover it. By opening a back door for the Legislature into the corpus, the amendment would permit withdrawals from the corpus as needed to maintain current spending, regardless of the impact on future generations.

We are not the only ones to have that concern. In a recent op-ed in the Alaska Beacon, former Senator Joe Paskavan raised the same alarm, saying this:

Consider this question: If the 5% withdrawal rate for the current POMV is a factor in fully depleting the ERA, isn’t it obvious that, if constitutional protection of the principal is removed, a 5% withdrawal rate from a single-component Permanent Fund can — and will — deplete the principal? The answer is, “Yes, of course.” Removing constitutional protection of the principal destroys the safety of the principal. Permanent becomes impermanent.

Some have taken different positions. One of those, a recent op-ed, also in the Alaska Beacon, by former PFC CEO Angela Rodell, raises an interesting point. While reading her column, we realized that one reason the earnings reserve is being drained is that withdrawals from it are used to cover inflation-proofing of both the portion of the Fund held in the earnings reserve and the portion held in the corpus.

Unlike the POMV draw, which requires cash distributions, inflation-proofing can be covered through unrealized gains. If inflation for any given year is 2.5% and the assets in the Permanent Fund appreciate (gain) in value in the same year by 2.5%, that growth has adequately compensated for inflation. There is no need for any additional contributions from the earnings reserve to cover it.

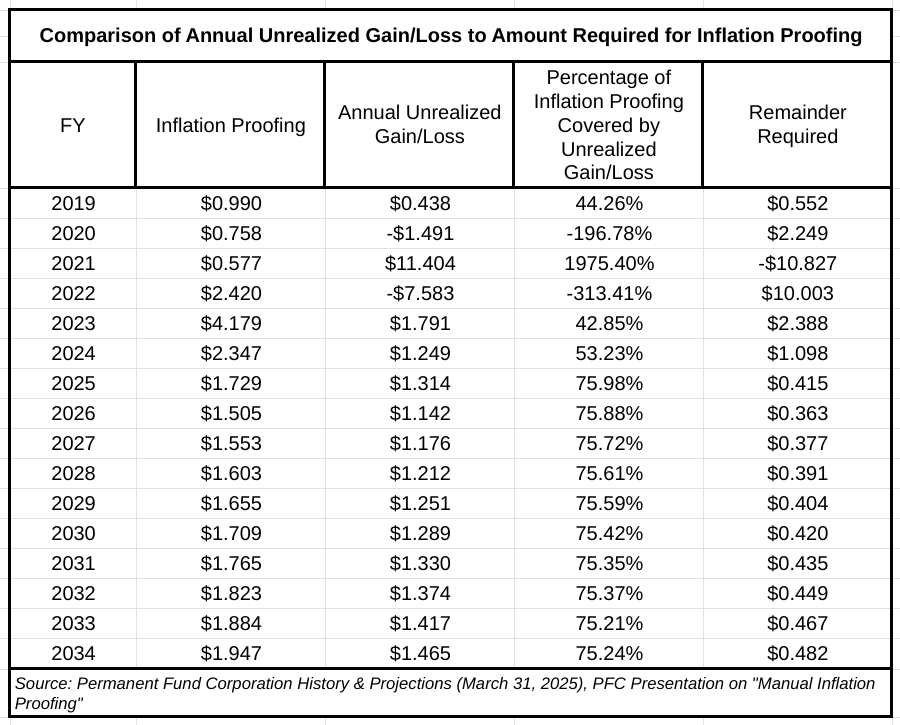

Looking at the history of the Permanent Fund since FY19 as well as the PFC’s projections through FY34, it appears that while appreciation is not sufficient to cover all of the inflation-proofing requirement in most years, it is sufficient to cover a substantial share of it.

In the first two columns, the chart shows the amount of required annual inflation proofing calculated by the PFC, as well as the unrealized gain or loss recorded or projected over the same period. The third column shows the percentage of inflation proofing covered by the unrealized gain or loss, and the fourth column shows the additional amount required for inflation proofing after accounting for the unrealized gain or loss.

By not taking the effects of unrealized gains into account when calculating the level of required inflation proofing, the Legislature has essentially been overcharging the earnings reserve account for inflation proofing. Looking at the projections for FY28, for example, the requirement for inflation proofing is projected to be $1.603 billion. Under its current approach, the Legislature would anticipate charging the earnings reserve for the full amount, reducing its balance by the full $1.603 billion. Taking into account the projected level of unrealized gains for that year, however, would reduce that amount by over 75%, to $391 million.

Making that change in calculating the amount of inflation proofing to be withdrawn from the earnings reserve could be made by adjusting the relevant statute (AS 37.13.145(c)). It would not require a constitutional amendment.

If the draw from the earnings reserve for inflation proofing is calculated in that way going forward, it is substantially less likely that the earnings reserve would ever be drained. As we have explained in other contexts, what may be going on with the earnings reserve is as much an accounting issue as anything else.

Regardless, even if properly accounted for, the earnings reserve is in danger of being drained, the solution is not to cover up the problem by opening a back door to the corpus, as proposed by SJR 14. The solution, instead, is to confront the problem head-on by asking why the PFC isn’t generating enough earnings to cover the POMV draw plus whatever portion of inflation proofing is required to be funded from the earnings reserve.

As we have explained in previous columns, there are two reasons for the shortfall.

The first is that the PFC is spending far too much on management and consulting fees, significantly reducing earnings. As we explained in a previous column, according to the PFC’s own reports on Management Fees, the PFC is currently spending more than 1% of its assets annually on such expenditures. That is both substantially higher than others and so high that it is reducing the Fund’s returns to levels below what it could achieve through a passive investment approach. Reducing those fees would do much to restore returns to a level that wouldn’t threaten to drain the earnings reserve.

The second reason for the shortfall is that the PFC has invested the Permanent Fund’s assets far too tentatively, resulting in returns that are well below what could be achieved if invested more proactively. As we explained in another previous column, the Fund would currently be generating substantially greater earnings and have a much higher balance if it had been invested more proactively, even since FY17. Certainly, doing so would go a long way to restoring earnings to a level that wouldn’t threaten to drain the earnings reserve.

Maintaining the current constitutional structure provides an incentive for the Legislature and PFC to confront these and other, similar issues, and develop responses that improve the Permanent Fund’s returns to levels that adequately cover the level of the draws being made from the earnings reserve.

Maintaining the current structure also puts the burden in the right place. The current generation is the only one that can affect the cost and investment policies being used by the PFC. It should be the current generation that pays the price, in terms of reduced withdrawals, if it adopts policies that significantly increase costs or cause lower returns.

SJR 14, on the other hand, would put the impact in the wrong place. By opening a back door to the corpus, the constitutional amendment embodied in SJR 14 would allow the Legislature and PFC to continue maintaining the current POMV draw, regardless of its impact on the corpus. Despite causing the problem, the current generation would largely be held harmless from its consequences. Those would be passed on to future generations in terms of a reduced corpus.

By holding the current generation harmless from the consequences of higher costs and lower returns, the passage of the amendment would also significantly reduce, if not eliminate, the incentive to address those issues. The current generation would continue to largely realize the same returns even if they overlooked those and any other serious problems.

In the end, the choice presented by SJR 14 is which generation to prioritize. Adoption of the constitutional amendment embodied in SJR 14 would enable the current generation to prioritize the Permanent Fund for its own use. It would allow it to continue withdrawing the full amount from the Permanent Fund, regardless of the problems it creates by spending too much on fees or failing to maximize earnings.

Maintaining the current constitutional provisions prioritizes future generations. By preventing the creation of a back door to the corpus, it limits the current generation’s draw largely to what the Permanent Fund earns, protecting the corpus as intended by the founders of the Permanent Fund for the generations yet to come.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

100% Wrong. Mike Shower introduced an amendment to overdraw by $5B a few years ago. Gabby Ledoux introduced an amendment to overdraw by $12B. Only way to protect it is to get it away from them and their bad decisions! If it is all under the constitutionally protected corpus, it can’t be overdrawn. Brad’s doomsday scenario is earnings are less than draws for eternity. Guess what…4% earnings and a 5% draw for 100 years stills leaves $25B in the corpus.

I am in my 70’s. When I was young, if I had had any money, it would have been wise to put my savings 100% into the S&P 500. But now that I’m much older, I cannot afford that same level of risk for my retirement savings and hold a much smaller percentage in stocks. Retired, my savings is for whatever remains of my life. The PF is a permanent retirement account, except that the State of Alaska, hopefully, will ‘live’ for decades, if not centuries to come. Putting 100% of the PF into the stock market would be as… Read more »

What happened to the my post of an hour or two ago that no longer appears?

Let’s take a simple example to show why this post is totally wrong. Say the Fund doubles from $80 billion to $160 billion in one year and fully realized the 100% return. Under Brad’s preferred approach and current law 50% of the fund can be drawn by the state for spending. 50% of the fund! $80B Gone. Under the proposed 5% draw, only 5% can be spent. $8B. 10x differential. Please provide examples of other institutions which share your “realized earnings” based distribution preference. There are few to none Because it is less effective. Less money and less predictable. Why… Read more »

That’s the equivalent of me saying, “Let’s assume the PF has -5% earnings for 10 years in a row, but the Legislature continues to draw +5% plus inflation-proofing. At that rate, the corpus is gone in “x” years.” We can all assume the ridiculous. Instead, let’s look at actual history since the POMV statute was adopted. In FY21, the Permanent Fund had a return of 29.73% ($19.4 billion). Only $7.9 billion was in realized earnings, however. The remainder was unrealized and was thus held mainly in the corpus. Of the $7.9 billion, the Legislature and Governor appropriated $4 billion as… Read more »

A POMV is used by everyone else for a reason. It glides spending down and up gradually over time. Preventing shut offs as well as over spending. Even if we reduce the draw to 3% there would still be structural instability unless we let the ERA run up to high levels which the legislature would always be tempted to spend.

We have never said we oppose a POMV (up to the amount of earnings). What we oppose is a structure that allows draws to exceed earnings, as has happened in five of the last six years. In a single account system, the difference will come from the corpus. We support maintaining the currently existing hard stop to prevent that from happening, to prevent current generations from making their lives easier at the expense of future ones.

Only reason to make it one account would be for the Legislature to have easier access to the rest of the Permanent Fund. Keep it separate. They have shown how much they like to spend down the Constitutional Budget Reserve Fund (CBRF). FYI: The Alaska state constitutional provision governing the operation of the CBRF REQUIRES the state’s general fund to repay the money that has been appropriated from the CBRF IF and when there is a surplus in the general fund at the end of any fiscal year. The general fund does not pay interest on the money it has… Read more »

Keithley is correct. The ERA is abuffer for the corpus (principal) of the Fund. But is not enough to deal with other issues related to POMV. For example look at the Operating Budget before the 2025 legislature. The Senate Finance Structure Allocation Summary ( p 3, [4]) lists APFC Investment Managent Fees: Appropriatoion Total: $978 million. Broken down as APFC Investment Manager Fees–$169 million; Investment Management oversight–$9 million; Fees Paid by Investments–$800 millio. Total $978 million. (All figures lightly rounded). Almost a billion dollars for the year whih is largely from Retained Fees by investment managers. Keithley has reported that… Read more »